Fascinating look at how investors view the electability question. One 2003 study found that the Iowa Electronic Markets were “both closer to eventual election outcomes and more stable than polls over the course of election campaigns.” According to Muller, last night’s primary results dropped Clinton slightly to 87.1 cents, while Sanders rose to 12 cents. -promoted by desmoinesdem

Supporters of both Senator Bernie Sanders and Secretary Hillary Clinton are busy on social media making their respective cases for why one or the other has a better chance of beating Donald Trump in the General Election. Insofar as you’re reading this, you have no doubt heard the arguments on both sides. Sanders is a socialist, and more than half of the American electorate will never vote for a socialist. Clinton has too much baggage, and is owned by Wall Street. On the one hand, there are national polls showing Sanders may have the edge over Trump, relative to Clinton. On the other hand, all of Clinton’s baggage is already common knowledge (real or imagined), and no one has really started attacking Sanders yet.

This is all an exercise in conjecture. Even sophistry. While I generally come down on the Clinton side of this debate, it’s been little more than a general feeling. Perhaps there are actual data that might give us a reason to prefer one candidate over another, provided “Democrat Winning the White House” is an important issue for a voter. The Iowa Electronic Markets (IEM) provide the data required to address the issue with a little more statistical rigor.

The infamous radio titan Dr. Laura used to advise callers to throw up before they drool. In that spirit, I’ll lead with the results. There is a positive correlation between Clinton winning the Democratic Nomination for President and a Democrat winning the White House in November. Voters who believe winning the White House is a primary or singular issue, should support Clinton in their primaries and caucuses.

Now for the drool.

From the IEM’s web site, “The Iowa Electronic Markets (IEM) are operated by faculty at the University of Iowa Henry B. Tippie College of Business as part of our research and teaching mission. These markets are small-scale, real-money futures markets where contract payoffs depend on economic and political events such as elections.” http://tippie.uiowa.edu/iem/about/

In the context of this blog, it’s a marketplace where people can place bets on who they think will win a given election. A more high minded view would describe gamblers as “investors”, and the outcomes they’re betting on as “derivatives”. The unit of measure is a dollar. Investors can buy a unit of a derivative of a political outcome for some amount less than a dollar. If the event comes to fruition, the investor is paid one dollar.

If you want to invest in the outcome of Hillary Clinton winning the Democratic Nomination, it will cost you 89 cents. If Clinton wins the nomination, you receive $1, or an 11 cent return (12.4%) on your initial investment. Or, you can invest in Bernie Sanders, and it only costs about 7 cents. If Sanders wins the nomination, you receive $1, or a return of 93 cents (1,329%).

The markets are based on the premise that markets are better predictors than polls or attitudes. If you ask a Sanders supporter if Sanders can win the nomination, you might get a different answer than if offer him 2:1 odds that it won’t happen. Or 3:1. Or even 10:1. Polls ask, “Who are you going to vote for?” The IEM asks, “If you put your money where your mouth is, who do you think will win?”

So how can we use the IEM to ascertain who has a better chance of winning the White House? I used the following markets to address this question:

