Thanks to Jon Muller for a close look at the effects of a law that is a major reason Iowa lacked the revenue to fund K-12 schools and higher education adequately this year. -promoted by desmoinesdem

Senate File 295, the keystone tax bill passed into Iowa law in 2013, is now in full swing. It left a big hole in the State’s General Fund. It delivered handsomely on its promise to cut taxes for commercial property owners, at least in the short run. It provided modest help to the working poor. For its $500 million (plus) price tag, it has accomplished little else.

One positive aspect from the bill, at least from the perspective of most readers on this blog, was an increase in the Earned Income Tax Credit, which returns approximately $30 million to low-income working Iowans. Whether that benefit was worth the hundreds of millions given away to Iowa commercial property owners is a question left to the political analysts.

The remainder of this piece will focus on the property tax components of the bill. For reasons economic, these provisions are not likely to fulfill their stated purpose of spurring development or reducing rents for small businesses and renters. Those issues will be the subject of a different blog post. This post addresses a variety of tax burden shifts, some intended, some not. Virtually all of the benefit has gone directly to improve the wealth of commercial property owners, and shifted the property tax burden to homeowners in the short-medium run. In a strange twist, for those who desired that impact, even that may possibly fail the test of time.

Background

The primary elements of SF 295 covered in this piece are:

1. Commercial property is now taxed at 90% of assessed valuation rather than 100%. In exchange for this, however, commercial property has lost the benefit of a rollback. If assessed values grow 5% in a year, then taxable values will grow 5%. Previously, there was protection from spikes. This provision also applies to railroad property and industrial property.

2. There is a provision for a Business Property Tax Credit, funded at $50 million in FY 2015, jumping to $100 million for FY 2016, and then increasing again to $125 million every year thereafter. The credit is prorated from the bottom up, such that it’s a fixed valuation credit set at a level that depletes the appropriation (think along the lines of the opposite of a Dutch auction). The maximum credit for the current year was $3,219.34. That maximum credit will increase in FY 2017, then trend lower over time.

3. Multi-residential property will now be taxed at 86.25% of assessed value, and separated as its own class of property. That valuation rollback will fall 3.75% each year going forward until 2022, at which point the Multi-res rollback will be equal to the residential rollback (currently 55.6%).

4. The taxable value limitation for residential and agricultural property is reduced from 4% to 3%. In other words, the taxable value of revalued property cannot grow more than 3% in a year.

5. Local Governments are reimbursed in two ways. The state pays the cost of the Business Property Tax Credit, much as they do the Homestead Tax Credit. The valuation reductions will be paid by the State as well, but will be capped going forward at FY 2017 levels. The future cost of that will be borne by local governments (mostly cities, counties, and community colleges), by the citizens they serve in the form of reduced services, and/or by an increase in tax rates. Some levies are rate limited, making recovery problematic. In other cases, the political environment in a given taxing authority can make it difficult to execute a tax increase, even if possibly by law.

It is almost impossible to make substantive changes in property tax law without a host of unanticipated consequences. In the short run, the effect of the bill will be to shift tax burden to and among various other classes of property. The residential and farm tax break will be shifted to commercial property owners. The commercial tax break will be shifted to homeowners principally, but also to farmland owners. And all of these tax breaks will be shifted to State government, which is now having a very difficult time funding schools and other priorities. The remainder of this piece will focus on the interplay between the various classes of property, and the winners and losers in that process.

