The good news is, the federal government won’t shut down before the end of the current fiscal year on September 30, 2016. The bad news is, members of Congress snuck some awful provisions in the “omnibus” budget bill and package of tax cut or tax credit extensions that just cleared the U.S. House and Senate. You know leaders aren’t proud when they bury news about a deal during another event occupying the political world’s attention, in this case Tuesday night’s Republican presidential debate. I enclose below background on key provisions in the bills, as well as statements from the Iowans in Congress. I will update this post as needed.

The House held separate votes on the “tax extenders” and the omnibus. Republicans were nearly united in support of the tax bill (confusingly named “On Concurring in Senate Amdt with Amdt Specified in Section 3(b) of H.Res. 566”), which passed yesterday by 318 votes to 109 (roll call). The Democratic caucus was split; Naomi Jagoda and Cristina Marcos reported for The Hill that House Democratic leaders “opposed the tax package” but “did not whip their members against it.” Republicans Rod Blum (IA-01), David Young (IA-03), and Steve King (IA-04) all voted for the tax extenders; so did Democratic Representative Dave Loebsack (IA-02), one of 77 House Democrats to do so.

Loebsack was the only Iowan to vote for the omnibus bill, which easily passed this morning by 316 votes to 113 (roll call). Most of the Democratic caucus supported the bill that keeps the federal government open for at least nine more months; just 18 Democrats voted against it.

Although House Speaker Paul Ryan and his team persuaded 150 Republicans to vote for the budget measure, 95 Republicans opposed it, including all three Iowans. Blum and Young appear to have concluded that the bill was simply too expensive. King’s main objection was that none of his nine amendments were included in the final deal. Click through to read the texts of those amendments, which would have barred the use of appropriated funds for: enforcing the 2010 Affordable Care Act (health care reform law); implementing President Barack Obama’s executive orders to provide temporary protection against deportation for some immigrants who entered the country without permission; enforcing the U.S. Supreme Court decision that legalized same-sex marriage nationwide; supporting any activities of Planned Parenthood Federation of America or any of its clinics, affiliates, or successors; implementing or enforcing any change to the U.S. EPA’s Waters of the United States rule; resettling refugees; implementing the multilateral deal struck earlier this year to prevent Iran from obtaining nuclear weapons; implementing any regulation that stemmed from the recent international agreement to combat climate change; or expanding the use of H-2B visas.

The Senate combined the tax extenders and budget bills into one package, which passed this morning by 65 votes to 33 (roll call). Iowa’s Senators Chuck Grassley and Joni Ernst both voted no; in the statements I’ve enclosed below, Grassley went into greater detail about his reasons for opposing the package. However, earlier this week he released a separate statement bragging about some of the provisions he helped to insert in the tax legislation. Members of Congress from both parties use that sleight of hand.

Among the presidential candidates, Bernie Sanders, Ted Cruz, and Rand Paul voted against the omnibus, Lindsey Graham voted for it, and unbelievably, Marco Rubio missed the vote. What is wrong with this guy? He “has missed more than half of the Senate’s votes since October,” Jordain Carney reported for The Hill. I think not showing up for Senate work will hurt Rubio in Iowa, though not having a strong field operation will hurt him more.

The Senate is now adjourned until January 11 and the House until January 5. During the winter recess, Bleeding Heartland will catch up on some of the Iowa Congressional voting not covered here during the late summer and fall.

From Ezra Klein’s look at the key points of the omnibus deal for Vox:

This deal is the first major legislation of Paul Ryan’s speakership, and it’s huge: it prevents a government shutdown, replaces much of the sequester, passes $700 billion of (unpaid-for) tax cuts, pauses or delays major provisions of Obamacare, and offers real insight into what both parties care about right now — and what they don’t care about. And one lesson of the deal — which may be a surprise to those who remember Ryan’s rise as the GOP’s chief deficit hawk — is that neither party really cares about deficits right now. […]

This deal sets discretionary spending levels for the 2016 fiscal year — if this portion, or something like it, doesn’t pass, the government will shut down.

A secondary objective for both parties here is agreeing on specific spending cuts that can replace the across-the-board “sequester” cuts that have been indiscriminately hacking away at the federal government for the past few years. This deal replaces much of (though not all!) of the 2016 sequester cuts. […]

A big part of what makes spending deals so controversial in Washington is the effort to use the appropriations process to accomplish controversial policy goals. These non-spending add-ons to spending bills are called “policy riders,” and examples include defunding Planned Parenthood, setting up a more stringent process for screening Syrian refugees, or telling the IRS it can’t tighten its regulations against 501(c)(4)s that raise anonymous donations. […]

In this case, the overwhelming majority of policy riders were stripped out of the final deal — including the super-controversial Planned Parenthood and refugee riders. The most significant rider left is about protecting anonymous political spending, because apparently that’s something both parties can agree on.

