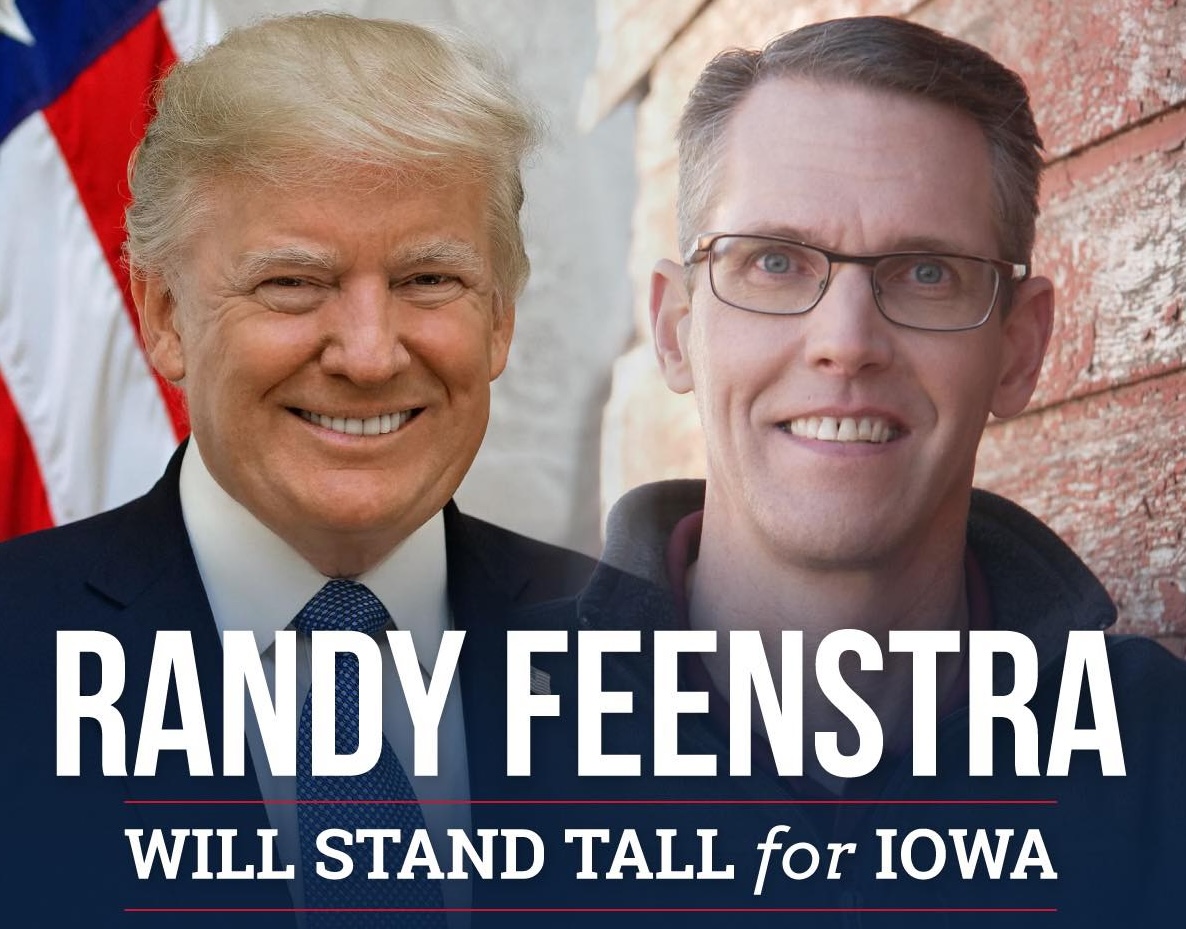

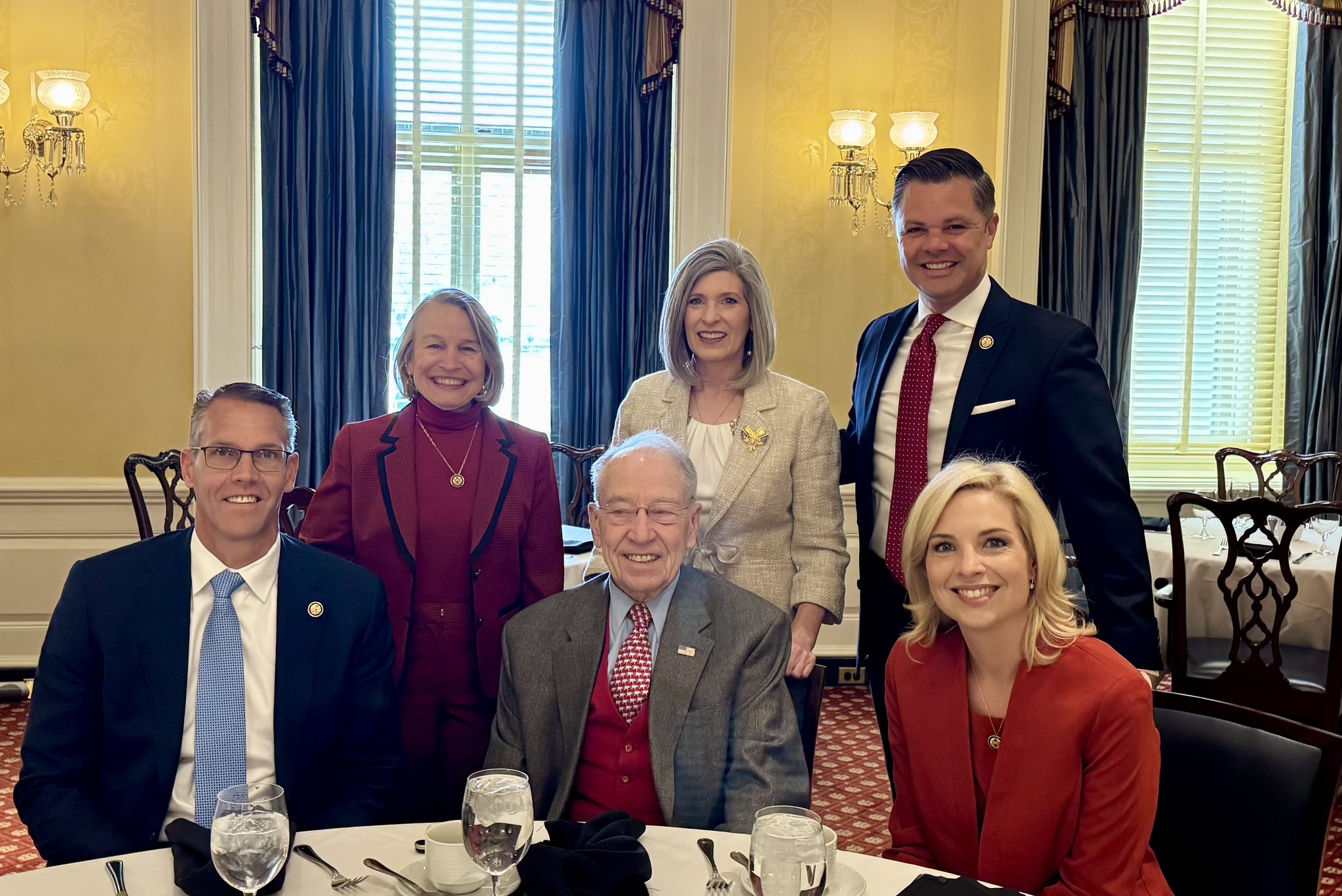

As U.S. Representative Randy Feenstra sought to drive supporters of his campaign for governor to attend the off-year Republican caucuses on February 2, he had a big assist from American taxpayers.

