Secretary of State Paul Pate failed to list two companies he controls on his latest personal financial disclosure form, Ryan Foley reported for the Associated Press on April 17.

Instead of instructing Pate to correct his filing, Iowa Ethics and Campaign Disclosure Board executive director Megan Tooker gave the incomplete form her blessing. She further suggested it would be unfair for her to require more detail from Pate after receiving a “media inquiry.”

Tooker and longtime board chair James Albert just gave every state official reason to believe they will be in the clear, even if watchdogs uncover material omissions on their personal disclosures.

Iowa Code Chapter 68B.35 requires “certain officials, members of the general assembly, and candidates” to file a personal financial disclosure form each year

that contains all of the following:

a. A list of each business, occupation, or profession in which the person is engaged and the nature of that business, occupation, or profession, unless already apparent.

b. A list of any other sources of income if the source produces more than one thousand dollars annually in gross income. Such sources of income listed pursuant to this paragraph may be listed under any of the following categories, or under any other categories as may be established by rule:

(1) Securities.

(2) Instruments of financial institutions.

(3) Trusts.

(4) Real estate.

(5) Retirement systems.

(6) Other income categories specified in state and federal income tax regulations.

Note that the statute mandates disclosure of “each business […] in which the person is engaged” and every source of income exceeding $1,000.

Not one or the other.

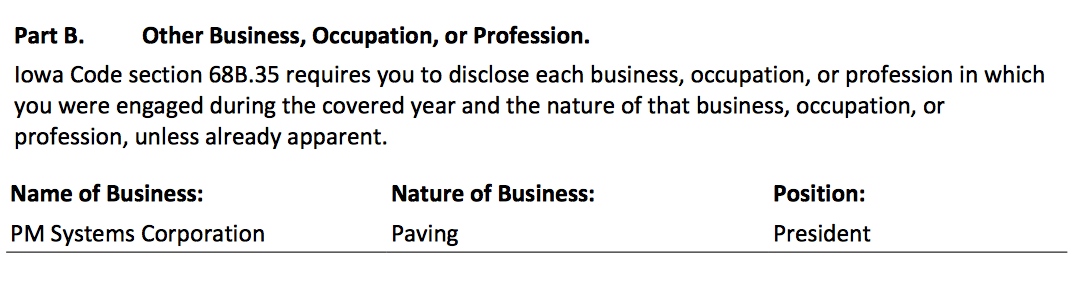

As part of its duty to enforce Iowa Code 68B, the Iowa Ethics and Campaign Disclosure Board receives personal financial disclosures. Part B of the form instructs officials to list “each business, occupation, or profession in which you were engaged during the covered year and the nature of that business, occupation, or profession, unless already apparent.” Pate’s disclosure for 2017 lists only one company in that section: his asphalt business PM Systems Corporation.

Yet Foley reported for the AP,

But business and government records show that another company Pate formed days before the 2016 presidential election, PRG Group LLC, worked throughout 2017 to open a new mini-storage business in Cedar Rapids. In a February filing, Pate called himself the “managing partner” of the corporation after closing on a $1.5 million mortgage to purchase a Hiawatha strip mall. […]

Pate filed paperwork with his office to organize the PRG Group on Nov. 4, 2016, listing himself as the registered agent and a corporate address that his asphalt company uses. At that moment, the secretary of state’s office was busy administering the Nov. 8 presidential election.

The PRG Group soon spent $255,000 to buy a vacant property in Cedar Rapids, where Pate served as mayor from 2002 to 2006. It petitioned the city for a series of permit and zoning approvals to build 50 self-service storage units and obtained a $630,000 line of credit for the project. The business, Noelridge Storage, opened in December [2017]. Pate is also an owner of the PEP Group, which runs another Cedar Rapids storage business and also wasn’t listed on his disclosure.

It would appear obvious that a founder and managing partner of a corporation negotiating a land purchase, permits, zoning approvals, and a line of credit for construction is “engaged” in that business. However, Pate dismissed Foley’s reporting as “#FakeNews” and insisted his disclosure was “accurate,” since “anyone who views the form I submitted can see that I included commercial and residential real estate holdings as sources of income.”

