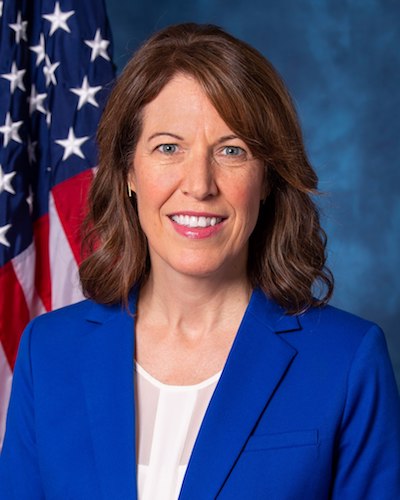

As many of us consider our New Year’s resolutions for 2022, I have one to suggest for U.S. Representative Cindy Axne: divest from individual stocks in your family’s retirement and savings accounts.

Axne’s investments attracted a lot of attention in September when the Campaign Legal Center filed ethics complaints against her and six other U.S. House members, who had not disclosed stock trades within the 45-day time frame required by law. Axne’s staff said she “does not personally manage or execute transactions related to her retirement account or the ones she has with her husband or her small business,” implying that she was unaware she needed to file periodic transaction reports for purchases and sales not directed by her.

The Democrat who represents Iowa’s third Congressional district soon corrected the errors on previous filings. Her office said in October that an outside counsel had audited her financial reports and confirmed “with the third-party money manager who oversees the related retirement accounts that she did not personally direct or execute any of these trades.”

In keeping with the disclosure requirements, Axne filed a periodic transaction report on December 7, listing six stock purchases and three sales executed in November. David Moore was first to report on the filing at Sludge, a website that covers money in politics. His December 8 story noted that Cindy and John Axne’s accounts had purchased shares in Visa, Mastercard, and the financial technology services company Global Payments. They had also sold stock “in Markel Corporation, a Fortune 500 holding company for insurance, reinsurance, and investment operations.”

The Financial Services Committee’s jurisdiction is wide-ranging, covering banks and banking, money and credit, securities and exchanges, and “insurance generally,” among other areas. Axne is the vice chair of its Subcommittee on Housing, Community Development and Insurance. The congresswoman, who started and owns a small business with her husband, is also a member of the Subcommittee on Investor Protection, Entrepreneurship, and Capital Markets.

In addition, Moore reported,

Axne is not a cosponsor of any of the three bills introduced that would ban members of Congress from transacting in individual corporate securities while in office, and her office did not respond to a question about her views on the proposals. […]

So far this cycle, Axne’s campaign has received over $218,000 from individuals employed in the Finance, Insurance, & Real Estate sector, according to OpenSecrets, and $36,000 from PACs in the sector, making it one of her top sources of re-election contributions.

On December 9, I sought comment from Axne’s office on Moore’s article. Wouldn’t it be prudent for her not to buy or sell individual stocks in the financial sector?

A spokesperson provided this comment.

As the Congresswoman has made clear previously, she does not oversee her family’s retirement or college savings accounts – which she opened more than a decade ago, long before she came to Congress. Federal law requires her to disclose the transactions in her family’s retirement accounts, even though they are run by a financial advisor and she does nothing to request or approve their actions. These retirement and savings accounts function without her input, and therefore have no bearing on her work as a Representative for Iowa – and the routine disclosures from them should be treated as such.

I have no trouble believing Axne has not directed the purchases and sales on those accounts. Many people let investment advisors make such decisions.

But it’s not my opinion that matters. Republicans will certainly try to make all of these trades look corrupt. Every new periodic transaction report will feed into that narrative. Conservative groups have already spent heavily on “issue ads” attacking Axne, whose House district looks like a toss-up.

Moreover, it’s reasonable for people to question whether Axne influenced the timing of any of these trades, given how easy it would be for a member of Congress (or spouse) to communicate with a money manager.

