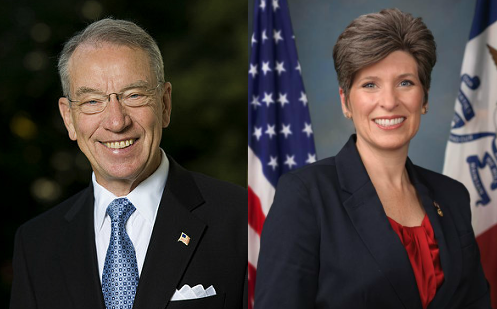

U.S. Senators Chuck Grassley and Joni Ernst joined all but one of their Republican colleagues to approve a $1.5 trillion tax cut and health care policy overhaul late last night. Whereas Ernst had told Iowans, “I look forward to carefully reviewing tax reform legislation in the Senate,” the final vote “came after Senate Republicans frantically rewrote the multi-trillion dollar legislation behind closed doors to win over several final holdouts,” Politico reported.

A list of key amendments was circulating among Washington lobbyists hours before Democratic lawmakers received the text. The bill senators finally received shortly before the floor vote included handwritten notes in the margins. GOP senators rejected a Democratic motion to adjourn until Monday to give senators and the public time to read and analyze the new provisions in the nearly 500-page bill.

The Washington Post’s James Hohmann wrote a comprehensive piece on “six violations of traditional governing norms that we’ve witnessed during the tax debate.” Dylan Scott noted that the process was not the “regular order” Senator John McCain had previously demanded: “the bill that passed out of committee isn’t the one that the Senate will pass — and the changes that are being added didn’t come through the usual amendment process, but by backroom negotiations with defecting senators.” One late amendment will benefit a single private college in Michigan; influential alumni include the billionaire Erik Prince, brother of Education Secretary Betsy DeVos. UPDATE: In a vote after 1:00 am, four Republicans joined all 48 Democrats to reject that amendment. However, Grassley and Ernst voted to keep the perk.

Norman Ornstein, who has studied Congress for decades and works at the American Enterprise Institute, a conservative think tank, tweeted on Friday, “There has never been a more outrageous, revolting, unfair process to pass a corrupted bill in the history of Congress.”

Although both Grassley and Ernst have been promising to support tax cuts for all income groups, the Republican bill overwhelmingly benefits wealthier Americans. Even worse, unlike President George W. Bush’s tax cuts of 2001 and 2003, the current bill will force many lower and middle-income people to pay more in future years. Graduate school will become unaffordable for thousands pursuing advanced degrees. The expanded child tax credit will do little for many families earning less than $50,000 a year, and the Senate voted down an amendment last night that would have improved the child tax credit “at the expense of corporations.”

Repealing the individual mandate to purchase health insurance will destabilize insurance markets and make policies unaffordable for many who don’t receive coverage through their jobs.

Next on the GOP agenda: cuts to safety net programs like Medicare and Social Security, which will further hurt the working poor and middle class.

I enclose below press releases from Iowa’s senators hailing a disgraceful vote. Neither of them acknowledge that “The big business cut would be permanent, while the rate reductions for real people are set to expire after 2025.”

UPDATE: The Washington Post’s Heather Long wrote the best, concise rundown of major provisions in this bill. Tara Golshan explained here how the bill “could trigger a $25 billion cut to Medicare.” Senator Susan Collins of Maine claimed yesterday to have secured a promise from Majority Leader Mitch McConnell that Medicare won’t be cut. But if you read his letter carefully, he didn’t make an ironclad pledge.

I forgot to link to Grassley’s November 30 interview with National Public Radio on why he was supporting the tax bill.

SIEGEL: Republican Alan Simpson and Democrat Erskine Bowles, who co-chaired the National Commission on Fiscal Responsibility and Reform, write this about the tax bill today. They say (reading) it reads as if it were developed for a country whose debt problems have been solved when in reality debt is the highest it’s been other than around World War II.

I want to hear from you. What happened to your concerns about deficits and the size of the debt, which would go up by $1.5 trillion, it’s said, under this bill?