Shift to Homeowners

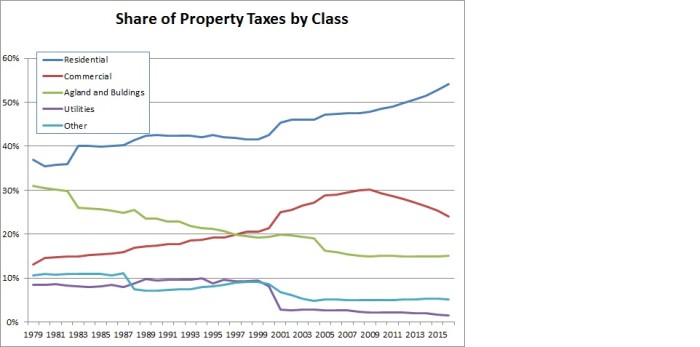

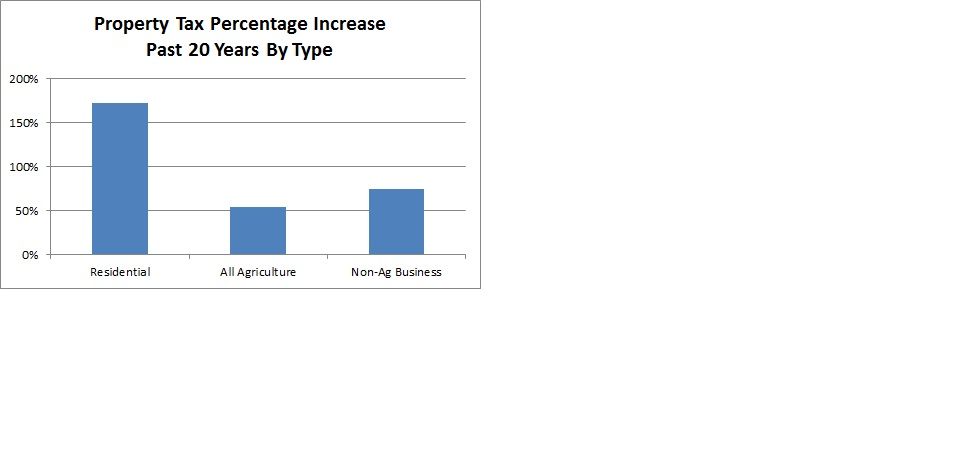

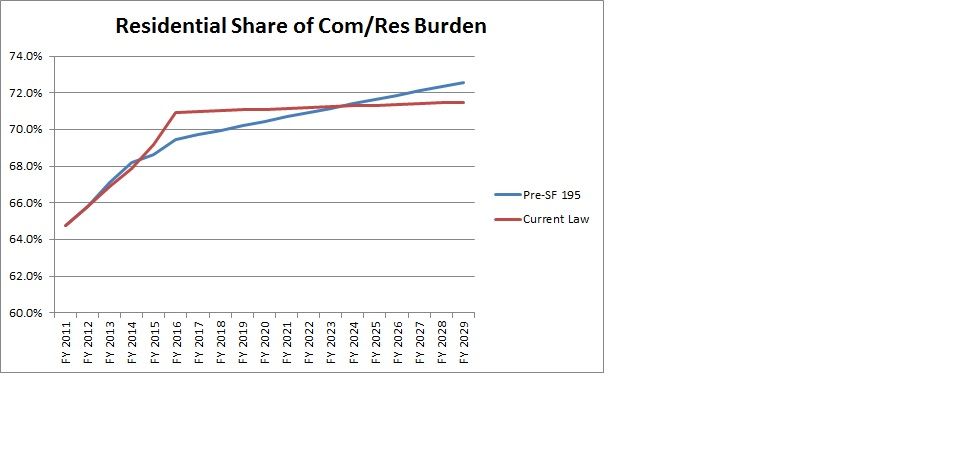

Property taxes are a little like a balloon. If you poke it in one spot, it’s going to expand everywhere else. In the case of SF 295, the effect thus far has been a shift in tax burden from commercial property owners to homeowners and the State General Fund, by way of property tax replacement dollars going to local governments. It should be self-evident from the following chart that the shift is on.

From 1979 to the late 90s, the balance between commercial property owners and homeowners was reasonably balanced, with both classes absorbing a larger share of the overall buden. For example, both classes saw a bump in the late 90s, due to the phaseout of the tax on Machinery and Equipment, which wiped out $80 million in tax burden on businesses. Both classes saw increased relative burdens, but they experienced the pain together.

While the pace of growth was slightly higher for commercial property owners, it did not result in commercial taxpayers having larger increases in their tax bills compared to nearby homeowners. If one looks exclusively at the taxes paid by existing commercial property owners and residential property owners from the early 1980s to 2013, it is almost indistinguishable. The excess burden paid by commercial property was due almost entirely to two factors.

