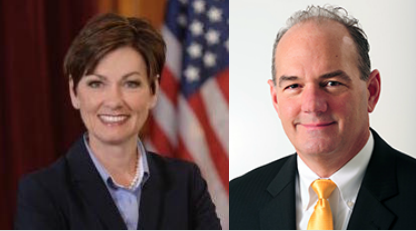

Cedar Rapids Mayor Ron Corbett fleshed out his case against Governor Kim Reynolds as a manager of state finances this week, saying she is behaving like former Democratic Governor Chet Culver. During the 2010 campaign, then-candidates Terry Branstad and Reynolds derided Culver as “Big Debt Chet.” Now, Corbett asserts, “instead of learning from Governor Culver, she’s mirroring from Governor Culver.”

As the leading GOP rival to Reynolds, Corbett will make fiscal policy a central issue in his gubernatorial campaign. But is Reynolds really on track to borrow more money for the state than Iowa’s last Democratic governor did?

BORROWING TO COVER CURRENT EXPENSES VS. BONDING FOR LONG-TERM CAPITAL INVESTMENT

Culver’s four years in office coincided with the worst national recession since World War II. Across the country, “The Great Recession that started in 2007 caused the largest collapse in state revenues on record.” As Iowa’s revenues fell short of projections, Culver enacted two rounds of across-the-board mid-year spending cuts. He also used $47.5 million from the state’s cash reserves to make ends meet.

Earlier this year, with the approval of the Republican-controlled legislature, the Branstad/Reynolds administration used $131 million from cash reserves to cover a projected shortfall–a remarkable occurrence during a period of economic expansion.

Still, revenues continued to lag well below projections for fiscal year 2017, which ended June 30. The latest non-partisan analysis indicates that Iowa finished the year $104.4 million short of funds needed to cover expenses. Those numbers could change slightly before the books are closed on September 30, but almost certainly Reynolds will have to call state lawmakers back for a special session this fall. Most observers expect House and Senate Republicans to approve another transfer of funds from cash reserves to cover the shortfall.

Hence Corbett’s comment to a Cedar Rapids audience on August 1: “If the current projections hold true of this $104 million, Gov. Kim Reynolds will be borrowing $104 million — twice what Gov. Chet Culver borrowed.”

Republican allies of Reynolds accused Corbett of “making things up” and “forgetting” about Culver’s I-JOBS debt.

Democratic lawmakers approved and the Culver administration managed the I-JOBS initiative, which involved selling $810 million in state bonds to pay for a wide range of infrastructure projects.

I asked Corbett about the discrepancy. He replied by e-mail, “when I make reference to debt I am referring to operational debt. Governor Culver had I-JOBS which was a debt construction program. I don’t include bonding. I [am] only comparing borrowing from cash reserve.”

Borrowing for capital investment differs from borrowing to cover ongoing expenses. Consider two people who have 30-year mortgages for $200,000 homes. One of them is able to cover everyday expenses without additional borrowing; the other repeatedly takes out payday loans to make ends meet until the next paycheck is in hand. Their total indebtedness may be the same, but one of them is managing the household budget much better than the other.

State Treasurer Mike Fitzgerald, a Democrat, will soon propose that Iowa engage in short-term borrowing this fall to keep the state solvent throughout the 2018 fiscal year. Reynolds rejected Fitzgerald’s call to consider short-term borrowing in June. The treasurer will raise the issue again, O.Kay Henderson reported on August 1.

Fitzgerald says it makes sense to borrow now, in preparation for a couple of “problem months” in the first half of 2018 when the state may not have enough cash in reserve to pay its bills on time.

“It’ll be borrowing in September, paying it off before the end of the year, so it doesn’t add to the state debt and, if we borrow early by what’s known as arbitrage, we can make money on the money we don’t use to pay for borrowing,” Fitzgerald says, “so it doesn’t cost us anything. It just ensures the state can pay its bills on time. That’s all it does.” […]

Fitzgerald says the state has done this kind of maneuver before the months of March and April can pose a problem. The state is waiting for Iowans to submit their income tax payments in March and April, while at the same time continuing to make school aid payments, send out tax refunds and cut paychecks for state workers.

“This year we ran short. We squeeked by,” Fitzgerald says. “Next year it’ll be harder because we won’t have as much reserves to rely on.”

Staff for Reynolds have not responded to my request for comment on whether the governor is open to Fitzgerald’s proposal, or what other measures she is considering to prevent cash-flow problems for the state during the early months of 2018. (This year, tax refunds were delayed because the state “didn’t have enough cash to pay people at the same pace as in previous years,” Brianne Pfannenstiel reported for the Des Moines Register in June.)