Cristina Marcos reported for The Hill,

To win over GOP votes, Ryan added language to the bill lifting the decades-old ban on U.S. oil exports. […]

Liberal Democrats were upset by the oil provision, though Pelosi and her leadership team noted that their party won the extension of several renewable energy tax credits in exchange for ending the ban on oil exports.

In an early Friday morning memo to House Democrats, Pelosi ticked off a variety of GOP riders Democrats prevented, including attempts to defund Planned Parenthood and overturn environmental regulations.

“Republicans’ desperate thirst for lifting the oil export ban empowered Democrats to win significant concessions throughout the Omnibus, including ridding the bill of scores of deeply destructive poison pill riders,” Pelosi wrote in a Thursday night letter to House Democrats urging them to support the bill.

Another provision that might have won Democratic votes dealt with ObamaCare.

The legislation calls for suspending for two years ObamaCare’s “Cadillac” tax on high-cost insurance plans. Many Democrats wanted that provision, because unions would like the tax to be repealed. Ahead of an election year in which labor’s ground support will be crucial to Democratic races around the country, it is a significant win for the party.

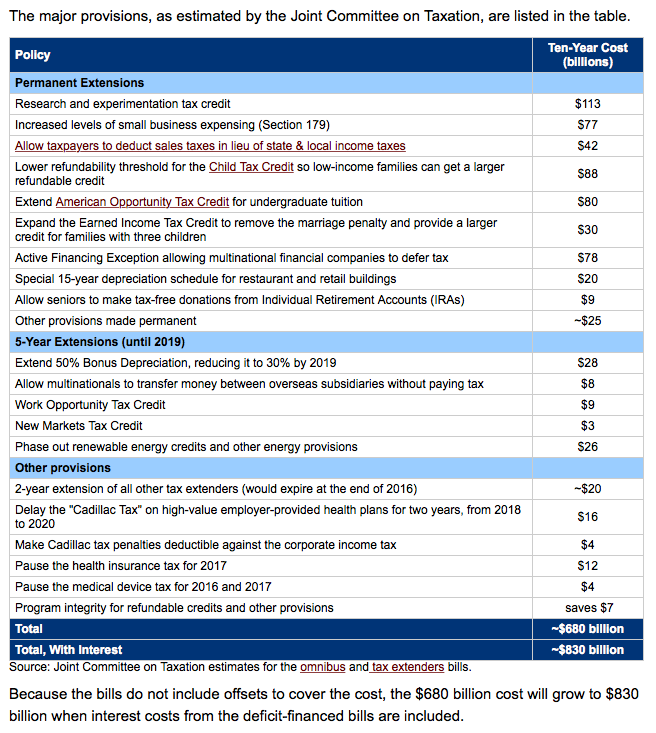

The Committee for a Responsible Federal Budget estimated the costs of the tax cuts and tax credits extended as part of this package:

News release from the Center on Budget and Policy Priorities, December 16:

Greenstein: Assessing the Tax Provisions of the Bipartisan Budget and Tax Deals

BY ROBERT GREENSTEIN

The tax parts of the new bipartisan deals include provisions that mark a major achievement in reducing poverty and helping poor and modest-income working families, but also disturbing provisions that could cause budget deficits and health care costs to rise substantially over time. Assessing the tax provisions as a whole depends on the standard one uses: whether one compares them to exemplary tax policy or to what policymakers likely would do in the absence of these deals.Moreover, a more definitive judgment lies in the future, because much depends on whether the provisions delaying the excise tax on high-cost health insurance plans and suspending the health insurance and medical device taxes prove a death knell for those measures or whether they ultimately take effect, with reforms in the excise tax.

Tax Credits for Working Families

The deal makes permanent three significant improvements in the Earned Income Tax Credit (EITC) and the low-income component of the Child Tax Credit (CTC), along with the American Opportunity Tax Credit (AOTC) — all of which were originally enacted as part of the 2009 Recovery Act. Under current law, these EITC and CTC improvements as well as the AOTC, which helps low- and middle-income families defray college costs, are set to expire at the end of 2017.

MAKING THE EITC AND CTC IMPROVEMENTS PERMANENT WOULD RANK AMONG THE BIGGEST ANTI-POVERTY ACHIEVEMENTS IN YEARS.Making the EITC and CTC improvements permanent would rank among the biggest anti-poverty achievements, outside of health reform, in years. These improvements lift about 16 million people, including about 8 million children, out of poverty or closer to the poverty line each year. With these improvements, the EITC and CTC keep more children out of poverty than any other federal program, which would no longer be true if the improvements expired. Making permanent the American Opportunity Tax Credit also would also help many low- and middle-income families, though we lack data on its poverty impacts.

The EITC and CTC improvements also help many families modestly above the poverty line that struggle to make ends meet. Overall, these provisions supplement the wages of working families that contain about 50 million people, including about 25 million children.

For example, a single mother with two children who works full time at the federal minimum wage of $7.25 an hour and makes $14,500 a year would lose her entire $1,725 Child Tax Credit if these improvements lapsed.

