Early in last year’s legislative session, state lawmakers voted to raise Iowa’s gasoline tax for the first time in more than two decades. Unlike many controversial policy questions, this issue did not split the public or elected officials along party lines. The Des Moines Register’s February 2015 statewide poll showed Iowans generally and subgroups of Democrats, Republicans, and independents were all divided on whether to raise the tax by 10 cents a gallon to pay for road and bridge repairs. In the Iowa House and Senate, lawmakers from both parties voted for and against the tax increase. Senate Majority Leader Mike Gronstal had reportedly refused to bring the bill to the floor without a guarantee that at least half of the 24 GOP senators would vote for it.

The immediate backlash against the gas tax hike came mostly from Republican circles. Former Iowa GOP Chair A.J. Spiker and former state party co-chair David Fischer were among the vocal critics. Conservative WHO Radio host Simon Conway urged Republicans to “send a message” by changing their party registration.

Governor Terry Branstad signed the gas tax hike into law within 24 hours of its passage. The following day, conservative activist Eric Durbin announced on Conway’s show that he would challenge nine-term incumbent State Representative Clel Baudler in the 2016 GOP primary to represent Iowa House district 20.

Yet a year later, there is little sign of political fallout for the 28 state senators and 53 state representatives who voted to make Iowans pay a little more at the pump.

The deadline for Democratic and Republican candidates to file for state legislative races was last Friday, March 18. The final primary candidate list revealed:

No wave of Iowans running for office.

Just 249 Iowans are seeking major-party nominations for state and federal offices this year, the lowest number since 2006. The high point of the past decade was 2010, when 283 candidates filed for the Iowa primary ballot after President Barack Obama’s election spurred the tea party movement. Almost as many candidates (280) qualified for the Iowa primary ballot in 2012, after redistricting had created many open or competitive state legislative districts.

No trend toward more lawmakers being challenged for their own party’s nomination.

In 2012, the first election under Iowa’s current map of political boundaries, twelve Iowa House members (all Republicans) faced primary challengers. GOP State Senator Pat Ward also drew a primary challenger, while redistricting forced incumbents Shawn Hamerlinck and Jim Hahn into the same GOP primary.

In 2014, three state representatives (Republicans Stan Gustafson, Dave Heaton, and Jake Highfill) and four sitting state senators (Republican Jack Whitver and Democrats Wally Horn, Herman Quirmbach, and Joe Seng) faced primary challengers.

This year, none of the 25 state senators up for re-election has a primary challenger. Nine Iowa House members (four Democrats and five Republicans) are facing competition for their own party’s nomination, more than during the last cycle but fewer than in 2012.

No correlation between voting for the gas tax hike in 2015 and facing a primary challenger in 2016.

The list of Iowa senators who voted to raise the gas tax (sixteen Democrats and twelve Republicans) can be found here. Eleven of the Democrats and six Republicans are not up for re-election this year. Of those whose seats are on the ballot, no one is facing a primary challenger, and five (Democrat Janet Petersen and Republicans Mark Segebart, Mark Costello, Tim Kapucian, and Ken Rozenboom) had no opponent file from the other party either.

In the Iowa House, 23 Democrats and 30 Republicans voted for the gas tax increase (full list here). All 100 House districts are on the ballot in every even-numbered year. Some lawmakers who supported the gas tax increase are retiring. Of those who are seeking re-election, only three (Democrats Brian Meyer and Jo Oldson and Republican Greg Forristall) drew primary challengers. I’ve seen no sign that the gas tax is a key issue for the Democrats running against Meyer or Oldson. Forristall’s challenger is a Liberty-oriented candidate who has run against establishment Republicans before.

The other six representatives facing primary challengers this year (Democrats Mary Gaskill and Dan Kelley, Republicans Stan Gustafson, Jake Highfill, Kevin Koester, and Jarad Klein) all voted against the tax hike. Their opponents appear to have a variety of motivations, from being “perennial candidates” to lacking respect for the incumbent or simply getting tired of waiting for a long-serving lawmaker to retire. Baudler’s would-be challenger Durbin announced on social media earlier this month that he had decided against seeking public office this year, having recently taken a new job. I heard rumors about another Republican planning to run against Baudler, but no one else filed for the GOP primary in House district 20.

It’s worth noting that the Iowa branch of the Koch brothers-funded group Americans for Prosperity lobbied against raising the gas tax last year, warning that the policy would “hit low and middle income families the hardest.” AFP’s message was utterly unconvincing on substantive grounds, since the organization supports budget and tax reforms that would have massive regressive effects. It now looks just as empty as a political threat, since I’m not aware of any effort by AFP-Iowa to recruit primary challengers or general election opponents to lawmakers who voted to raise the gas tax.

AFP-Iowa did announce last week that it will fund phone banking, door knocking, and direct mail to “hold State Sen. Rick Bertrand accountable for his vote in favor of a gas tax increase last year.” But that’s only because Bertrand is challenging Representative Steve King in the GOP primary to represent Iowa’s fourth Congressional district, and King has a very high lifetime rating from AFP.

