Jack Hatch isn’t happy with the work of his former colleagues in the Iowa Senate. Writing in the Sunday Des Moines Register, he declared the 2016 legislative session to be a “disaster for Democrats,” who made no progress on improving water quality, protecting public employees, raising the minimum wage, or funding education adequately. In Hatch’s view, Governor Terry Branstad has “bullied” Senate Democrats “into siding with him in serving only the top 10 percent.” In particular, he cited the “historic levels of tax relief for corporations” senators approved three years ago, part of a trend toward providing generous tax breaks for business while Iowa schools lack essential resources.

I couldn’t agree more that the commercial property tax cut lawmakers approved at the end of the 2013 legislative session was too expensive and mostly oriented toward businesses that didn’t need help, with foreseeable consequences for public services. Undoubtedly, that legislation and other corporate tax breaks are largely responsible for budget constraints that drove Democrats toward lousy deals on funding for K-12 school districts as well as higher education.

Just one question: why didn’t Hatch listen to the experts who warned at the time that the tax cut amounted to “Christmas for Walmart and McDonald’s”?

Here’s the key passage from Hatch’s commentary, “2016 legislative session was disaster for Democrats,” which appeared on the front page of the May 1 Sunday Des Moines Register opinion section:

Three years ago, the Democratic Iowa Senate passed and then campaigned on historic levels of tax relief for corporations. Since 2011, they have partnered with Branstad to give away a staggering $400,000,000 in new tax breaks to Iowa corporations benefitting mostly the largest 100. This represents more tax breaks to corporations than any Legislature has provided in any consecutive six-year period since Iowa became a state in 1846. That’s enough business generosity to make Donald Trump blush.

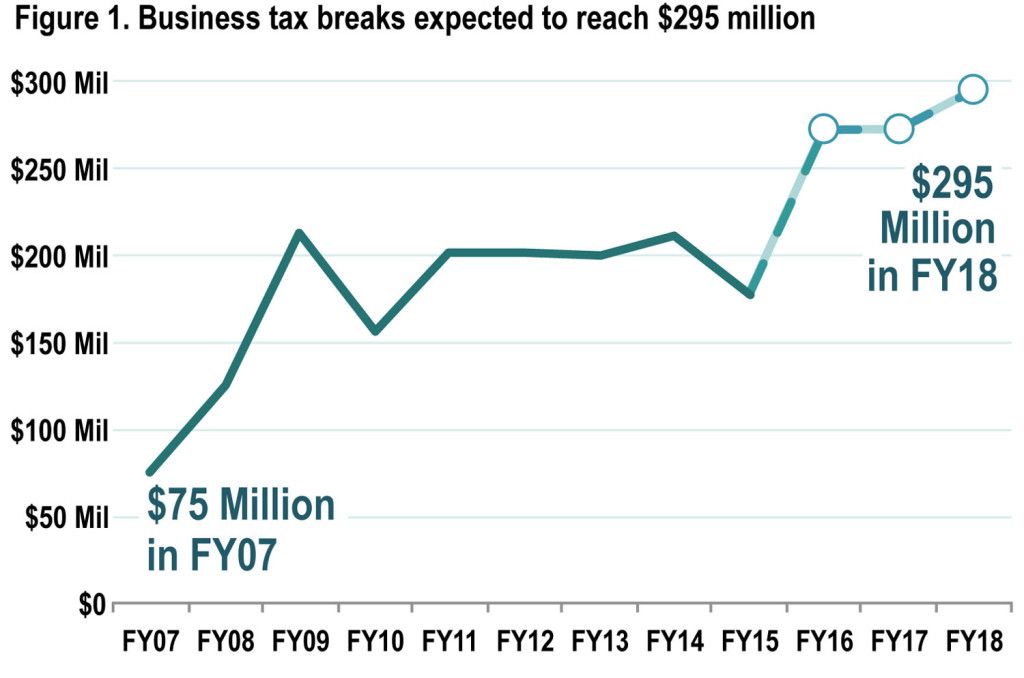

“Altogether, business tax breaks will drain $611 million in revenue from the state general fund next fiscal year,” Peter Fisher of the Iowa Fiscal Partnership says, “at a time when the state is struggling to fund education at all levels.”