Growing evidence indicates that not only do the EITC and CTC encourage and reward work, but the income that low-income working families receive from these credits is also linked to improvements in maternal and infant health, better school performance among children, higher college enrollment, and increased work effort and earnings when the children reach adulthood.

Tax Extenders

The deal makes permanent several of the most popular “tax extenders,” including the research and experimentation (R&E) tax credit, a provision (known as section 179) that allows small businesses to deduct a certain amount of investment immediately, a deduction for certain state and local sales taxes, and tax breaks for charitable giving. The deal extends most of the other extenders for two years, with a few small or modest breaks continued for five years. It also continues for five years the bonus depreciation tax break — a major corporate tax break that has been in effect since 2008 — while scaling it down so that by the fifth year, the tax reduction that this measure provides would be three-fifths its current size.

On the one hand, policymakers should not continue these tax breaks without paying for them, and they shouldn’t continue bonus depreciation — launched as a stimulus measure during the economic downturn — at all, given that the economy is well into recovery. On the other hand, without the deal, policymakers almost certainly would continue nearly all of the extenders for another two years, without scaling them back. And at the end of the two-year period, they very likely would extend them again, as they consistently have in the past.

Consider the history. The R&E tax credit has been around for over three decades and is strongly supported by Republicans and Democrats alike. The pattern with these extenders is clear: every year or two, no matter the balance of party power, policymakers enact a package of tax extenders without paying for them by huge bipartisan majorities.

In this respect, the official “score” for (that is, cost of) the tax-extender provisions is a little deceptive: the R&E credit and other extenders that the deal makes permanent will ultimately cost the same amount whether policymakers make them permanent now or continue to extend them every year or two.

In this vein, I can find one modest benefit and one glimmer of hope in this part of the package. On the modest benefit, absent the deal, policymakers would likely extend bonus depreciation for two years without scaling it back at all. That would increase the risk that this large tax break would become embedded as one of the ongoing extenders and be extended every few years. At least this package scales bonus depreciation back.

On the glimmer of hope, perhaps after making the most popular extenders permanent, thus removing them from future extender packages, policymakers may not find it so easy politically in the future to keep extending all of the other tax breaks without paying for them, thinning them out, or scaling them back.

Health Tax Provisions

The health tax provisions, by contrast, do not continue tax breaks that are already in law, and they threaten to punch a large new hole in federal revenues and to undo one of the most important measures on the books to slow the rate of growth of health care costs.

The deal delays for two years the excise tax on high-cost health insurance plans (the “Cadillac tax”) that would otherwise take effect in 2018, suspends for two years the medical device tax (which is already in effect), and suspends for one year the tax on health insurance companies (also already in effect). We won’t know how large and deleterious the effects of these provisions will be until we see what happens to these taxes at the end of these delay and suspension periods.

If policymakers treat the delays or suspensions of these taxes themselves as a new kind of “extender,” repeatedly renewing the delays and suspensions and never letting the taxes take effect, the adverse long-term consequences would be big. The federal government would have substantially less revenue: these taxes are projected to raise $257 billion over the next ten years and a much larger amount — close to $750 billion — in the decade after that. (The $257 billion reflects the Joint Committee on Taxation’s estimate for the next ten years. Based on JCT’s estimated revenue losses in the tenth year, 2025, and its estimate of the year-to-year change in the revenue losses, the loss in the second decade would be roughly $750 billion.)

In addition, economists widely believe the excise tax on high-cost insurance plans would play a significant role in slowing the rate of growth of health care costs throughout the U.S. health care system. Higher health-care cost growth ultimately has adverse effects on federal and state budgets, on consumers, and on the economy.

Accordingly, the long-term impacts of the tax provisions will depend significantly on what happens to these health taxes after their delay and suspension periods. If policymakers make needed adjustments in the Cadillac tax to address various concerns with it (the deal takes a small first step in that direction by making the excise tax on high-cost plans deductible for firms) — or if they replace the tax with another measure to achieve cost-containment goals such as a well-designed cap on the tax exclusion for employer-based health coverage — and they reinstate the other two health taxes, the damage (in terms of rising deficits and health care cost growth) will be contained. On the other hand, if the health tax measures die, the long-term damage will likely be substantial.

Senator Chuck Grassley press release, December 18:

Grassley Statement After Senate Passes Omnibus Spending and Tax Relief Bill

Dec 18, 2015

Senator Chuck Grassley made the following statement after the Senate passed an omnibus bill. Grassley voted against the measure.“Omnibus appropriations bills are never the best way forward. Republicans made a commitment to individual spending bills. The Appropriations Committee worked through the grueling task of putting together individual bills, only to be thwarted by the Democrats with nearly every attempt to bring them to debate on the Senate floor.

“So, now we’re left with a bloated year-end deal that increases spending by tens of billions of dollars above the bipartisan promise Congress made in 2011 to rein in runaway spending.

