Des Moines attorney Gary Dickey has asked the Iowa Ethics and Campaign Disclosure Board to reconsider its recent vote to dismiss his complaint related to free private plane flights provided to Governor Kim Reynolds and her family last year. The Reynolds campaign received prior approval from ethics board executive director Megan Tooker that the flights could be declared as an in-kind campaign contribution and would not be considered a violation of Iowa’s gift law.

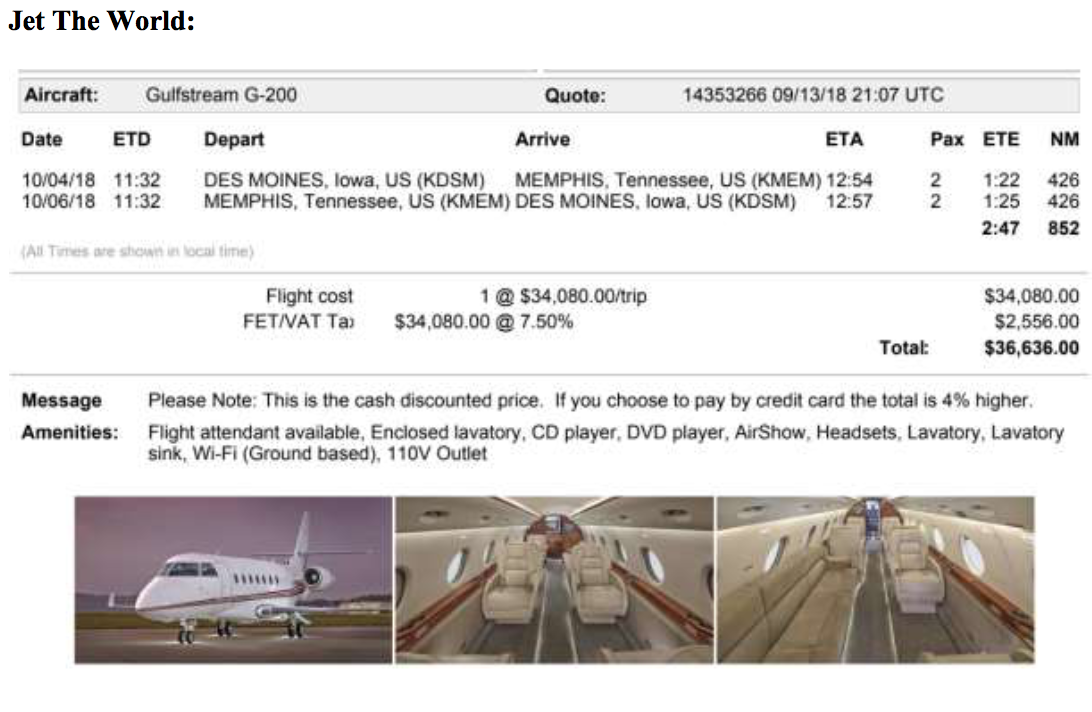

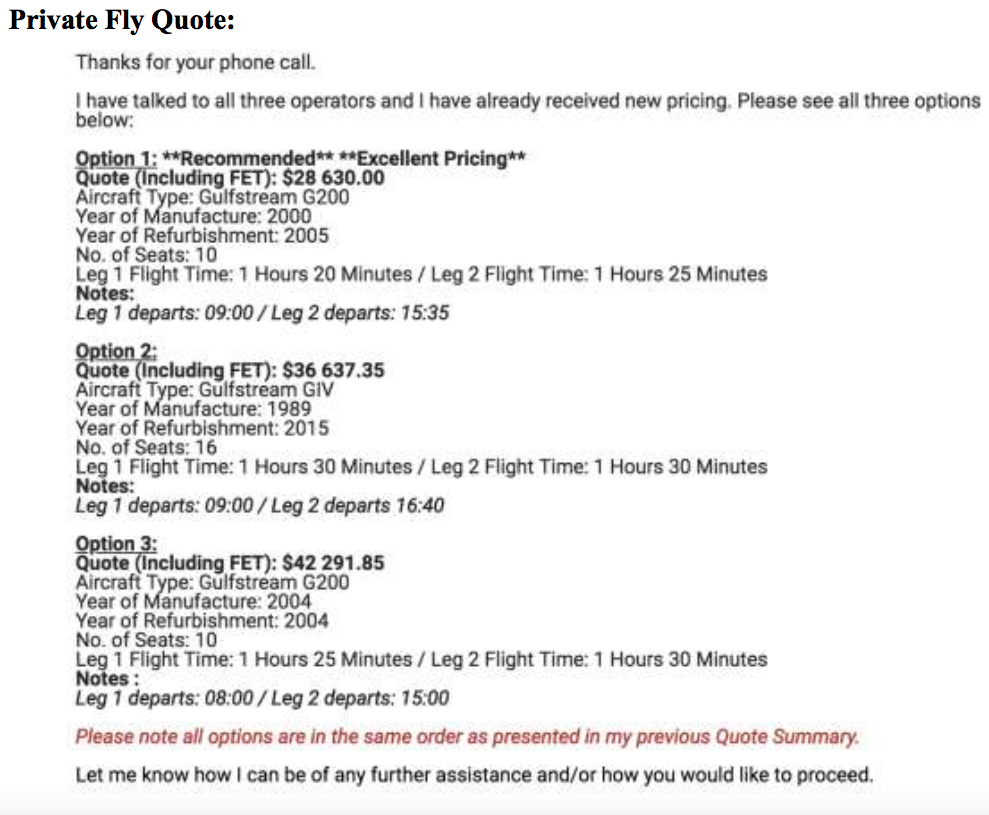

David North, CEO of the Sedgwick corporation, covered the cost of travel to and from Memphis on December 30, 2017. In a complaint filed last week, Dickey asserted that the Reynolds campaign “underreported the fair market value” of that private jet service. If the board does not reconsider its decision, Dickey plans to appeal the agency’s action to district court.

Iowa law requires campaigns to “report the estimated fair market value” of goods or services “at the time it is provided to the committee.” The person making the in-kind donation is supposed to inform the campaign of the estimated fair market value, which “shall be reported regardless of whether the person has been billed for the cost of the in-kind contribution.”

North offered the governor’s family the use of Sedgwick’s plane to watch Iowa State University’s football team play in the Liberty Bowl. (Reynolds later paid for the football tickets with a personal check.) The campaign reported the value of North’s in-kind contribution at $2,880. Dickey did some checking on the cost of private plane service between Des Moines and Memphis.

Multiple quotes show that the fair market value of a chartered Gulfstream G200 from Des Moines, Iowa to Memphis, Tennessee costs an average of $35,000 for a one- day trip. See Ex. 3 (Jet the World Quotation 09/13/18); Ex. 4 (Air Charter Service Quotation 09/13/18); and Ex. 5 (Private Fly Quotation 09/13/18). On the low end, the fair market value of a seat on a privately chartered Gulfstream G200 would be $2,290 per passenger. At the high end, the fair market value of seat would be $4,229 per passenger. On average, the fair market value of a seat is $3,108 per passenger.

The Associated Press article indicated that Governor Reynolds and her husband accepted the flight in order to campaign. Thus, the campaign contribution should be valued at the fair market value of two seats on a chartered Gulfstream G200, which would be $4,580 on the low-end, $8,458 on the high-end, and an average of $6,216. Either way, it appears that Kim Reynolds for Iowa failed to disclose the fair market value of the in-kind contribution from David North.

Another Iowan had raised separate concerns about the governor’s reporting of free flights as campaign contributions. A confidential complaint filed in late August noted that several donors who had provided airplane travel do not personally own jets. If those donors did not reimburse the companies for the use of planes owned by a business, then the in-kind gifts could be construed as illegal corporate contributions.

