The official Iowa Senate Republican tax plan would repeal the state’s popular Solar Energy Systems tax credit later this year.

Ways and Means Committee Chair Randy Feenstra introduced Senate Study Bill 3197 on February 21 and scheduled a subcommittee meeting on the 130-page bill for 8:00 am the following morning. Sweeping changes to individual and corporate income tax rates could reduce state revenue by more than $1 billion annually, though the details are unclear, because no fiscal analysis is publicly available.

Although the bill would create a new legislative committee to “comprehensively review and evaluate each tax credit” (pages 31-2), it also calls for scaling back or eliminating some tax credits, with the solar incentive the first to go.

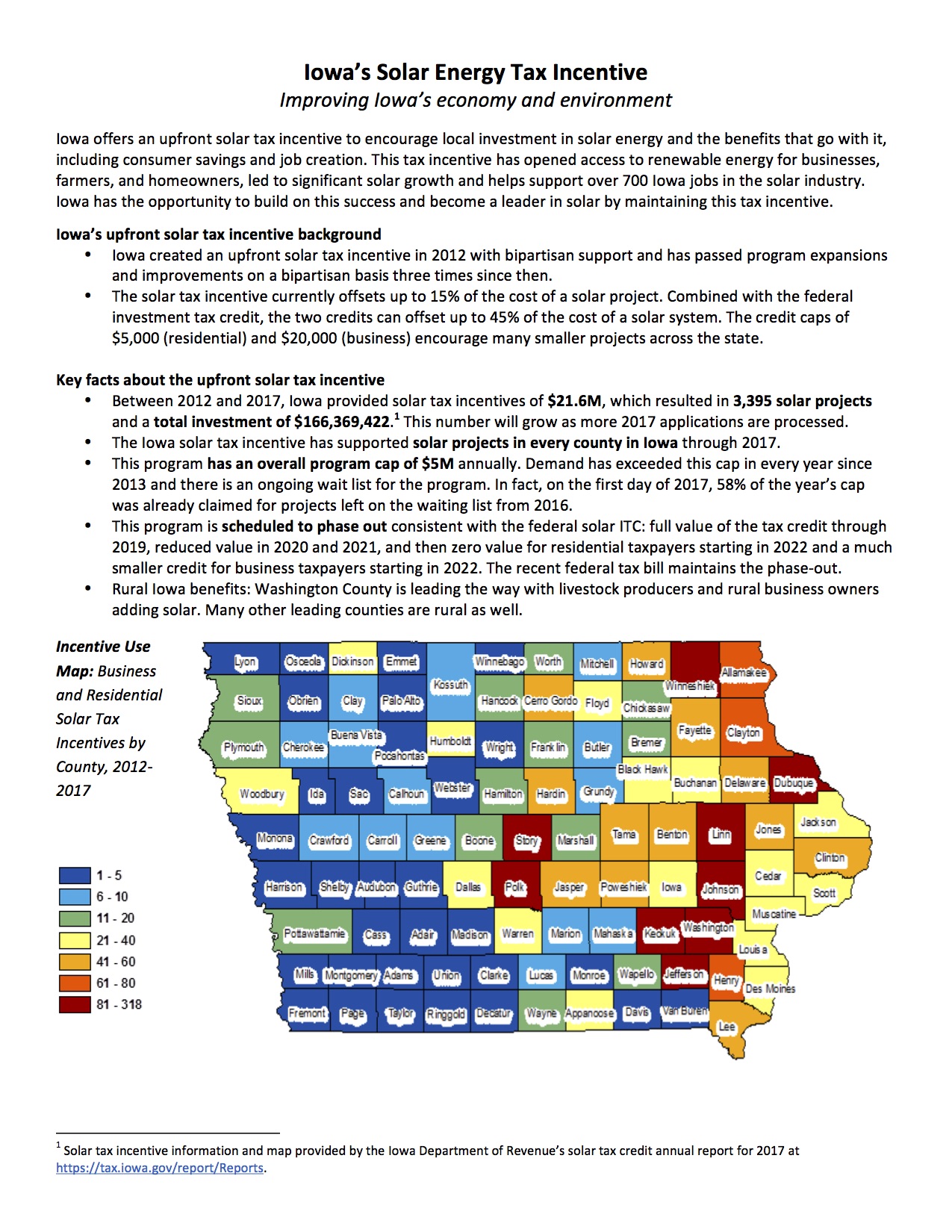

That popular tax credit can apply to residential or business photovoltaic systems. Kerri Johannsen of the Iowa Environmental Council noted in an e-mail message today that “many farmers and rural businesses” have benefited from the program. As of January 2018, the credit “has helped develop solar projects in all 99 of Iowa’s counties and leveraged $21.6M in state dollars into 3,395 solar projects and a total investment of $166,369,422.” Furthermore,

The program is already capped at $5M per year and on a path to phase down along with the federal investment tax credit starting in 2019. This credit is not draining state funds, but supporting rural economic development and getting rid of the credit actually risks the loss of 700+ solar jobs across the state and many small, independent businesses.

The bill creates a committee to study tax credits. The solar credit easily holds its own in economic payback for the state. Let its merits be considered along with Iowa’s others credits as the legislature takes a look at all credits in the interim.

I enclose below a fact sheet with more details on the solar tax credit, along with language summarizing the other proposals in that section of the Senate GOP bill. Two geothermal tax credits would be repealed as of January 1, 2019. Another red flag for environmentalists is the call to reduce the historic preservation tax credit from $45 million to $35 million, starting next fiscal year, and repeal that tax credit in 2025. Historic preservation dollars have been essential for countless projects to renovate old buildings and revitalize main streets in Iowa communities of all sizes.

