A new report by the Center on Budget and Policy Priorities shows that Iowa and many other states fail to incorporate enough long-term fiscal planning in the budget process. Click here to read the executive summary of the thoroughly researched piece by Elizabeth McNichol, Vincent Palacios, and Nicholas Johnson. Click here to download the full report (pdf).

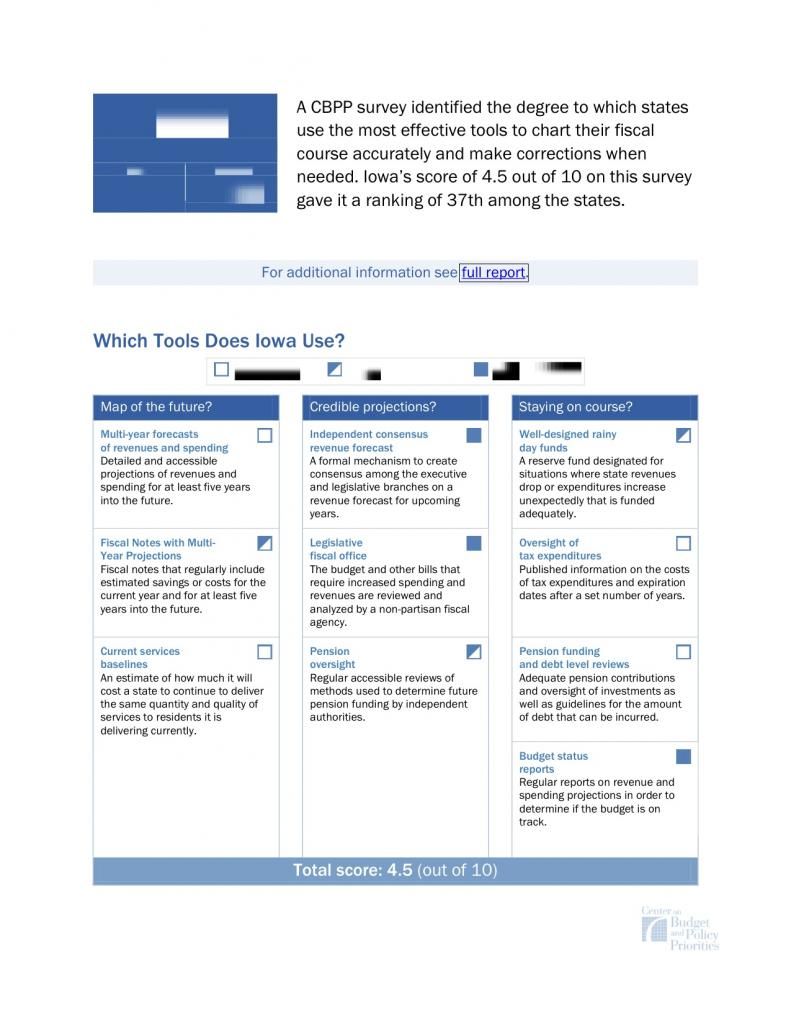

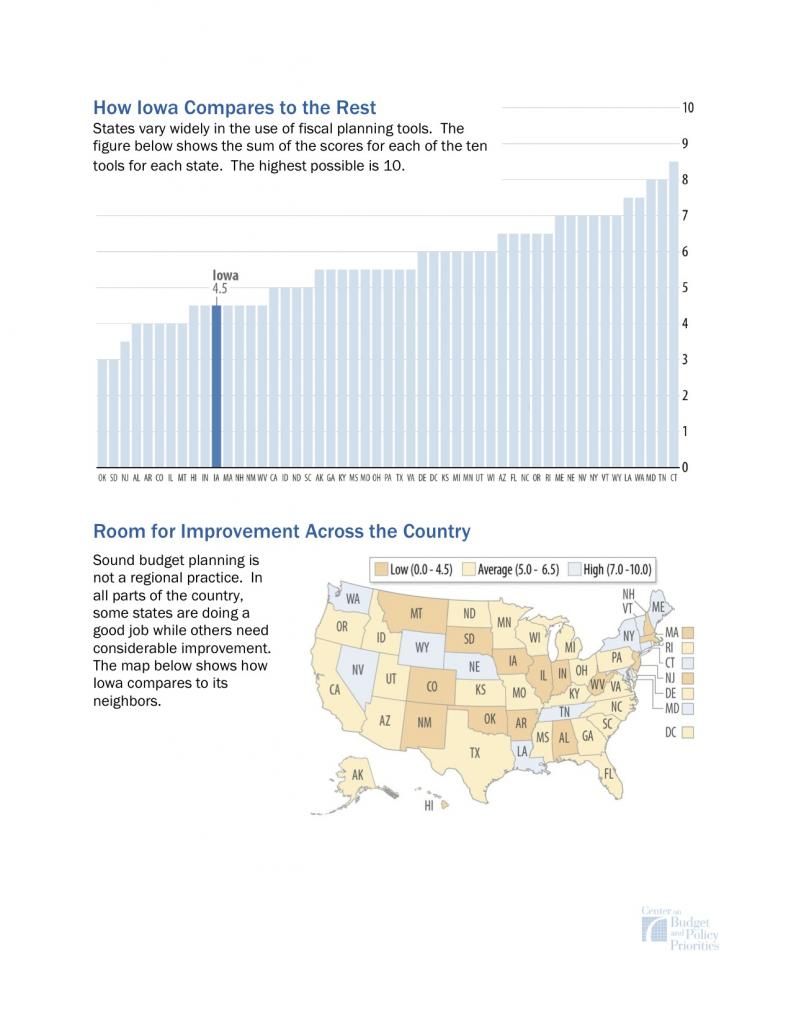

After the jump I’ve posted the two-page fact sheet on Iowa, which scored only 4.5 out of a possible 10 and ranked 37th among the states. I’ve also enclosed a sidebar explaining the ten criteria they used to evaluate state fiscal planning. Table 1 toward the bottom of this page shows that Iowa received full marks under three categories: consensus revenue estimates, legislative fiscal offices, and budget status reports. Iowa received half-credit in three more categories: multi-year fiscal notes, pension oversight, and well-designed rainy-day funds. Iowa received zero marks in four categories: multi-year forecasting, a projection of future costs to deliver the “quantity and quality of services to residents that it is delivering in the current budget period,” pension funding and debt level reviews, and oversight of tax expenditures.

For years, the Iowa Policy Project and the Iowa Fiscal Partnership have been sounding the alarm on how Iowa needs to start calculating the costs of various tax breaks and tax credits.

While you’re at it, read the Iowa Fiscal Partnership’s recent background piece on why “Iowa lawmakers must recognize the long-term impact of tax cuts on spending choices. Past choices will force future legislatures to lower investments on critical services on which economic growth depends.”

Sidebar from a new report by Elizabeth McNichol, Vincent Palacios, and Nicholas Johnson for the Center on Budget and Policy Priorities:

Ten Tools for Budgeting for the Future

Here are ten mechanisms states can use to inform long-term planning.

Does the Budget Provide a Map of the Future?

* Multi-year forecasts of revenues and spending: projections of revenues and current services spending for at least five years. These projections should be a regular part of the budget and should be detailed and easily accessible.

