Cato is an attorney who spent most of his career fighting for civil liberties and other public policy matters in Iowa. He is a lifelong Iowan. His legal interests include constitutional law (separation of powers), federalism, legislative procedures and public policy, and the laws of war. Editor’s note: Bleeding Heartland allows guest authors to publish under pseudonyms at Laura Belin’s discretion.

INTRODUCTION

The Iowa General Assembly changed some practices in light of the Iowa Supreme Court’s ruling in LS Power Midcontinent v. Iowa, which struck down the Right of First Refusal (ROFR) portion of the 2020 Budget Omnibus Bill (House File 2643) as violating Article III, Section 29 of the Iowa Constitution. Justice Thomas Waterman wrote the decision, joined by Chief Justice Susan Christensen and Justices Edward Mansfield and Christopher McDonald. Justices Dana Oxley, Matthew McDermott, and David May recused from the case.

In the weeks following the court ruling, Republicans in both the state House and Senate refused to answer questions during floor debate regarding ambiguities in legislation and other questions relating to how certain language will play out in the real world lives of Iowans. Iowa media covered those developments in April:

- Todd Dorman, Cedar Rapids Gazette, Iowa Senate GOP has no answers

- Zach Sommers, We Are Iowa, Iowa Republicans refuse to answer questions during debate, citing recent Iowa Supreme Court Case

- Stephen Gruber-Miller, Des Moines Register, Iowa Senate Republicans’ new strategy is to stop answering questions during bill debate

- Laura Belin, Bleeding Heartland, Republicans shatter another Iowa Senate norm

- Erin Murphy, Cedar Rapids Gazette, Iowa Republicans self-censor debate, citing Supreme Court ruling

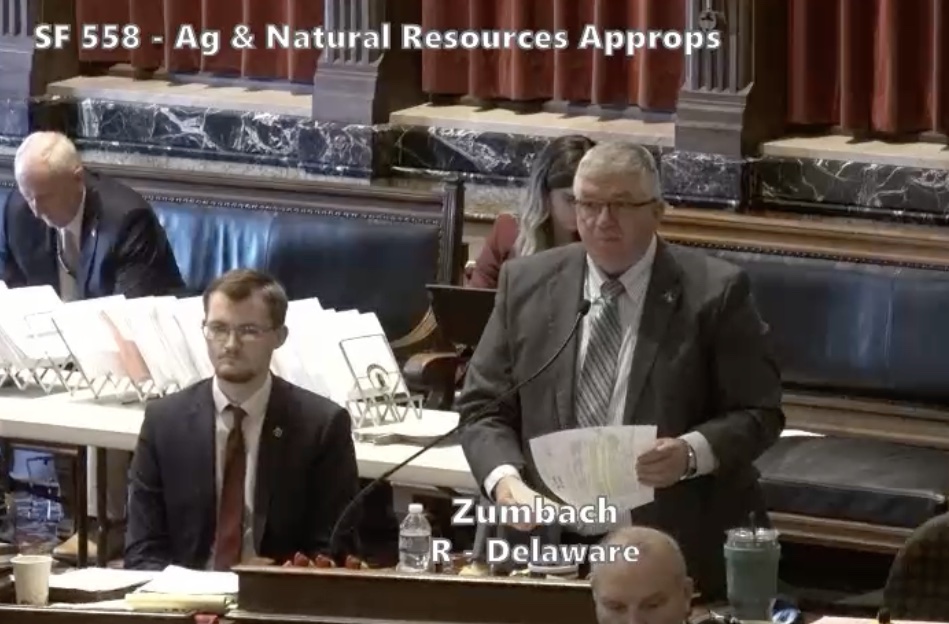

Senate and House Republicans seem to have stopped answering questions because the Iowa Supreme Court’s LS Power ruling extensively quoted comments Senator Michael Breitbach made while floor managing HF 2643. They apparently believe the Court used these floor comments as justification for striking down the ROFR provision at issue in that case.

Attorneys for the state and for intervenors filed applications on April 7, asking the Court to reconsider its conclusions and holdings in the ruling. LS Power filed its response on April 19. The Supreme Court denied the request for a rehearing on April 26 without much explanation. An amended opinion released on May 30 corrected some (but not all) factual inaccuracies in the initial ruling.