“The best part of this bill is the tax provisions. It includes many items I either drafted or co-authored and many more that I support. The renewable energy items, including the five-year extension of the wind energy production tax credit, support jobs. They support the renewable energy that consumers want for a cleaner environment and energy independence from countries that wish to do us harm. The college savings provisions help families and students afford college. They improve a tax incentive that’s popular with Iowans and others around the country who work hard to save money for their children and grandchildren to get an education. These families were rightly upset when the President proposed getting rid of these plans. The IRS provisions are necessary to get the agency more focused on its number one job of taxpayer service and less concerned about ignoring or manipulating decision-making about groups’ tax status.

“After the tax provisions and knowing a shutdown has been averted, there’s not a lot else to be happy about. Inclusions of the 9-11 victims compensation fund bill, the Cybersecurity Information Sharing Act and funding for the Entry-Exit System are positive, but a straight extension of the EB-5 immigration program, allowing the Waters of the United States rule to continue, continued admittance of Syrian refugees and thousands of unskilled workers who are competing with Americans for jobs, along with several agriculture provisions, are big disappointments.

“The reauthorization of a fully off-set 9-11 victims’ compensation fund for five years is one of the few highlights of the omnibus. I’m particularly satisfied that in this measure I was able to include a separate mechanism for thousands of U.S. victims of state sponsors of terrorism to obtain compensation, funded not by taxpayers, but with fines and penalties assessed against those who choose to do business with state sponsors of terrorism. For decades, many of these victims, including the Tehran hostages, have never been able to obtain justice.

“I was also able to secure funding designated specifically for the Entry-Exit System that has been authorized but not funded since 1996, to address some gaping holes in the visa system and better secure the border. Funding for this is especially important as we see increases in terrorism threats against the United States. It only makes sense that we know who is in the country, when they’re supposed to depart, and when they actually leave.

“One of the biggest disappointments is the straight 10 month extension of the EB-5 immigrant investor program. There are well-documented national security concerns and abuse of the program, and a bipartisan, bicameral agreement on reform. It should have been a no-brainer. Instead, negotiations were allowed to be hijacked by a small number of special interest groups who wanted the status-quo and the necessary reforms were shoved aside.

“From an agriculture standpoint, there are some major changes to policy being made in this bill. For one, the appropriators opened the farm bill by bringing back generic certificates that are simply used to circumvent payment limits. The largest farmers who will benefit the most from these unlimited subsidies will continue their stranglehold on acres that prevent young and beginning farmers from ever having a chance to get started in farming.

“The Country of Origin Labeling (COOL) law repeal is an unfortunate necessity because of pending retaliation. After the World Trade Organization ruled that COOL was a trade barrier, a group of us worked to find a way to avoid possible sanctions by Canada and Mexico, while still allowing voluntary labeling of meat products. Unfortunately, our bipartisan solution was never acted on by the Senate, and a full repeal was necessary to avoid potentially $1 billion in retaliation from Canada and Mexico. We’ll continue to work to find a solution that shows people where their food comes from, just like people know where their t-shirts come from, that is World Trade Organization compliant.

“Unfortunately, the bill also failed to block implementation of the Waters of the United States rule. It’s clear the EPA overstepped its bounds when writing this rule. Federal courts have temporarily put this rule on hold, and rightly so. In addition, this week’s Government Accountability Office report saying that the EPA engaged in ‘covert propaganda’ to illegally promote its WOTUS rule should put a rest to any talk that this rule should continue. Congress should do its part and put a stop to it once and for all.

“It’s too bad that the omissions and negative aspects of the bill overall outweigh the many good provisions.”

For more information on the tax provisions, click here.

Senator Joni Ernst press release, December 18:

WASHINGTON, D.C. – U.S. Senator Joni Ernst (R-IA) released the following statement after voting against the more than 2,000 page bill which includes $1.8 trillion dollars in spending and tax policy:

“Once again, Washington finds itself governing from one crisis to the next, cutting back room deals and now, jamming through this $1.8 trillion package in spending and tax policy. Iowans deserve better; they deserve to have a voice in this process, instead of a being told what’s been negotiated behind closed doors.“While there are some positive aspects of the deal, I could not in good faith support it in its entirety because it not only fails to address the drivers of our fiscal mess, but it exacerbates the problem by leaving taxpayers on the hook. Simply put, I was sent to Washington to cut the pork and this deal adds too much money to an already growing government and unsustainable national debt.

“Additionally, this back room deal fails to include a critical measure to stop the EPA’s harmful expansion of the WOTUS rule. The reality is the WOTUS rule is ill-conceived and breeds uncertainty, confusion, and more red tape that threatens the livelihoods of many in Iowa and across the country. Failure to act hurts hardworking farmers, ranchers, manufacturers, and small businesses who are continuously ignored by the EPA.

“This bill also sidesteps the need to pause the refugee program for Syrians, in order to ensure that Americans are safe.

“Like Iowans across our state, I’m fed up with politicians’ talk of change, only for it to result in more Washington dysfunction. Congress should debate this deal in an open and transparent process.

“We must work together to cut spending and make the tough decisions that the American people elected Congress to make.”