The complaint also questioned whether Iowa campaigns should be required to disclose the corporation’s name as an entity that in effect loaned the use of the aircraft to the donor named on the in-kind schedule. Sedgwick administers workers’ compensation claims for the state, but a person reviewing the Reynolds campaign filings would see only North’s name, no indication the governor flew on a plane owned by a state vendor.

In later correspondence, the complainant raised other concerns. Had the campaign accurately estimated the value of the flights to and from Memphis? Did that trip have a legitimate campaign purpose? (Staff have said the half-day trip included “campaign donor meetings”; if no such activity occurred, the travel would be a gift law violation.) Were the governor’s adult children allowed to accept the free flights?

In advance of the ethics board’s September 20 meeting, Tooker drafted an order dismissing both complaints as legally insufficient. You can read the full document here or near the end of this post. Campaign contributions are “the first exception to the gift law,” it noted. Adult, non-dependent children are not covered under that law, so any person or corporation can legally provide cash or goods and services to the governor’s children. Iowa administrative rule 351–4.47(4) specifically allows for candidates or campaign committees to use a corporate airplane.

As for the fair market value of such flights, that rule states,

a. Air travel. A candidate, candidate’s agent, or person traveling on behalf of a candidate who uses noncommercial air transportation made available by a corporate entity shall, in advance, reimburse the corporate entity as follows:

(1) Where the destination is served by regularly scheduled commercial service, the coach class airfare (without discounts).

(2) Where the destination is not served by a regularly scheduled commercial service, the usual charter rate.

Tooker reasoned that since Memphis is a destination served by commercial airlines from Des Moines, $2,880 was in line with what coach class airfare would have cost for Reynolds and her husband to fly to the Iowa State game.

That logic makes no sense to me. A coach ticket on a commercial airliner does not have the same value as a flight on a private jet. Could someone provide the use of a luxury penthouse condo for a campaign event, then report the in-kind contribution as the cost of renting a one-bedroom apartment in the basement of the same building?

In addition, Dickey explained to Bleeding Heartland, the administrative rule states that if a campaign committee uses the cost of coach class airfare to estimate the value of a private flight, they “shall, in advance,” reimburse the corporation. In this case, there was no campaign expenditure for plane tickets before the trip to Memphis. Instead, the campaign reported the travel as an in-kind contribution after the fact.

The board’s dismissal order also said that fair market value for a plane trip could be calculated in line with “detailed guidance” from the Internal Revenue Service “on how to value employer-provided flights for income tax purposes.”

During the September 20 meeting, Tooker and ethics board chair James Albert noted that candidates for governor from both parties had accepted plane travel as in-kind contributions during past election cycles. The four board members present voted unanimously to dismiss the complaints.

Dickey provided this statement to Bleeding Heartland on September 21 (emphasis in original).

The Ethics Board’s understanding of IRS fair market valuation of corporate flights is demonstrably incorrect. Under IRS rules, the “fair market value” of a flight on a corporate jet “is equal to the amount that an individual would have to pay in an arm’s-length transaction to charter the same or a comparable piloted aircraft for that period for the same or a comparable flight.” And, the IRS expressly prohibits determining fair market value by comparing it to the same cost of a commercial flight. That is exactly the definition I requested the Board to apply, which is why I provided it with three quotes of a comparable charter flight.

The Iowa Legislature could have allowed campaigns to report in-kind contributions of corporate jet service at the cost of a commercial flight, but instead expressly required in-kind contributions to be reported at fair market value. I presented the Board with probable cause to believe that the Reynolds for Iowa candidate committee did not report David North’s in-kind contribution at fair market value. If the Board will not voluntarily fulfill its statutorily required duty to investigate, then I will ask a court to force them to do so.