DCONV16 – 2016 Democratic Convention Market

RCONV16 – 2016 Republican Convention Market

PRES16_WTA – 2016 Presidential Election Winner-Take-All

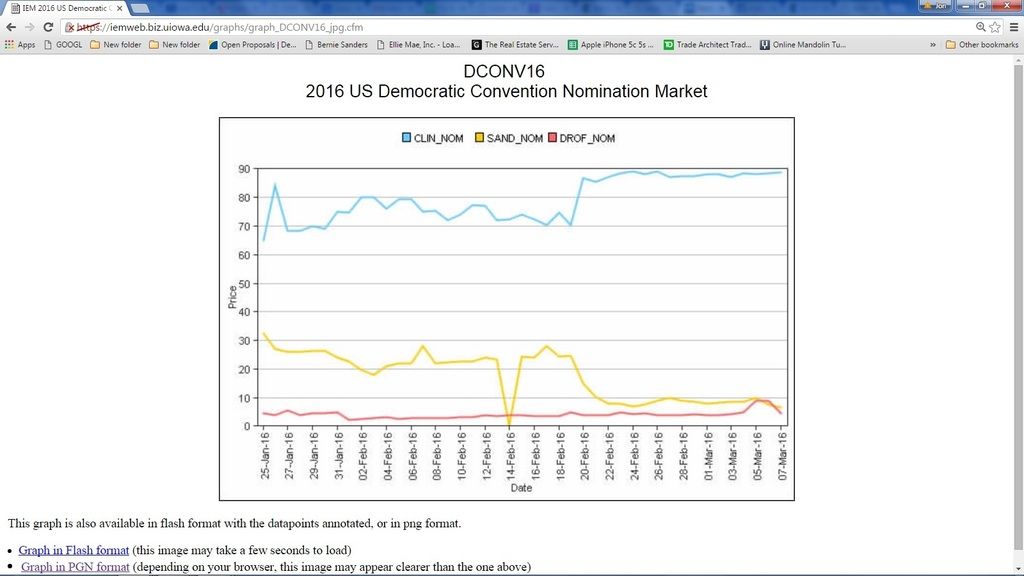

The first two markets give you a number of options. In DCONV16, you can bet that any of the following outcomes will occur.

CLIN_NOM – Clinton will win the nomination

SAND_NOM – Sanders will win the nomination

DROF_NOM – Someone else will win the nomination, “Rest of Field”.

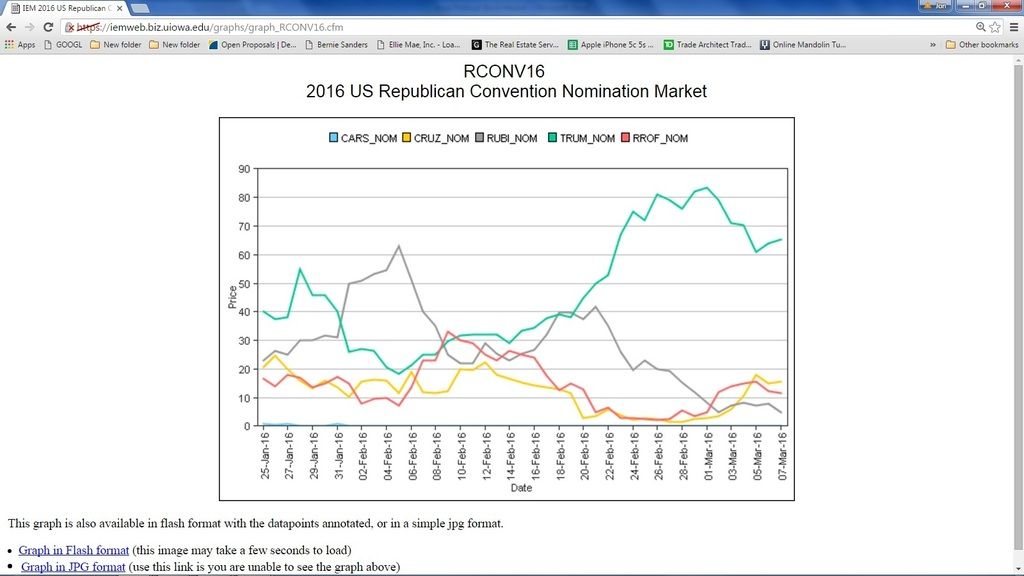

Similarly, in the RCONV16, you can bet that any one of following will win: Trump, Cruz, Carson, Rubio, or Rest of Field. If you believe a brokered convention might do something unforeseen, you might bet on the rest of the field if you think Paul Ryan might win, or Kasich, or Mitt Romney. If anyone wins, other than the 4 marketed candidates, you win your bet if you buy “RROF_NOM”.

The nomination markets for both Republicans and Democrats are “winner-take-all” markets, meaning that winning investors win back their entire dollar(s). Losing investors lose their entire investment. There are two markets for the General Election. One is the “winner-take-all” market. The other is a bet on the margin of victory. For purposes of this exercise, I used only the WTA market. Consider the following chart for the Democrat Nomination Market.

