Iowa House and Senate conference committee negotiators appear to have struck a grand bargain on taxes. I haven’t seen any press release on the agreement yet from Senate Democrats, so I don’t know whether there is consensus in the caucus for the deal. But both Senate Majority Leader Mike Gronstal and Minority Leader Bill Dix are backing the compromise, as is House Speaker Kraig Paulsen.

After the jump I’ve posted commentary on the deal and a memo outlining the details. The bulk of the tax cuts will go to commercial property owners, but I see no evidence that the majority of small business operators (who rent rather than own property) will benefit at all. Democrats are getting the earned income tax credit increase they’ve been trying to pass for years, and that’s an important issue. However, the same vulnerable populations that benefit from the earned income tax credit will bear the brunt of the state and county service cuts that will likely happen as the commercial property tax reductions are phased in.

I haven’t had my eye on property taxes during this year’s legislative session, because I assumed no compromise would be found between the very different bills favored by Iowa House Republicans and Iowa Senate Democrats. A recent analysis by the Iowa Fiscal Partnership showed that the Democratic approach was better for commercial property owners “with less than $622,500 valuation in property,” while larger businesses (such as national retailers or real estate trusts) would do better under the GOP plan. That must-read study also undercut the case for any urgency to reduce property taxes in Iowa.

Any relevant thoughts are welcome in this thread. UPDATE: Added some comments from Iowa legislators and information about a loophole that could disqualify a lot of commercial property from the tax reduction.

Senate File 295 has had a long, bumpy road through the legislature this session. A few weeks ago, House Republicans and Senate Democrats appeared to be miles away from a compromise.

Earlier this week, rumors about an imminent deal started circulating. Yesterday the Cedar Rapids Gazette posted a good summary of the deal by Rod Boshart, and the Des Moines Register posted a report by William Petroski and Jason Noble. I enclose below a four-page memo with more details.

Governor Terry Branstad said he looks forward to signing the bill, and his communications director Tim Albrecht said the governor won’t use his line-item veto power to block any portion of the bill. In 2011, Branstad twice used the line-item veto to remove the earned income tax credit increase from broader bills on taxation.

Peter Fisher, research director for the Iowa Policy Project, released this statement yesterday on behalf of the Iowa Fiscal Partnership:

It’s Christmas for Walmart and McDonald’s, which will happily receive property-tax breaks that they don’t need, while their low-wage employees receive a better Earned Income Tax Credit.

This Christmas tree will grow bigger with each passing year, leaving less room in local budgets to respond to needs. The EITC expansion is important to working families – including 37 percent of all Iowa kids – but in the balance of who benefits from this package, it is a very small ornament.

If there is any question as to who benefits, Iowans should note that the EITC boost will be $35 million when fully phased in, compared to about 10 times that for property owners.

As we noted last month, the only justification for dealing with commercial property taxes was a political one. It has never been based on either an economic or competitive need to cut commercial property taxes in Iowa. So we have a politically derived package that will meet the demonstrated need to improve the EITC but leaves open new challenges to the support of critical public services in our state.

I highly recommend reading the Iowa Fiscal Partnership’s recent report on property taxes and previous writings on the earned income tax credit.

I sought comment from Jon Muller on the tax deal. He is a long time Iowa public policy anlayst who worked in Governor Tom Vilsack’s administration and is now partner in Iowa School Finance Information Services. Muller pointed out that many small business owners are tenants who won’t see a cent of the property tax cut the large property owners are getting. He noted,

[W]hen you increase property taxes, the landlord will be unable to pass on the tax increase to the tenant.

Property tax is a wealth tax.

It’s not a rent tax. […]

Rents will stay the same. A larger portion of rent will go to the landlord, and a smaller portion to the government. But rents will stay the same.

In Muller’s view, this compromise is great for real estate trusts but not for most small business owners. Their rents are determined by market supply and demand.

Muller also pointed me toward this research from a peer-reviewed economics journal, which indicates that rents are not affected by property tax rates. Two identical houses on the same street but in different school districts may have very different property tax rates, but the rents will be the same. From the perspective of the commercial property owner, Muller said,

On one side, you will pay a low price, but pay high taxes.

On the other side, you will pay a high price, and low taxes.

Your return on investment will be identical on either side of the street.

Iowa Citizens for Community Improvement Action called on Iowa lawmakers to vote down this tax deal.

Iowa Citizens for Community Improvement Action Fund (CCI Action Fund) members blasted a tentative legislative deal to cut corporate property taxes after a confidential memo was leaked Thursday, saying the deal will severely limit the ability of state and local governments to provide basic public services without raising taxes on everyday Iowans.