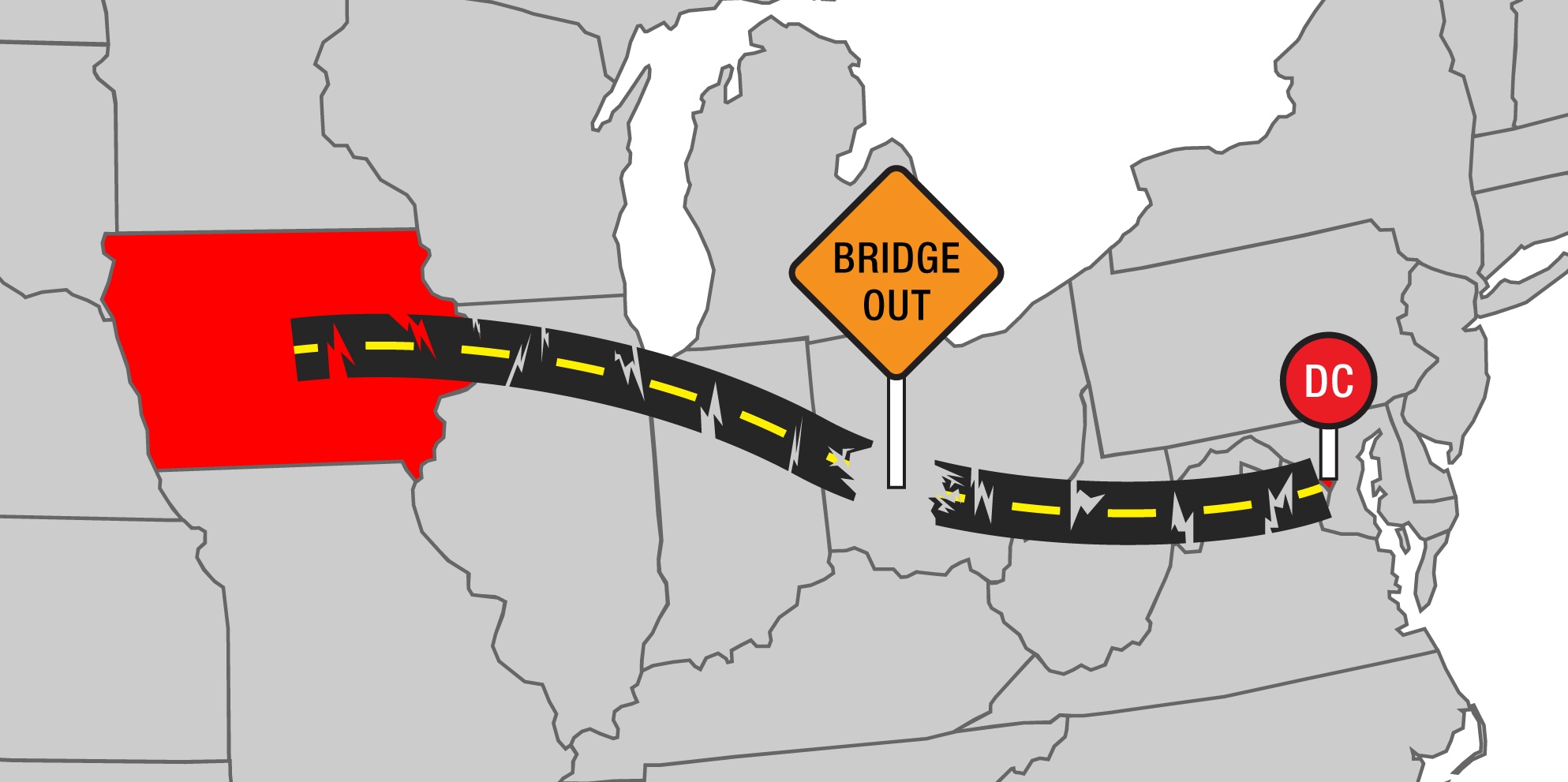

The General Assembly adjourned its legislative session on May 4 without any action in response to the court denying the requests for a rehearing. Only time will tell how this constitutional impasse between the legislative and judicial branches gets resolved. Paths available to both branches could restore the balance of power without escalating the dispute.

Regardless of how long it takes or how the dispute gets resolved, Iowans must never forget that your constitution exists for the sole purpose of protecting and guaranteeing your individual rights and liberties as free and independent People. Iowa Const. Art. 1, Sec. 2 (“All political power is inherent in the people. Government is instituted for the protection, security, and benefit of the people, and they have the right, at all times, to alter or reform the same, whenever the public good may require it.”).

This article hopes to explain why the Iowa Supreme Court and Republicans in the Iowa House and Senate are both guilty of violating the Iowa Constitution, while also seeking to provide a framework to resolve the impasse between the legislative and judicial branches. Similarly, this article hopes to persuade a future litigant to nudge the court in the right direction in a future case, and to persuade the people to nudge the General Assembly in the right direction consistent with this constitutional framework.

To that end, here is the analysis of Article III, Section 29 of the Iowa Constitution from the perspective of the Iowa People.

Continue Reading...