A couple of observations. First, investors are clearly betting on Clinton to win the nomination. If we think of the “price” as the “odds”, then it appears Clinton has about a 90% chance of winning the nomination. Second, you’ll notice the markets have far less volatility than opinions expressed in polls or on social media. She has always been, in the eyes of investors, the odds on favorite to win the nomination. Right after Super Tuesday, the bet against her got cheap in a hurry.

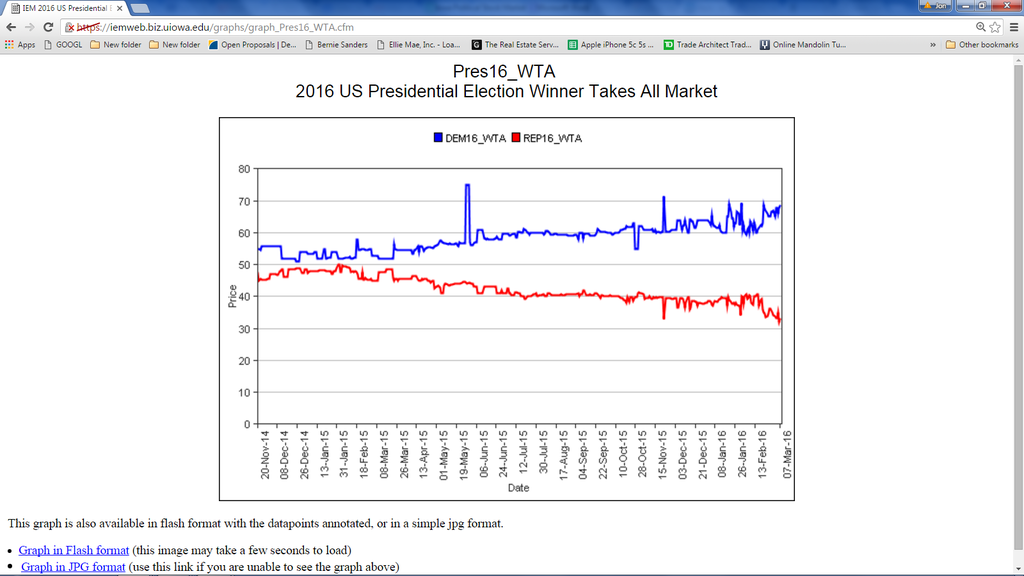

As candidates become more or less inevitable over time, so too do beliefs about the likely winner of the White House in November. Recall, we can’t bet on a given person to win the White House on IEM (there are other markets where this can be done, such as https://www.predictit.org/). But we can bet on whether a Democrat or Republican will win. Consider the market for the White House.

While the Candidate Markets started trading in January, this market goes back to late November. Whereas a Republican outcome closed the gap a couple of times in early January, a Democrat White House has been the odds on favorite since Day 1. And since the primary season got underway, the trend is clearly in that direction as well.

By downloading the Daily Trading information on the IEM web site, we can compare the relationship between what investors think about the Democrat Nomination, and what they think about the chances of a Democrat winning the White House.

