The Iowa Ethics and Campaign Disclosure Board voted unanimously on July 13 to fine and reprimand the city of Windsor Heights for sending a mass mailing that appeared to advocate for passage of a local-option sales tax in Polk County.

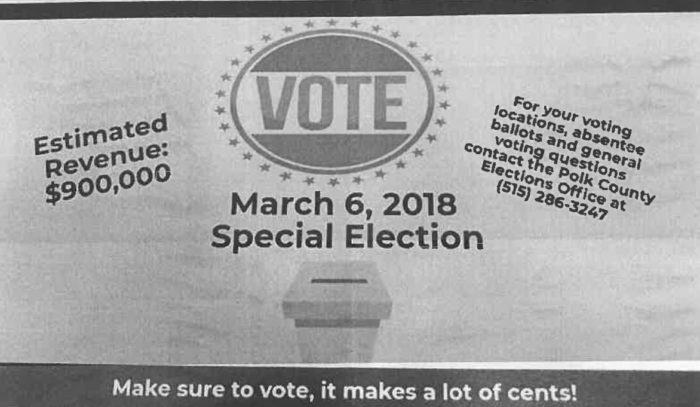

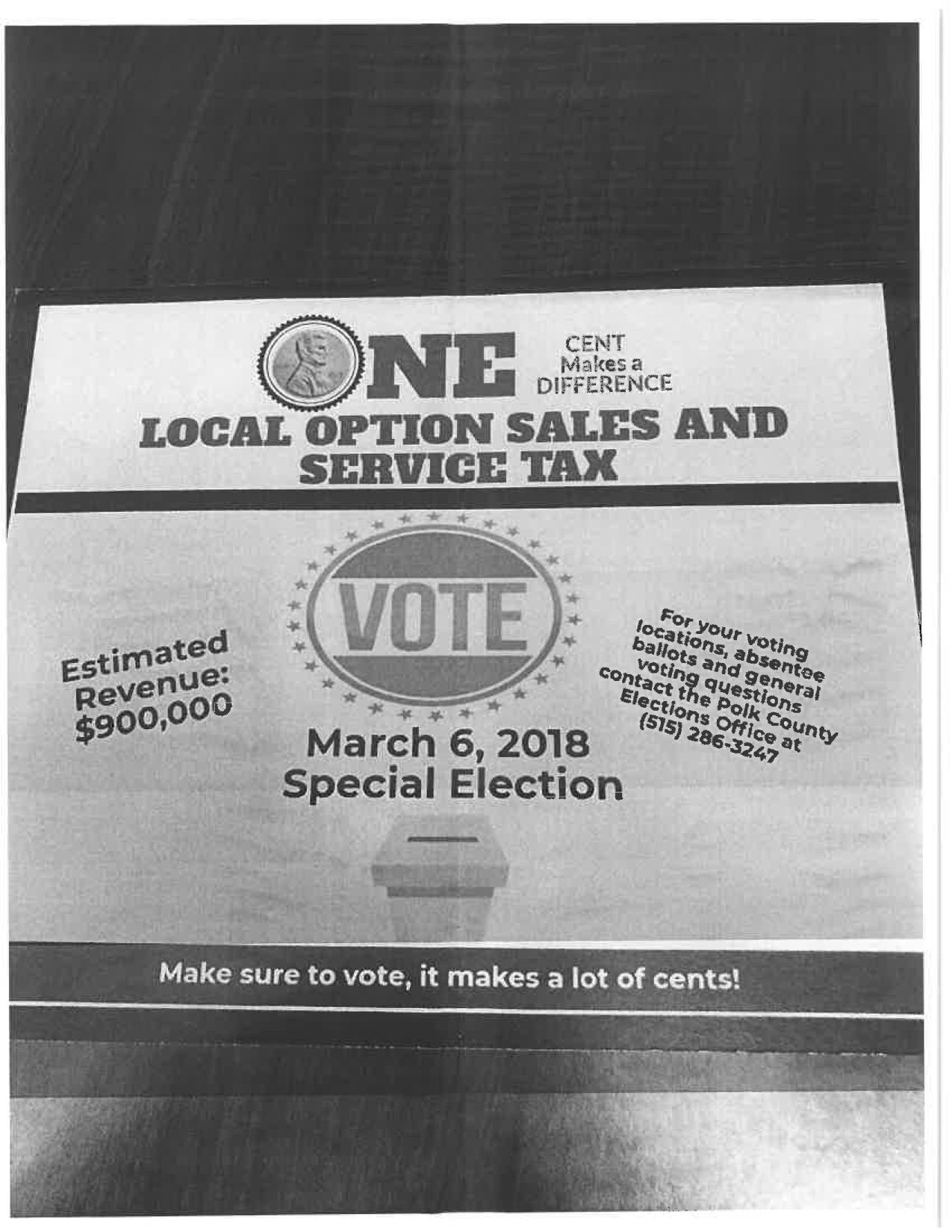

Iowa Code 68A.505 forbids state or local governments from spending public money “for political purposes, including expressly advocating the passage or defeat of a ballot issue.” Haley O’Connor filed a complaint with the ethics board after receiving this city-funded mailer, which went to all Windsor Heights households a few weeks before the March 6 election.

