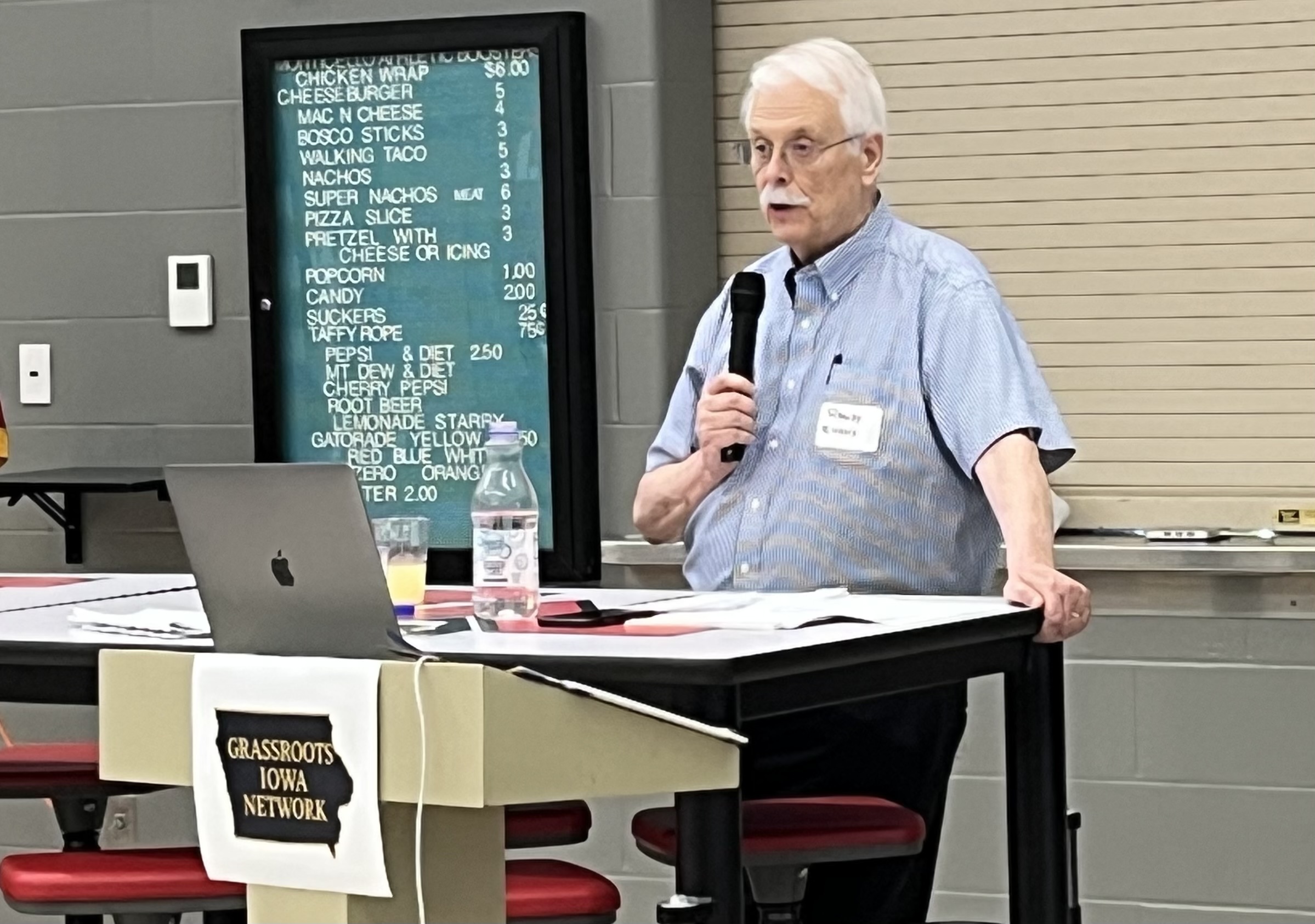

Herb Strentz was dean of the Drake School of Journalism from 1975 to 1988 and professor there until retirement in 2004. He was executive secretary of the Iowa Freedom of Information Council from its founding in 1976 to 2000.