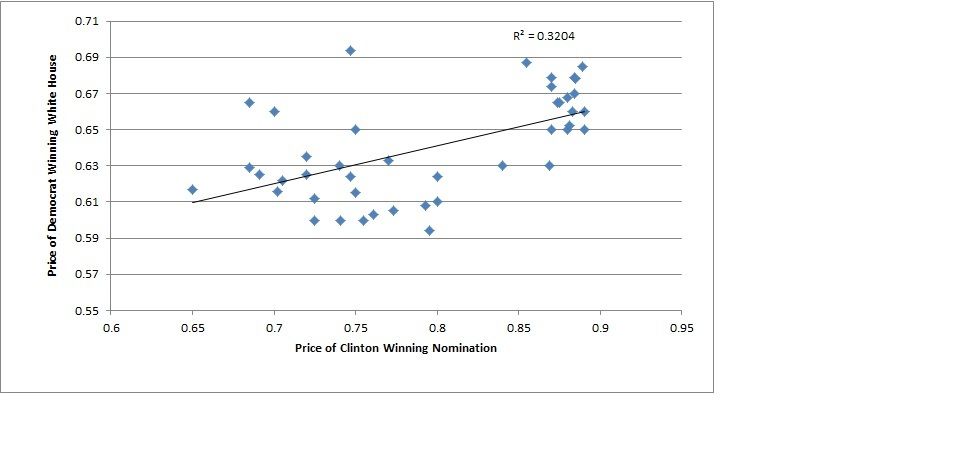

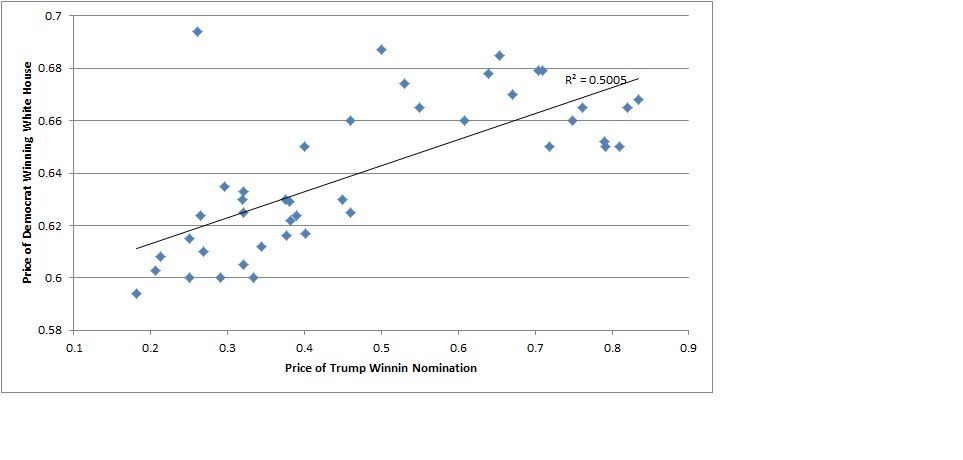

If investors believe, as many Sanders supporters do, that Sanders has a better chance than Clinton of winning the White House in November, then we should expect changes in the “Price of Sanders” to be positively correlated with the “Price of a Democrat White House.” If investors believe Clinton has the better shot, then when her price goes up, so too should the price of the Democrat November victory. The following scatterplot diagram takes the daily “pairs” of the “Price of Clinton” and the “Price of a Democrat White House”. While the relationship is by no means perfect, a best fit line shows a positive relationship.

The best fit line has an R-Squared of 0.32, which is by no means a profound relationship. One way to think of this is, approximately 32% of the variability of investors prediction about the General Election is a function of their certainty that Clinton will win the nomination. Nonetheless, the correlation is clearly positive.

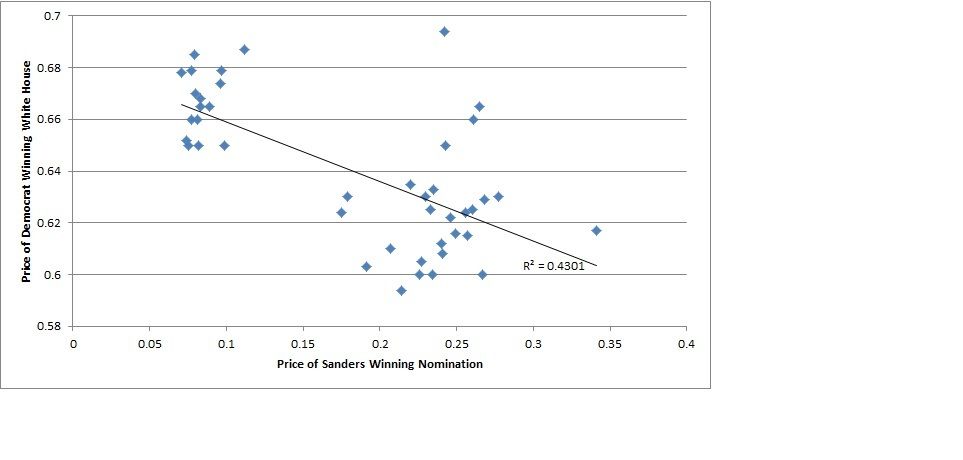

Unlike the General Election, where there are only two possible outcomes, the nomination markets have a Rest of Field option. Thus, it’s not entirely a zero sum game. An increase in the price of Sanders does not necessitate a decrease in the price of Sanders. Consider the following scatterplot, which compares the Sanders market with the General Election market.

