Al Charlson is a North Central Iowa farm kid, lifelong Iowan, and retired bank trust officer.

I had to send Senator Chuck Grassley a quick email to thank him for starting my day with a chuckle. In the latest edition of his email newsletter “The Scoop,” he commended the U.S. Supreme Court’s ruling that federal district courts do not have the authority to issue universal injunctions blocking the Administration’s Executive Order. Grassley declared the decision “a victory for checks and balances.”

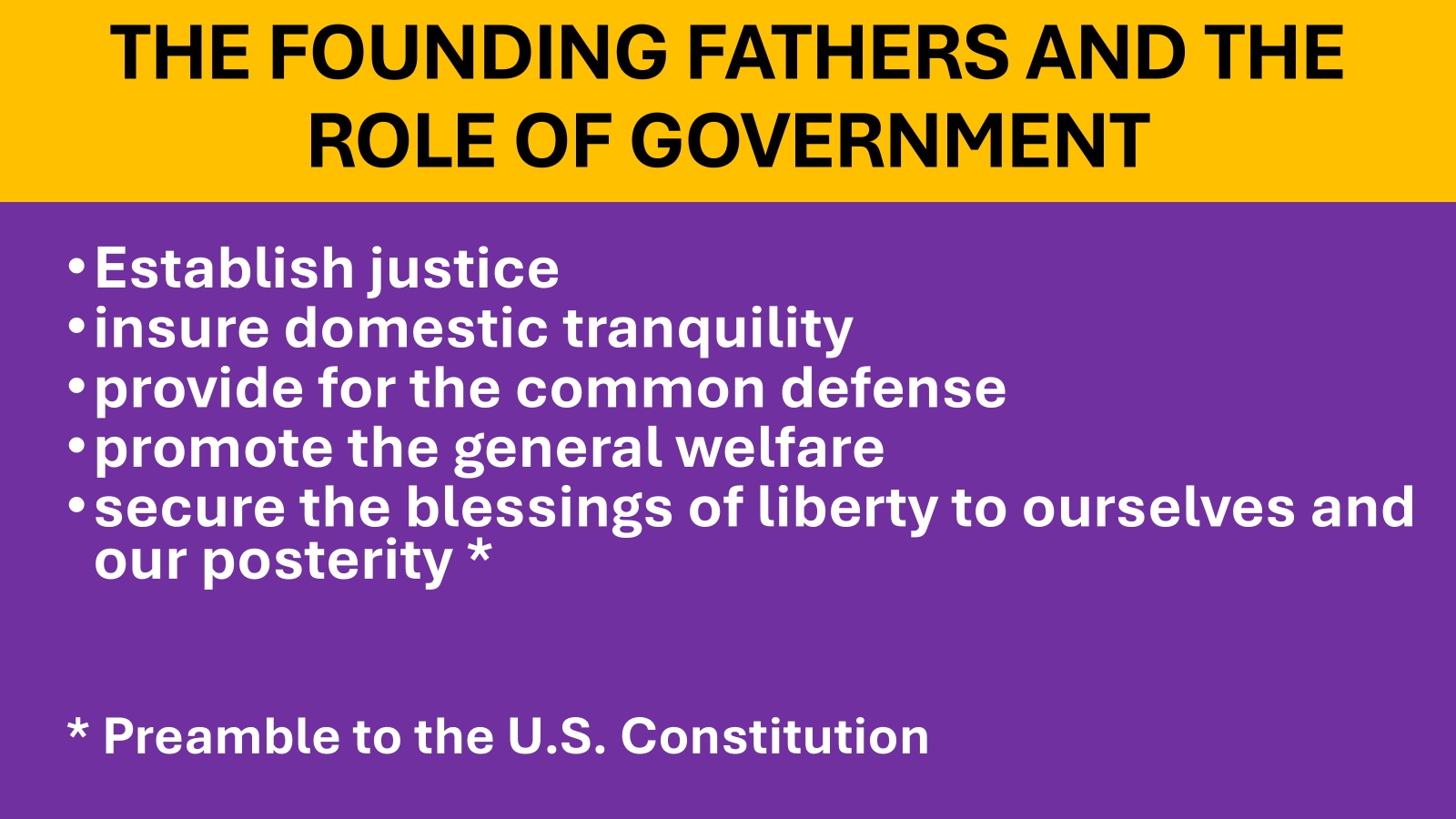

Checks and balances? Since Grassley and his Senate Republican colleagues voluntarily abdicated their Constitutional authority, responsibilities, and prerogatives, we no longer have a functioning constitutional representative democracy. We essentially have a king.

Of course, the biggest show in Washington, D.C. has been the around-the-clock push to pass a budget reconciliation bill. Republicans want to get the One Big, Beautiful Bill (also known as a Big Ugly Mess) to President Donald Trump’s desk for a reality TV style triumphant bill signing on the Fourth of July. The days-long Senate debate ended on July 1 with a dramatic tie-breaking vote by Vice President J.D. Vance. Grassley and Iowa’s junior Senator Joni Ernst voted for the bill, along with all but three of their GOP colleagues.

Congressional Republican leadership have characterized the bill as Trump’s domestic policy agenda. That’s misleading at best. At its core, this legislation is the Senate Republican leadership’s tax cut agenda with enough of Trump’s ideas and MAGA bumper stickers attached to keep his support base on board.

Continue Reading...