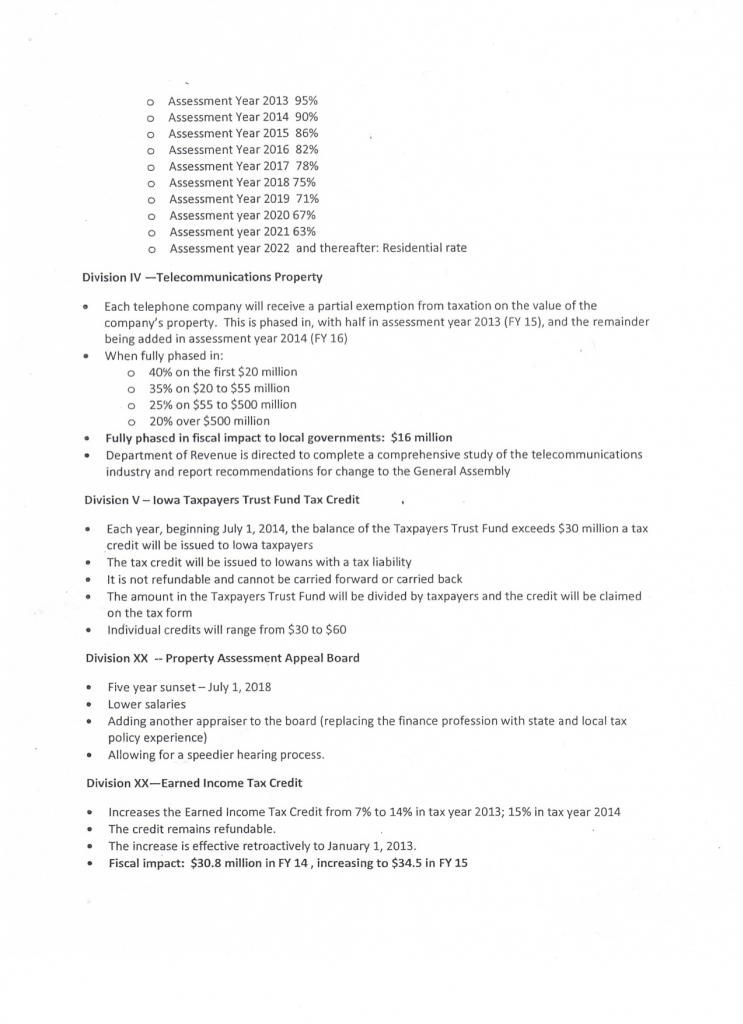

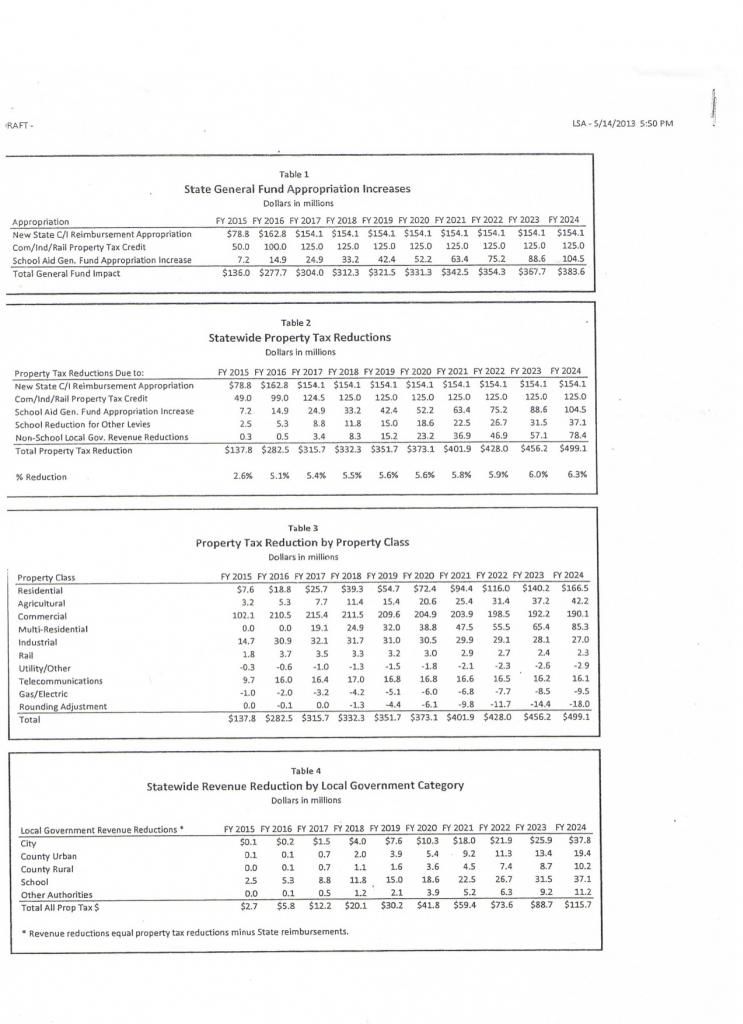

The confidential conference committee report on Senate File 295 shows state government stands to lose $383.6 million in annual revenue by 2024, while local governments would lose $115.7 million by 2024.