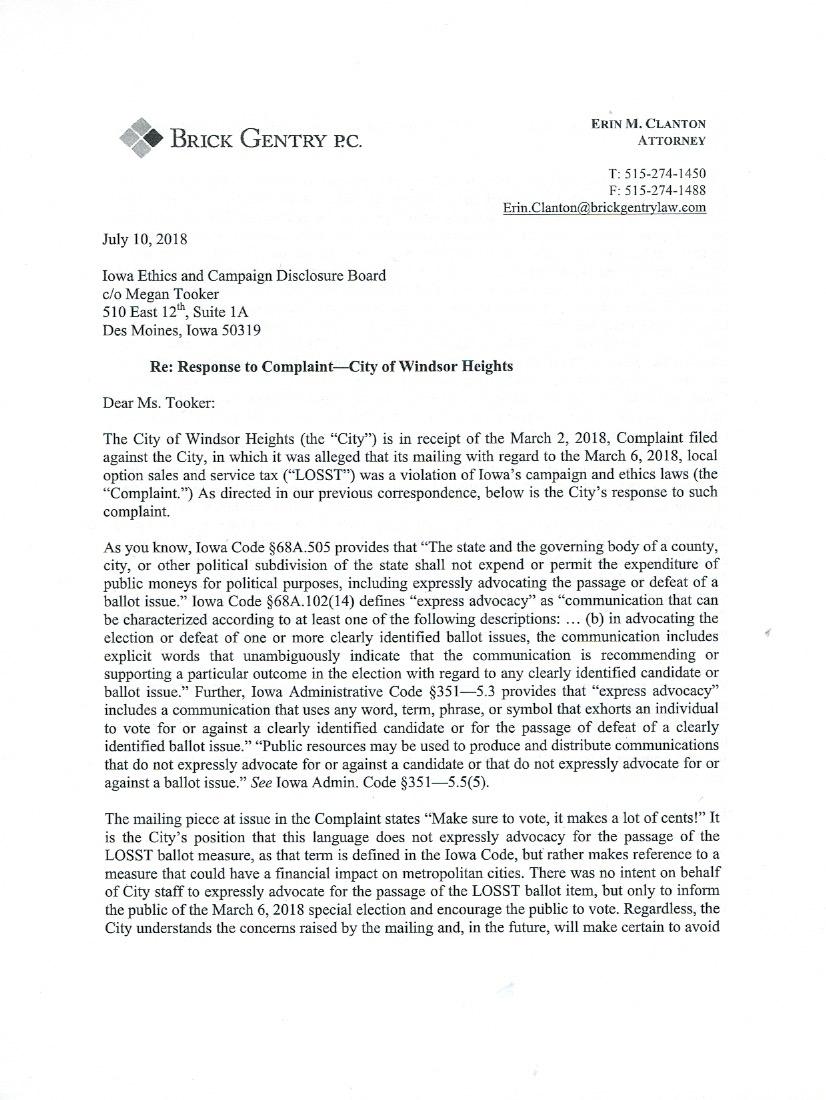

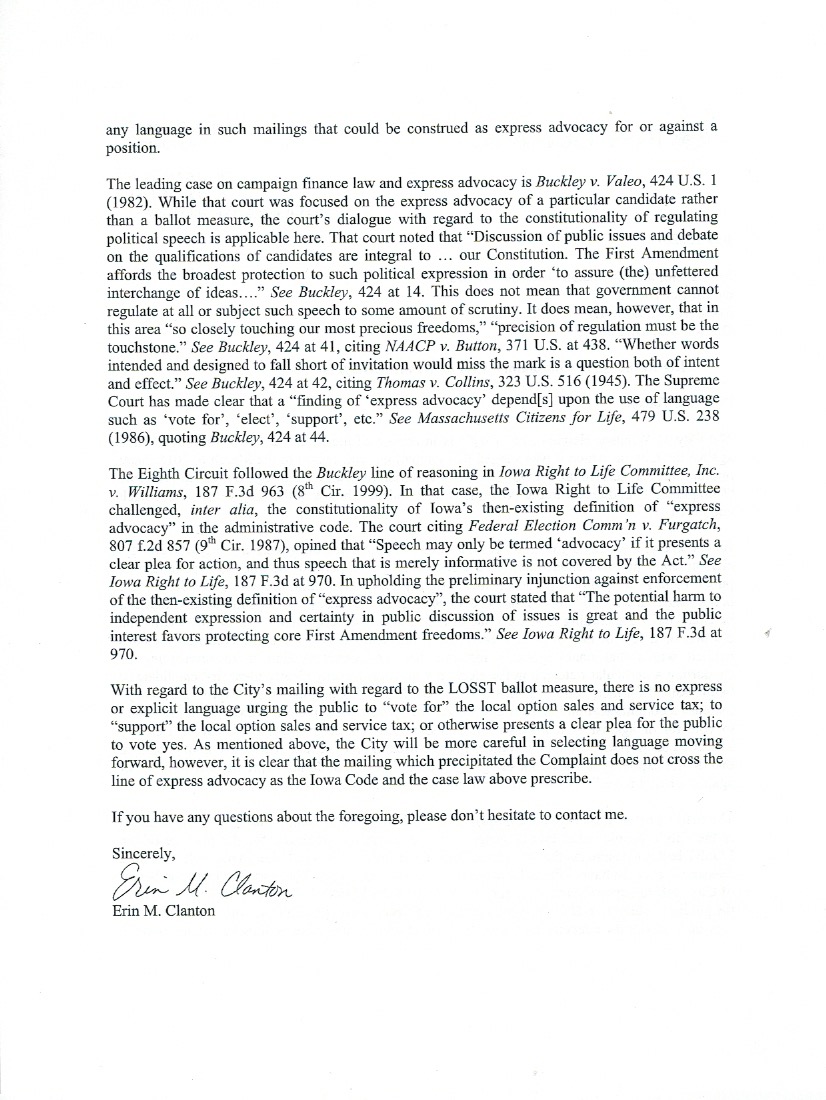

Writing to the ethics board on behalf of the city, attorney Erin Clanton argued that Iowa Code defines “express advocacy” as messages containing “explicit words that unambiguously indicate that the communication is recommending or supporting a particular outcome in the election […].”

The mailing piece at issue in the Complaint states “Make sure to vote, it makes a lot of cents!” It is the City’s position that this language does not expressly advocacy [sic] for the passage of the LOSST ballot measure, as that term is defined in the Iowa Code, but rather makes reference to a measure that could have a financial impact on metropolitan cities. There was no intent on behalf of City staff to expressly advocate for the passage of the LOSST ballot item, but only to inform the public of the March 6, 2018 special election and encourage the public to vote. Regardless, the City understands the concerns raised by the mailing and, in the future, will make certain to avoid any language in such mailings that could be construed as express advocacy for or against a position. […]

With regard to the City’s mailing with regard to the LOSST ballot measure, there is no express or explicit language urging the public to “vote for” the local option sales and service tax; to “support” the local option sales and service tax; or otherwise presents a clear plea for the public to vote yes.

After discussing the matter in closed session at their July 13 meeting, the six ethics board members agreed that the Windsor Heights mailing crossed the line to advocacy. Even without a direct call for a yes vote, the phrases “ONE CENT Makes a DIFFERENCE” and “it makes a lot of cents!” put a positive spin on a tax that would have generated an additional $900,000 in revenue.

The Iowa Ethics and Campaign Disclosure Board doesn’t always punish entities that violate election-related statutes. Sometimes remedial action, such as correcting an erroneous report, is sufficient to resolve a complaint. But this time, the board sent a message by approving a reprimand and a $500 fine, the maximum civil penalty allowed through an administrative resolution.

Windsor Heights city administrator Elizabeth Hansen provided this written comment to Bleeding Heartland following the board’s action.

While in hindsight the City wishes it had used different language, it is the City’s position that this language does not expressly advocate for the passage of the LOSST ballot measure, but rather makes reference to a measure that could have a financial impact on metropolitan cities. There was no intent on behalf of City staff to expressly advocate for the passage of the LOSST ballot item, but only to inform the public of the March 6, 2018 special election and encourage the public to vote.

The City will certainly be more careful in selecting language moving forward.

