When the Republican-controlled Iowa House and Senate approved large tax cuts in 2018, not a single Democrat voted for the legislation. Critics pointed out that the bill hailed by Governor Kim Reynolds was skewed to provide most of the benefit to wealthy people, with little savings for middle class Iowans.

Much of that bill went into effect immediately, but lawmakers put some portions on hold until 2023, provided that state revenue hit certain targets. In her annual address to legislators in January, Reynolds called for eliminating “the unnecessary triggers that were put in place in 2018,” so all of the tax cuts would go into effect.

Republicans embraced that idea in Senate File 576, which would take out the triggers and phase out Iowa’s inheritance tax by 2024. Democrats didn’t support the bill when the Senate’s tax-writing committee voted on it this month. But a surprise to many observers, including the GOP floor manager Dan Dawson, every senator from both parties voted for Senate File 576 on March 17.

Why did Democrats come around to supporting a bill that is estimated to reduce state revenues by more than $100 million annually, beginning in fiscal year 2023?

I reached out to State Senator Pam Jochum, the ranking Democrat on the Senate Ways and Means Committee. She spoke in favor of Senate File 576 during the floor debate, which you can watch beginning around the 12:46:30 mark of this video, and explained her position via email on March 19.

Senate Democrats “spent several hours discussing the pros and cons” of the bill, Jochum said. While there was no official caucus position, they came around to supporting the bill for a few reasons.

Bill enacts a longtime Democratic priority

Iowa is one of only three states that allow taxpayers to deduct what they pay in federal tax from their taxable state income. Democrats have wanted to eliminate federal deductibility “for three or more decades,” Jochum told me.

Most people and businesses, when comparing taxes between the states, do not notice the “*” that indicates Iowa is one of three states with federal deductibility. What they see is that our top tax rate is 8.98 percent when it is actually closer to 6 percent after federal deductibility is factored in. […]

Local economic development organizations have also lobbied for years to eliminate federal deductibility.

The Iowa Senate approved a tax reform plan that would have eliminated federal deductibility in 2009, when Democrats had full control of state government. However, the measure lacked enough support to clear the Iowa House, in part because of intense GOP lobbying against what they called “a tax on a tax.”

Reynolds endorsed doing away with federal deductibility in 2018, saying the policy “creates complexity” and ends up raising state taxes on Iowans when the federal government cuts their taxes.

Democrats opposed the 2018 tax law for other reasons. Now that most of the law has taken effect, Democratic senators were motivated to ensure that federal deductibility goes away, as planned.

Triggers likely to be met anyway

Without Senate File 576, the remaining provisions of the 2018 law will go into effect only if total state revenues hit $8.3 billion and increase by at least 4 percent over the previous fiscal year. The December 2020 projections by the state’s Revenue Estimating Conference indicated Iowa would likely fall short of that mark. However, Jochum told me, current projections from the nonpartisan Legislative Services Agency suggest “we are very close to hitting the triggers.”

At its March 19 meeting, the Revenue Estimating Conference projected total revenues of $8.3 billion with 3.8 percent revenue growth for fiscal year 2022, and $8.7 billion total revenue with 4.5 percent growth for fiscal year 2023.

Predicting state revenues is not an exact science. Senate File 576 would guarantee that Iowa ends federal deductibility on January 1, 2023.

Inheritance tax primarily affects middle-income Iowans

“The inheritance tax issue was a bit more challenging for us,” Jochum told me. Only six states impose an inheritance tax; among neighboring states, only Nebraska has this policy.

The difference between Inheritance tax and estate tax is who pays.

As it sounds, the estate itself pays the taxes on the value of the estate before the assets are distributed to the beneficiaries.

With inheritance tax, the beneficiaries pay the tax after they receive their inheritance.

Democratic senators were swayed by an Iowa Department of Revenue analysis of this tax over the past five years, Jochum said. The agency found that “85 percent of beneficiaries who inherit and pay inheritance tax earn less than $80,000 and 66 percent of these beneficiaries are under the age of 65.”

During the Senate debate, Jochum recalled a conversation with an estate planning attorney. He assured her, “I do this for a living. I make sure that those who are very wealthy are able to shelter their income so that when they die they never pay a tax.”

“Love is bigger than government”

Under current Iowa law, whether a person pays inheritance tax depends on the relationship to the deceased. Spouses, direct descendants (children and grandchildren), and ascendants (parents or grandparents) pay nothing. Siblings of the deceased pay between 5 and 10 percent. Another class of beneficiaries, including extended family, pay between 10 and 15 percent. Jochum told me,

We also had a lengthy discussion on how the family unit has changed since Iowa’s inheritance tax was first imposed. There are more couples choosing not to have children or who are unable to have children due to a medical condition; they often leave their assets to other family members like their nieces and nephews, brothers and sisters. There are also more people choosing not to marry.

Democratic State Senator Janet Petersen highlighted the discriminatory aspects of Iowa’s inheritance tax during the March 17 debate. “I believe that love is bigger than government,” Petersen said before describing how LGBTQ Iowans and those who never married are disadvantaged by current policy. I pulled the clip of her speech.

Under Senate File 576, every Iowan who inherits from a relative or friend would be treated equally. Petersen said the LGBTQ community would be grateful for the change.