No correlation between voting for the gas tax hike in 2015 and facing a challenger from the other party in 2016.

Of the 34 Iowa House members who are seeking re-election and have no challenger from either their own party or the opposite party, 21 voted for the gas tax hike and thirteen voted against it. Late-announcing candidates may be nominated by special conventions in some of their districts, but most will get a free pass to another term in the legislature. Maybe these numbers point to a political calculation: lawmakers representing relatively safe seats felt more emboldened to vote for the gas tax increase.

State representatives who voted for the gas tax hike and have no current opponent in either party: Democrats Ako Abdul-Samad, Marti Anderson, Bruce Hunter, Lisa Heddens, Mark Smith, Dave Jacoby, Jerry Kearns, Vicki Lensing, Mary Mascher, Dennis Cohoon, Jim Lykam, and Cindy Winckler and Republicans Megan Jones, Dan Huseman, Mike Sexton, David Sieck, Cecil Dolecheck, Dave Deyoe, Linda Upmeyer, Bobby Kaufmann, and Norlin Mommsen.

Those who opposed the gas tax hike and have no challenger in either party: Democrats Ruth Ann Gaines, Timi Brown-Powers, Bruce Bearinger, Art Staed, Kirsten Running-Marquardt, Curt Hanson, Abby Finkenauer, and Chuck Isenhart, and Republicans Terry Baxter, Steve Holt, Rob Taylor, Guy Vander Linden, and Tom Sands.

Why didn’t the gas tax hike spur more voter anger and political activism?

For one thing, it happened early in a non-election year. The 2015 legislative session dragged on until after Memorial Day, by which time statehouse news coverage had long since moved on to other matters, such as the school funding debate. The governor’s veto of supplemental education funding in July and his unilateral decisions to privatize Medicaid and shut down two state-run mental health facilities became even bigger Iowa politics stories over the summer and fall. Those issues fit more easily into the standard frame for political reporting, since they generally split Iowa’s elected officials along party lines.

In addition, the impact of the gas tax increase was limited because consumers paid the extra 10 cents a gallon a little at a time. William Petroski reported last year for the Des Moines Register, “For a person who drives 15,000 miles per year in a vehicle that gets 25 miles per gallon, the proposed tax increase would cost $60 annually.” That amount of money spread out over many months would not cause sticker shock at any one trip to the filling station.

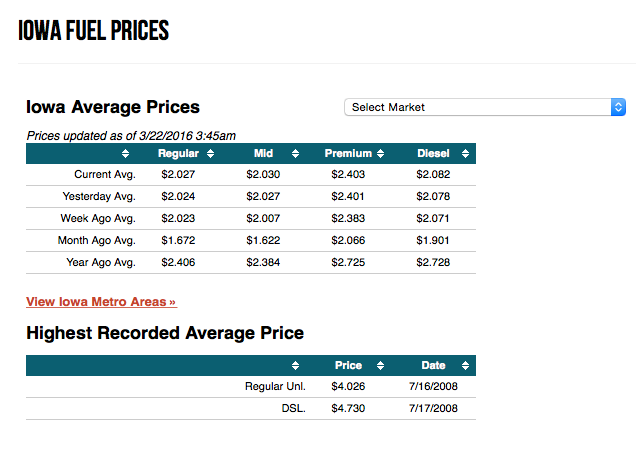

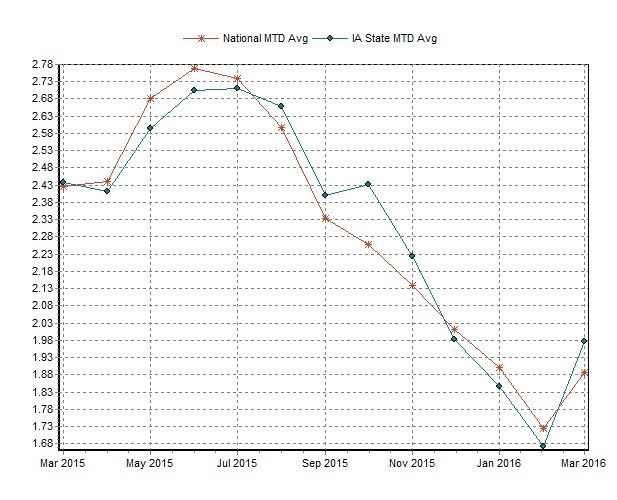

Perhaps most important, Iowa’s gas tax increase was well-timed economically as well as politically. In February 2015, gasoline prices nationally were significantly lower than they had been the previous year, in large part because oil prices had recently hit their lowest point since 2009. According to the AAA’s Daily Fuel Gauge Report, average gasoline prices in Iowa now are even lower than when the 10 cent tax hike went into effect, and are barely more than half the record price per gallon set in 2008. I enclose those statistics below.

Please share your own thoughts about the gas tax increase or any other relevant comments in this thread.