SK Group logo in Kerala, India, in October 2023. Image by Jidev jidu photography, available via Shutterstock

Nancy Dugan lives in Altoona, Iowa and has worked as an online editor for the past 12 years.

On November 28, SK Growth Opportunities Corp., a Cayman Islands exempted blank check company formed in December 2021, filed a Schedule 14A Proxy Statement notifying the Securities and Exchange Commission (SEC) of an upcoming “extraordinary general meeting” of shareholders, with the express purpose of extending a looming December 28, 2023, deadline to consummate a business combination. The meeting is slated to take place December 22.

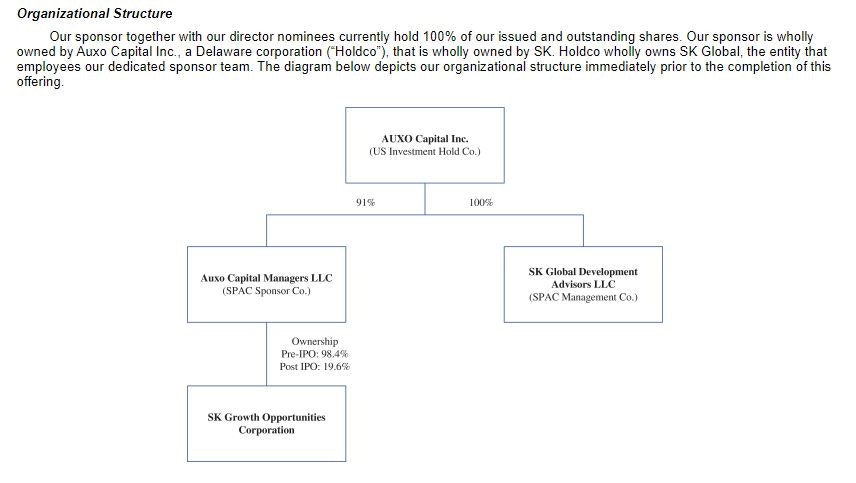

According to SK Growth’s initial May 23, 2022, Form S-1 Registration Statement under the Securities Act of 1933, the anchor investor in its sponsor, Auxo Capital Managers, LLC, is a wholly owned subsidiary of South Korean chaebol SK Group. A chart depicting SK Growth’s organizational structure is listed below:

SK E&S, also a subsidiary of SK Group, holds a 10 percent ownership interest in Summit Carbon Solutions.

Also known as special purpose acquisition companies, or SPACs, blank check companies are listed on public markets for the purpose of merging with or acquiring privately held companies. A June 15 Forbes article explained the structure of SPACs: “According to SEC rules, SPACs have a lifespan of two years. If a special purpose acquisition company is created but is unable to close the deal with the target company within two years, the SPAC has to be liquidated.”

The Forbes article goes on to state, “It is important to note, however, that the deadline for liquidation can also be extended to three years in some special cases.”

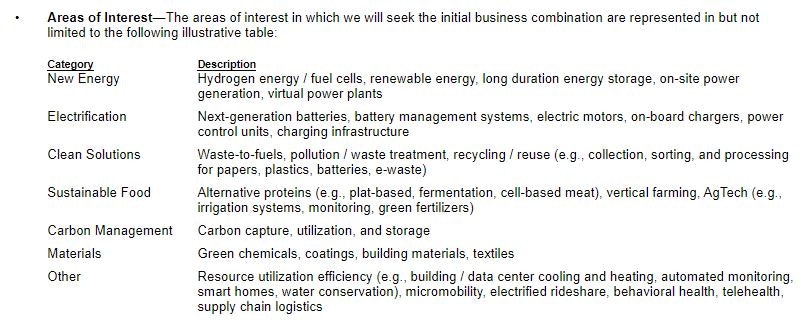

In March 2022, the SEC proposed new rules to govern SPACs, shell companies, and projections disclosures. An SEC fact sheet explains the reasoning behind the proposed new rules. SK Growth has not publicly announced a target company for its business combination, and it is not known if it is in discussions with one or more companies, including Summit Carbon Solutions, surrounding a potential business combination. In its initial Form S-1 registration statement, SK Growth identified carbon management (carbon capture, utilization, and storage) as one of several areas of interest:

According to its initial S-1 filing,

SK is a leading global conglomerate based in the Republic of Korea (“Korea”) with breadth and depth across a diverse array of industries spanning multiple continents. A wholly-owned subsidiary of SK is the anchor investor in our sponsor. SK and its affiliated companies operate more than 125 businesses across the energy, life sciences, advanced materials, mobility, and semiconductors industries with over $130 billion in assets globally.

Also in May of 2022, SK E&S announced that it had secured a 10 percent ownership interest in Summit Carbon Solutions.