Representative Rod Blum press release, December 17:

Legislation Provides Certainty for Families, Small Business, Agriculture

WASHINGTON, DC – Today, Congressman Rod Blum (R-IA) joined a bipartisan majority of his colleagues in the House of Representatives to pass H.R. 2029, the Protecting Americans from Tax Hikes (PATH) Act, a permanent tax extenders package. The bill passed 318 – 109.“This legislation allows Iowans to keep more of their hard earned money while providing long term certainty for business that make the investments in new technology and infrastructure that are so important for job creation,” said Congressman Blum. “I was especially encouraged to see two of my legislative priorities — making small business expensing (Section 179) and the Research and Development Tax Credit permanent — included in this legislation instead of being temporarily extended at the last minute as is typically done in Washington. Iowa farmers and businesses need to know what the rules are ahead of time so they can plan for the future and make investments that create jobs for Iowans.

“The bill also provides Iowa families with the certainty they deserve by making the Child Tax Credit and the Earned Income Tax Credit permanent while also encouraging our citizens to contribute to charity by making contributions tax free. Overall, this package is an important step on the path to comprehensive tax reform and moves us closer to the goal of a tax code that will help reignite our economy and raise wages for our working families.”

For more information on Congressman Blum’s previous work to make Section 179 and the R&D Tax Credit permanent please click here and here.

Representative David Young press release, December 18:

WE MUST HOLD THE LINE ON WASTEFUL SPENDING

WASHINGTON, D.C. – This morning, Iowa Congressman David Young voted against H.R. 2960 – Consolidated Appropriations Act, 2016.

“I spent all year fighting for Iowa values and priorities from my seat on the Committee on Appropriations, where we passed 12 bills that held the line on wasteful spending. At the end of the day, this was neither the process nor the result I or Iowans wanted. Ultimately, I could not support this measure.” Young said.

Representative Steve King press release, December 18 (emphasis in original):

King votes NO on Omnibus Spending Bill

Washington, D.C. – Congressman Steve King released the following statement after voting no on the omnibus spending bill:

“I introduced 9 amendments to the omnibus spending bill,” said King. “All of which would have passed if brought to the floor, yet none were made in order. I put these up as a record of what Congress should be doing to restore Article I Constitutional Authority. The American people have been demanding that we defund ObamaCare, executive amnesty, the Supreme Court’s ruling on same-sex marriage, Planned Parenthood, WOTUS, the Iran nuclear deal, the refugee resettlement process, climate change, and strike out any expansion of H-2B visas.

Going into next year we need to put the priorities of the American people, the promises we made to our constituents and the Constitution at the forefront of the House’s legislative agenda. I am hopeful we can turn the page and start fresh with a Congress that respects the will of the American people.”

Mr. King’s Nine Amendments to the omnibus spending bill:

1. Defund ObamaCare

2. Defund Executive Amnesty

3. Defund the Supreme Court’s Ruling on Same-Sex Marriage

4. Defund Planned Parenthood

5. Defund New WOTUS

6. Defund the Iran Nuclear Deal

7. Defund the Refugee Resettlement Process

8. Defund the Climate Change Agreement

9. Strike the Expansion of H-2B Visas

Grassley press release, December 16:

Grassley Secures Victories for Wind Energy Production, College Savings Plans, Taxpayer Rights in Omnibus, Tax Extenders Package

WASHINGTON – Sen. Chuck Grassley of Iowa today praised the inclusion of a five-year extension of the wind energy production tax credit, his provisions to enhance Section 529 college savings plans, his measures to protect taxpayer rights and more welcome provisions in the newly released bipartisan, bicameral omnibus budget and tax package before Congress.

“Certainty and predictability in tax policy are necessary so businesses can plan and invest accordingly, which is important for job creation.” Grassley said. “A five-year extension of the wind energy provision will support jobs. It supports the renewable energy that consumers want for a cleaner environment and energy independence from countries that wish to do us harm. The college savings provisions help families and students afford college. They improve a tax incentive that’s popular with Iowans and others around the country who work hard to save money for their children and grandchildren to get an education. The IRS provisions are necessary to get the agency more focused on its number one job of taxpayer service.”

The five-year extension of the wind energy production tax credit is a victory for wind energy producers. The extension is meant to lead to a phase-down of the industry-specific tax credit. As included, the wind production tax credit will be 100 percent in 2015 and 2016, 80 percent in 2017, 60 percent in 2018 and 40 percent in 2019.

“As the father of the first wind energy tax credit in 1992, I can say that the tax credit was never meant to be permanent,” Grassley said. “I also can say that the wind energy industry is the only energy industry that came forward with a phase-out plan. The oil and nuclear industries have benefited from tax incentives that have been permanently on the books for decades. The five-year extension for wind energy brings about the best possible long-term outcome that provides certainty, predictability and a responsible phase-down of a tax incentive for a renewable energy source.”

On education, the tax package before Congress includes Grassley’s provisions to improve the already successful Section 529 savings program. Grassley’s provisions allow 529 funds to purchase a computer on the same tax-favorable basis as other required materials; cut outdated, unnecessary rules that increase paperwork and costs on plan administrators; and provide tax and penalty relief in instances where a student may have to withdraw from school for illness or other reasons.

