Congress “expanded unemployment insurance by 250 billion dollars” to support laid-off workers, Senator Joni Ernst said during a news conference organized by Governor Kim Reynolds on March 29.

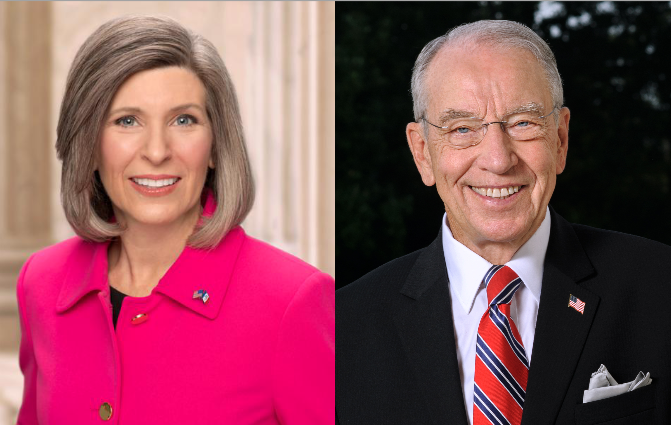

She didn’t mention that she and fellow Republican Senator Chuck Grassley had voted to reduce the amount millions of jobless people will receive over the next four months.

President Donald Trump signed the Coronavirus Aid, Relief, and Economic Security (CARES) Act on March 27, hours after U.S. House members approved the $2 trillion bill by voice vote. The Senate had passed the bill unanimously late in the evening of March 25. I’ve enclosed below comments from most of the Iowans in Congress, highlighting important parts of the bill. (Representative Steve King did not release a statement.) Click here for a more detailed summary of the tax provisions.

The National Employment Law Project created a fact sheet to explain the three new unemployment insurance programs that will be fully federally funded.

“Pandemic Unemployment Compensation” will give all who qualify for unemployment benefits an extra $600 per week, beyond their usual calculated benefit, for the next eighteen weeks (through July 31).

“Pandemic Emergency Unemployment Compensation” will provide an extra 13 weeks of state unemployment insurance benefits, “which will become available after someone exhausts all their regular state UI benefits.” Most states, including Iowa, provide 26 weeks of unemployment benefits. The 2009 federal stimulus contained a similar provision.

“Pandemic Unemployment Assistance” was designed to give “emergency unemployment assistance to workers who are left out” of state programs. The National Employment Law Project noted (emphasis in original),

Importantly, this program will provide income support to many workers who are shut out of the state UI systems in this country. In fact, workers who are eligible for state UI are not eligible for the PUA program.

Those eligible for PUA include self-employed workers, including independent contractors, freelancers, workers seeking part-time work, and workers who do not have a long-enough work history to qualify for state UI benefits.

Many Republican senators opposed the first of those three programs, because the extra $600 a week might allow some low-wage workers to receive more than they had earned while employed. David Lerman reported for Roll Call,

Treasury Secretary Steven Mnuchin defended the provision at a White House news conference, saying the additional $600 a week that jobless workers could receive for four months was a compromise to avoid logistical challenges.

While lawmakers sought to provide the unemployed with their full salary in insurance benefits, the Labor Department advised there was no way to tailor the benefit to each worker’s former salary.

“This was the only way we could assure that the states could get money out quickly, in a fair way,” Mnuchin said at the White House briefing. “So, we used $600 across the board. I don’t think it’ll create incentives. Most Americans, what they want, they want to keep their jobs.”

Senate Finance Committee aides to both GOP and Democratic members, who weren’t authorized to speak for the record, said to avoid complexity the panel decided to take the average weekly compensation across the states, or $350, and top it up with the $600 to equal average weekly wages.

Imagine being prepared to vote for a $2 trillion bill but worrying that some low-wage workers who just lost their jobs might get an extra $600 a week for four months. Over eighteen weeks, that works out to $10,800 for each unemployed person–hardly a huge windfall.

Four GOP senators–Ben Sasse, Rick Scott, Tim Scott, and Lindsey Graham –drafted an amendment to cap unemployment insurance at 100 percent of a person’s prior salary. Jordain Carney reported for The Hill,

A Senate GOP aide also pushed back against the four senators, underscoring the divisions within the caucus, saying that “nothing in this bill incentivizes businesses to lay off employees; in fact, it’s just the opposite.”

“Each state has a different UI program, so the drafters opted for a temporary across-the-board UI boost of $600, which can deliver needed aid in a timely manner rather than burning time to create a different administrative regime for each state,” the aide said. “It’s also important to remember that nobody who voluntarily leaves an available job is eligible for UI.”

