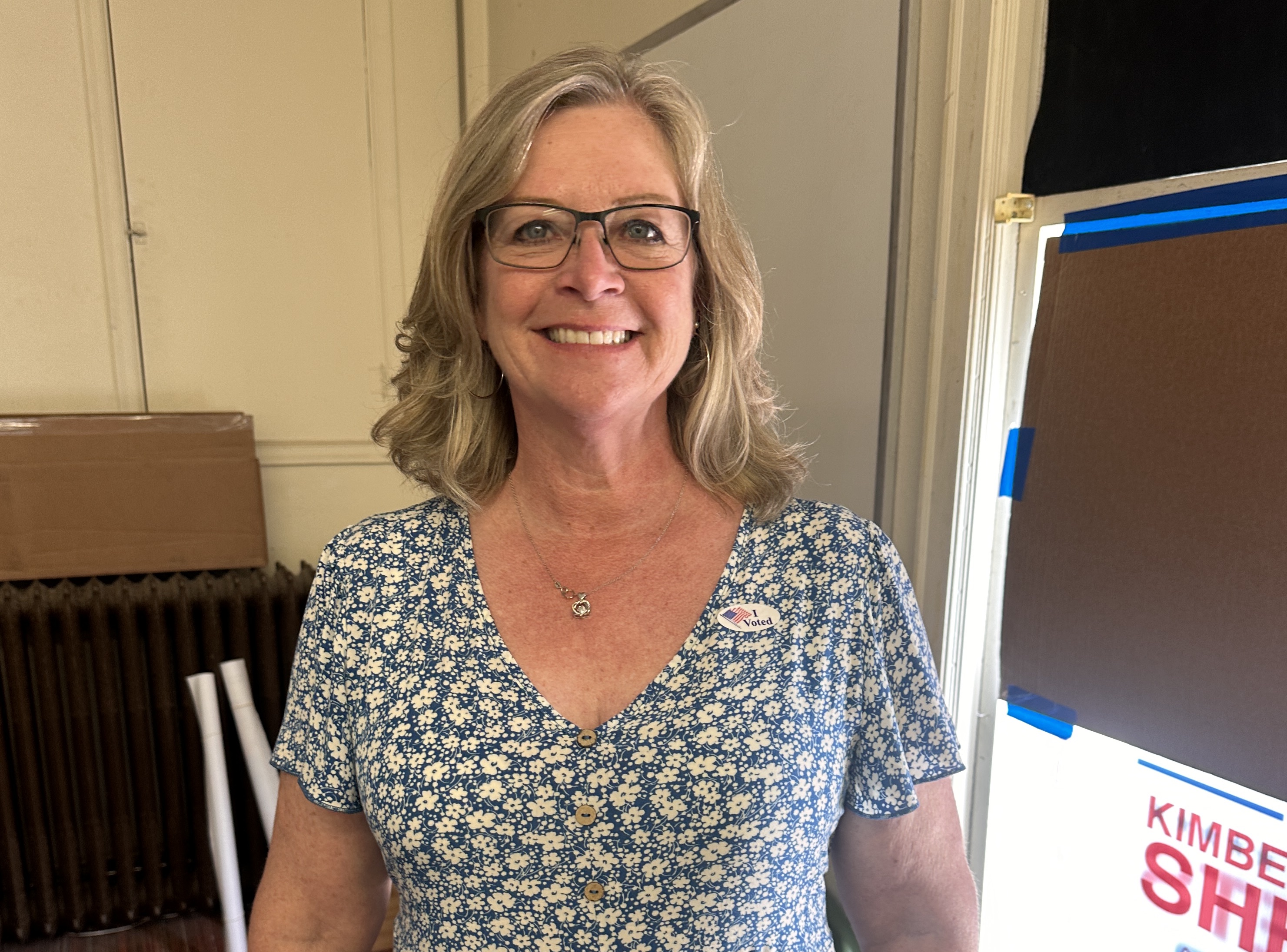

A massive organizing effort paid off for Kimberly Sheets, as the Democrat won the August 29 special election for Warren County auditor by a two-to-one margin. Unofficial results first reported by Iowa Starting Line show Sheets received 5,051 votes (66.56 percent) to 2,538 votes for Republican David Whipple (33.44 percent). Turnout was more than three times higher than the previous record for a Warren County special election (a school bond issue in 2022).

Republicans haven’t lost many races lately in this county, but they pushed their luck by nominating Whipple. Not only was he lacking experience in election administration—one of the duties of Iowa county auditors—he had shared Facebook posts espousing conspiracy theories about the 2020 presidential election and other QAnon obsessions.

The county’s previous auditor, Democrat Traci VanderLinden, retired in May and wanted Sheets (the deputy in her office) to succeed her. Whipple’s appointment by an all-Republican county board of supervisors generated lots of statewide and some national media attention, because of his now-deleted social media posts. Local Democrats collected about 3,500 signatures over a two-week period demanding a special election.

County GOP activists could have picked a less controversial nominee for the auditor’s race, but they stuck with Whipple. The move backfired spectacularly.

Continue Reading...

8:31 PM--Destiny appears to be losing badly, track the news over at Iowa Independent.

7:57 PM--Bumped back up to the top for discussion as the polls start to close. - promoted by Chris Woods)