This year is no different; Democrats continue to allow the governor to manipulate the agenda. Branstad has found Democrats’ soft spot: offer us some chump change in trade for a dramatic shift in corporate taxes.

This year Branstad added $35 million in tax breaks in the form of a special sales-tax giveaway to manufacturers. He did it by abusing his executive authority and with no fear Democrats would stop him. In fact, they negotiated the governor’s number down a bit, and that was all. They capitulated. But they didn’t stop there; Branstad and the Democratic Senate added another $10 million a year for 10 years for the bio-tech industry. By contrast, public school funding increases since 2011 averaged a pitiful 1.58 percent, well below inflation.

Jon Muller explained the Branstad administration’s attempted abuse of administrative rulemaking in the service of Iowa manufacturers. Because House Republicans were content to let the executive branch seize some power to write tax code, the sales tax break appeared unstoppable as the legislature’s 2016 session began. Hatch is correct that Democrats succeeded only in reducing the scope of that manufacturing tax break.

Hatch is also right about the business tax breaks. Peter Fisher explained our state’s “largely self-inflicted” revenue shortfall in this Iowa Fiscal Partnership brief in January.

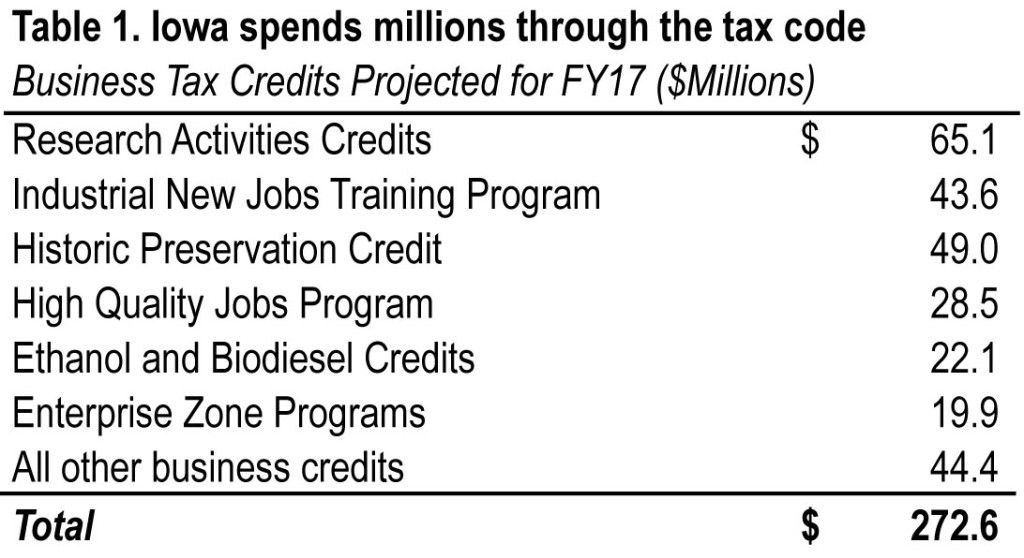

Why is revenue growth a problem in a state that has done better than most in recovering from the Great Recession? The answers can be found in the growth in business tax breaks. Business tax credits already on the books drained $178 million from the state treasury in fiscal year 2015, then grew by $94 million to $272 million in FY16, and are expected to remain at about that level next year. The six largest credits (or groups of credits) account for 84 percent of the total (Table 1).

The sentence that jumped out at me from Hatch’s op-ed: “Three years ago, the Democratic Iowa Senate passed and then campaigned on historic levels of tax relief for corporations.”

The 2013 commercial property tax cut cost the state budget an estimated $252.6 million in the current fiscal year and will cost $279.6 million during fiscal year 2017, which begins July 1.

I doubt any of the 20 Senate Democrats who voted for that bill campaigned on it more than Hatch did. He began exploring a run for governor a few days after the 2013 legislature adjourned and officially launched that campaign four months later. Co-sponsoring legislation to reduce property taxes was part of the official bio on Hatch’s campaign website.