Divesting from industries under the jurisdiction of the Financial Services Committee—or better yet, from all individual stocks—would eliminate the appearance of any conflict of interest or undue influence.

House Speaker Nancy Pelosi told reporters earlier this month that members of Congress should not be banned from buying and selling stocks: “We’re a free-market economy. They should be able to participate in that.”

But Democratic Representative Alexandria Ocasio-Cortez got it right when she tweeted in response, “There is no reason members of Congress should hold and trade individual stock when we write major policy and have access to sensitive information. There are many ways members can invest w/o creating actual or appeared conflict of interest, like thrift savings plans or index funds.”

Regarding Pelosi’s comments, Matt Ford argued in The New Republic, “Banning lawmakers, their top staffers, and their spouses from buying and selling individual stocks should be as noncontroversial as crop rotation or pulling to the side of the street when an ambulance goes by.” He noted that “even an appearance of self-dealing or conflicts of interest can breed cynicism in the electorate. And in an era when the very bedrock of our democracy is under attack, that cynicism can be doubly damaging.”

Axne can take this issue off the table by shifting all investments into index funds while she serves in Congress, and co-sponsoring bills that would prohibit all members of the House and Senate from trading individual stocks.

7 Comments

As a side note to Matt Ford's comment...

…good crop rotation is unfortunately not the norm in Iowa. Rotating between soybeans and corn barely qualifies as rotation. And a growing amount of Iowa is in continuous corn.

“Extended crop rotation” is defined by Clean Water Iowa as “a rotation of corn, soybean, and two to three years of alfalfa or legume-grass mixtures managed for hay harvest.” Extended crop rotation is far better than corn-bean rotation for water quality, soil health, biodiversity, clean air, and the environment. It is also very uncommon.

PrairieFan Sat 1 Jan 3:04 PM

Hijack alert!

Should Axne hold stocks or not? Why are you changing the subject?

iowavoter Sat 1 Jan 11:05 PM

Hijack?

This essay contained a comment that specifically referred to crop rotation as “noncontroversial” when discussing the subject of the essay, and seemed to imply that crop rotation, like pulling over for an ambulance, is just common sense. I used fewer than one hundred words to point out that in Iowa, crop rotation is not common sense, and in fact is very uncommon. Because Iowa is overwhelmingly agricultural, I thought my comment could be considered acceptable as long as it was short.

If Laura Belin removes my comment and/or agrees that it was a hijack, I will absolutely accept that judgment and will try harder to never veer even slightly away from the main essay subject in the future. Though it was the essay that mentioned crop rotation first, not me. And I do agree with the point of the essay. Would my comment have been acceptable if I had said that first, or would any discussion of crop rotation still have been a hijack?

PrairieFan Sun 2 Jan 1:52 AM

it's fine

No worries.

Laura Belin Sun 2 Jan 7:48 PM

Axne should read Bogle

Anyone who is on the Financial Affairs committee needs to know what Vanguard’s founder John Bogle taught years ago: Stock picking is a fool’s game. The only reason for Axne to persist in buying individual stocks is to deploy insider knowledge she may have from her position in government.

As a contributor to Axne since her first campaign, and as a holder of stocks myself, I urge her to accept your advice. Axne should invest in America by investing in a total stock market fund. It’s cheaper, too! There is no excuse for her to court scandal like those senators from Georgia did. It turned out badly for them. Pelosi’s attitude makes her look corrupt, too.

iowavoter Sat 1 Jan 11:14 PM

I doubt she is picking these stocks

I believe that she is letting a money manager make these choices, not deploying any insider knowledge.

The senators from Georgia were much more involved in the stock trades, from what I read about the scandal. But there’s no way to avoid the appearance of a conflict when you serve in Congress and hold individual stocks.

Laura Belin Sun 2 Jan 7:48 PM

Exactly!

“But there’s no way to avoid the appearance of a conflict when you serve in Congress and hold individual stocks.”

PrairieFan Wed 5 Jan 3:57 PM