“Strong Island Hawk” is an Iowa Democrat and political researcher based in Des Moines. Prior to moving to Iowa, he lived in Washington, DC where he worked for one of the nation’s top public interest groups. In Iowa, has worked and volunteered on U.S. Representative Cindy Axne’s 2018 campaign and Senator Elizabeth Warren’s 2020 caucus team.

With President Joe Biden’s decision to forgive student loan debt for up to $10,000 per borrower ($20,000 for Pell Grant recipients), the public sphere has been flooded with opinions from across the spectrum. Liberals and progressives have celebrated it as a necessary economic maneuver, while Republicans have decried it as an unfair handout or vote-buying. Student loan relief is an issue that splits across class, party, generational and even urban-rural lines. It’s a great time to examine this tricky topic.

This post will not delve into every detail of Biden’s plan. Instead, I will make the general case for student loan forgiveness and thoroughly explain the liberal (or at least, my philosophy) on it.

I will also address the conservative case against the plan, which is weak given the facts. Finally, I will offer some middle-of-the-road solutions I think we can all agree on.

Why student loan forgiveness is needed

First, in full disclosure: I had lots of student loans. I will benefit from this plan, but I’ve paid off the vast majority of my loans at this point. This plan provides me a little relief at the end.

In short, student loan borrowers have gotten a raw deal. It’s true: college tuition costs have risen faster than the rate of inflation and wages for decades. Let’s look at some key facts:

- In total, approximately 44 million Americans hold more than $1.6 trillion dollars (that’s trillion with a ‘T’) in outstanding student loan debt.

- The average amount per borrower is more than $35,000 ($31,000 in Iowa).

- Lower income, Black, and Latino communities are more severely impacted by the student loan crisis.

- The average interest rate among households with student loan debt is 5.8 percent.

- Roughly 1 million(!) borrowers default on their student loans each year.

- Iowa ranks fourteenth nationally in residents per capita with student loan debt. In 2021, 55 percent of in-state students graduating from the University of Iowa left school with student debt, as did 58 percent of in-state students leaving Iowa State and 69 percent of in-state students leaving UNI.

Those astounding numbers indicate there is a serious problem. But it’s important to take them out of the realm of statistics and apply them in a more human context. Thousands of young people are entering the workforce each year already tens of thousands of dollars in the hole. And that hole will only get worse with high interest rates and the scarcity of good wages.