Indeed, Pate listed unspecified commercial and residential rent on Part C(4) of his disclosure, where officials are supposed to disclose “the type of real estate (e.g. agricultural, commercial, residential) that generated gross income in excess of $1,000 for the covered year and the source of the income (e.g. rent, sale, mortgage).” That portion of the form does not ask for the name of every entity that produced real estate income.

But Part B does ask for the name of every business with which a person was engaged and the position held. Here’s how that portion of the form looks on Pate’s most recent disclosure:

Remember, state law requires officials to fill out Part B and Part C. That is logical, because receiving income as a passive investor is different from making deals as a corporate leader. The law was designed to reveal the person’s work activities as well as all sources of income exceeding $1,000 in any given year.

Since Pate holds a full-time elected position in state government, for which he is paid a generous salary of $103,212, the public has an even stronger interest in knowing about businesses he runs in his spare time. Some Iowans who fill out the annual disclosure forms serve on boards or commissions part-time as appointed volunteers.

Communications staff for the Secretary of State’s office have not answered my questions about leaving PRG Group LLC off the disclosure. (“Is Secretary Pate asserting that as managing partner he was not in any way engaged in their negotiations to buy property during 2017? If he wasn’t, who was handling those deals?”)

After reading Pate’s initial statement on the AP story, I sought comment from Tooker:

• Had she told Pate he didn’t need to revise his form to mention PRG Group LLC?

• Was it her view that because Pate listed real estate rent on part C(4) of his disclosure, he was not required to mention the corporation he founded and led on part B?

• How is the public supposed to evaluate potential conflicts of interest if state officials don’t disclose the names of companies they created and manage?

The following day, Tooker issued a remarkable written statement you can read in full here. Key excerpts:

I spoke with Secretary Pate on April 17th and he told me he owns self- storage facilities and a strip mall, which are held in the names of the LLCs. He disclosed on his personal financial disclosure statement that he received rent from commercial and residential real estate although he did not disclose the names of the LLCs or the addresses of the properties. I told Secretary Pate that ultimately it is up to the Ethics Board to determine whether someone’s disclosure is sufficiently detailed.i However, his personal financial disclosure statement is comparable in the level of detail to many other statements that are filed with the Ethics Board and with the legislature. In my opinion, Secretary Pate’s statement is not false or fraudulent.

I also talked to the Ethics Board’s chair, Professor James Albert, on the 17th. He agreed with me that Secretary Pate’s disclosure was not out of the norm in its level of specificity. We further discussed that it would be wise for the Ethics Board to develop for next year a list of frequently asked questions and answers that would help filers understand how much detail they should provide on their personal financial disclosure statements.

I told Secretary Pate he was welcome to amend his personal financial disclosure statement if he so desired but I would not require him to do so at this time. As the Ethics Board’s executive director, I strive every day to treat every person within the Ethics Board’s jurisdiction the same, regardless of political party or whether there is a pending complaint or a media inquiry. Since I am not requiring other filers to provide more detail for their real estate or other sources of income, I do not think it would be appropriate to single out Secretary Pate and hold him to a different standard simply because I received a media inquiry.

Tooker has in effect told every Iowa official:

1. She will not check the Secretary of State’s website or other records to see whether officials own any businesses not listed on Part B of their disclosure forms.

2. She does not deem it necessary for officials to name each business or the position held on Part B of the form, as long as they mention some general category of income on Part C.

3. Even if a watchdog uncovers a corporation not listed on Part B of someone’s disclosure form, Tooker will not require an amendment, out of a misguided belief that would be unfair to officials facing scrutiny.

4. Since many Iowa officials submit vague personal financial disclosures, it would not be “appropriate” for the ethics board to ask Pate–or presumably anyone else–for more details.

Predictably, Pate seized on Tooker’s words to discredit a journalist who has embarrassed him before. Hours after the AP scoop appeared, a statement from Pate depicted the story as a “false hit piece, written by a biased reporter with a partisan agenda.” He took it up a notch in an April 18 news release posted to the Secretary of State’s official website and circulated by Pate’s election campaign, titled “Campaign Ethics Board exonerates Secretary Pate from dishonest media attacks.” Excerpts:

DES MOINES – Iowa Campaign Ethics and Disclosure Board Executive Director Megan Tooker and Chairman James Albert rebutted the false attacks against Iowa Secretary of State Paul Pate published in an Associated Press article on Tuesday. Tooker said it would not be appropriate to single out Secretary Paul Pate and hold him to a higher standard than other elected officials. […]

Tooker added that she spoke with Professor James Albert, chairman of the Iowa Campaign Ethics and Disclosure Board, and “he agreed with me that Secretary Pate’s disclosure was not out of the norm in its level of specificity”.