The Senate GOP bill would also reduce the “high quality jobs program,” used to lure many large corporate projects over the years, to $80 million annually starting on July 1. It would repeal that tax credit as of July 2025.

Fact sheet provided by the Iowa Environmental Council:

From the explanation section of Senate Study Bill 3197, as published on February 21:

4 DIVISION III —— TAX CREDITS. Division III makes numerous

5 changes to tax credits and tax credit programs.

6 The bill repeals the taxpayers trust fund tax credit

7 effective January 1, 2020.

8 The bill increases the annual tax credit allocation limit

9 of the angel investor tax credit program from $2 million to

10 $4 million, and provides that in any fiscal year in which the

11 angel investor program allocation exceeds $2 million, the $8

12 million annual tax credit allocation limit of the innovation

13 fund investment tax credit program shall be reduced by the

14 amount that the angel investor tax credit allocation exceeds $2

15 million for that same fiscal year. This change takes effect

16 July 1, 2018.

17 The bill increases the annual tax credit allocation limit of

18 the workforce housing tax incentive program to $22 million from

19 $20 million, and provides that the entire $2 million increase

20 shall be reserved for housing projects in small cities, thereby

21 increasing the small city reserve under the program from $5

22 million to $7 million per fiscal year. These changes take

23 effect July 1, 2018.

24 The bill makes several changes to the high quality jobs

25 program. The bill reduces to $80 million the annual tax

26 credit allocation limit of the high quality jobs program, for

27 fiscal years beginning on or after July 1, 2018. The bill

28 also prohibits data center businesses and web search portal

29 businesses, as defined in the bill, from participating in

30 the high quality jobs program, unless the businesses had a

31 physical presence in this state prior to July 1, 2018. The

32 bill repeals the ability under the high quality jobs program of

33 eligible businesses to receive tax credits and tax refunds for

34 taxes attributable to racks, shelving, and conveyor equipment

35 to be used in a warehouse or distribution center, beginning

-112-

LSB 5452XC (3) 87

mm/jh 112/130S.F. _____

1 January 1, 2019. The bill repeals the refundability of the

2 supplemental research activities tax credit available under the

3 high quality jobs program beginning January 1, 2019. Finally,

4 the bill repeals the high quality jobs program effective July

5 1, 2025.

6 The bill increases, from 5 percent and 15 percent, to

7 7 percent and 17 percent, the two tax credit rates of the

8 agricultural asset transfer tax credit, beginning January 1,

9 2019. The bill also increases from $6 million to $8 million

10 the number of tax credits that may be issued per fiscal year

11 under the agricultural asset transfer tax credit program,

12 beginning July 1, 2018.

13 The bill repeals the accelerated career education program

14 provided under Code chapter 260G on July 1, 2025.

15 The bill extends by one year the deadline for entering into

16 withholding agreements under the targeted jobs withholding

17 credit pilot project from June 30, 2018, to June 30, 2019.

18 The bill reduces to $35 million from $45 million the number

19 of historic preservation tax credits that may be awarded each

20 fiscal year, beginning July 1, 2018, and repeals the historic

21 preservation tax credit program on July 1, 2025.

22 The bill modifies the research activities tax credits under

23 the individual and corporate income tax by providing that the

24 credits will only be available to businesses engaged in the

25 manufacturing, life sciences, software engineering, or aviation

26 and aerospace industry, and to the extent the business claims

27 and is allowed a research credit for such qualified research

28 expenses under the IRC for the same taxable year it is claiming

29 the state research activities credit. The bill includes

30 examples of persons ineligible for the tax credits. These

31 changes take effect upon enactment and apply retroactively to

32 January 1, 2018, for tax years beginning on or after that date

33 and for tax returns, including amended returns, filed on or

34 after that date for any tax year.

35 The bill further modifies the research activities tax

-113-

LSB 5452XC (3) 87

mm/jh 113/130S.F. _____

1 credits under the individual and corporate income tax by

2 amending the definition of “base amount” for purposes of

3 calculating the credits. This change takes effect upon

4 enactment and applies retroactively to January 1, 2010, for tax

5 years beginning on or after that date.

6 Because Division II repeals the individual and corporate

7 alternative minimum taxes, the bill allows a taxpayer to

8 claim any remaining alternative minimum tax credit against

9 the individual’s or corporation’s regular tax liability for

10 the 2019 tax year, and the bill then repeals the alternative

11 minimum tax credit beginning in tax year 2020.

12 The bill increases the total amount of school tuition

13 organization tax credits that may be issued per tax year to $13

14 million from $12 million for tax years beginning on or after

15 January 1, 2019. The bill also increases the household income

16 limit at which a student is considered an “eligible student”

17 under the school tuition organization tax credit program to

18 four times the federal poverty amount for tuition grants

19 provided on or after January 1, 2019.

20 The bill repeals the tuition and textbook tax credit, the

21 volunteer fire fighter and volunteer emergency medical services

22 personnel member tax credit, and the reserve peace officer tax

23 credit, effective January 1, 2022.

24 The bill repeals the geothermal tax credit, the geothermal

25 heat pump tax credit, the farm to food donation tax credit, and

26 the ethanol promotion tax credit on January 1, 2019.

27 The bill repeals the solar energy system tax credits on July

28 1, 2018, for solar energy system installations occurring on or

29 after that date.

30 The bill requires the legislative tax expenditure committee

31 created in Code section 2.45 to study all tax credits available

32 under Iowa law during the 2018 interim, and to submit its

33 findings and recommendations to the general assembly for

34 consideration during the 2019 legislative session. As part

35 of the study, the legislative tax expenditure committee is

-114-

LSB 5452XC (3) 87

mm/jh 114/130S.F. _____

1 required to consider new or different tax credit or other

2 incentive programs for economic development.