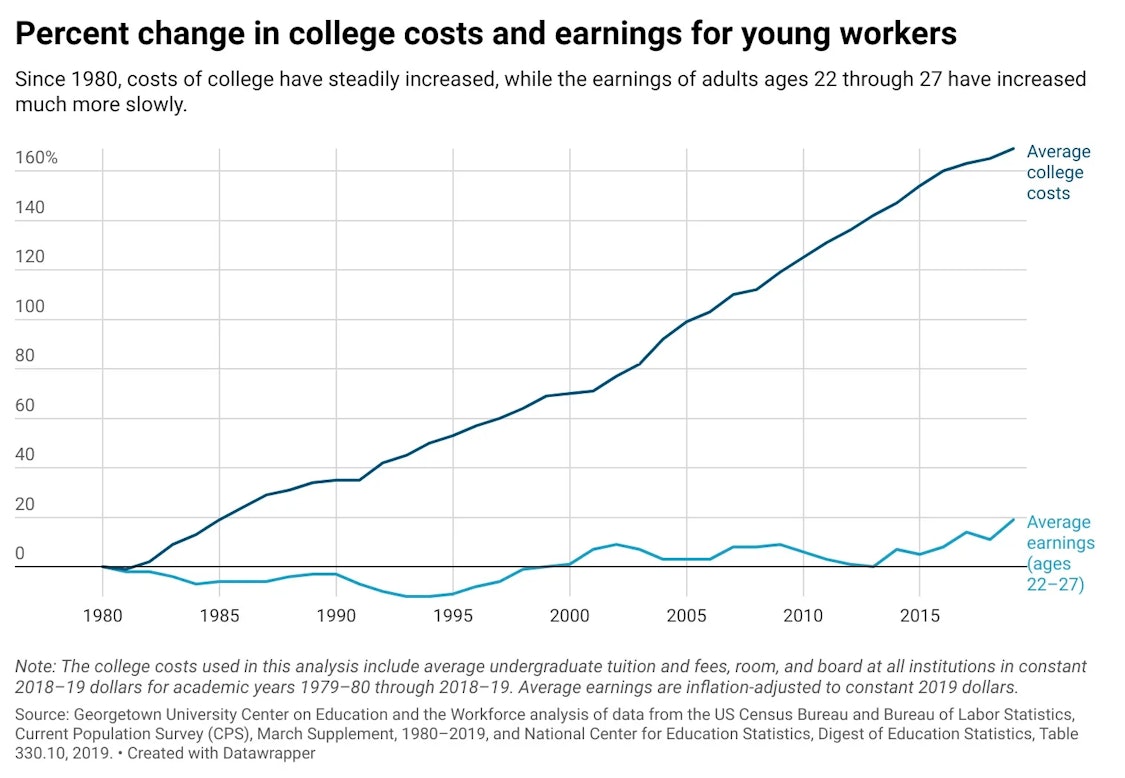

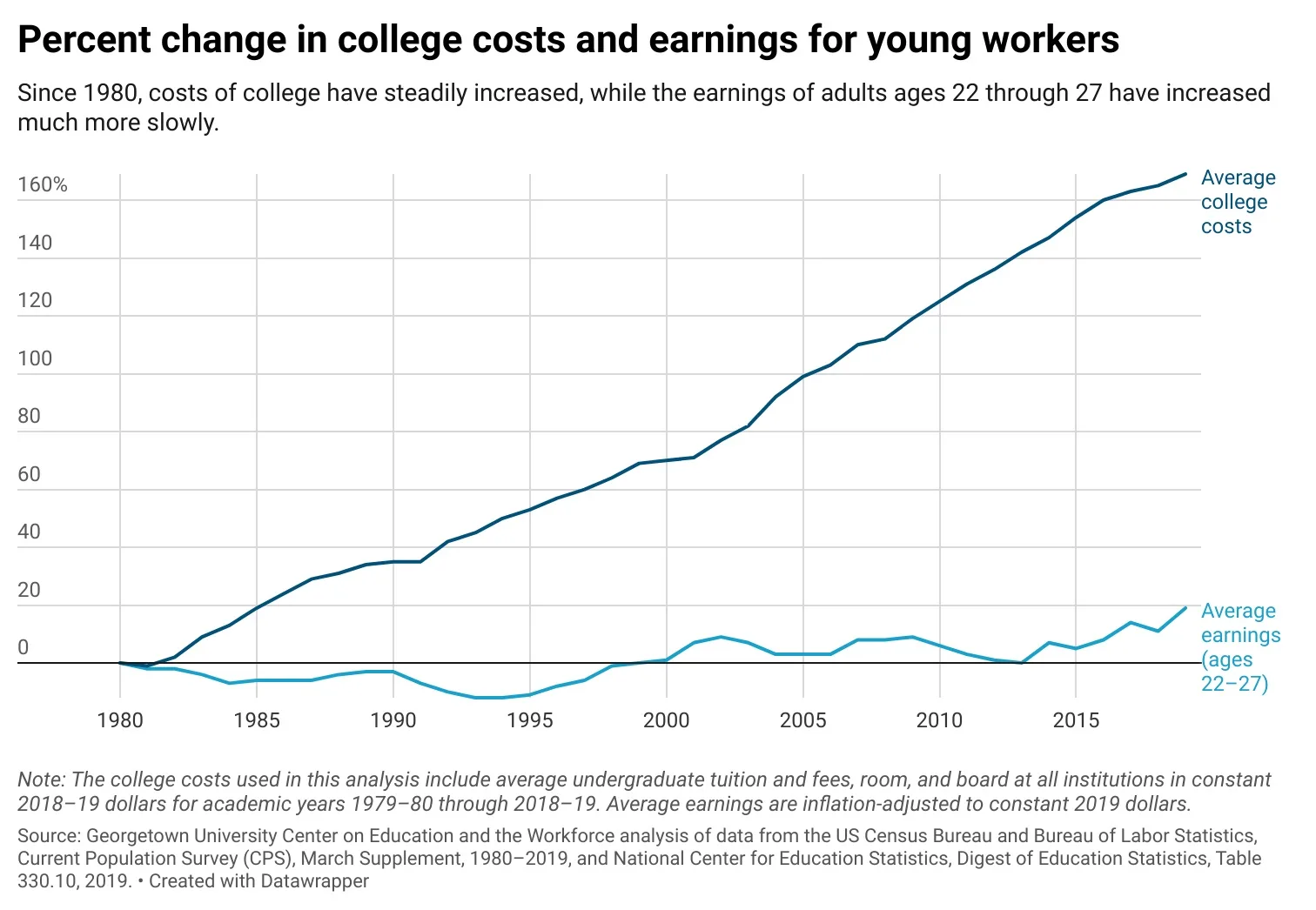

The good high-paying jobs are just not there. Look at this terrifying graph of college costs versus wage growth:

Source: NBC News, Georgetown University.