First, there is more of it. More malls. More office buildings. More apartments. While the net residential housing stock has grown somewhat, it doesn’t come close to the growth in net new commercial construction. Net new construction represents roughly 60% of the contribution to commercial valuation growth. For residential, it’s only about 40% of the growth in valuation. Residential property values grow generally faster than commercial property values, all other things being equal.

That all began to shift, first with the turn in commodities prices. There’s a peculiarity of the assessment formula that prevents residential taxable values from rising more than farmland values, and visa versa. Without getting into details, it only comes into play when at least one of the two property classes is taxed at 100% of assessed value. For many years, there was very little assessment growth in farmland values, largely due to the productivity formula that determines these values. That all changed in the last half of the last decade when farmland values went from being taxed on 100% of productivity value (ie. assessed value) to 43% in just 7 years. As corn prices have since come back down, the rollback percentage has increased to 46%. Agriculture taxable property values will increase 3% for the indefinite future. The rollback acts as a ratchet. If assessed values plummet, they go down all at once. But once down, they can only go up 3% per year from then on out, until the 100% assessment level is reached. (Keep this in mind for subsequent discussion about how commercial property owners may one day regret what they wished for).

Of course now, the shift has been exacerbated by SF 295. It has happened so fast that commercial’s share of the statewide property tax burden, relative to residential property, is down to levels not seen in 25 years, before there was any Jordan Creek Town Center or Coral Ridge Mall or Bass Pro Shop.

We have already experienced a shift in the relative burden of the taxes paid, as shown in the first chart. It is also true that the absolute burden has increased for residential and fallen for commercial. Since FY 2012, the year before SF 295 was passed, residential taxes have increased 19%. Commercial property taxes have fallen 6%. Even with the benefits provided by the legislation, we have experienced a compounded increase in burden of 4.5% annually, far outpacing either inflation or the increase in the cost of government services. In many cases, the cause is attributable to an increase in tax rates, which is where the rubber meets the road…..or, to borrow from an earlier metaphor, where the balloon bulges when you press in on it.

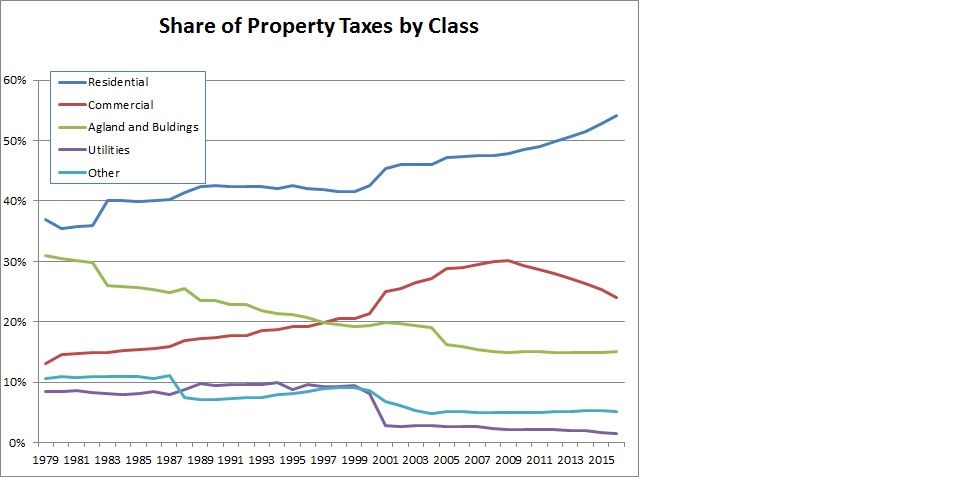

I’ll leave it to political analysts to offer suggestions on why the focus has been on business tax relief, but the data bears out that it has. Utilities scored a massive cut from a restructured assessment process some 15 years ago. Industrial property owners scored a big cut with the elimination of the property tax on machinery and equipment. Of course farmland owners have done a consistently good job of limiting both their tax burden and the rate of change in tax. And now the commercial property owners have jumped aboard as well. The following chart shows the change in burden over the past 20 years by class of property.