Some concerns remain

Despite their support for this bill, Jochum said, Democratic legislators are concerned that implementing tax cuts at the state level could jeopardize Iowa’s receipt of federal COVID-19 assistance from the recently-passed American Rescue Plan. The U.S. Treasury Department has not yet issued detailed guidance but indicated on March 17 that “states are free to make policy decisions to cut taxes – they just cannot use the pandemic relief funds to pay for those tax cuts,” David Lieb reported for the Associated Press.

The tax cuts that would go into effect under Senate File 576 long predate the latest COVID-19 relief package, and the state government’s share of federal assistance (estimated at $1.4 billion) will go into a separate account, not Iowa’s general fund. But Iowa lawmakers will want to make sure the Treasury Department does not view this bill as violating the clawback provisions of the American Rescue Plan, which apply to tax cuts enacted after March 3, 2021.

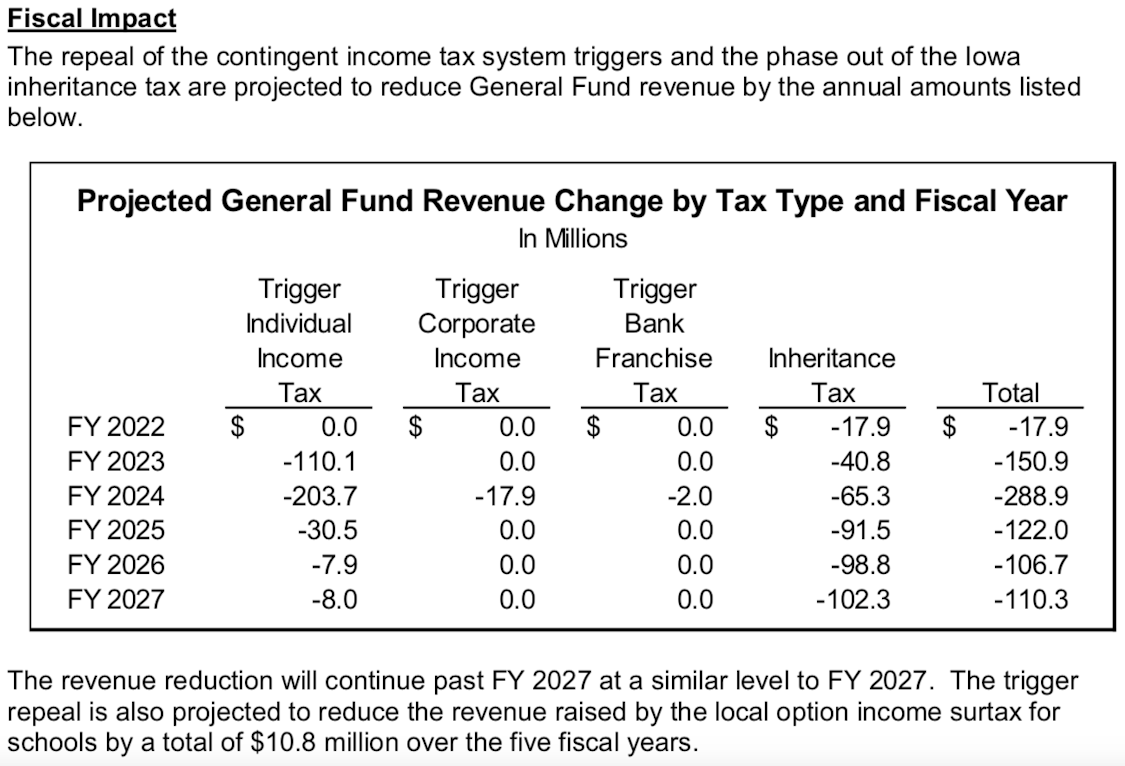

State revenue losses would be substantial, especially during the first two years after Iowa eliminates federal deductibility. This table comes from the fiscal note produced by the Legislative Services Agency.

The think tank Common Good Iowa warned that Senate File 576 was already a “terribly costly tax bill that Iowa cannot afford.” It could come “at twice the price” if the federal government determines the cuts are not allowed under the COVID-19 relief package.

the intentional revenue cut of over $450 million from FY 2022-24, as SF 576 provides, is doubled by the loss of federal COVID support in the same amount. That adds up to an over $900 million total loss.

Iowa House Speaker Pat Grassley has not endorsed Senate File 576, telling reporters on March 18 his caucus will “take a cautious approach to looking at the triggers.”

Top image: State Senator Pam Jochum speaks during the March 17 debate on Senate File 576. Screenshot from the official legislative video.

1 Comment

Speaking of Iowa tax bills...

…a new one, SSB 1253, is going to be discussed this week. And among many other provisions, it would eliminate the Iowa Charitable Conservation Contribution tax credit, which was established in 2008 and which helped protect about 3,500 acres this past year.

If you hate parks, trails, wildlife areas, and other public land, and think Iowa shouldn’t add any more of it to the paltry amount we’ve got (we rank 48th in the nation, as I recall), and if you also hate the idea of protecting private conservation land, ending this tax credit is for you. But if you don’t feel that way, you might want to have a word with your state senator.

PrairieFan Wed 24 Mar 1:40 AM