So, in summary: young people are overpaying for college compared to previous generations, borrowing at high interest rates to pay for it, and facing a nearly impossible labor market once they graduate. So, yes, student loan debt is a major problem facing our country and our economy. And it is on the cusp of becoming unsustainable.

It’s also important to remember that a student loan is not some kind of luxury item. It can be a necessity. A college education is not a foolish gamble: it’s an investment in one’s future. But, we have told generations of young people to go to college to unlock their potential. And at the same time, we’ve made it absurdly expensive.

Student loan forgiveness is not unfair

As I said, this is a raw deal. And it’s not like the borrowers are getting anything cool or fun. It’s not like the government is giving them Ferraris or vacation houses or something. There’s a reason it’s called student debt relief. The burden can be pretty heavy.

The scope of the problem points to a policy failure. College costs have soared for decades because states have cut funding to their higher education systems (cough-cough Iowa Republicans, this means you). So the universities make up for it by raising tuition. And what’s worse, the increased availability of government loans and certain types of financial aid has resulted in colleges and universities charging more fees and higher tuition. Schools have done little to nothing to rein in their own costs.

There’s a notion among conservatives and even older moderates and independents that the borrowers are deadbeats who are shirking responsibility. “They borrowed the money and agreed to pay it back,” “they’re lazy,” “I shouldn’t have to pay their debts,” and so on. However, the people I know who have dealt with these loans have been anything but irresponsible.

Student loan debt is a primary reason millennials and Gen Zers are not saving for the future, buying homes, starting businesses or having children. They are a chief reason why many young people often live with their parents. Ask your average student-debt-laden millennial if they have a retirement account and if they do, how much is in it. Ask them about the last time they went on a vacation or if they plan to go on one in the future. Many of them don’t spend money foolishly. Many have second jobs. Many cut costs in other aspects of life.

It’s unfair to claim those who will benefit from forgiveness “didn’t work hard to pay them off” like previous generations. The thing is: They are working hard. But, it’s not enough (please see Charlie Hodges’ excellent Bleeding Heartland post).

It’s fair to say that previous generations benefited from more affordable education, so these comparisons are apples-to-oranges. And just look at the above stats and graph. The status quo is unsustainable. If these trends continue, in the future it will be mathematically impossible for many to save for college or ever pay off a student loan.

Considering that costs have risen so much over the last several decades, it’s an indisputable fact that if you went to college from the 1960s through the 1990s, you paid less than later generations (check out this table; for University of Iowa costs over time, look here). If a 2015 Iowa State grad paid the same amount adjusted for inflation as someone from the Class of 1985, then I agree, it would not be fair to forgive those loans. But that is not the case. Younger generations have paid significantly more. And for no good reason.

Many people in my generation joke that because of their student loans they’ll have to decide between starting a family, buying a house or retiring. And it’s even worse for younger Americans. But, why should this generation have to make that choice?

Addressing conservative arguments

Last year, I read a letter to the Des Moines Register in which the writer claimed that student loan cancellation would benefit the “wealthy.” It seemed like the writer was trying to make the case that anyone who has college debt or who ever went to college is comfortably rich.

It’s a stretch to call 44 million student loan borrowers “wealthy,” considering this issue affects various ages and backgrounds and the fact that lower-income, black and Latino constituencies have heavier debt loads.

In addition, this line of thought is a logical fallacy because it overlooks a simple fact: Wealthy people don’t need student loans.

Reasonable minds differ on who is considered “wealthy.” But this isn’t the 1950s anymore when only the sons of rich families went off to college. We now have a diversified, high-tech economy that needs STEM workers and critical thinkers to compete with China and the rest of the world.

I would estimate that the top 10 to 15 percent of earners would not even need student loans for tuition at most public universities.So it’s likely that many of those 44 million borrowers are from the bottom 80 percent, not what I would call “rich.” It’s also important to note that many black and Latino families have close to zero generational wealth, which is likely the reason why they have higher student loan balances.