GRASSLEY: It’s because of the concern of the debt that we’re very much writing this bill and because over the last eight years, the economy has only grown on an average of 1.4 percent. The 50-year average is about 3 to 3.5 percent. So we have a situation in our country where the economy isn’t growing, and the whole idea behind this is that we get the economy growing at 3 percent so we can start to pay down on the national debt like we did between 1997 and the year 2000.

SIEGEL: But you agree that before you begin to do that, this bill would increase deficits and the debt by at least $1.5 trillion, some would say, unless you really do take away middle-income tax cuts, $2 trillion, right? Are those numbers about right?

GRASSLEY: Yeah, if you look at it on paper the way the Congressional Budget Office puts things together, that is right. But here’s what it leaves out is if we can get just four-tenths of 1 percent growth in the economy, then that is made up. […]

SIEGEL: I want to ask you about estate taxes. The Tax Policy Center estimates that nationwide only about 80 family-owned small business and small farm estates will face any estate tax in 2017. Why is it so important to raise the ceiling on estate taxes when already a couple can pass on an estate of up to $11 million tax free?

GRASSLEY: I suppose to show appreciation for people that have lived frugally early in their life, delayed spending so they could save. It seems to me there ought to be some incentive and reward for those who work and save and invest in America as opposed to those who just live from day to day. You could take the same hundred-thousand-dollar income for two people – one of them, they spend it, have it all spent at the end of the year and the others have saved a fourth of it and invested and create jobs and leave something for the future. The first person leaves nothing for the future.

SIEGEL: But very, very few couples that make a combined income of $100,000 are going to have estates of $20 million that they pass on. I mean, that’s a tiny fraction of people.

GRASSLEY: Listen, in no way is my statement meant to dispute the statistics you gave me. I’m giving you a philosophical reason for recognizing savings versus those who want to live high on the hog and not save anything or invest in the commodities.

December 2 statement from Senator Chuck Grassley:

Grassley: Tax Reform a Victory for Iowans of Every Level of Income and Way of Life

WASHINGTON – U.S. Sen. Chuck Grassley of Iowa, a senior member and former chairman of the Senate Finance Committee, voted for landmark tax reform legislation, the Tax Cuts and Jobs Act of 2017, which passed the United States Senate today.

“The passage of this bill is a historic moment for Iowa and the entire country. It’s been more than 30 years since Congress passed significant tax reform. The good news is that this legislation will let Iowans keep more of their own hard-earned money, increase average wages and help create new jobs.

“This reform bill enacts across-the-board tax cuts, providing financial relief to middle-class and low-income earners who need it most. As just one example, an average family of four with two children would receive a $2,200 tax cut. Lowering taxes lets people decide how to spend more of their own money instead of Washington politicians. It would help working families struggling to make ends meet, allow farmers and small business owners to further expand and invest, and makes American jobs and workers more competitive globally.

“This bill also gets rid of the unfair and regressive Obamacare individual mandate tax, giving Iowans the freedom to make choices that work best for them instead of being forced by the federal government to purchase an unaffordable product they either don’t want or don’t need. More than 52,000 Iowans in 2015 were required to pay the individual mandate tax, even though more than 80 percent of those who paid the tax made less than $50,000 a year. That’s a tax on working families, and I’m hopeful to see it gone.

“The Senate passage of this legislation is a victory for Iowans of every income level and way of life, but there’s more work to be done. It now needs to be reconciled with the House-passed version. This is a once-in-a -generation opportunity to make lasting reforms to our broken and outdated tax code. I look forward to working with my House and Senate colleagues to draft a bicameral bill to be signed into law by the President.”

Grassley successfully included several provisions in the Tax Cuts and Jobs Act of 2017, including whistleblower protections, taxpayer rights and corporate accountability measures. More information on these provisions is available here. As chairman of the Senate Finance Committee, Grassley previously led through Congress $2 trillion in bipartisan tax relief, leaving more money in workers’ pockets, reducing tax rates across the board and spurring economic growth and activity. Congress later made permanent the vast majority of the Grassley-led measures with significant bipartisan support.