In fairness, the original property tax bill Hatch helped to write would have been more targeted to small business, while Branstad’s initial proposal would have given more away to larger corporations. During all three debates against Branstad in 2014, Hatch criticized the governor’s focus and credited Senate Democrats with getting some assistance to small businesses into the property tax bill.

Nevertheless, the drive to get something, anything, done on commercial property taxes in 2013 was ill-conceived from the start. Fisher argued in March of that year,

The annual debate about commercial property taxes in Iowa is under way, and once again the discussion ignores the larger picture — that overall business taxes in Iowa are below average among states — and fails to consider reforms that should be addressed first. […]

Commercial property tax break will spur little or no growth. A state or local government’s tax rate — be it corporate income or commercial property or the combination of all taxes on business — is a tiny portion of a business’ overall costs. Taken together, state and local taxes on business are, on average, only about 1.8 percent of total business costs. The commercial property tax by itself would be an even tinier fraction of a business’ overall costs. The notion that cutting commercial property taxes further by reducing assessments will bring in new economic activity and new revenue is a pipe dream.

As lawmakers considered different approaches to cutting property taxes, Heather Milway and Fisher noted in this Iowa Fiscal Partnership piece from April 2013,

The House and Senate proposals, which have set the stage for late-session negotiations, have two important things in common. First, both are costly, and therefore affect the ability of the state to meet its residents’ essential needs. They would use a very significant share of the projected overall growth in state revenue, some of which is needed simply to maintain existing services. Second, both also play to a myth about Iowa taxes on business, which in reality are below business taxes in most states when considered comprehensively, and which already include substantial loopholes and preferences that disproportionately benefit select industries.

[…] While we have argued that the case for substantial property tax cuts for commercial property is exaggerated,[1] if some tax reduction measure is undertaken it should focus on inequities. The House bill, in fact, would provide large benefits to the big box retail chains.

Over $1 billion in taxable value in Iowa is owned by just seven national retail chains: Target, Walmart, Lowe’s, Home Depot, Menard’s, Kohl’s and Sears. These store locations are driven by local demand; they are in Iowa because the state’s residents are customers and potential customers. No economic reason exists to subsidize these national companies, which know they must locate in Iowa to sell products to Iowans. They also compete with local businesses.

During the final weeks of the 2013 session, statehouse Democratic leaders were strongly committed to reaching a deal on commercial property taxes. After a few weeks of work, a conference committee managed to blend aspects of the House and Senate property tax bills, though the overall approach was closer to the Republican proposal. To attract more support from Democrats, the conference report included an expansion of the Earned Income Tax Credit, long one of the top Democratic economic policy priorities.

Strong negotiators know that you have to be able to walk away from a bad deal. The Iowa Fiscal Partnership commented on the conference report before the final bill came before the Senate,

It’s Christmas for Walmart and McDonald’s, which will happily receive property-tax breaks that they don’t need, while their low-wage employees receive a better Earned Income Tax Credit.

This Christmas tree will grow bigger with each passing year, leaving less room in local budgets to respond to needs. The EITC expansion is important to working families — including 37 percent of all Iowa kids — but in the balance of who benefits from this package, it is a very small ornament.

If there is any question as to who benefits, Iowans should note that the EITC boost will be $35 million when fully phased in, compared to about 10 times that for property owners.

Only six Senate Democrats and thirteen House Democrats had the guts to vote against the commercial property tax compromise. They listened to economists who had studied the issue closely. They listened to groups representing educators, cities, and counties, who opposed the bill because they knew how it would affect the ability of state and local governments to fund public services.

Writing in the Des Moines Register this week, Hatch railed against “pitiful” school funding increases since 2011. He correctly linked the budget shortfalls for K-12 and higher education to our state’s ineffective array of business tax breaks.

Too bad he didn’t reach the same conclusions when he was on the inside and could have made a difference.

photo used for fundraising during Hatch’s 2014 gubernatorial campaign

UPDATE: Hatch responded thoughtfully in the comments. First, he noted,

I was one of two Democratic Senators in 2012 who did not support the Governor’s property tax reform bill which passed the House and had 24 Senate Democratic votes (and no Republican votes). The two Democratic Senators who voted against Branstad’s first bill were Senator [Rob] Hogg and myself – which killed the bill in 2012. We withstood significant leadership and colleague pressure to change our vote and thus neutralize this issue in the 2012 elections. We were not convinced and thus the bill died.