Conservatives like to point out that a large portion of student loan debt is held by doctors, lawyers, MBA’s and other professionals considered “high earners.” And that’s true. But that doesn’t mean they don’t also have burdensome loans. Graduate school, law school, and medical school are outrageously overpriced as well. These professionals may have high salaries, but their monthly payments are also incredibly high.

For example, this commentary argues that student loan relief is “class war” for the rich. I agree that total loan cancellation would be regressive and would certainly favor top end borrowers and earners. But the amount Biden has proposed is fair.

And I disagree with the assessment that canceling even small amounts would favor higher earners. Knocking $10,000 or $20,000 off a $150,000 balance may not do much for a high-powered attorney. But, what about the public school teacher/UNI grad/Pell Grant recipient in Sioux City? Trimming his or her balance from $27,000 to $7,000 would make a huge difference.

Millions of borrowers will get only $10,000 in relief, and the average outstanding debt is more than $30,000. And here’s a reminder: a college education costs a lot more than $20,000. So the vast majority of borrowers have already been working hard for years to pay off these burdensome loans. No one is getting a free ride off of this.

Conservatives are also pushing the idea that people who have already paid off student loans are getting “screwed” by forgiveness for others. And they want to turn it into a moral dilemma. For example, take this 2020 confrontation involving then-presidential candidate Senator Elizabeth Warren. An Iowa father complained that future student loan forgiveness would be unfair to him because he worked double shifts to save for his daughter’s education. Unfair? No. Unlucky? Yes.

I mean, I feel for this guy but I don’t think he’s understanding the greater problem. He’s assuming that those with student loans have not saved money or made sacrifices (it’s almost literally impossible for the average person to save for college now). Further, he demonizes those who would benefit from forgiveness. He cites a friend of his who “bought a car” and “went on vacations” as someone who is undeserving of relief.

The point is: he shouldn’t have had to do that. There’s no good reason people like him should have to work double shifts to pay for college as we let costs spiral out of control. This guy got screwed by a broken system, not by missing out on loan forgiveness. Should we all avoid buying cars or going on vacation so we can overpay for college? I don’t think that would be good for the automobile, hotel or tourism industries.

These conservatives often fail to see that the system is broken. Should we not fix the problem just so others will have to suffer under it as well? That’s an odd interpretation of “fairness.”

In sum, many arguments against debt forgiveness are actually misdirected complaints designed to divide and anger people. When critics complain that Biden’s plan is unfair, I want to know if they think the current system is fair and sustainable. And if not, what do they plan to do about it?

Alternative solutions

I agree that student loan forgiveness could be wasteful and unsustainable if the greater forces driving up college costs are not brought under control. If we don’t address these problems, the costs will keep ballooning. Here are some simple things we can do without spending a lot of taxpayer money.

Simple fixes to student loans

Allow borrowers to expunge student loans in bankruptcy and allow low-income graduates and earners to tie repayment to their salary for an extended period. Fix the Public Student Loan Forgiveness program, which has been broken for years and leaves many eligible candidates in the cold.

Interest rates

Seriously, just cut the interest rates. If you want to help student loan borrowers without any government “handouts,” just cut the interest rate to zero. Or even cap it at 1 percent. Just allow the students to pay back the balance of what they borrowed to attend school. Most borrowers hate the interest more than anything else. They’d be glad to pay back what they borrowed, but the interest makes that difficult. It makes them feel like they’re getting ripped off.

Tuition control and endowment contributions

The government needs to make sure colleges are being held accountable. I would like to see new laws limiting how much a college can increase costs over a given time period.

Congress and state legislatures should also amend the rules surrounding university endowments and charitable donations to ensure that those schools are using some of that money to keep costs down.

Grinnell College has a $2 billion(!) endowment, which is impressive for a small school. Grinnell also does a good job of providing student aid and helping its students avoid heavy debt loads. But many schools do not. Their costs soar while they rake in millions from endowment investments and donations from rich alums.

Since this is a crisis of the government’s own making, I welcome government action to fix it. While Biden could have structured his plan a bit differently, for the most part I think he has the right idea.

In the final analysis, student loan forgiveness will significantly benefit Iowa and will deliver positive long-term effects for the nation’s economy as well.

Top photograph taken by Eduardo Medrano on September 14, 2018, featuring the old state capitol building and part of the University of Iowa campus, available via Shutterstock.

1 Comment