December 2 statement from Senator Joni Ernst:

Ernst Votes to Reform Tax Code, Promote Economic Growth

Includes Iowa Senator’s SQUEAL ActWASHINGTON, D.C. – U.S. Senator Joni Ernst (R-IA) issued the following statement after the Senate passed the Tax Cuts and Jobs Act, which includes the SQUEAL Act:

“Today, the Senate took a monumental step forward in pursuing a simpler tax code that provides much-needed relief for hardworking Iowans and helps strengthen our economy. It also eliminates ObamaCare’s costly individual mandate that forces Americans to buy health insurance that is in many cases for Iowans, unaffordable.

“Additionally, I am thrilled that the SQUEAL Act is included in this tax reform legislation. My proposal will force Congress to offer up its own unnecessary tax break that allows Members of Congress to deduct, for income tax purposes, thousands of dollars annually in living expenses while in the Washington, D.C. area.

“This Senate bill also includes a bipartisan measure I helped lead to spur economic growth in poverty-stricken areas, and bring hope and opportunity back to many distressed rural communities in Iowa.

“Moreover, job creators of all sizes will finally see relief from the burdensome and complicated tax code. The Tax Cuts and Jobs Act would allow Iowa small businesses and entrepreneurs to keep more of their hard-earned dollars to reinvest in their companies, and is estimated to create over 10,000 jobs across Iowa. This legislation also gives more money back to Iowa’s hardworking parents by doubling the child tax credit.

“While the bill does not include everything I hoped, I am pleased that this legislation creates more opportunities for all, including lower- and middle-income families across the State of Iowa who will see thousands of dollars back in their pockets. I look forward to seeing this important bill move ahead to reduce the burden of our overly-complicated tax code and enact reforms that provide relief to Iowa’s hard-working families and businesses.”

Senator Ernst’s efforts included in the Tax Cuts and Jobs Act:

SQUEAL Act

The Investing in Opportunity Act

Read Senator Ernst’s recent column in the Des Moines Register on the importance of tax reform here.

LATER UPDATE: The Des Moines Register’s Jason Noble checked the numbers on the estate tax. Contrary to what Republican politicians like Grassley and Representatives David Young and Steve King would have you believe, Noble confirmed few Iowans are subject to the tax. An even smaller number of Iowans who would pay estate tax own farm assets.

The estate tax applies to around 5,000 taxpayers across the entire country each year, and very few of them come from Iowa. Of the Iowans subject to the tax, only a fraction are actually farmers, and a vanishingly small number of them face a tax bill requiring them to sell off farmland or other assets. […]

According to IRS data from 2016, just 682 tax filers in the entire country who owed estate taxes owned any farm assets. That represents about 13 percent of the 5,219 estate tax returns in which taxes were owed. […]

Kristine Tidgren, the assistant director of the Center for Agricultural Law and Taxation at Iowa State University, said she’s not aware of any Iowa estates forced to sell land since the estate tax exemption was raised to its current level in 2012. […]

The number of small businesses impacted by the estate tax is similarly small. […]

All this means, in essence, is that lawmakers’ argument for abolishing a tax that generates tens of billions of dollars annually is based on the challenges faced by perhaps a few dozen farm estates and a few dozen more small businesses across the entire country. […]

In a Nov. 29 interview, Grassley was adamant about the need for change, even if farmers and small business owners represent a tiny minority of estate tax payers. The reason, he said, is as much philosophical as practical.

An estate tax effectively and unfairly taxes a person’s earnings twice, he argued: first when they earn it and again when they die. And, he added, it penalizes savers without touching spenders.

“I think not having the estate tax recognizes the people that are investing,” Grassley said, “as opposed to those that are just spending every darn penny they have, whether it’s on booze or women or movies.”

No wonder Grassley was happy to vote for a bill that directs most of the benefits to people who least need help financially.