When I put the same question to Corbett, he replied, “I don’t have access to all the details the treasurer has on this subject. He doesn’t come across as partisan and have no reason to what he says isn’t true. I believe the budget issue is bigger than what the public is being told. We still have not heard what the new rates will be with MCO’s. Those rates were suppose[d] to be public July 1st.”

MCOs stands for managed-care organizations, the three private insurance companies that are now handling Iowa’s Medicaid program. The Register’s Tony Leys reported last month on the closed-door negotiations between Iowa Department of Human Services officials and representatives for the MCOs. Even key state lawmakers haven’t been informed about the status of the talks or why they were “stretching past the date when the new rates were supposed to take effect.” Earlier this year, the DHS agreed to a “risk corridor” arrangement to transfer more money to the insurance companies. Most of the funds would come from the federal government. The state’s share of about $10 million would be paid sometime after June 2018 (that is, during the 2019 fiscal year).

CORBETT VS. REYNOLDS ON TAX REFORM

Tax policy will be another central issue for Corbett in the GOP gubernatorial primary. For nearly two years, he has been promoting a tax reform plan to audiences in scores of cities and towns. He has also criticized the Branstad/Reynolds administration for neglecting tax policies he considers vital, such as “coupling” with federal code to preserve certain deductions.

During his August 1 campaign event, “Corbett chastised Reynolds for not releasing a tax reform plan yet, so that the public can weigh in on it before lawmakers return for the legislative session in January.” His plan would establish a flat income tax while “eliminating nearly all deductions for people making more than $10,000 a year.” At the same time, he would increase the state sales tax from 6 percent to 7 percent, with three-eighths of that penny increase filling the Natural Resources and Outdoor Recreation Trust Fund. Iowa voters approved that fund’s creation in 2010, but lawmakers have never allocated any money to it.

Corbett told me in June that it would be “a big mistake” for Reynolds to lead an “exclusively Republican” push for tax changes next year. I asked him this week how he saw bipartisan support shaping up for his tax plan. Democrats generally support progressive tax systems, not a flat tax approach. Corbett gave three reasons: first, many Iowa Democrats have long wanted to eliminate federal deductibility, which is part of his plan. (That deduction primarily benefits people with high incomes.) Second, many Democrats support filling the Natural Resources trust fund. Finally, “The current system hits middle class the hardest and democrats have traditionally stood up for them.” Click here for more thoughts from Corbett about how Iowa’s tax code now forces middle-class people to pay a larger share of their incomes than the wealthy.

Responding to Corbett’s August 1 comments, the governor’s office said in a statement,

“Governor Reynolds made clear on day one that comprehensive tax reform is her top priority to grow Iowa’s economy and build a better Iowa. It was the first policy item she mentioned in her swearing in address.

“As you may have seen, Governor Reynolds was in DC this morning, fighting for Iowans, advocating for a robust Renewable Fuel Standard. A strong RFS grows our Agriculture economy, and will help our farmers get through the most turbulent farm economy we’ve experienced in many years.”

Reynolds did emphasize tax reform in her speech on May 24. She hasn’t revealed her specific plans, though.

“Fighting for Iowans” in Washington isn’t the strongest card for Reynolds to play right how. Five Republican governors lobbied the U.S. Senate last month not to pass a bill that “could leave millions of Americans without coverage,” making health insurance unaffordable and Medicaid unavailable to hundreds of thousands of their constituents.

Meanwhile, as Bleeding Heartland will discuss in a forthcoming post, Reynolds has had nothing to say about the health care reform debate other than standard GOP talking points about “Obamacare” being “unsustainable, unworkable, unaffordable.” On July 18, she complained to reporters, “You all are constantly asking me to weigh in on whatever the proposal of the day is, and it fluctuates even within a day.” Quite a contrast to the Republican spin depicting the governor as someone who “goes overboard, in terms of doing the additional study on her own and making sure that she fully grasps the nuances of policy and the positions that the administration will take.”

Any comments about the GOP gubernatorial campaign are welcome in this thread.

UPDATE: Henderson reported for Radio Iowa on August 5 that Reynolds disagrees with Fitzgerald on a possible cash-flow problem.

“I want to just assure Iowans we have almost half a billion dollars in cash reserves. I don’t think this is a time when we need to be short-term borrowing, ” Reynolds says. “I don’t think it’s necessary.” […]

“I want to just reassure all Iowans that our bills are being paid and have been paid and are being paid,” Reynolds says. “…We’re continuing to collect the facts. We’re doing the due dilligence that we need to be doing so that we can make an informed decision on the procedures moving forward.”