With that in mind, it might help policy makers to understand not just the various classes of property, but a grouping that shows how the major economic players are faring, breaking it down into just three types: Residential, Agriculture, and Non-Ag Business. It does give one pause as to how the priorities are served, particularly in light of the fact that the people who live in homes rely so heavily on the State General Fund Revenues that have paid for so many of these tax cuts.

This shift will be magnified even further with changes to the valuation for Apartment Buildings. Those taxes will fall at least 35%, possibly more, by 2022. That benefit begins to be implemented for the next tax payment due in September. Ironically, a share of that burden will no doubt be picked up by commercial property owners who don’t happen to own apartment buildings, in addition to homeowners, farmers, etc. Part of the argument for reducing apartment building taxes was to give relief to renters. In the short run, that will not happen. The owners of the property will enjoy 100% of the benefit, and rents will not fall. In the long run, there will be a modest supply response, which will cause landords to reduce rents. For now, it acts purely to increase the return on investment and wealth of existing property owners.

Long Term Shift

It remains to be seen what the long term shifts will be from SF 295. This piece doesn’t walk deep enough into the weeds to quantify the impact of apartment buildings, railroads, industrial property owners, all of whom benefited from SF 295 as well. But it is important when getting close to the weeds that you don’t step into the shift. I suspect commercial property owners will be back to the table before long asking for some remedy for the shift they are experiencing, once they figure out they can’t get it off their shoe.

Prior to SF 295, commercial property owners generally paid taxes on 100% of their assessed valuation. They witnessed their homeowning brothers and sisters paying taxes on as little as half their assessed values, and viewed that as unfair. As explained earlier, had assessed values of commercial property grown as fast as residential, their assessment limitation would have come into play. Conversely, had commercial property been given the residential rollback, the taxes paid by existing property owners would have been cut in half, while residential taxes would have continued to grow.

It’s important to note that commercial property is not taxed on 100% of its value every year, even pre-SF 295. In 7 of the 20 years preceding SF 295, there was a commercial rollback. In other words, commercial property owners paid tax on less than 100% of their taxable valuations. In those 7 years, the rollback prevented taxable value for the class to grow more than 4%. Granted, it wasn’t huge. But in 1997, for example, assessed value for commercial property grew 7%. Their taxes also likely would have grown commensurately, had it not for a rollback limiting the growth to 4%. The lowest commercial rollback was 87.8%, below the 90% rollback put into place via SF 295.

A 7% jump in taxable value will not go unnoticed, likely leading to further calls for property tax reductions, even if the jump is short term. And it’s not difficult to imagine a 7% increase, or even a 14% spike. Generally, revaluations occur every other year. If there were two back to back years with 7% growth in the value of commercial property, both of those spikes would be felt at the same time. With inflation near 2%, that’s difficult to imagine in Iowa’s economic climate. But with a rise in inflation to 4% or 5%, it is completely possible, even likely.

