Only a week after United Auto Workers members ratified a new six-year contract with John Deere, the company announced record profits of $5.96 billion during the fiscal year that ended on November 1.

Tyler Jett reported for the Des Moines Register on November 24,

The company announced Wednesday that the new contract with the UAW will cost $250 million to $300 million. J.P. Morgan analyst Ann Duignan wrote in a note that she expects Deere to increase prices by 1.5% to offset its higher pay to workers.

That cost estimate appears to cover the immediate 10 percent raises and $8,500 ratification bonuses for each of Deere’s approximately 10,000 employees represented by UAW. The range of $250 million to $300 million would work out to between 4 percent and 5 percent of the company’s profits for the fiscal year that just ended.

Under the new contract, Deere has also promised UAW members additional 5 percent raises in 2023 and 2025, as well as quarterly cost-of-living increases and better pension terms. Deere is also giving all of its salaried employees (who are not represented by the union) an 8 percent raise, the company announced last week.

Clearly none of the above will break the bank for a company as profitable as Deere. While there’s no guarantee the equipment manufacturer will continue to post record profits in the coming years, it is well positioned for several reasons. The company said in a November 24 news release that it is forecasting “net income” (profit) of $6.5 billion to $7 billion for the 2022 fiscal year.

“Looking ahead, we expect demand for farm and construction equipment to continue benefiting from positive fundamentals, including favorable crop prices, economic growth, and increased investment in infrastructure,” [Deere CEO John] May said. “At the same time, we anticipate supply-chain pressures will continue to pose challenges in our industries. We are working closely with our suppliers to address these issues and ensure that our customers can deliver essential food and infrastructure more profitably and sustainably.”

Jett summarized a recent note from Jefferies Group analyst Steve Volkmann as saying “the strike should not inflict long-term problems for Deere. The walkout occurred at a traditionally slower time for the company, as farmers wrapped up their harvests. And with most factories struggling to buy raw material, Volkmann said, competitors did not have a chance to take a lot of Deere customers.”

As for supply chain problems and associated cost increases for raw materials, Deere executives believe the company can cover most of those expenses by raising prices for consumers.

UAW members were obviously right to reject the company’s first contract offer, which offered raises half as large, less generous pension terms, no quarterly cost-of-living increases, and no pensions for future hires.

The company’s latest forecast made me wonder whether the union could have held out for a better deal. The contract ratified on November 17 by a 61 percent to 39 percent vote was nearly identical to the second tentative agreement, which UAW members rejected by 55 percent to 45 percent in early November.

Votes appear to have changed mostly due to fears that Deere might not come back to the negotiating table anytime soon if the union the rejected the third tentative agreement. Some leaders of UAW locals warned the company could hire strikebreakers. The last John Deere strike, which began in 1986, lasted for a little more than five months. That’s a long time to get by on strike pay of $275 a week.

We’ll never know whether the new contract was truly Deere’s “last, best and final” offer, as management kept saying. Perhaps public pressure on the company to share more of the wealth would have increased after Deere reported another record-breaking annual profit this past week. Most Iowans sympathized with the workers on strike rather than with management, according to an Iowa Poll by Selzer & Co for the Des Moines Register and Mediacom.

Or perhaps the company would have offered just a minor tweak to the deal, confident union members would not vote to prolong the strike again during or soon after the holiday season. Holding out for several more weeks or months would make sense financially only if the eventual contract included significantly more generous terms for UAW members.

Final note: Deere’s news release mentioned “increased investment in infrastructure,” a reference to the bipartisan bill President Joe Biden recently signed. Republican U.S. Representatives Ashley Hinson, Mariannette Miller-Meeks, and Randy Feenstra all voted against that legislation. Thousands of Deere employees live in Hinson’s district (Waterloo and Dubuque) or Miller-Meeks’ district (Ottumwa and Davenport). I’ll be watching to see whether John Deere’s PAC (which gave $5,000 to each of Iowa’s U.S. House Republicans this year) repeats the favor after the Republicans offered flimsy excuses for opposing the infrastructure bill.

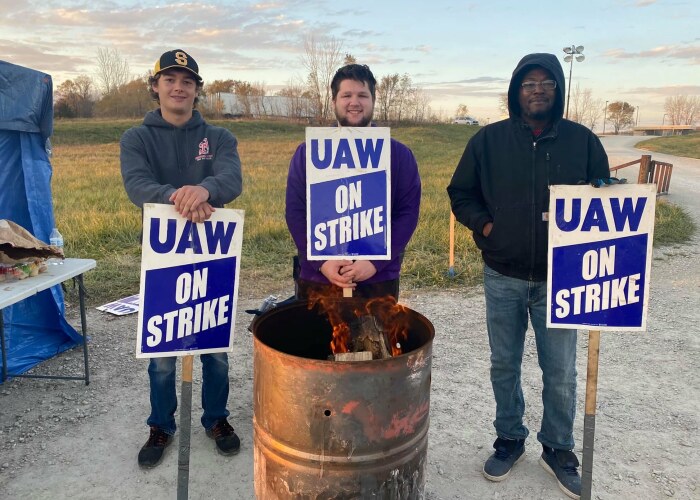

Top image of UAW members picketing in Waterloo on November 18 first posted on the UAW Local 838’s Facebook page. Members of UAW Local 838 in Waterloo were the only Iowa-based unit to vote to reject the contract offer on November 17.

1 Comment

Share repurchases

Deere has spent more than $1 billion annually on share repurchases, which serve no purpose other than to boost a company’ stock price and thus support management. Deere’s outlook for agriculture shows obvious confidence that congress will renew farm subsidies when the new Farm Bill is debated and persumably passed in 2023. If Republicans sweep congress in the 2022 election, as expected, we can only assume that the Farm Bill will be sweeter than usual not only for farmers but for the various “rural revitalization” schemes which annually put about $15-$20 billion in taxpayer subsidies into rural America.

Dan Piller Mon 29 Nov 5:04 AM