The old saying goes:

“The only things Inevitable in Life, are Death and Taxes!”

These are both unpleasant subjects, and since political candidates can’t really do a lot about one, this diary will be exploring the other — Taxes.

John Edwards has based his campaign on hard hitting messages about the need for “Economic Parity” in our Country — this Diary will be taking a serious look at what Edwards will do about Taxes.

The Senator often says “I do not wanting to live in a Country made up of the Super-Rich and Everybody Else!”

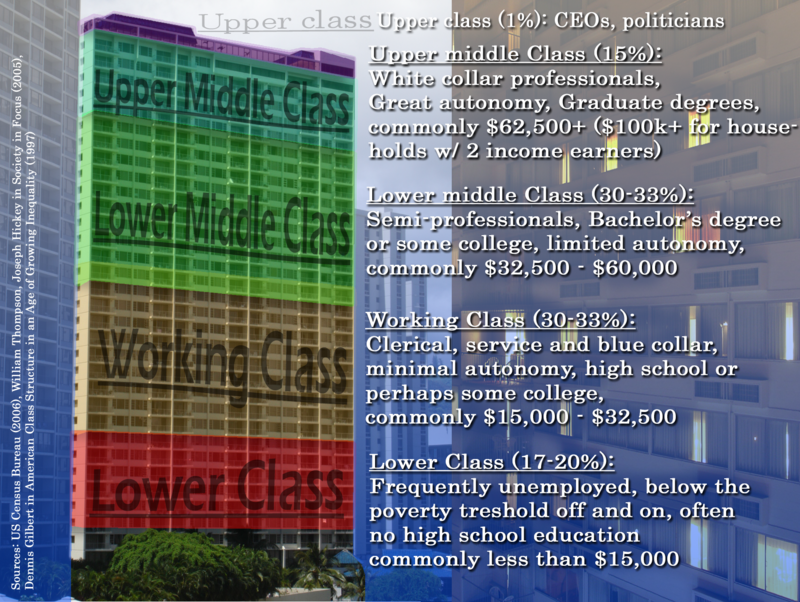

That’s not the America we all grew up in. Each year achieving the American Dream becomes more and more difficult. What are working people to do, in this society of Haves and Have-Nots?

Is John’s tough Campaign Rhetoric just Talk, or does he actually have the Plans to Back it up?

Turn the page, to see where the “Rhetoric meet Reality” when it comes to that annual April Ritual, most hard-working American love to hate — spelled I.R.S.

Solutions like UHC and stopping Global Warming will take Money — where’s ALL that money going to come from?

First the Documents to be discussed:

The Policy Summary Document:

John Edwards: The Plan to Build One America [pdf1]

http://johnedwards.com/issues/…

—-

The Edwards Issue Page on Tax Reform:

http://www.johnedwards.com/tax…

—-

The Policy Details Document:

Building One Economy with Tax Reform to Reward Work [pdf2]

http://johnedwards.com/issues/…

—-

Here’s where regular Working Americans start getting some Respect again in our Economic System (as expressed in an incomprehensible Tax Code), which all too often favors only those Wealthy enough to “work the system”:

John Edwards’ Tax Reform to Reward Work [from pdf1]

The Goals:

“Our tax code has shifted most of the burden onto the backs of working Americans. There is simply no end to the special tax breaks available to big corporations and wealthy individuals who can afford lawyers and lobbyists.

“It’s time to end the President’s war on work. And it’s time to restore fairness to a tax code that has been driven badly out of whack.”– Remarks on “Restoring Economic Fairness,” July 26, 2007

The Summary

John Edwards will rewrite our tax code to make it simpler and fairer and to help hard-working families succeed. Millions of working and middle-class families will keep more of their paychecks. Those at the very top will again pay their fair share.

The Edwards Tax Reform Plan — Policy Points

(1) New tax breaks to Strengthen the Middle Class

The Goals:

“It’s time for us to put our economy back in line with our values and strengthen three pillars of America’s middle class: savings, work and family.”

The Steps: to Strengthen the Middle Class

(A) Encourage Savings(a) Establish a new Get Ahead tax credit to match up to $500 a year in retirement savings for families earning up to $75,000.

(b) Create new Work Bonds to offer extra savings incentives for low-income workers.

(B) Reward Work

(a) Expand the Earned Income Tax Credit (EITC) to reward low-wage workers by tripling the EITC for single adults and cutting the marriage penalty.

[ some key details from pdf-2: ]– Edwards will expand the Child and Dependent Care Tax Credit to pay up to 50 percent of childcare expenses up to $5,000 and make it partially refundable to benefit low-income working families. He will also allow stay-at-home parents to get the credit to help pay for child care for newborn infants.

– Triple the EITC for 4 Million Adults without Children: A single worker at the poverty line pays more than $800 in federal income and payroll taxes. Edwards will offer more than $1,200 to poor single workers, tripling the current EITC, and it will give 4 million low-income workers an average tax cut of $750.

– Edwards believes that we must cut the EITC marriage penalty. His proposal will cut taxes for 3 million couples by about $400 a year.

(C) Support Families

(a) More than double the Child and Dependent Care Credit to up to $2,500 per child.

(2) Reward work, not just wealth, and Repeal the Bush tax breaks for the Wealthy

The Goals:

“It’s time to stop promoting the wealth of the wealthy and start making sure that everyone has the chance to move up the economic ladder.”

The Steps: to Repeal the Bush tax breaks

(A) Restore Fair Taxation of Wealth(a) Restore the investment income tax rate to 28 percent for Americans making more than $250,000 a year so that wealthy investors don’t pay a lower rate on investments than many regular Americans pay on wages.