Under IRS rules:

If an employee takes a flight on an employer-provided piloted aircraft and that employee’s flight is primarily personal, the value of the flight is equal to the amount that an individual would have to pay in an arm’s-length transaction to charter the same or a comparable piloted aircraft for that period for the same or a comparable flight. A flight taken under these circumstances may not be valued by reference to the cost of commercial airfare for the same or a comparable flight. The cost to charter the aircraft must be allocated among all employees on board the aircraft based on all the facts and circumstances unless one or more of the employees controlled the use of the aircraft.

26 C.F.R. section 1.61-21(b)(6) (emphasis added).

https://www.law.cornell.edu/cfr/text/26/1.61-21

Dickey filed a formal request for reconsideration on September 21. That document is available here or near the bottom of this post. Dickey argued that $2,880 “was not consistent with ‘the amount an individual would have to pay in an arm’s length transition to charter the same or comparable piloted aircraft for that period or for the same or a comparable flight.'” On the contrary, “the Reynolds for Iowa candidate committee severely underreported the value. More importantly, the Board undertook no investigation to determine what the fair market value of the flight [was] under the IRS rules.”

Dickey argued that it was “a stunningly incorrect statement of the law” for the board to conclude administrative rules allow North “to estimate the fair market value of the trip using coach class airfare.”

By its plain language, that methodology applies only when a candidate committee pays in advance for the use of a corporate jet in which case the amount must be reported as an expenditure on the committee’s Schedule B. Here, the Reynolds for Iowa candidate committee did not pay in advance for the use of a corporate jet, nor did it report the amount on Schedule B. Rather, the expense was paid by David North and reported as an in-kind contribution. Under Iowa Code section 68A.402A, the in-kind contribution must be reported at its “fair market value.” Reimbursement cost is not the same as fair market value. Fair market value is “generally understood to be the price for which an asset would be sold, in a transaction between a willing buyer and willing seller, with neither party being under any particular computation to complete the deal within any particular period of time. In re Marriage of Lang, 2017 WL 1735893 at *2 (Iowa Ct. App. 2017); accord Black’s Law Dictionary at 597 (6th Ed. 1990). The Board has essentially adopted definition in its administrative rules: “‘fair market value’ means the amount that a member of the general public would expect to pay to purchase or rent similar property within the community in which the property is located.” 351 Iowa Admin. Code 4.47(1). Astonishingly, the Board’s order fails to acknowledge its own definition of fair market value. This shortcoming alone is sufficient to reconsider the dismissal order.

In conclusion, Dickey argued, “The legal and factual errors are so apparent, that the Board’s action in dismissing the complaint will not survive judicial review. The citizens of the State of Iowa deserve to have the matter investigated in advance of the 2018 general election so they can fairly evaluate the Reynolds for Iowa candidate committee’s campaign finance reports.”

Tooker has not clarified whether the board will reconsider its dismissal, nor has she responded to my questions about other points Dickey raised. I will update this post as needed.

UPDATE: The Reynolds campaign also reported an in-kind donation of $2,640 from North, covering a flight and dated October 25, 2017. The governor was in Washington, DC the day before to receive an award. Presumably that flight was under-valued as well.

Appendix 1: Iowa Ethics and Campaign Disclosure Board’s September 20 order dismissing two complaints regarding the Reynolds campaign’s reporting of free private plane flights.

Appendix 2: Gary Dickey’s request for reconsideration, filed on September 21.

Appendix 3: Selected pages from Dickey’s complaint, showing quotes he received from companies offering private plane travel between Des Moines and Memphis.

Exhibit 3 :

Exhibit 5:

Top image: Gulfstream 200, the same type of aircraft Sedgwick used to transport Governor Kim Reynolds and her family to and from Memphis, Tennessee on December 30, 2017 for the Liberty Bowl. By Greg Goebel [CC BY-SA 2.0 (https://creativecommons.org/licenses/by-sa/2.0)], via Wikimedia Commons.