Grassley introduced his bipartisan provisions in February. His reforms build on improvements to 529 college savings plans enacted in 2001 and 2006 under Grassley’s leadership on the Finance Committee and with broad bipartisan, bicameral support. The 2001 law made distributions from the plans tax-free if used for education expenses but it was scheduled to expire. The 2006 law made the tax-free provision permanent. The President proposed eliminating the 529 program earlier this year, drawing opposition from parents and Congress.

The measure includes another long-time Grassley provision, the extension of an above-the-line deduction for qualified tuition and related expenses for higher education. The provision extends the above-the-line deduction for qualified tuition and related expenses. The deduction is capped at $4,000 or $2,000 for individuals, depending on income. Another long-time Grassley priority included is an extension and modification of a deduction for certain expenses of elementary and secondary school teachers, including school supplies that they purchase out of pocket.

The tax package includes an extension of the existing biodiesel fuel blenders credit, the small agri-biodiesel producer credit, the tax credit for cellulosic biofuels producers, the alternative fuel vehicle refueling tax credit, and bonus depreciation for cellulosic biofuel facilities. Grassley authored the initial version of many of the alternative fuels provisions when Finance Committee chairman.

Grassley hoped to include his bipartisan provision to modify the biodiesel blenders credit to a domestic production credit. “I’m disappointed that my common-sense, cost reduction modification was not included,” Grassley said. “We shouldn’t provide a U.S. taxpayer benefit to imported biofuels. The domestic production credit would have made sure that U.S. policy incentivizes a domestic industry instead of benefiting foreign producers, and I’ll continue to push this reform. Still, a blenders credit will help a growing industry that creates jobs and gives consumers alternatives to fossil fuels. The more fuel options, the better to meet demand.”

The measure includes the enhanced per-child tax credit, making it permanent. “This is helpful for families facing the tremendous expense of raising children,” Grassley said.

The tax package permanently extends enhanced Section 179 expensing for equipment purchases, which is popular with farmers and small businesses. This allows farmers and small business owners to deduct the cost, up to a limit, of major equipment and property purchases that contribute to farm and business operations and job creation. The permanence is a major achievement because this provision has been temporary over the last several years.

Included is a bipartisan measure Grassley led to increase the alternative tax liability limitation for small property and casualty insurance companies. These small companies largely serve rural communities, which rely on this adjustment to provide additional surplus and cash flow used to pay customers’ insurance claims.

“This provision helps to ensure that small mutual insurance companies will continue to be able to serve rural residents who have unique circumstances, such as living far from a fire station, and so are often unable to obtain private property insurance through traditional insurance companies,” Grassley said.

The package includes several provisions from Grassley’s Taxpayer Bill of Rights Enhancement Act of 2015, introduced in June amid gross mismanagement and inappropriate actions by IRS employees that have shaken what little confidence taxpayers may have had in the agency. The provisions include:

–Codifying the Taxpayer Bill of Rights, which includes the right to: be informed; quality service; pay no more than the correct amount of tax; challenge the position of the IRS and be heard; appeal a decision of the IRS in an independent forum; finality; privacy; confidentiality; retain representation; and a fair and just tax system and requires the IRS commissioner to ensure that IRS employees are familiar with and act in accordance with these rights.

–Prohibiting IRS employees from using personal email accounts for official business. This codifies an already established agency policy barring use of personal email accounts by IRS employees for official governmental business.

–Declaratory judgments for 501(c)(4) and other exempt organizations. The provision permits 501(c)(4) organizations and other exempt organizations to seek review in federal court in instances where the IRS fails to act on an application in a timely manner or makes a negative determination as to their tax-exempt status.

–Termination of employment of Internal Revenue Service employees for taking official actions for political purposes. The provision makes clear that taking official action for political purposes is an offense for which the employee should be terminated. The bill amends the Internal Revenue Service Restructuring and Reform Act of 1998 to expand the grounds for termination of employment of an IRS employee to include performing, delaying, or failing to perform any official action (including an audit) by an IRS employee for the purpose of extracting personal gain or benefit for a political purpose.

“The IRS has never been anyone’s favorite agency,” Grassley said. “But it shouldn’t repel and mistreat the people it exists to serve. The IRS’ level of customer service might be at all-time low. Taxpayers are at a disadvantage with an agency that has tremendous power over their money. The IRS might talk about good customer service. Too often, talk is all there is. The IRS needs to walk the walk. These changes will help swing the pendulum away from agency self-preservation and back to taxpayer service.”

The tax package adopts Grassley-led policy to ensure that those granted deferred action under the President’s executive actions on immigration cannot retroactively get the Earned Income Tax Credit based on earnings from work performed illegally in the United States.

Grassley is former chairman and a senior member of the Finance Committee, with jurisdiction over the IRS. Grassley championed the 1988, 1996 and 1998 taxpayer rights laws currently on the books.