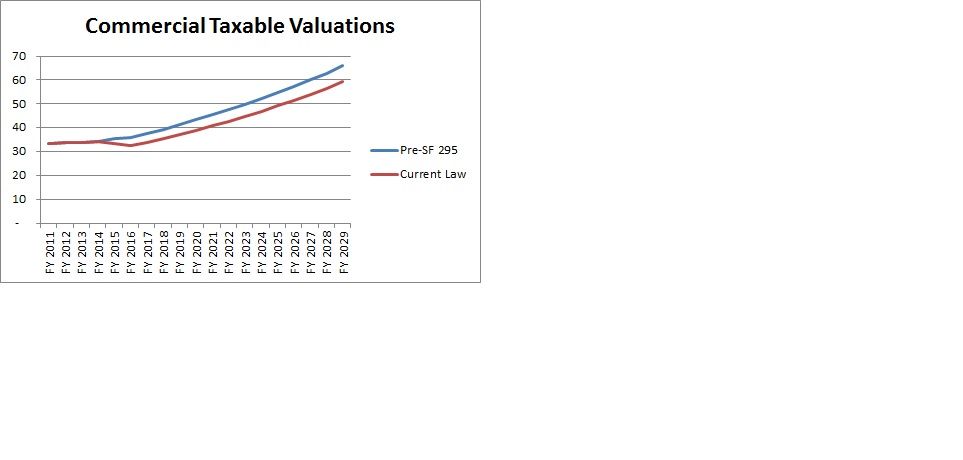

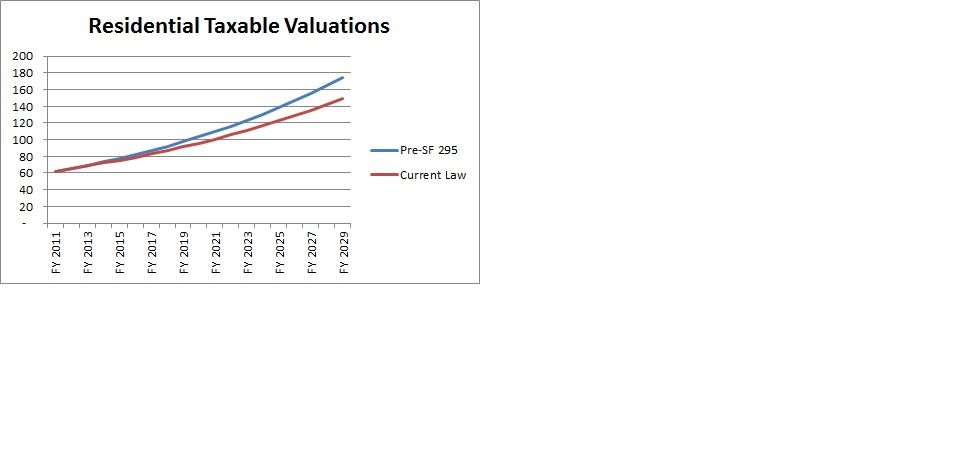

Meanwhile, as shown earlier, farm property and residential property are now limited to 3% growth each year, rather than 4%. In the short run, the benefit to commercial property (a 10% reduction, plus the business property tax credit) will far outstrip the benefit to homeowners. But over time, the compounding effect of the ag/res assessment limitation will outstrip the benefit to commercial property owners. For ease of understanding, consider the following two charts, which show the change in taxable valuations for Commercial and Residential Property.

This is a variation on the old 5th grade math question, “Would you rather have $100 today, or a penny today, which I’ll then double each day for 16 days?” Commercial property owners may one day realize they chose the $100 today. Keep in mind, this is a fairly simple scenario. I used average growth rates and net new construction rates by class, comparing just the two classes of property, residential and commercial. Admittedly, this test could be more rigorous. That said, with property tax systems, it’s all in the mechanized increases afforded by law. With commercial property, the new law gives a one-time scalar benefit. Commercial valuations will generally be 10% lower than they would otherwise be. For residential (and agland also), there’s an exponential function: 1% this year, then 2%, then 10.6% in year 10, and 16% by year 15.

That enables us to compare which class of property fairs better in the long run. Eventually, the lines will cross in relative valuations.

Again, this is a simple illustration. It only addresses taxable valuation, which is the number that the tax rate is multiplied by to arrive at your tax bill. It doesn’t take into account the Business Property Tax Credit, but that is a fixed number as well. It’s even less meaningful over time than the 10% reduction in taxable values. Less meaningful, that is, unless commercial property owners come back to the table to ask for a larger appropriation. They will see average tax increases higher than residential and agriculture. They will once again complain of unfair treatment and noncompetitive nature of the property tax system. When they show a graph displaying the inequity, the first year displayed on their graph will be 2016…..the year after their scalar and one time benefit was fully realized.

When all this is played out again, as it inevitably will be, the question will be whether State government takes care to implement something that provides predictable property tax growth rates for all the classes, raises sufficient revenue to fund services, and leaves adequate State revenue for education and other priorities. Perhaps cooler heads will prevail, and they’ll return to a system closer to the one that worked fairly well for 30 years.

9 Comments

Sorely needed!

Thanks for this post. You should do it much more often. The property tax situation and history is too complicated to cover in one essay.

Let’s go back to the Business Tax Credit. Can you give an example or two? Wasn’t this the feature that Dems demanded? Can you explain why they demanded it?