* Fiscal notes with multi-year projections: an established set of guidelines for preparing fiscal notes that estimate the savings, costs, or revenue changes for the current year and at least five future years. Estimates should be easily available.

* Current services baseline: a projection of how much it will cost a state in an upcoming budget period to deliver the same quantity and quality of services to residents that it is delivering in the current budget period, taking into account factors such as inflation, expected changes in the number of people utilizing those services, any previously enacted rule changes that have not yet phased in, and ongoing formula-based adjustments.Are the Projections Professional and Credible?

* Independent consensus revenue forecast: a formal mechanism to create consensus among the executive and legislative branches on a revenue forecast.

* Legislative fiscal office: a non-partisan agency that analyzes the budget and other bills that affect spending and revenues.

* Pension oversight: regular reviews by independent authorities of methods used to determine future pension funding. These reviews should be published and easily accessible to the public.Are Ways to Stay on Course in Place?

* Well-designed rainy day fund: a reserve fund designated for situations where state revenues drop or expenditures increase unexpectedly. These funds should not be capped at an inadequate level (below 15 percent of the state budget) and should be governed by rules that encourage deposits in good times and provide notice if deposits are skipped.

* Oversight of tax expenditures: expiration dates for tax expenditures after a set number of years to subject them to regular scrutiny of their cost and effectiveness, in addition to tax expenditure reports that list the costs of individual tax breaks.

* Pension funding and debt level reviews: recommended standards for pension funding and guidelines for the amount of debt that the state can incur.

* Budget status reports: regular reports by a professional fiscal authority on updated revenue and spending projections in order to determine if the budget is on track.