Furthermore, Tooker refuted insinuations from Associated Press reporter Ryan Foley that Secretary Pate’s disclosure form was not in compliance with Iowa Code. “His personal financial disclosure statement is comparable in the level of detail to many other statements that are filed with the Ethics Board and with the legislature. In my opinion, Secretary Pate’s statement is not false or fraudulent.”

The Republican Party of Iowa is now calling on the AP to correct or retract what they depict as a false story. Government and business records support Foley’s account of Pate’s activities with PRG group and the fact that Pate did not list PRG Group or PEP Group on his disclosure for 2017.

During the Iowa Ethics and Campaign Disclosure Board’s January meeting, board member Jonathan Roos argued for imposing the maximum possible fine on Health Facilities Council member Connie Schmett, who had not disclosed several significant sources of income. Roos noted that the board had an opportunity to send a message to officials who don’t seem to take the requirement seriously.

Tooker and Albert (a professor of administrative law who has served on the ethics board since 1997) sent the opposite message yesterday. They implied that Iowa law allows officials to conceal companies they own or manage when filling out Part B of the disclosure form, as long as Part C contains some vague language about income received from that business activity.

I welcome feedback from attorneys or others with relevant expertise, either through comments in this thread or a confidential message.

Final note: A staunch defender of Pate claiming to be a certified public accountant argued on Twitter that the secretary of state is in the clear because the Internal Revenue Service doesn’t define commercial rentals as a “business.”

“Engaged” means being occupied with an activity. A plain reading of Iowa Code Chapter 68B.35 suggests that “each business, occupation, or profession in which the person is engaged and the nature of that business, occupation, or profession” refers to all employment or management positions held during the covered year. The purpose is to shed light on work done outside of the state role.

The next line of that code section requires disclosure of sources of income. As mentioned above, a passive investor may receive rent on commercial property. In contrast, Pate was founder and managing partner of a company that acquired a mall and built on a vacant lot during the covered period. Nothing in the statute indicates that listing unspecified real estate income can be an alternative to disclosing “each business, occupation, or profession in which the person is engaged.”

UPDATE: Iowa Freedom of Information Council executive director Randy Evans provided these comments to Bleeding Heartland.

The position of the Iowa Ethics and Campaign Disclosure Board is quite troubling. The disclosure requirements exist for a very important reason — so the people of Iowa know whether their government officials do, or do not, have connections that represent a potential conflict of interests with their government duties.

To excuse Secretary of State Pate’s lack of full disclosure, as the board has done, should trouble Iowans. It’s even more troubling that the justification for this lack of full disclosure is because other government officials have been permitted to submit forms that are not complete and not accurate.

The Ethics and Campaign Disclosure Board should give every official who is required to file these disclosure reports a deadline — perhaps 60 days at the most — to correct their most recent filings and make those reports complete and accurate.

That’s the purpose of the disclosure requirement, and that’s what the board should be requiring of every officials who has to make these disclosures. The public is entitled to know this information, and the board should be ensuring that officials are fully complying.

2 Comments

Three cheers for good investigative journalism

Ryan Foley is the same AP journalist who uncovered the very interesting aviation history of former ISU president Steven Leath, the Magnificent Man in ISU’s Flying Machine who went uppity-up-up and went down-diddy-down-crash. Thank you, Ryan Foley.

PrairieFan Thu 19 Apr 12:56 PM

And boos to the ethics board

Megan Tooker never met a miscreant public servant who, by dint of stupidity or intent, ran afoul of the Iowa code in matters before her agency. Public officials, who apparently can’t understand plain English, get a pass while citizens, in whose name Tooker is supposed to be advocating, are ignored or worse.

As for Pate, perhaps he can put the green-light he got from Tooker, and his knowledge about the Secretary of State’s filing procedures, and open another new business — this time a consultancy to help other elected officials evade their reporting obligations. Ain’t capitalism grand?

JohnMorrissey Fri 20 Apr 5:05 PM