[ some key details from pdf-2: ]To ensure that the wealthiest Americans are paying their fair share of taxes and to reduce the economic distortions from tax shelters resulting from large capital gains preferences, Edwards will raise the top tax rate on long-term capital gains to 28 percent for the most fortunate taxpayers, the same rate signed into law by President Reagan. The 28 percent rate will ensure that high-income investors will pay taxes on their investment income at a similar rate to what regular families pay on their earned income.

(b) Repeal the Bush tax cuts for households earning more than $200,000 a year.

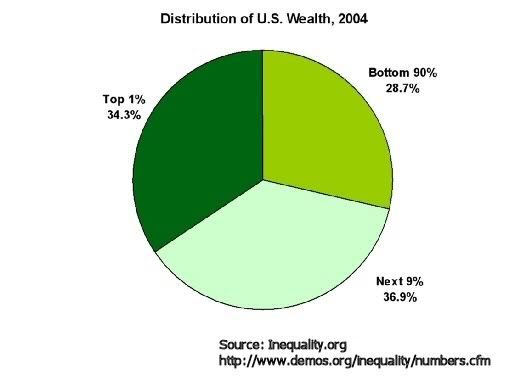

[ some key details from pdf-2: ]More than half of the Bush tax cuts – $132 billion – will go to the top 1 percent of taxpayers in 2010. Edwards will repeal the Bush tax cuts for the highest-income households. He will also eliminate estate taxes for the middle class, small business owners and family farmers, while keeping these taxes on the few families with large estates above $4 million in value.

(c) Keep the tax on very largest inheritances while protecting family businesses and family farms.

(B) Simplify Taxes

(a) Simplify taxes for up to 50 million families by giving them the option of letting the IRS complete a first draft of their forms for “five-minute filing.”

(3) Shut down special Loopholes for insiders

The Goals:

[ some key details from pdf-2: ]

Declare War on Tax Havens: About $300 billion a year in taxes go unpaid, and about $1.5 trillion in personal assets of U.S. taxpayers are held offshore. These unpaid taxes increase the share of the tax burden shouldered by honest taxpayers. Edwards will end the abuse of foreign tax havens: low-tax countries that facilitate American corporations and wealthy individuals seeking to avoid U.S. taxes.

Close the Hedge Fund and Private Equity Loopholes: Some of the most highly paid people in America are the managers of hedge funds and private equity funds, some of whom make hundreds of millions of dollars or even billions a year. Although most of their income, like other earned income, is nothing more than payment for the work they do, they pay only the 15 percent capital gains rate rather than the ordinary income tax rate. Edwards will close this loophole and also ensure that publicly traded private equity and hedge funds pay corporate taxes.

Cap Executive Pensions: Top executives at large corporations commonly receive deferred compensation packages that allow them to put off indefinitely the payment of taxes on much of their compensation. They have in effect unlimited IRAs or 401(k)s, without the limits that apply to other workers. Edwards will limit the amount of money that can be put into these funds to $1 million a year.

The Steps: to Shut down special Loopholes

(A) Declare War on Offshore Tax Havens

(a) Edwards will fight offshore tax havens by working with other nations to fight tax evasion, crack down on tax shelter promoters and eliminate special tax breaks for corporations’ offshore investments.

[ some key details from pdf-2: ]– Extend the time the I.R.S. has to investigate offshore tax havens

– Crack down on peddlers of tax shelters by increasing penalties, prohibiting contingent fee arrangements for tax advisors, and eliminating the ability to patent tax shelters.

– Fight the tax gap by … auditing more large corporations and high-income individuals

(B) Close the Tax Gap

(a) Edwards will collect a greater share of the $300 billion in uncollected taxes every year through better IRS service, targeting audits at wealthy individuals and corporations likely to have committed evasion, and requiring more third-party reporting.

(C) Close Hedge Fund and Private Equity Loopholes

(a) Edwards will close the loophole that elite Wall Street traders use to pay only 15 percent in taxes on their huge incomes, while regular families often pay twice that amount.

Impressive goals and steps! How does the Plan stack up?

Edwards Tax Plan: Reward Work Not Wealth

The Reviews: [ from pdf1: ]

“Former North Carolina senator John Edwards has a tax plan that is… smarter, targeted at taxpayers who need the most help and at creating incentives for savings.”

– Washington Post editorial

“Edwards, at least, is willing to say which taxes he would raise to keep the deficit from going through the roof…. Edwards deserves points for honesty. …”

– E.J. Dionne, Washington Post columnist

“We need a president and a tax system that will grow the middle class, not the gap between the haves and have-nots. John Edwards has a fair tax plan that will help middle-class families and promote healthy economic growth.”

– Betty Yee, Chairwoman, California State Board of Equalization

Sound like these Reforms would indeed go a long ways to achieving Economic Fairness in the Country again — a tax system that will grow the middle class — now that really would be something!

If we stay with the “status quo” and continue with “Business as Usual” —

America could indeed become like the gated city on the hill,

made up of the “super rich” who “run everything” —

(the top 1%)

and “everybody else” —

who just get “run over”!

It’s time to take down that Wall of a Tax Code too!

It’s time to Reward Work — instead of just Wealth!

It’s time to support John Edwards!

2 Comments

John Edwards: Tax policy

John Edwards: Tax policy

http://www.youtube.com/watch?v…

—-

jamess Mon 3 Dec 9:56 PM

this is great policy and great politics

The common-sense language he uses on tax policy, combined with great ideas for improving the tax code, are among the top reasons I decided to support Edwards for president.

This will resonate with many millions of Americans.

desmoinesdem Mon 3 Dec 11:11 PM