No surprise here. The higher the probability of a Sanders nomination, the lower the probability of a Democrat winning the White House in November. In fact, the inverse relationship between Sanders and a Democrat President is even stronger than the positive relationship for Clinton. And this makes some sense for those who tend to believe Sanders presents more uncertainty, even if they tend to believe he may have a greater chance to win the White House. Keep in mind, this isn’t a question of who beats Trump. It’s a question of who is more likely to win the White House, regardless of Republican opponent. While Sanders supporters do make some reasonable claims about his viability against Trump, many of those same arguments suggest he may not do as well against candidates other than Trump. The markets are able to capture all of these nuances in a way that is problematic for pollsters.

There is something else going on with these markets. Three trends were already addressed. Over the past few months, Clinton’s stock has trended higher. Sanders stock has trended lower. And a Democrat White House trended higher. At the same time, the Republican side of the equation hasn’t been explored. Consider the Price of Trump over the past few months.

Trump’s rise toward inevitability is well documented. It appears the debates, attacks by the establishment, or other factors may have taken some of the shine off of his apple. Not surprisingly, and more in line with conventional wisdom, Trump appears to be good for the Democrats.

The more likely Trump is to win the Republican nomination, the more likely is a Democrat to win the White House. In fact, Trump’s probability of winning the Republican nomination is more highly correlated with a Democrat winning the White House than anything going on between Sanders and Clinton.

These statistics are not particularly pure. The markets themselves are correlated with each other, all across the board. Perhaps Clinton’s near-inevitability impacts investors’ views on the probability of a non-Trump candidate, for example. There are not nearly enough data to build a statistically significant regression model, and there are exogenous factors as well, such as the unemployment rate, price of oil, or activity in the Middle East.

Still, just to see if the “signs” would change, I ran a series of linear regression to measure the extent to which the nomination probabilities impact the probability of a Democrat White House. These variables are so correlated with each other that little was gleened. In all the scenarios run, the relationships described above were confirmed (Clinton and Trump positively correlated with a Democrat President, and Sanders negatively correlated).

Given the extremely high probability of a Clinton victory at the Convention, this may largely be academic. There is no shortage of rational arguments why we should prefer Sanders over Clinton, or Clinton over Sanders. Electability in the General Election is only one of the issues raised in these debates. If nothing else, those of us who hold the general view that a Democrat President is preferable to a Republican President, and who also believe it is the single most important issue, shouldn’t worry too much about a Clinton victory at the Convention.

5 Comments

Clinton's Huge Weaknesses on Trade and Her Ties to Wall Street Could Cost Her the General Election

I think a lot of this is academic. Nate Silver’s five-thirty-eight algorithms had Marco Rubio winning the GOP nomination, and we all know what happened there.

What isn’t factored in is how well Sanders does with independents – especially independents in the rust belt swing states where trade is a huge issue. Exit polls showed that 70% of independents went for Sanders.

White collar Democrats (which make up the punditry class) and Hillary Clinton do not understand how angry many voters are at Clinton’s support of NAFTA and Obama’s support of the TPP. Thomas Frank, author of “What’s the Matter with Kansas?” does. I’m concerned that Clinton will have a hard time winning swing states because Trump – who is very anti-NAFTA and TPP – will clobber her on this issue. This is what happened last night in Michigan.

http://commondreams.org/news/2016/03/09/donald-trump-flawed-candidate-hillary-clinton-easy-beat

Much has been made of Sanders’ consistent opposition to corporate-friendly trade deals that have devastated the Rust Belt. On the Republican side, however, Trump’s bombastic bigotry often eclipses the fact that by some measures, “trade may be his single biggest concern,” as Thomas Frank argued in the Guardian this week.

“Ill-considered trade deals and generous bank bailouts and guaranteed profits for insurance companies but no recovery for average people, ever—these policies have taken their toll,” across the U.S., Frank said.

