Al Charlson is a North Central Iowa farm kid, lifelong Iowan, and retired bank trust officer. This commentary was first published in the Waverly Democrat.

With reluctance and apprehension I am beginning 2026 by venturing back into the property tax jungle. In my September column, which focused on farmland taxes, I indicated I would return to address the property tax concerns of my in-town friends and neighbors.

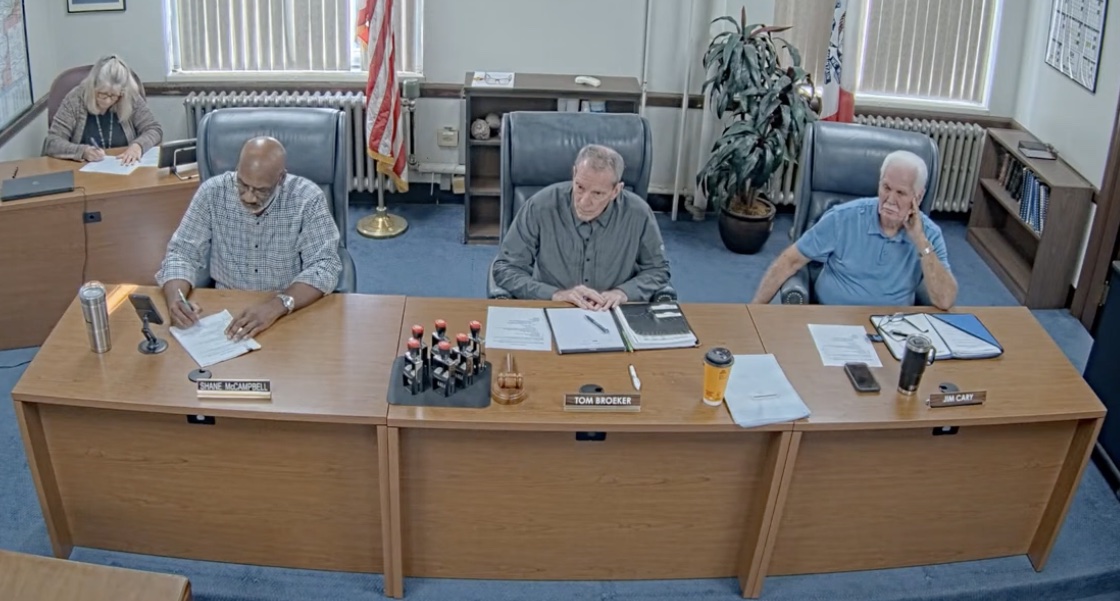

In-town residential property taxes are more complicated for a couple of reasons. Of course, city residents pay city taxes—city finances could easily be the topic for an entire column. I had the opportunity to be a guest Waverly City Council member in January 2025, which included attending annual budget hearings. My overall impression was that our city operating departments are seriously committed to providing the services they deliver as efficiently as possible.

The other complicating factor is that houses are taxed on their estimated market value. That gets interesting. In 2024 the assessed value of our home was increased 15.3 percent. The Assessor only bumped up the value of the house by 6 percent, but increased the value of our lot by 56 percent.

Continue Reading...