Grassley press release, December 17:

Prepared Floor Statement of Senator Chuck Grassley of Iowa

Chairman, Senate Judiciary Committee

EB-5 and the Omnibus

Thursday, December 17, 2015Mr. President,

At 1:30 am Wednesday morning, an omnibus appropriations bill was filed to keep the government operating for the remainder of the fiscal year. This bill, which will be voted on by the House on Friday, includes a straight and clean extension of a program called the EB-5 Immigrant Investor program. This program has been plagued by fraud and abuse. But more importantly, it poses significant national security risks. Allegations suggesting the EB-5 program may be facilitating terrorist travel, economic espionage, money laundering and investment fraud are too serious to ignore. Yet, the omnibus bill fails to include much needed reforms.

The spending bill being considered by the House and Senate is a major disappointment. I’m frustrated that, despite the alarm bells and whistleblowers warning us about the program, Republican and Democrat leadership in the House and Senate decided to simply extend the program without any changes. This was a missed opportunity.

What makes this especially frustrating is that the Chairs and Ranking Members of the House and Senate Judiciary Committees agreed on a bill. We had consensus. I appreciate the support of Senator Leahy, the Ranking Member of the committee. I also commend Chairman Goodlatte, Ranking Member Conyers, Congressmen Issa and Lofgren. We worked in a bi-partisan fashion. We agreed on every aspect, believing in our heart of hearts that we were doing the right thing. We found common ground on national security reforms. We made sure that rural and distressed urban areas benefited from the program. We instituted compliance measures, background checks, and transparency provisions.

Through months of hard work, we put together a great deal. But despite this broad, bi-partisan support, and the work of the committees of jurisdiction, not a single one of our recommendations will be implemented. Instead of reforming the program, some members of leadership have chosen the status quo.

This failure to heed calls for reform proves that some would rather side with special interest groups, land developers and those with deep pockets.

It is widely acknowledged that the EB-5 program is riddled with flaws and corruption. Maybe it is only here on Capitol Hill—on this island surrounded by reality—that we can choose to plug our ears and refuse to listen to commonly accepted facts. The Government Accountability Office, the media, industry experts, members of congress, and federal agency officials, have concurred that the program is a serious problem with serious vulnerabilities.

Why did congressional leaders ignore the chairmen and ranking members who were spearheading EB-5 reform? Why did they ignore the GAO, the FBI, and the Secretary of Homeland Security?

Allow me to remind my colleagues why the EB-5 Regional Center program is in need of reform.

For several years, I’ve kept close tabs on the program, thanks in part to the reports of wrongdoing brought forward by whistleblowers. The fact is that other federal agencies, including the FBI, have raised national security concerns. Whistleblowers say that requests from politically influential people were being expedited.

Last June, Congress heard from a whistleblower who was harassed for speaking out against the program. This whistleblower said in a Senate committee hearing:

“EB-5 applicants from China, Russia, Pakistan and Malaysia had been approved in as little as 16 days and in less than a month in most. The files lacked the basic and necessary law enforcement queries… I could not identify how USCIS was holding each regional center accountable. I was also unable to verify how an applicant was tracked once he or she entered the country. In addition, a complete and detailed account of the funds that went into the EB-5 project was never completed or produced after several requests. During the course of my investigation it became very clear that the EB-5 program has serious security challenges.”

There are also classified reports that detail the problems. Our committee has received numerous briefings and classified documents to show this side of the story.

Our own executive branch agencies have communicated to us their concerns about the program. Officials within the Securities and Exchange Commission, the FBI, and Immigration and Customs Enforcement expressed concerns about the program, and how prone it is to fraud.

An internal national security report stated the following:

“As in any instance where significant investment funds are raised…the regional center model is vulnerable to abuse. The capital raising activities inherent in the regional center model raise concerns about investor fraud and other conduct that may violate US securities laws. Third Party promoters engaged by regional centers to recruit potential investors overseas fall outside of U.S. Citizenship and Immigration Services’ regulatory authority and may make false claims or promises about investment opportunities. Unregistered broker-dealers may operate outside of U.S. Citizenship and Immigration Services’ statutory oversight to match prospective investors with project developers. Moreover, the statute and regulations do not expressly prohibit persons with criminal records from owning, managing, or recruiting for regional centers.”

How many more intelligence reports are needed to understand the problems? How many more headlines are needed before we have the will to deal with them? How many more whistleblowers are going to be demoted for speaking the truth?

The Secretary of Homeland Security sent a letter to the Judiciary Committee and requested more authority to deny, terminate or revoke a regional center’s designation. They wanted more authority to root out the bad apples. They have been requesting that since 2012.

Our bill would have done that. But, the fact that our bipartisan bill was dismissed means bad actors and bad regional centers will continue to operate.

The EB-5 program also encourages a whole host of financial fraud and corruption. The program’s abundant loopholes and lack of regulation have created a virtual playing field for unethical gamesmanship and con-artists.