The three proposals put forth in SK Growth’s November 28 proxy statement are as follows:

1. Proposal No. 1—Extension Amendment Proposal—To amend SK Growth’s amended and restated memorandum and articles of association (the “Memorandum and Articles of Association”) to extend the date by which SK Growth has to consummate a business combination (the “Extension Amendment”) from December 28, 2023 to September 30, 2024 (the “Extended Termination Date”), or such earlier date as SK Growth’s board of directors (the “Board”) may approve in accordance with the Memorandum and Articles of Association (the “Extension Amendment Proposal”);

2. Proposal No. 2—Trust Amendment Proposal—To amend the Investment Management Trust Agreement, dated June 23, 2022, by and between SK Growth and Continental Stock Transfer & Trust Company, as trustee (“Continental”), to extend the date on which Continental must liquidate the trust account (the “Trust Account”) established in connection with SK Growth’s initial public offering if SK Growth has not completed its initial business combination, from December 28, 2023 to September 30, 2024 or such earlier date as the Board may approve (the “Trust Amendment” and, such proposal, the “Trust Amendment Proposal”). A copy of the proposed Trust Amendment is set forth in Annex A to the accompanying proxy statement; and

3. Proposal No. 3—Adjournment Proposal—To adjourn, by ordinary resolution, the Shareholder Meeting to a later date or dates or indefinitely, if necessary, either: (i) to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Shareholder Meeting, there are insufficient Class A ordinary shares, par value $0.0001 per share (the “Class A Ordinary Shares” or the “Public Shares”), and Class B ordinary shares, par value $0.0001 per share (the “Class B Ordinary Shares” and, together with the Class A Ordinary Shares, the “Ordinary Shares”), in the capital of SK Growth represented (either in person, virtually or by proxy) to constitute a quorum necessary to conduct business at the Shareholder Meeting or to approve the Extension Amendment Proposal and the Trust Amendment Proposal, or (ii) if the Board determines before the Shareholder Meeting that it is not necessary or no longer desirable to proceed with the Extension Amendment Proposal and the Trust Amendment Proposal (the “Adjournment Proposal”), in which case the Adjournment Proposal will be the only proposal presented at the Shareholder Meeting.

Also in its November 28 proxy statement, SK Growth included the following three main categories under the Risk Factors heading (emphasis in original):

We may not be able to complete a Business Combination since such Business Combination may be subject to regulatory review and approval requirements, including pursuant to foreign investment regulations and review by governmental entities such as the Committee on Foreign Investment in the United States (“CFIUS”), or may be ultimately prohibited. […]

If we are deemed to be an investment company for purposes of the Investment Company Act, we would be required to institute burdensome compliance requirements and our activities would be severely restricted. As a result, in such circumstances, unless we are able to modify our activities so that we would not be deemed an investment company, we may abandon our efforts to complete an initial Business Combination and instead liquidate SK Growth. […]

To mitigate the risk that we might be deemed to be an investment company for purposes of the Investment Company Act, we may, at any time, instruct the trustee to sell the securities held in the Trust Account and instead to hold the funds in the Trust Account in cash until the earlier of the consummation of an initial Business Combination or our liquidation. As a result, following sale of securities in the Trust Account, if any, we would likely receive minimal interest on the funds held in the Trust Account, which would reduce the dollar amount the public shareholders would receive upon any redemption or liquidation of SK Growth.

According to a June 24, 2022, SK Growth Opportunities press release, SK Growth priced its initial public offering of 20,000,000 units at $10 per unit on June 23, 2022. The units began trading on the Nasdaq stock exchange under the ticker symbol “SKGRU” on June 24, 2022. The initial public offering closed on June 28, 2022.

Richard Chin serves as SK Growth’s Chief Executive Officer and Director. Chin previously served as President of SK Hynix and Head of SK’s Global Development Group. In a November 21, 2020, Financial Times article, one industry leader described the SK Group as “a kingdom built on M&As.”

The Financial Times article documents the SK Group’s checkered history in both the U.S. and South Korea. Its Chair, Chey Tae-won, was twice convicted in South Korea of accounting fraud and misappropriating company funds, although his prison sentences were reduced and he subsequently received presidential pardons. The Times article quoted Kim Woo-chan, an Economics Professor at Korea University, who stated: “The amount of [alleged] fraud was several times bigger than Enron’s and Mr. Chey was imprisoned twice for serious financial crimes but he still controls the group—this would be unthinkable in the west.”

As previously reported, on March 4, 2021, the U.S. International Trade Commission issued an opinion finding that the SK Group had misappropriated trade secrets from LG Chem, Ltd., another South Korean chaebol, worth billions of dollars, further finding that the “investigation demonstrates not merely SK’s eagerness to destroy documents, but also SK’s callous disregard to ascertain the scope of the destruction.”

According to an April 11, 2021, National Public Radio article by Wynne Davis, a settlement requiring SK to pay LG $1.8 billion was announced in April 2021, paving the way for SK to complete construction on an EV lithium-ion battery plant in Georgia that will provide batteries to Ford and Volkswagen, two contracts it had secured before the trade commission’s ruling.

One prominent SPAC that has faced SEC sanctions in recent years is Digital World Acquisition Corp (DWAC). In July of this year, the SEC settled fraud charges against the SPAC “for making material misrepresentations in forms filed with the SEC as part of DWAC’s initial public offering and proposed merger with Trump Media & Technology Group Corp. (TMTG).”