I did not remember this debate from the 2012 legislative session. The Iowa Policy Project’s executive director Mike Owen pointed me in the right direction.

Two commercial property tax bills were introduced that year. The Republican version was House File 2475, which passed the Iowa House with bipartisan support, then died in the Senate Ways and Means Committee. The Democratic version, Senate File 2344, was similar but funded differently, so its proponents said local governments and residential property tax payers would be protected. Owen pointed out that Senate File 2344 also included an earned income tax credit at 15 percent of the federal level, whereas House File 2475 included an EITC at just 10 percent of the federal.

As Hatch described, Senate File 2344 failed on the Senate floor by just two votes: his and Hogg’s. Republicans opposed that bill because they preferred the House version. The legislature adjourned for the year on the following day.

Hatch went on to say that toward the end of the 2013 legislative session, the fate of commercial property tax reform was caught up in the debate over Medicaid expansion.

In one of my proudest moments as a Senator, my colleagues told our majority leader that they would not support Branstad’s Property Tax bill without his agreement to sign Medicaid expansion. For five days our Senate caucus held firm and at his Monday morning press conference, he announced he would sign a “reasonable” Medicaid expansion bill. As a member of the conference committee, we negotiated an agreement that included 90% of the Senate’s original bill (which I wrote), Our trade off was to accepted the negotiated property tax bill. By all accounts, we had the better deal and now over 100,000 Iowans have access to health care that they would not have had. Hell yes, I voted for this awful property tax bill but because the governor wanted his property tax reform for his corporate friends more than he wanted to suffer undue heartache for agreeing to expand Obamacare from the right wing, he agreed to our expansion of Medicaid. IT WAS WORTH IT. Both bills came out of conference committee at the same time and passed within minutes of each other.

But let me be clear, that doesn’t mean the corporate property tax bill was good public policy. I believed we should have never even agreed to his corporate property tax bill but rather we should have pushed for a middle class tax cut which I proposed and introduced in the Senate but that was not what our leadership wanted. Sad but true. This is one reason I opened by opinion piece with the fact that we had to live with the consequences of our actions.

Democrats were right to insist on some form of Medicaid expansion in 2013. That compromise secured health insurance coverage for a large chunk of Iowa’s uninsured population.

Getting health care for 100,000 people may have been worth the cost of underfunded schools for several subsequent years. It’s debatable. Six Democratic senators, including Hogg, voted against the commercial property tax bill. Whether you agree with them or with Hatch, characterizing the property tax cut as a necessary evil to accomplish Medicaid expansion is different from the point Hatch made in his Des Moines Register column: Branstad has offered Democrats “chump change” in return for reducing corporate taxes.

Hatch further noted that he didn’t highlight the property tax cut during his gubernatorial campaign. Fair enough. The issue came up during all three debates, which I live-blogged (first, second, third). Hatch did not portray the property tax bill as bad public policy. He took credit for helping to write it and pass it in a better form than the governor’s original proposal. No question, the final bill was less bad than Branstad’s initial proposal.

In closing, Hatch argued, “it would be good if you did not try to make me the story but rather, get to the real meaning of the message,” since he is not running for office and was trying to remind Democrats of what’s important. Bleeding Heartland has frequently covered the Branstad administration’s excessive focus on business tax cuts. I was writing about commercial property tax policy from the beginning to the end of the 2013 legislative session, and focused on the tax cut’s likely consequences for other public services immediately after Branstad signed the bill into law. I highlighted the connection between under-funded schools and business tax cuts in this piece shortly after lawmakers adjourned in 2015 and in multiple posts this spring.

I don’t think any media outlet covered the latest sales tax exemption for Iowa manufacturers more thoroughly than this blog did in Jon Muller’s backgrounder and my follow-up posts about Republican tolerance for the abuse of administrative rule-making. Shortly after lawmakers approved a scaled-back sales tax break in March, I returned to the topic, again with a focus on the relationship between business tax cuts and Iowa schools starved of resources.