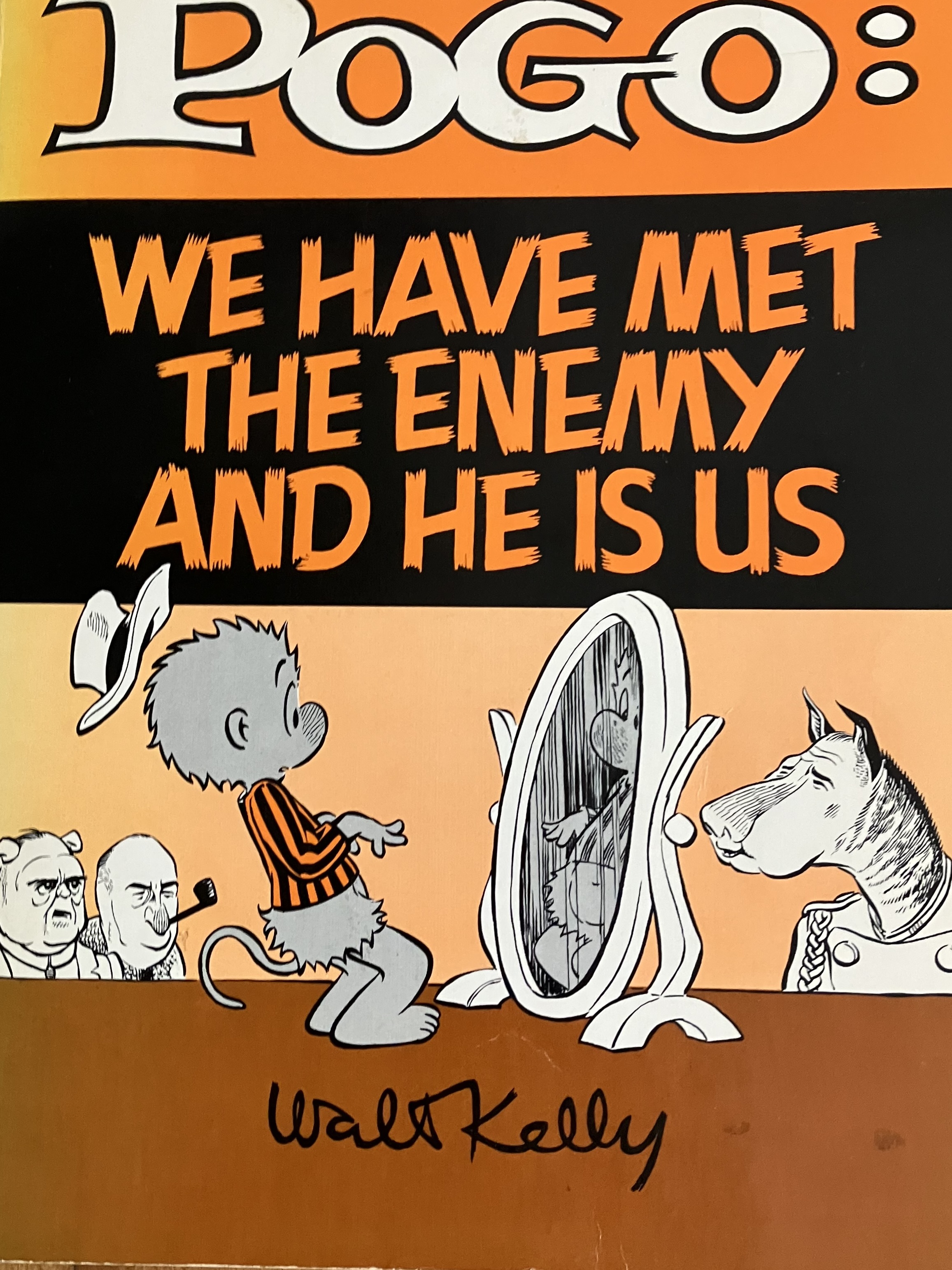

Given the turmoil of today’s politics and environmental concerns, it’s time to revisit Okefenokee Swamp and attend to the wisdom of Pogo Possum. He sagely advised more than 50 years ago, “We have met the enemy and he is us.”

Cartoonist Walt Kelly wrote that line for the Pogo comic strip in 1971, as Pogo Possum and one of his cartoon companions, Porky Pine, surveyed the human despoliation of their wetlands home. The swamp covers almost half a million acres straddling the Georgia-Florida border; the cartoon depicted it as awash in discarded furniture, a bath tub, a car half sunk in the swamp and other tons of trash.

Continue Reading...