“Many of Trump’s followers are bigots, no doubt,” he continued, “but many more are probably excited by the prospect of a president who seems to mean it when he denounces our trade agreements and promises to bring the hammer down on the CEO that fired you and wrecked your town, unlike Barack Obama and Hillary Clinton.”

Indeed, Frank’s colleague Lucia Graves pointed out: “A majority of Democrats and Republicans in Michigan have reported that recent trade deals have given people like them the shaft. On the Democratic side, six in 10 Michigan voters thought trade takes away jobs and the majority of those voters supported Sanders; on the Republican side, four in 10 thought trade costs the country jobs, and the majority of them supported Trump.”

Lori Wallach, director of Public Citizen’s Global Trade Watch, added on Wednesday: “Americans’ opposition to job-killing trade policies fueled the stunning Bernie Sanders upset victory in Michigan. But it also could be a deciding factor in the general election, especially with Donald Trump being the likely GOP nominee.”

“The outcome of the Michigan primary shows the potency of trade issues,” she said, “and foreshadows the trouble Hillary Clinton could face winning key Midwestern states in a race against Trump.”

farmgirl Wed 9 Mar 1:44 PM

how well Sanders does with independents

who vote in Democratic primaries tells us very little. These independents have not heard any case against Bernie yet. Once hundreds of millions of dollars have been spent telling them that Bernie will raise their taxes, put the government in charge of their health care, etc., it will be a different story.

I have seen no polling evidence suggesting that the trade issue could allow Trump to beat Clinton. All polling I’ve seen shows her beating him nationally and in key states. I don’t see his path to 270 electoral votes. His unfavorable ratings among Latinos alone will kill him in the general against Clinton.

desmoinesdem Wed 9 Mar 3:05 PM

Scare Tactics

Were Clinton the nominee, those hundreds of millions of dollars would go toward trying to defeat her and would use scare tactics as well. She’s on record for having supported single-payer health care (and Obamacare, which Trump is against), so that would get dredged up as well. Rust Belt Independents in swing states get as angry about paying a few more dollars in taxes as they do about having their jobs shipped away. Clinton’s NAFTA has decimated the economies of Michigan, Ohio, and Pennsylvania – key swing states. People aren’t going to forget that, which is what the white-collar punditry just doesn’t get.

farmgirl Wed 9 Mar 7:42 PM

but they've already spent millions and millions

against her, and everyone has heard all the arguments already, and she is still leading Trump in the important states.

It will be much easier for Republicans to define Bernie, who is less well known and whose negatives have not been discussed at length in the media for years.

desmoinesdem Wed 9 Mar 9:24 PM

From Nathan Robinson of Current Affairs

I’m not sure that “he’ll raise your taxes” will be as big as a hammer as it’s been in the past. I think that that Trump’s attacks – which galvanize his support – will be more effective against Clinton and more effective at smearing her.

http://www.democracynow.org/2016/3/10/hillary_clinton_or_bernie_sanders_who

So, whoever the Democratic nominee is in the fall can be assured that the Democratic base will support them, right? Because Trump has the support of the Klan, he’s, you know, called all Mexicans rapists, the Democratic base will be solid. What’s going to be difficult in the general election is winning over the working class, the so-called Reagan Democrats. And those are people that Trump has a message for. Trump has a message for people in Michigan who have lost their jobs. Trump has a message for people in rural Oklahoma. Those people come to his rallies. But those people also come to Bernie Sanders’s rallies. And Bernie Sanders has a message that resonates in those communities in a way that Hillary Clinton simply doesn’t, because of her record with Wall Street, because of her record with free trade. And so, I think what you see is that Hillary Clinton is not well positioned to capture the particular national mood at the moment, which is an antiestablishment mood. And if the Democrats run an establishment candidate in an antiestablishment election cycle, they are going to lose.

Bernie Sanders inspires people. Hillary Clinton hemorrhages support all the time. Donald Trump builds support. Bernie Sanders builds support as [people get] to know him. As people get to know Hillary Clinton, they trust her less and less.

farmgirl Thu 10 Mar 4:59 PM