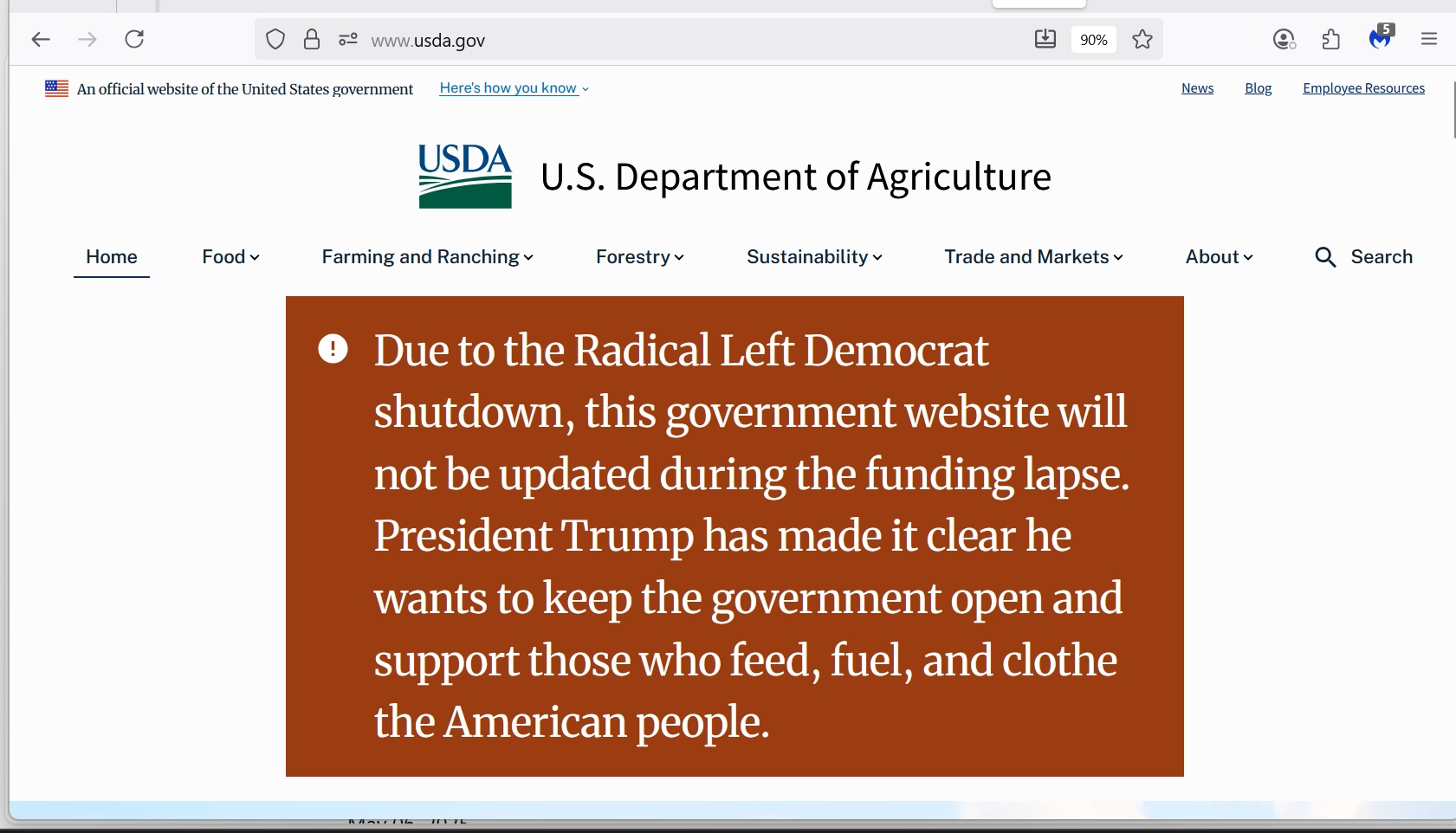

Feenstra spent nearly $33,000 from his Congressional office budget on radio advertising that aired from January 12 to February 6, my review of Federal Communications Commission documents shows. He will spend at least $31,000 more on taxpayer-funded radio ads scheduled to run from February 16 to mid-March.

The U.S. House database of franked communications shows Feenstra also spent official funds on four direct mail pieces in January—three of them timed to reach households during the two weeks before the caucuses. Currently available documents do not show how much was spent on those mailings, but past budget reports suggest the cost ran well into five figures.

Feenstra’s campaign for governor had more than $3.2 million in the bank at the end of 2025—more than enough to execute a robust paid advertising plan without using any of his Congressional office budget.

Continue Reading...