Also—it seems odd that the Dems agreed to cut commercial property taxes (which depletes local coffers) in exchange for greater Earned Income Tax Credit(which depletes state coffers). Two sets of constituents (commercial property owners and EITC recipients) both benefit but the counties and cities (the rest of us!!) suffer. Some trade off that was!

iowavoter Tue 31 May 12:19 PM

More Color on Business Tax Credit

Thanks, iowavoter. The idea behind the BTC was to give a disproportionate amount of benefit to smaller properties, thinking that would make it progressive. There are, of course, very wealthy owners of small properties, and relatively poorer owners of large properties (eg., if I owned Principal Financial Group in my 401k). Basically, the forgive the first dollar of value on your building. The credit is equal to the Tax Rate X that dollar. So, if the average state rate was $35/$1,000 of taxable value, then your credit would be $3.50 on every commercial parcel. Once a commercial property’s valuation is reduced to the level of the Residential Rollback, no more credit. So they just set the valuation forgiveness at the greater of: A) The Residential Rollback Percentage, or B) an amount such that, in the aggregate, the appropriation for the credit is consumed. Smaller, less expensive buildings will get a larger percentage reduction in their tax bill than large expensive buildings.

jonmuller Tue 31 May 12:37 PM

Ah but what to do about that darned ag valuation formula

This was a good, in the weeds, explanation of what happened, why, and what to expect. Having studied the genesis of the previous property tax system with its joined-at-the-hip rollback treatment of both ag land and residential property, I still am amazed at the disconnect between farmland profitability (basically its annual rent value) and the taxes paid on that land. Remember, ag land taxes are paid by the owner who increasingly is not actively farming the land. Ag land property taxes are sacred territory that no sane legislator will ever tread. The exceptions and allowances are too numerous to mention beyond the favorable treatment afforded land extends to confinement operations.

daveswen Tue 31 May 4:23 PM

RE: Agland Taxes

Thanks, Dave. I’ve been thinking of writing one up just on the agland tax issue as well. The tie to residential won’t have any impact for a very long time, even longer now that the max TV increase was lowered to 3%. The farmers have done a better job reducing their tax burden than anyone else, with the possible exception of utilities. There is one very curious feature that you touched on that is particularly interesting. The law says that ag land and ag buildings are both to be taxed on their productivity value. But they are not. Rather, the formula that is used to assess ag property only takes into account the land value. That is a countywide total assessment, and then it is apportioned to all the land and buildings in the county. If a new CAFO is built, all that does is reduce the valuation on the land. The law doesn’t read that way at all. In my judgement, the application of the formula is completely contrary to the law. To my knowledge, it has never been challenged.

jonmuller Tue 31 May 4:33 PM

how does that work?

Are you saying that if I build a new CAFO on my farmland, the total valuation of my property (land and buildings) will not increase at all?

If I build a big addition to my house, the valuation of my residential property (and consequently my tax bill) will go up.

desmoinesdem Tue 31 May 7:00 PM

Not quite like that

If you build a new CAFO on your land, your tax will increase. It’s not the same in every county, but figure 30% of net acquisition cost (unless things have changed in recent years). So, if you build a $1 million facility, your taxable valuation will increase, say, $300,000. However, the total assessed valuation for the county will not change. The assessed value for all acres in the county will fall by that $300,000. There is an argument to be made that CAFOs increase the average price per bushel, which increases the valuation. There are some problems with this idea I won’t get into here and now. For the most part, a CAFO will increase the CAFO owner’s valuation, but lower the valuation for other landowners in the county.

jonmuller Tue 31 May 9:32 PM

I would be very interested

in a close look at how the rollback works for farmland as well as the various exceptions that allow ag land to be tied at a lower rate.

desmoinesdem Tue 31 May 6:57 PM

Fact Check

Just curious as to where the numbers for this article came from. I might site them in a townhall meeting and I want to be able to back them up. Thanks Dave

dcough Fri 24 Feb 1:35 PM

Sources

I missed this question. Sorry about that. All the underlying data came from the Iowa Department of Management, and is readily available on their web site.

jonmuller Tue 30 May 4:11 PM