As Iowa legislators consider what to do with the state’s nearly $1 billion budget surplus, Republicans are advocating a $750 income tax credit for “every average Iowa family.” But that credit would do nothing for lower-income Iowans who have the largest state and local tax burden. The latest report by the Institute on Taxation and Economic Policy shows yet again that in Iowa and across the country, the bottom 20 percent of households by income pay the largest percentage of their income in state and local taxes (mostly property, sales and excise taxes).

The full report is available on the institute’s website. For the Iowa data, click here or here. Some charts, facts and figures on Iowa’s regressive tax system are after the jump. In my opinion, the bulk of Iowa’s surplus should go toward restoring and improving state services that have been underfunded for many years. The most valuable tax policy change would be increasing the earned income tax credit that benefits working families. Cutting personal income taxes should be way down the priority list, especially since high-income Iowans can already use a wide range of deductions to lower their income tax bill.

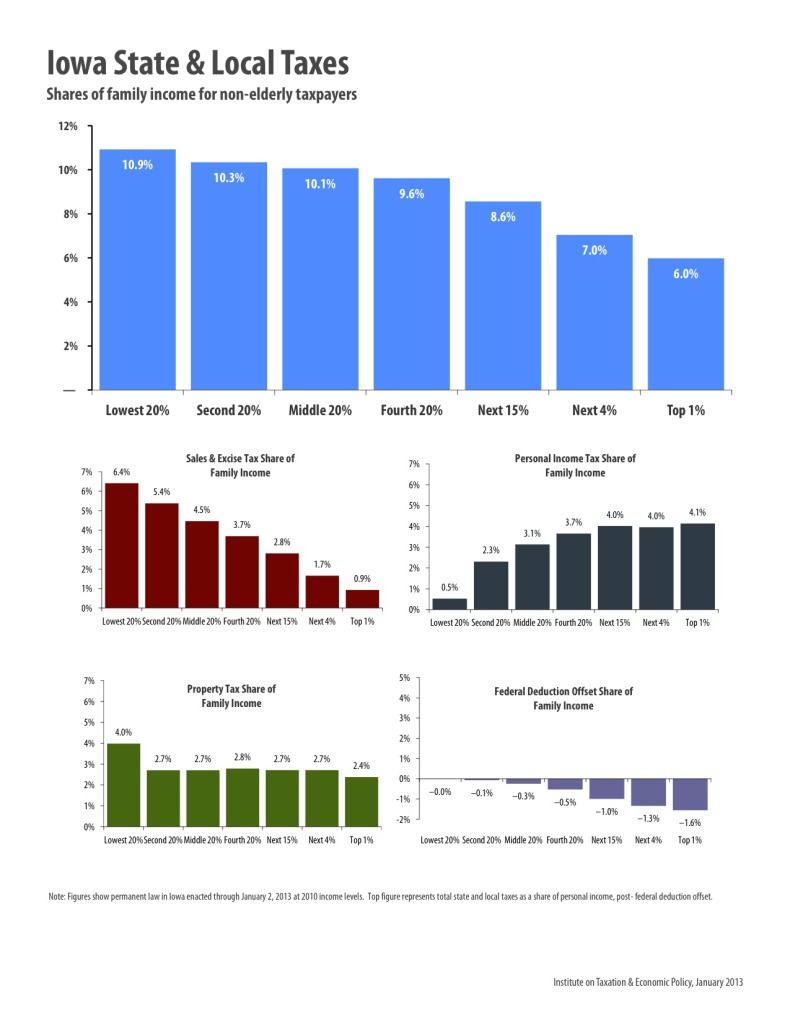

Iowa isn’t one of the 10 states with the most regressive tax systems, but this chart shows some of the inequities. Higher-income Iowans pay a smaller share of their income in state and local taxes than middle-class Iowans, and low-income Iowans pay an even larger share.

The Iowa Fiscal Partnership commented on the new report in this January 30 press release. Excerpt:

“The latest findings confirm a nagging problem of inequity in Iowa’s overall tax system,” said David Osterberg, executive director of the nonpartisan Iowa Policy Project, part of the Iowa Fiscal Partnership (IFP).

“In fact, the ITEP report illustrates the unfairness of a new proposal at the State Capitol to give away Iowa’s surplus in $750 chunks through income-tax credits. Many Iowans who pay most of their taxes on sales and property would not benefit from the proposed income-tax credit.”

According to the ITEP report, the average effective overall tax rate for the non-elderly taxpayers in the bottom 20 percent is 10.9 percent. The rate drops steadily to a 6 percent level for the top 1 percent of taxpayers. In the middle 20 percent, the level is 10.1 percent.

The report – available at www.whopays.org and www.iowafiscal.org – separately examines the share of income paid at various income levels for sales and excise taxes, personal income tax and property tax. It also calculates the reduction, a tax offset going mainly for higher-income families, caused by the ability to deduct state and local taxes from federal income tax. In addition, Iowa state income-tax payers may deduct their federal income taxes paid, again a device that disproportionately benefits higher-income earners.

“The state’s present surplus is a poor excuse to give one more break to the wealthiest – at the expense of fairness for lower-income earners, and at the expense of critical public services that need to be funded,” said Charles Bruner, executive director of the Child & Family Policy Center, also part of IFP.

For low-income families (earning below $21,000 per year), sales and excise taxes take a 6.4 percent share of family income, compared with 0.9 percent in the top 1 percent (income of $312,000 and higher).

“We know that governors nationwide are promising to cut or eliminate taxes, but the question is who’s going to pay for it,” said Matthew Gardner, executive director of ITEP and an author of the study. “There’s a good chance it’s the so-called takers who spend so much on necessities that they pay an effective tax rate of 10 or more percent, due largely to sales and property taxes. In too many states, these are the people being asked to make up the revenues lost to income tax cuts that overwhelmingly benefit the wealthiest taxpayers.”

State consumption taxes (mainly sales taxes) are particularly regressive – meaning they take a greater share of income from people at low incomes than people at high incomes. Overall, those rates average 7 percent for the poor, 4.6 percent for middle incomes and a 0.9 percent for the wealthiest taxpayers nationwide.

Gardner noted that in some states, there are efforts to cut or eliminate the income tax, and that of the 10 most regressive tax states, four do not have any taxes on personal income and one applies it only to interest and dividends. The other five have a personal income tax that is flat or virtually flat across all income groups.

“Cutting the income tax and relying on sales taxes to make up the lost revenues is the surest way to make an already upside down tax system even more so,” Gardner stated.