Local officials should remember this case the next time they draft publicly-funded communication about any election. School districts have often skated close to the line in educational materials about bond initiatives. Iowa’s campaign regulator has now determined that the legal prohibition on “expressly advocating the passage or defeat of a ballot issue” doesn’t only refer to materials containing the magic words “vote yes” or “vote no.”

Also on July 13, the ethics board unanimously dismissed a complaint charging that the city of Des Moines improperly used public resources to advocate for the local option sales tax. The e-mail message at the center of that allegation was more neutral than the Windsor Heights mailing, didn’t require a special expenditure for printing or postage, and targeted only e-mail list subscribers (not all city residents).

The local option sales tax could come before some Polk County voters again as soon as next year. A new Iowa law allows cities in three counties (including Polk) to approve such taxes regardless of how neighboring towns vote. *See update below. Previously, state code considered contiguous cities as a bloc for these elections. On March 6, residents of suburbs that opposed the sales tax by large margins gave “no” a slim majority in the ten municipalities with touching borders. That prevented the extra penny sales tax from taking effect in Des Moines, Windsor Heights, and West Des Moines, where voters approved the ballot initiative.

UPDATE: Ethics board executive director Megan Tooker commented on July 16,

[T]he Board found that the language “make sure to vote, it makes a lot of cents!” was a clear plea to vote yes because the only way to “make a lot of cents” is to vote yes. The Board found this language coupled with “one cent makes a difference” and the estimated revenue to meet the definition of express advocacy in 68A.102 which requires “explicit words that unambiguously indicate the communication is recommending or supporting a particular outcome in an election with regard to any clearly identified candidate or ballot issue.” The Board found the language “make sure to vote, it makes a lot of cents!” to be explicit words that unambiguously indicate the mailing piece was advocating for a yes vote because you can’t “make a lot of cents” ($900,000 to be exact) unless the ballot issue passes.

Appendix: July 10, 2018 response from the city of Windsor Heights to the Iowa Ethics and Campaign Disclosure Board.

*SECOND UPDATE: In the comments, Bleeding Heartland user cr_citizen noted that the section of the new law dealing with local option sales tax votes does not apply statewide.

To clarify, the LOSST bill that passed as part of the tax reform package only applied to “qualified counties”, defined as those counties with a population of either: more than 400,000; between 130,000 and 131,000; or between 60,000 and 70,000 as of the 2010 Census.

That only affects three counties in Iowa: Polk, Johnson, and Dallas (respectively).

It also requires 50% of the LOSST revenue to be devoted to property tax relief, rather than allowing any percentage (down to 0%) to be devoted to property tax relief.

The other 96 counties in Iowa are all still subject to contiguous-bloc voting and allowed any percentage to property tax that they’d like for LOSST.

SECOND UPDATE: The board released its reprimand and civil penalty order on July 20. After explaining its legal analysis and the $500 fine, the letter states, “The Ethics Board cautions the City to be more careful with its communications in the future when discussing ballot issues or candidates. The Board will consider a more significant civil penalty in the future if the City violates section 68A.505 again.”

3 Comments

Clarification on the LOSST bill

I had to look up the LOSST bill information, as it was something I hadn’t heard about before today (and with the current penny tax for streets in Cedar Rapids and 4 other cities contiguous to the bloc, the bloc thing is kind of a big deal).

To clarify, the LOSST bill that passed as part of the tax reform package only applied to “qualified counties”, defined as those counties with a population of either: more than 400,000; between 130,000 and 131,000; or between 60,000 and 70,000 as of the 2010 Census.

That only affects three counties in Iowa: Polk, Johnson, and Dallas (respectively).

It also requires 50% of the LOSST revenue to be devoted to property tax relief, rather than allowing any percentage (down to 0%) to be devoted to property tax relief.

The other 96 counties in Iowa are all still subject to contiguous-bloc voting and allowed any percentage to property tax that they’d like for LOSST.

I’m also happy to see the clarification of the language used on bond and levy mailings. One could likely point to many mailings by public entities over the last 5 years that would fit the bounds set by this ruling, and it would be nice to see the public expenditures on such mailings come to an end. Drop the facade and just let the boosters pay for it so that they can run as free as they want with the language!

cr_citizen Mon 16 Jul 2:48 PM

thank you for catching this

I have updated the post to mention that.

desmoinesdem Tue 17 Jul 3:20 PM

The target-a-few-counties bills...

…are becoming weirder and weirder. This one, with the really careful yet random-appearing population ranges, may be the weirdest yet. I suppose there must be some legal reason why the Legislature can’t just name the counties they’re aiming at, but no one is being fooled and it would be refreshing to see the facade dropped.

PrairieFan Mon 16 Jul 3:15 PM