CCI Action Fund members also say the bad deal allows current and future budget surpluses – created by spending cuts years ago – to be squandered in the form of a small income tax credit rather than being reinvested in state programs that have faced cuts.

“Iowa CCI Action Fund members support expanding the Earned Income Tax Credit for working families, but not as a horse-trade for a bad deal on income and corporate property taxes,” said CCI Action Fund member Larry Ginter, an independent family farmer from Rhodes.

“If this bad deal goes through, we will either see cuts to vital public services or more taxes on family farmers and everyday people, or both. Shame on any legislator that votes for this thing. Bipartisanship should not come at the expense of good policy that puts people first.”

UPDATE: Speaking to the Des Moines Register on May 17, Senate Ways and Means Committee Chair Joe Bolkcom said he hasn’t decided yet whether to support the bill. Iowa House Democrat Tyler Olson said he is also undecided.

Senator Jack Hatch, a possible candidate for governor next year, hit the nail on the head in my opinion.

Sen. Jack Hatch, D-Des Moines, said he was finding it difficult to back the tax package while Democratic efforts to expand the state’s Medicaid program were being ignored by Republicans.

“For me, I have to see that there is real effort on the part of the Republican leadership in the governor’s office to recognize that there are 300,000 Iowans without health insurance and we are trying to get a majority of them in the circle,” Hatch said. “To dismiss that at a time that we are providing significant tax breaks to big corporations and good tax breaks to moderate families as well is a consideration that I have to resolve in my mind.”

Only a handful of Democratic votes would be needed in the Iowa Senate if the 24 Republicans all support the compromise.

Meanwhile, Jon Muller posted the following comment on his Facebook page Friday afternoon:

Warning: For Iowa Policy Wonks

Curious Side Effect of Taxing Apartment Buildings Like Houses……

Taxable value will fall for all the affected local governments, right? Cities, schools, counties, community colleges, etc. Right? Wrong. One type of local taxing authority will be unaffected. Tax Increment Financing Districts. The taxable value of TIFs are based on the “Growth in Assessed Value”. The “Assessed Value” of multi-family buildings is not being reduced by the law. Only the “Taxable value”. Clear as mud, right? Think this thing has been thoroughly thought through?

Some Iowa cities have put quite a lot of commercial property in TIF districts in an effort to stimulate economic development. Finding out they don’t qualify for the property tax cut will be a rude awakening for some business owners.

CORRECTION: The property owners will still get the tax cut, even in a TIF district. But in a TIF district, property taxes collected on the “base” property value (before creation of the TIF district) go to local institutions including cities, counties, school districts, and community colleges. At the same time, taxes collected on the “increment” (increase in property valuation since the TIF was created) are reserved for an economic development authority.

According to Muller, the language in this tax deal suggests that all of the reduction in taxable value will be applied to the “base” part of the TIF area. Conceivably, local economic development authorities might be able to collect as much in property taxes as before from properties in TIF districts, while school districts, community colleges, city and county governments have to make do with less revenue.

Here is the four-page memo leaked yesterday.

2 Comments

Did they also pass a bill making 2+2=5?

So I see $500 million in annual state and local revenue loss by year 10. I see no reform that would close loopholes, broaden the base, or otherwise create offsetting revenue enhancements. Last I knew we still had a mandatory requirement to balance the budget. I am aware of no contemporaneous bill cutting any programs or services (to the contrary, EITC increases).

Are they just bad at math up there?

(More seriously, as great as Gronstal is up there on a lot of issues, it sure looks like he just willingly handed the Grover Norquist crowd the tools in which to drown government in Grover’s fantasy bathtub. Please tell me I’m just missing something and am totally wrong about that.)

zeitgeist Fri 17 May 10:51 AM

I don't think you're missing anything

I don’t understand why Senate Democrats would agree to this deal. They get to say they compromised and “got something done” on property taxes, which won’t help the economy but will starve state and local governments in future years.

The EITC expansion is nice but not worth the price of this deal.

desmoinesdem Fri 17 May 11:08 AM