My intention was not to personalize the issue. My intention was to highlight that it’s easier to criticize from the outside than it is for insiders to take the politically tough stand against costly tax cuts pushed by powerful interest groups.

3 Comments

Hatch

Comment

You apparently agree with all or most of my comments in my opinion piece that appeared in the Des Moines Register but you are bothered by my apparent hypocrisy of railing on the misfortunes of Branstad’s commercial property tax legislation in 2014 but having voted for it in 2013.

To the casual observer, it would appear you are right but, not so fast. I was one of two Democratic Senators in 2012 who did not support the Governor’s property tax reform bill which passed the House and had 24 Senate Democratic votes (and no Republican votes). The two Democratic Senators who voted against Branstad’s first bill were Senator Hogg and myself – which killed the bill in 2012. We withstood significant leadership and colleague pressure to change our vote and thus neutralize this issue in the 2012 elections. We were not convinced and thus the bill died.

In 2013, the Branstad bill was rewritten, small businesses were given a bigger reduction in their property taxes and again the House passed his bill onto the Democratically controlled Senate. This time the Republicans senators were in agreement and the bill would pass easily without a majority of the Democrats. However, my work on expanding Medicaid which the governor fought was working its way through the Senate and the House. At the end of the session, both bills were sitting in separate conference committees waiting for action.

Since the US Supreme Court ruled that Obama Care was legal, the fight to expand Medicaid was left for each state to decide. From the beginning, I made it clear in public statements, that was reported widely in the press, that we would not adjourn until Iowa expanded Medicaid to the poor.

My colleagues agreed. In one of my proudest moments as a Senator, my colleagues told our majority leader that they would not support Branstad’s Property Tax bill without his agreement to sign Medicaid expansion. For five days our Senate caucus held firm and at his Monday morning press conference, he announced he would sign a “reasonable” Medicaid expansion bill. As a member of the conference committee, we negotiated an agreement that included 90% of the Senate’s original bill (which I wrote), Our trade off was to accepted the negotiated property tax bill. By all accounts, we had the better deal and now over 100,000 Iowans have access to health care that they would not have had. Hell yes, I voted for this awful property tax bill but because the governor wanted his property tax reform for his corporate friends more than he wanted to suffer undue heartache for agreeing to expand Obamacare from the right wing, he agreed to our expansion of Medicaid. IT WAS WORTH IT. Both bills came out of conference committee at the same time and passed within minutes of each other.

But let me be clear, that doesn’t mean the corporate property tax bill was good public policy. I believed we should have never even agreed to his corporate property tax bill but rather we should have pushed for a middle class tax cut which I proposed and introduced in the Senate but that was not what our leadership wanted. Sad but true. This is one reason I opened by opinion piece with the fact that we had to live with the consequences of our actions.

And your second point that I campaign all over the state on it is a stretch. It was in my literature but no where was it a piece of legislation that I highlighted or spoke about.

I appreciate your agreement on my points because that is really the most important part of our politics now. I am not running for any office but I am trying to ensure a message that Democrats should not forget. If I participated in those bad decisions, it would be good if you did not try to make me the story but rather, get to the real meaning of the message.

jackhatch Tue 3 May 10:58 PM

fair points

I did not remember the vote on the 2012 property tax bill. Why were none of the Senate Republicans supporting it after it passed the House?

I know other sub-optimal legislation was agreed to in 2013 so that some form of Medicaid expansion would happen (including the bad homeschool provisions in the education reform bill). Arguably, helping tens of thousands of people get health insurance coverage was worth short-changing schools and other priorities in subsequent years.

I don’t know how we could ever get a minimum wage increase, collective bargaining legislation, and some of the other points you mentioned until we flip the Iowa House. But I do agree that Democrats have few accomplishments from this year’s legislative session.

desmoinesdem Wed 4 May 12:38 PM

Speaking of Medicaid

Somebody tell me if I’m wrong, but hasn’t the Medicaid expansion that Hatch fought for now neutered by Branstad’s privatization shenanigans?

dbmarin Fri 6 May 6:39 PM