The amendment needed 60 votes to clear the Senate’s threshold for most legislation. It should have been overwhelmingly rejected. But 48 Republicans supported it (roll call), including Iowa’s senators.

Only days after Iowans and workers across the country filed the largest number of new unemployment claims ever recorded in a single week, Ernst, Grassley, and every Republican present except for Susan Collins voted to make unemployment benefits less generous. Remember, this group supported huge giveaways for the wealthiest Americans as part of the 2017 tax bill.

Once the GOP amendment had failed, the COVID-19 response bill cleared the Senate unanimously.

News releases from Grassley and Ernst touted the CARES Act provisions without mentioning that Iowa’s senators had tried to take $10,800 away from many constituents who qualify for unemployment benefits. It’s standard operating procedure for the pair, who didn’t publicize their votes to remove mandatory paid leave language when bragging about the previous bill Congress approved in response to the COVID-19 pandemic.

_____________________________________

March 25 statement from Senator Joni Ernst:

Ernst: We’ve stepped up in this time of crisis and delivered critical additional relief for Iowans

Senator Ernst secures more aid and support for Iowa’s workers, families, seniors, small businesses, health care system, child care providers, farmers, students, and vets in Phase 3 packageWASHINGTON – U.S. Senator Joni Ernst (R-IA), a member of the Senate Small Business Committee, supported and delivered critical additional relief for Iowans across the state in the bipartisan Phase 3 package that passed the Senate today. Phase 3 builds on the Senate-passed, and now law, Phase 1 bipartisan package that provided resources to federal, state and local authorities and the Phase 2 bipartisan package to provide paid sick leave, free COVID-19 diagnostic testing, and increased support for nutrition for seniors and children.

“As this COVID-19 pandemic has evolved, I’ve continued to listen to Iowans from all sectors of our economy, and there has been one resounding message: we need relief, and we need it now. After heeding these calls, I pushed my colleagues to take swift, bold action to deliver immediate aid to folks in Iowa, and across the country. And thankfully, we’ve done that,” said Senator Ernst. “From Phase 1, where we bolstered our state and local response efforts; to Phase 2 where we provided paid sick leave and free testing; and now, to Phase 3 where we’ve come to the aid of America’s workforce and those in our health care industry on the front lines of this pandemic.

“Iowans from every corner of our state – moms and dads, nurses and doctors, small business employers and employees, cashiers and clerks, seniors and students, veterans and farmers – will get support from this Phase 3 deal. The Senate has stepped up in this time of crisis and delivered critical additional relief for Iowans and all Americans.

“Now, the House must do their job, pass this bipartisan bill quickly, and get it to President Trump’s desk. We don’t have time for delay; Iowans need this aid right now.”

Senator Ernst has been hosting calls with Iowans from across the state, listening to their needs and concerns, and bringing their voices to her Senate colleagues to secure more assistance during the COVID-19 pandemic. Highlighted below are a number of the emergency relief measures Ernst successfully included in the bipartisan Phase 3 package.

**MEDIA CALL TOMORROW**

Senator Ernst will be available to speak with Iowa press on a conference call tomorrow, Thursday, March 26 at 9:00 a.m. CT. Video from the call will be available as well as audio. NOTE: If you plan to participate, please RSVP to Press@Ernst.Senate.Gov.Iowa’s Workers, Families, Seniors, and Small Businesses:

· Provides direct assistance to Americans: $1,200 for individuals, $2,400 for married couples, and $500 per child.· Protects workers and small businesses by allowing local banks and credit unions to provide federally-backed loans for small businesses to keep their employees on payroll and to pay bills; loans can be forgiven if they maintain payroll.

· Expands loan access to child care providers, non-profits, and businesses with less than 500 employees.

· Bolsters unemployment benefits for workers and provides assistance to self-employed and contractors through a new Pandemic Unemployment Assistance program.

· Grants access to loans for distressed sectors, including retail, restaurants, and hotels.

· Increases funding opportunities for child care providers by bolstering the Child Care and Development Block Grant program.

· Secures support for children and families in poverty or lower income communities by increasing funding for states through the Healthy Start Program.

· Expands access to home-delivered meals for seniors who are homebound due to social distancing or illness.

Iowa’s Health Care Workers, Hospitals, and Rural/Community Health Centers:

· Provides direct financial assistance to health care workers and hospitals on the front lines of COVID-19.· Delivers robust funding to increase the supply of personal protective equipment in the Strategic National Stockpile and other medical supplies for federal and state response efforts.

· Bolsters funding for development of a COVID-19 vaccine and provides free coverage of a future vaccine for the American public.

· Expands telehealth services through Rural Health Clinics and Federally Qualified Health Centers.

· Increases funding for Community Health Centers on the front lines of testing and treating patients for COVID-19.

· Improves access to home health services by allowing physician assistants and nurse practitioners to certify a beneficiary’s eligibility.

· Increases Medicare rates for treating COVID-19 patients.

· Decreases US dependency on foreign entities for our medical product supply chain by demanding the Department of Health and Human Services (HHS) examine the security of the supply chain and collaborate with other federal agencies.

Iowa’s Students, Teachers, Veterans, and Farmers:

· Provides more assistance for schools, teachers, and students, including K-12 and higher education institutions.· Waives student loan payments, principal, and interest for 6 months. Allows employers and employees to exclude student debt payments made by employer from taxes.

· Improves access to care for veterans by increasing additional funding for medical services and equipment, telehealth, community care, and more.

· Assists food banks and pantries by providing funding for additional commodity purchases.

· Bolsters direct assistance to farmers and producers through the Commodity Credit Corporation and emergency support.

· Protects the security of our food supply by additional funding for food inspections.

· Eliminates the excise tax for alcohol used to produce hand sanitizer.

March 26 statement from Senator Chuck Grassley:

Finally, Senate Advances Needed Aid for Workers, Families, Businesses & Health Services

Mar 26, 2020

Grassley-led recovery checks & unemployment insurance included in Senate-approved packageWashington – After days of Democratic obstruction, the U.S. Senate today unanimously cleared a bipartisan package to provide immediate and prolonged economic relief to American families, workers, employers and health care providers coping with the coronavirus pandemic. As Chairman of the Finance Committee, Sen. Chuck Grassley (R-Iowa) marshalled direct recovery payments, expanded unemployment insurance and a slate of individual and business tax relief policies to help families cover their expenses and preserve jobs. The legislation, known as the Coronavirus Aid, Relief, and Economic Security (CARES) Act was approved by a vote of 96-0 after Democrats blocked similar versions on Sunday and Monday.

“Across our nation, Americans are doing their part to slow the spread of the coronavirus. Through no fault of their own, Americans are being ordered to stay home or close their businesses. As a result, this health crisis is quickly becoming an economic crisis. This bipartisan legislation rapidly delivers recovery checks to help individuals and families cover their immediate expenses. It also helps businesses of all sizes keep employees on the payroll throughout the crisis and ensures that those who are furloughed or laid off have access to beefed up unemployment insurance. The bill also provides a much-needed infusion of cash to our health care professionals who are fighting the pandemic on the front lines.

“For days, I worked with my Democratic colleagues to craft key tax- and health-related provisions as well as the recovery checks and unemployment insurance. It’s a bipartisan product that regrettably was hijacked and delayed because of partisan politics. But the important thing is that it’s finally approved in the Senate. I urge the Speaker of the House to immediately pass this critical relief for the American people, even if it means ending their week-long recess. The needless delays in the Senate have run out the clock. There’s no more time to waste,” Grassley said.

The CARES Act is the single largest economic aid package in American history aimed at combatting a health crisis not seen in living memory. It comprises policies from various bipartisan task forces to deliver relief through immediate payments, deferred tax collection, small business loans, stabilization for the hardest hit sectors of the economy and expanded unemployment insurance available to more workers than ever before.

Details of the Grassley-led provisions are available HERE. Grassley also introduced the COVID-19 Funding Accountability Act to safeguard taxpayer dollars by deploying similar oversight tools as those used in the 2008 economic stimulus package. Portions of this bill were included in the CARES Act.

March 27 statement from Representative Abby Finkenauer (IA-01):

Finkenauer Votes to Pass Third Coronavirus Emergency Aid Package

WASHINGTON, DC – Today, Congresswoman Abby Finkenauer (IA-01) was in the House chamber for debate and voted to pass the Coronavirus Aid, Relief, and Economic Security (CARES) Act, a $2 trillion emergency aid bill to respond to the ongoing coronavirus pandemic and assist small businesses, manufacturers, farmers and everyday Americans.

The bill, which has now passed the House and Senate, would provide direct payments to individuals, suspension of student loan payments, and financial assistance to small businesses, farmers, healthcare workers and hospitals among other things.

“I’m proud of the fact that in the face of a global pandemic, we are able to pass a historic bill that provides immediate relief to millions of folks across the country whose lives have been altered,” Finkenauer said. “We know hard-working Iowans will find the direct financial assistance helpful, as we heard directly on our telephone town hall Thursday, and through the feedback we’ve received over the last few weeks. Healthcare workers will get much-needed help as they battle the outbreak 24 hours a day. Small businesses, educators and farmers will get the aid they need to continue persevering in our communities. We still have more work to do, but hopefully this helps make the next few weeks or months more manageable for everyone.”

The package also assists in the areas that Finkenauer prioritized in her response plan that would directly affect her district, including financial aid for small businesses and healthcare professionals, and stronger unemployment benefits for the millions of Americans left without a job.

Among other things, the stimulus package includes:

Direct payment to individuals – Americans would receive $1,200, married couples would get $2,400 and parents would see $500 for each child under age 17 unless you’re above an income threshold. Student loan payments suspended – The Department of Education would suspend payments on student loan borrowers without penalty through September 30. Boost for unemployment benefits – The federal government would give jobless workers an extra $600 a week for four months on top of their state benefits. Billions in funding for hospitals – Hospitals across the country will receive more than $100 billion. Federal aid for independent contractors and ‘gig’ workers – Millions of part-time workers would receive federal aid. Funding for food assistance – The Emergency Food Assistance Program, which supplies food banks, would receive $450 million. Emergency assistance for schools – More than $30 billion would be provided for emergency education funding for colleges, universities, state and school districts. Funding for state and local governments – $150 billion would be dedicated to state and local governments. Also included is Finkenauer-introduced legislation to help small businesses that are receiving State Trade Expansion Program (STEP) funding and have been affected by coronavirus. The final legislation includes reimbursement of expenses to STEP recipients for financial losses relating to trade missions and trade show exhibitions that were canceled because of coronavirus.

March 27 statement from Representative Dave Loebsack (IA-02):

Iowa City, IA – Congressman Dave Loebsack released the following statement today after the House passed the Coronavirus Aid, Relief and Economic Security Act, or CARES Act, which is the third piece of legislation to combat the COVID-19 illness. The bipartisan legislation now heads to the President who has suggested he will sign the bill into law.

“Ensuring the health and economic security for all hard working Iowans and Americans is my top priority. That is why I am pleased the bill passed today gets the resources and tools to the people and workers who have been affected by COVID-19. This bill contains provisions to make health care affordable and accessible, bolster the health care system, protect frontline response workers, support small businesses and assist states and local governments. As with all compromise pieces of legislation, this bill did not contain everything I would have liked and I don’t support every provision, which is why we will have to make some fixes in future legislation. The American people need and deserve a coordinated, fully-funded, whole-of-government response to keep them and their loved ones safe from the COVID-19 illness. That is why I will continue working with my colleagues on future bills to make sure hardworking Iowans and Americans get the care they need and have the economic security they deserve.”

This bill marks the third piece of legislation that has passed to help combat the COVID-19 illness that has spread worldwide. Loebsack has supported all three bills and will continue working with his colleagues on future legislation that will bring further relief to Iowans and people across the country.

Specifically, the CARES Act includes:

$350 billion for Paycheck Protection Program for small businesses with zero-fee loans to retain employees and their salary levels.

Unemployment benefits expanded. This includes an increase of $600 per week and an additional 13 weeks of unemployment compensation to those who have already exhausted regular benefits.Individual payments of $1,200 and $2,400 for married couples and includes $500 per child. Health insurers will cover any Covid-19 vaccines without any cost-sharing. Any lab that runs a Covid-19 diagnostic test will be required to report results to HHS. $15.5 billion for increased need for SNAP program $5 billion additional funding for Community Development Block Grants for flexible funding to state and local governments. $150 million in grants for rural hospital to respond to increased demand. $1.3 billion supplemental grants to expand services for Community Health Centers. $100 million in reconnect broadband grants for state and local governments to provide broadband in rural areas. $100 million for PPE for firefighters and emergency responders. $1.25 billion for public housing to ensure tenants remain stably housed during this crisis. $4 billion for Homeless Assistance Grants. $1 billion for Community Service Block Grants. $100 billion in direct payments to Hospitals Federally qualified health centers and rural health clinics can be used for telehealth services and will be reimbursed based on the national average for these services. Medicare telehealth service requirements can be waived. Medicare sequestration delayed through the end of the year Public Health Programs extended through Nov. 30, 2020, including Community Health Centers, THCGME, National Health Service Corps, Special Diabetes Program, Money Follows the Person $8.8 billion for child nutrition programs Suspends student loan payments and interest through September 30. $30.8 billion to create an Education Stabilization Fund to support elementary and secondary schools as well as higher education institutions $20 billion for the Department of Veterans Affairs for medical services, facilities, community care, and information technology systems Supports expanded access to mental health services for isolated veterans through telehealth or VA Video Connect $1 billion for procurement expenses under the Defense Production Act Over $1 billion to support the Army and Air National Guard $9.5 billion in emergency aid to farmers $14 billion to replenish the Commodity Credit Corporation

March 27 statement from Representative Cindy Axne (IA-03):

Rep. Axne Applauds Unanimous House Passage of Critical Coronavirus Stimulus Package

The bipartisan CARES Act provides billions of dollars for Iowa hospitals, businesses, workers, and farmers – and authorizes direct payments to Iowans

WASHINGTON, D.C. – Today, Rep. Cindy Axne (IA-03) applauded the House of Representatives’ unanimous passage of the Coronavirus Aid, Relief, and Economic Security Act (CARES) Act, the third major piece of legislation passed by Congress to address the ongoing coronavirus (COVID-19) outbreak.

The legislation contains $2 trillion in economic relief for small businesses, improved assistance for workers, reimbursements for state efforts, and grants for hospitals and other health centers on the front lines of fighting the spread of this disease.

“I’m proud that Congress has passed this bipartisan legislation to help get relief and additional resources directly to those who are feeling the burden of this coronavirus outbreak,” said Rep. Axne. “The funds in this package will go towards helping Iowa’s hospitals and health care professionals, the workers who’ve been laid off and the families they’re still trying to support, and the small businesses who are struggling from diminished demand as we continue to observe social distancing guidelines to slow the spread of this disease.”

The CARES Act, which is now headed to the President’s desk for signature, includes:

$1.25 billion for the State of Iowa to cover additional expenses due to COVID-19 $350 billion to help small businesses keep their employees paid, support employee benefits insurance premiums, and cover mortgage payments and other debt obligations $100 billion for grants to hospitals and other health entities to cover unreimbursed expenses or lost revenues attributable to coronavirus $30 billion for education funding to help schools cover expenses, support distance learning, and make up for the lost days of classroom time $14 billion to replenish the Commodity Credit Corporation to support Iowa farmers and producers, and $9.5 billion to assist specialty crop and livestock producers An additional $600 per week of unemployment benefits for up to 4 months and expanded unemployment coverage to cover gig workers and independent contractors An employee retention credit that offers employers tax credits equal to 50% of the wages paid to employees for those employers who are fully or partially shut down or who have lost most of their revenue Direct payments of up to $1,200 for each adult and $500 for each child The inclusion of $14 billion for the Commodity Credit Corporation (CCC) and $9.5 billion for specialty crop and livestock producers comes after Rep. Axne called on congressional leadership to include assistance to help Iowa farmers and producers.

The legislation also includes a foreclosure moratorium for all federally backed properties, as well as a consumer right to request forbearance for loans. This is a measure Rep. Axne called on the managers of those federally backed properties, including Fannie Mae and Freddie Mac, to implement earlier this month.

This is the third piece of legislation Rep. Axne has supported to provide federal assistance to local and state efforts to combat the COVID-19 outbreak.

Rep. Axne voted to pass the Families First Coronavirus Response Act, which included provisions to establish an emergency paid leave program, enhance unemployment aid, and ensure testing for COVID-19 is cost-free.

Earlier this month, Rep. Axne voted to pass legislation that provided $8.3 billion to reinforce federal, state, and local efforts to combat COVID-19 across the United States. That legislation has already produced multiple investments to build Iowa’s capacities to fight COVID-19 totaling $6.5 million.

Direct Payments:

The direct payments authorized in the CARES Act are refundable, renewable tax credits available to all tax filers in Iowa. Single filers that made less than $75,000 in 2019 are be eligible for the full payment of $1,200. Joint filers can receive up to $2,400, and an additional $500 for each child.

If the single filer made more than $75,000 in 2019, payments will be reduced by $5 for every $100 of income that exceeds the limits, with no payment for an individual making more than $99,000 or a couple making $198,000. The payments will be dispersed via direct deposit when available or mailed to last known filing address. If a 2019 return has not been completed, the information on the 2018 filing will be used. Recipients of Social Security are also eligible for direct payments.