Have you wondered why U.S. Representative David Young (IA-03) voted with fellow Republicans to table indefinitely a resolution “directing the House to ask for 10 years of [President Donald] Trump’s tax returns,” only four days after telling constituents the president should release those returns?

Explaining his vote today, Young demonstrated that he is ill-suited to the task of holding Trump accountable.

At a public forum in Urbandale on February 23, Young drew applause by stating, “Donald Trump should release his taxes. It’s a no-brainer.”

Thomas Beaumont reported for the Associated Press on March 1,

Rep. Bill Pascrell, D-N.J., had proposed the resolution directing the House to ask for 10 years of Trump’s tax returns and allow the House Ways and Means Committee to review them in private. Trump broke with most modern-day presidential candidates by refusing to release his tax returns, arguing that he was being audited. However, the IRS has said an audit would not prevent an individual from releasing the returns.

The Republican-controlled House backed Majority Leader Kevin McCarthy’s motion to postpone the resolution indefinitely on a near party-line vote of 229-185.

An aide to Young dismissed Pascrell’s measure, arguing it was not a serious legislative proposal. Taylor Mason said the congressman “has publicly stated, while there is no legal requirement for the president to release his taxes, he personally believes he should per the longstanding voluntary tradition.”

Mason said Pascrell’s effort “accomplished its intended purpose as a partisan stunt for political gain.”

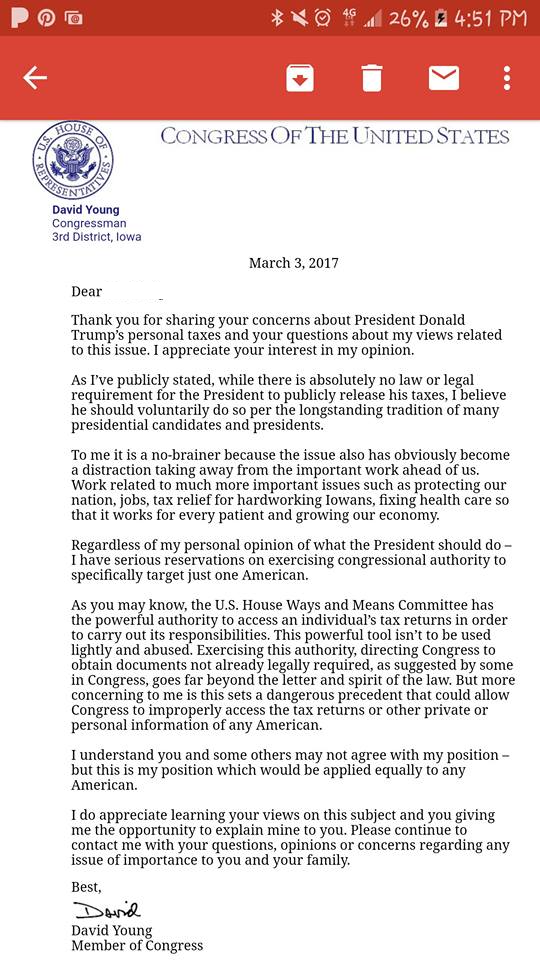

An acquaintance wrote to Young and received an letter back today. With her permission, I enclose that message in full below. Rather than dismissing the resolution as a “partisan stunt,” Young made a substantive argument against it.

As I’ve publicly stated, while there is absolutely no law or legal requirement for the President to publicly release his taxes, I believe he should voluntarily do so per the longstanding tradition of many presidential candidates and presidents.

To me it is a no-brainer because the issue also has obviously become a distraction taking away from the important work ahead of us. Work related to much more important issues such as protecting our nation, jobs, tax relief for hardworking Iowans, fixing health care so that it works for every patient and growing our economy.

Regardless of my personal opinion of what the President should do–I have serious reservations on exercising congressional authority to specifically target just one American.

As you may know, the U.S. House Ways and Means Committee has the powerful authority to access an individual’s tax returns in order to carry out its responsibilities. This powerful tool isn’t to be used lightly and abused. Exercising this authority, directing Congress to obtain documents not already legally required, as suggested by some in Congress, goes far beyond the letter and spirit of the law. But more concerning to me is this sets a dangerous precedent that could allow Congress to improperly access the tax returns or other private or personal information of any American.

Young dismisses concerns over the president’s tax returns as an unimportant “distraction.” He implies that forcing Trump to release the returns would be tantamount to abusing a “powerful tool” of Congress.

Though Young has avoided acknowledging the multiple scandals related to Trump’s involvement with Russian officials, those contacts raise “fundamental questions of national security.” They are “far more deserving of close scrutiny by Congress, the media, law enforcement, and the public than any of the White House’s many other alleged misdeeds,” Frida Ghitis argued in a recent article for Foreign Policy.

Richard Painter, formerly the chief ethics lawyer for President George W. Bush, said this week, “The facts now in this investigation are much worse than the facts in the early stages of Watergate, […] We have a foreign power that has orchestrated a break-in. It’s a much worse situation than the outset of Watergate.”

One of several angles that urgently require investigation: undisclosed financial connections between Russian entities and the president or Trump companies. The president’s son, Donald Trump Jr., said publicly in 2008, “Russians make up a pretty disproportionate cross-section of a lot of our assets. […] We see a lot of money pouring in from Russia.”

During my ten years covering Russian politics, I closely followed the government’s use of private corporations to advance political goals. Early in President Vladimir Putin’s tenure, pressure from lenders or shareholders in media companies allowed the Kremlin to assert control over the country’s leading non-governmental news organizations, including Russia’s most-viewed private television network.

Trump has hired several senior staffers with close ties to Russia. Several of the president’s aides and associates, including his son-in-law Jared Kushner and Attorney General Jeff Sessions, held secret meetings and conversations with the Russian ambassador.

The public needs to know what Trump’s representatives discussed regarding Russia’s interference in the U.S. election and/or the future alignment of American foreign policy with Putin’s interests. The public also needs to know whether the Russian government has financial leverage over Trump, through banks or companies to which Trump enterprises may owe money.

Speaking of Congressional authority to access tax returns, Young says disingenuously, “This powerful tool isn’t to be used lightly and abused.” On what planet is it abusive for the legislature–the main check on executive power–to examine whether a foreign government has means to squeeze the president financially?

Repeating that Trump should “voluntarily” release his tax returns is the emptiest of gestures by Young. We’ve all seen that this president does not respect long-established norms of U.S. politics.

Young feigns concern that forcing Trump’s hand would set a “dangerous precedent that could allow Congress to improperly access the tax returns or other private or personal information of any American.”

Not any American–just those who can set our country’s foreign policy and may be selling out our national interests.

My husband Kieran Williams, who has studied authoritarian regimes, discussed the phenomenon of “normalization” in a commentary for this site last November. He noted that normalization “happens because people in a position to stop it decide to play along, and find ways to convince themselves that they are doing the right thing.” As for resisting efforts to normalize either “authoritarian creep” or behaviors that would once have been universally recognized as unacceptable, Williams wrote,

[T]he initial challenge is not so much to persuade the powerless – with nothing to lose – that they in fact can make a difference; it is to press those in positions of power – and thus having everything to lose – to resist the temptation to be and do the lesser evil, because it is still an evil.

By failing to walk his talk on Trump’s tax returns, Young exemplifies this challenge. And he’s not an isolated profile in cowardice. He’s one of 229 House Republicans (including Iowa’s own Rod Blum and Steve King) who would rather keep Americans in the dark about a potential threat to national security than shine a light on Trump’s finances.

I can’t think of a more dangerous precedent than that.

Full text of Representative David Young’s March 3 letter to an Iowan: