The Iowa Fiscal Partnership released a must-read report yesterday by economist Peter Fisher. Facts don’t support political rhetoric about a supposedly unfriendly tax environment for Iowa business, Fisher demonstrates:

Whether one focuses only on the corporate income tax, or the whole range of taxes falling on business, Iowa’s state and local taxes are well below average, and have been for some time.

Iowa’s corporate income tax in recent years has been considerably lower than the national average level of taxation and lower than all but 11 states. How can this be when the top tax rate – 12 percent – is the highest in the nation? The answer is simple: That 12 percent tax rate is applied to only a small portion of a company’s profits in Iowa. Iowa is one of only four states that allows a portion of federal corporate income taxes to be deducted from income. On top of this, Iowa determines how much of a multi-state firm’s profits are taxable in Iowa solely on the basis of sales in Iowa. The majority of states take into account a firm’s payroll and property in the state as well as sales. As a result, many large corporations selling nationally and worldwide earn substantial profits on Iowa operations but pay taxes on only a small fraction of those profits. Finally, Iowa offers a range of generous tax credits that further reduce corporate tax liability.

I recommend reading the full report, Corporate Taxes and State Economic Growth (pdf file) or at least the two-page backgrounder. While you’re on the Iowa Fiscal Partnership’s site, check out the many other valuable reports they have published in recent years. For instance, last month’s report showed why “additional cuts to essential public services are not needed to balance the 2011-12 [Iowa] budget.” The Iowa Policy Project, which is part of the Iowa Fiscal Partnership, is on Twitter here.

After the jump I’ve posted a few excerpts highlighting key conclusions from Fisher’s latest research. Keep these facts in mind next time you hear Iowa Republicans claim that we “can’t afford” a modest raise for state employees, continued investment in preschool or any growth in K-12 education budgets.

UPDATE: Agree 100 percent with what Fisher told Iowa Independent:

“Revenues are improving, in spite of the drain already in place by business breaks. A responsible budget does not include new breaks, especially when we know that the services provided by state and local government are important to a thriving business climate,” Fisher said. “We should be looking for ways to avoid cuts in services that will actually hurt Iowa jobs and the Iowa economy.”

From the backgrounder: Iowa Businesses Already are Taxed Lightly:

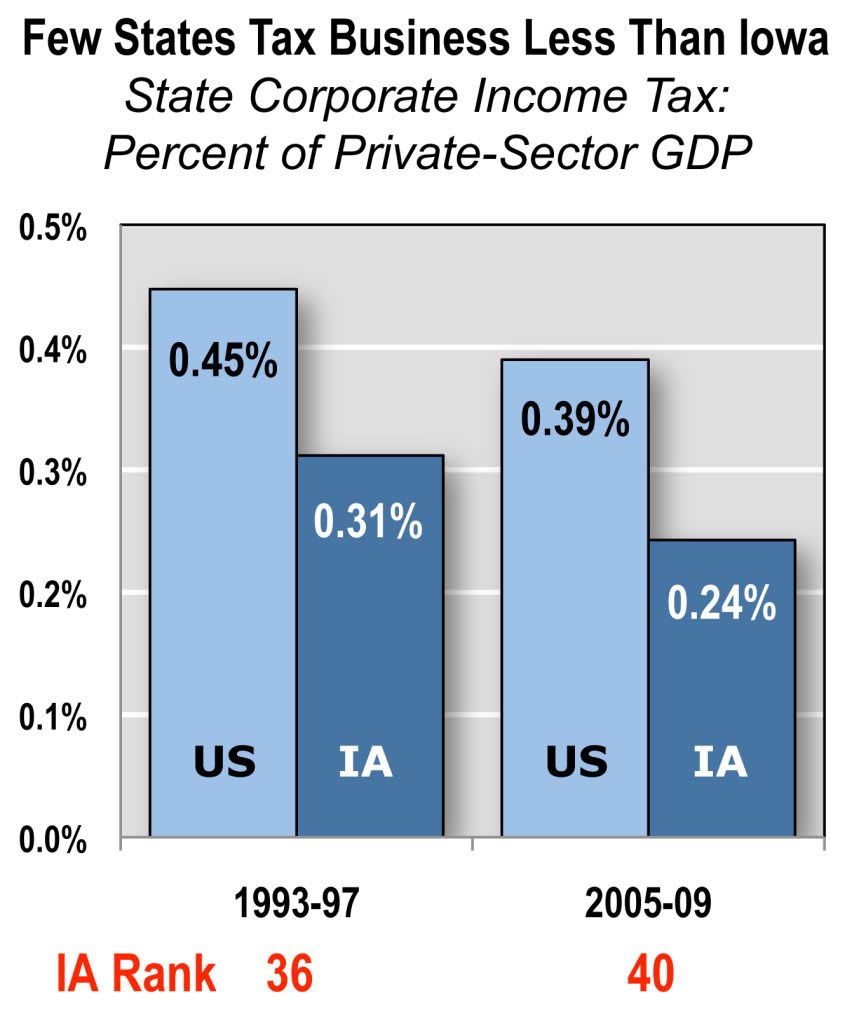

The best summary measure of the level of corporate income taxation from one state to another, that takes into account all features of the tax code, is the amount of tax collected as a percent of the private economic activity generated in the state, as measured by state private sector GDP (gross domestic product). In Iowa, this fraction fell from 0.31 percent in the mid-1990s to 0.24 percent over the last five fiscal years, as shown in Figure 1.

On this measure, Iowa’s rank among the 50 states fell from 36th to 40th. (For the most recent year, 2009, Iowa ranked 36th.) In both periods, Iowa has taxed well below the average for all 50 states.

[…]

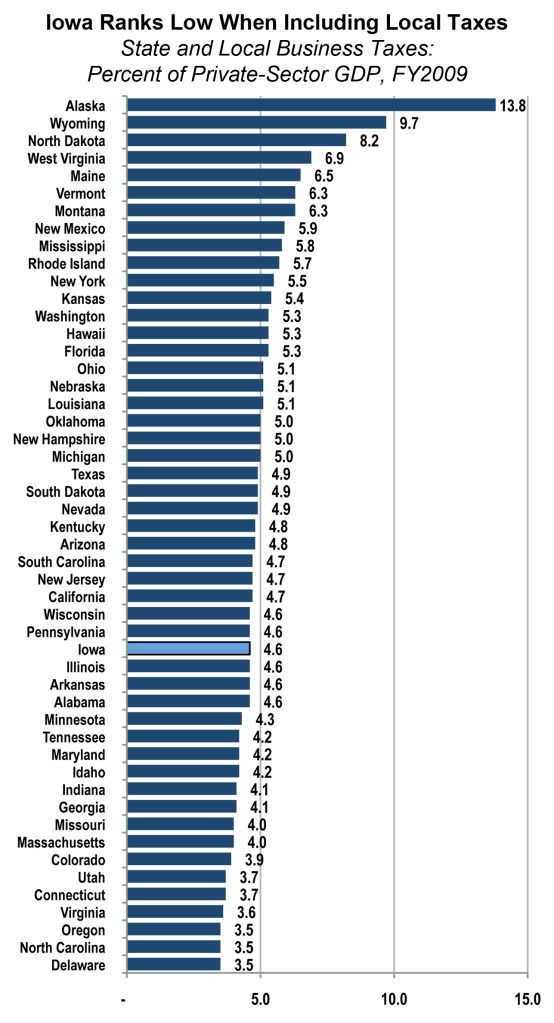

A recent report sheds light on the overall level of taxation of businesses of all kinds in the 50 states. The accounting firm Ernst and Young produces an annual report on business taxation that shows all business taxes, imposed by local as well as state governments, as a percent of state private sector GDP. On that measure Iowa was tied with six other states for 30th; as the table below shows, in only 15 states were business taxed at a lower rate.

Conclusion from Corporate Taxes and State Economic Growth (pdf file):

Business tax breaks are an expensive and inefficient way to attempt to stimulate a state economy. Because of the small effect of tax breaks on business costs, and the much larger importance of other production costs and location considerations, tax breaks will have little if any positive effect on private- sector employment. In fact, the revenue losses may well produce immediate public-sector job losses. Furthermore, the private-sector employment effects of such tax cuts could be reduced or even eliminated by a long-term deterioration in the quality of public services, which themselves have been shown to be important to businesses making location decisions, and which provide an important part of the foundation for the state economy.

1 Comment

Story

My mother dated a guy who owned a trucking company in the past. He has lived in Illinois most of his life. I asked him “Why did you start your trucking company in Iowa instead of Illinois”? We both grinned because it was a rhetorical question.

Iowa is a much cheaper state to start a company in, we are very competitive. Plain and simple

moderateiadem Thu 10 Feb 3:48 PM