Fortune magazine reported how one man cheated potential immigrants out of $147 million dollars for a make-believe building project he never intended to finish. The article explains how the trickster claimed the project would create over 8,000 jobs. In reality, some 290 foreigners were tricked out of their cash.

This is not the only example of how regional centers can be used to defraud people out of millions of dollars for non-existent projects. The Securities and Exchange Commission encountered another fake project in which two men in Kansas purported to build an ethanol plant in Kansas. The Commission stated in a litigation release that, “The plant was never built and the promised jobs never created, yet the [two men] continued to misrepresent to investors that the project was ongoing.”

The report goes on to say that millions of dollars of investor money was used for other purposes—even going to another completely unrelated project in the Philippines.

Just last month, the National Law Review reported another case in which the Securities and Exchange Commission filed suit against the owner of a regional center who allegedly stole $8.5 million in EB-5 funds. The owner claimed that all the money provided from the foreign investors would be held in escrow until the approval of their green cards. Instead, the article reports that the owner of the regional center blew the money on two different personal homes, a luxury Mercedes, a BMW, and a private yacht. All the while, clueless investors were exploited by loopholes in the EB-5 program. For example, the article states that both the investors and the owner of the regional center were represented by the same attorney.

But for many potential EB-5 immigrants, a safe investment is not the main concern. Paying $500,000 is simply the ‘price of admission’ that they are able and willing to pay. For these wealthy elites, a profitable investment is just icing on the cake of buying a green card.

A lot of the debate in the past two months has been on Targeted Employment Area reforms. The Targeted Employment Areas created by Congress to steer foreign investments to rural and distressed areas have been greatly abused. The designations have been gerrymandered to include the most lavish of developments in the richest neighborhoods.

The Hudson Yards Project has generated millions of dollars for a luxury apartment complex in mid-town Manhattan.

Not far away, another flagrant example of gerrymandering is the Battery Maritime Building right next to Wall Street in lower Manhattan. The New York Times described it by saying it, “snakes up through the Lower East Side, skirting the wealthy enclaves of Battery Park City and Tribeca, and then jumps across the East River to annex the Farragut Houses project in Brooklyn.”How many more media reports will it take to understand the extent of EB-5 gerrymandering? Have the senators who helped table our reforms ever read those reports in the Wall Street Journal? I can say with certainty that the status quo will not benefit Middle America. It benefits New York City and other affluent areas at the expense of areas in Iowa, Kentucky, Wisconsin, and Vermont.

Some may say that there wasn’t enough debate or public input on EB-5 reforms. Well, let me walk you through just how much debate we’ve had on this issue.

The Judiciary Committee held a hearing on the program in late 2011. In every hearing since in which Secretary Johnson has testified, the issue of EB-5 has come up. The Homeland Security and Government Affairs Committee, as well as other House committees, have had hearings on the program.

In 2013, the Senate debated an immigration bill that was over 1,000 pages long. In a few short months, we voted that bill out of this body. Part of that bill included EB-5 reforms, some of which are in the Judiciary Committees agreement.

Then, in 2014, the House Judiciary Committee voted out a bill that included some changes to the program. The bill would have raised the investment level to $1.6 million.

This year, in June, Senator Leahy and I introduced S. 1501, The American Job Creation and Investment Promotion Reform Act. It was a tough, serious bill to overhaul the program.

And since June, we have listened to members. We have heard input from their constituents and the regional centers in their states. We listened to shareholders. We met with lawyers, lobbyists, and regional center operators. We listened to groups that represented trade and labor union groups. We met with the agency at the Department of Homeland Security that runs the program. We have worked with them and the Securities and Exchange Commission on language. We consulted various congressional committees.

We took this input, and made changes to our bill. On November 7, we circulated a new draft with Chairman Goodlatte. Ranking member Conyers joined our conversations as well, and has provided invaluable input.

So, again, we had a bipartisan and bicameral agreement with the four leaders of the committee of jurisdiction. Leadership of both bodies said that committees would do their jobs and be relevant to the legislative process again. And, we weren’t the only ones who wanted action.

On November 6, Chairmen Corker and Johnson joined me in sending a letter to Leaders McConnell and Reid, urging them to include critical provisions that would better guard against fraud and abuse and give the department the ability to terminate questionable centers.

Senator Feinstein said she’d prefer to see the program end. In early November she wrote, “We have seen in recent years that the program is particularly vulnerable to securities fraud. According to legal complaints, applicants for some projects were swindled out of their investment, and jobs were never created… When the program comes up for renewal in December, Congress should allow the program to die.”

Two weekends ago, Judiciary staff was asked to come in and talk to Democrat and Republican leadership. Staff was asked to hear out the U.S. Chamber of Commerce, the Real Estate Roundtable, and other industry representatives.

On that first day of December negotiations, there was a lot of discussion about how New York wouldn’t be able to compete with rural America if our reforms were enacted. They thought the bill was unfair to urban areas and they wanted every project in the country to qualify for the special Targeted Employment Area designation. The solution was to provide a set-aside of visas at the higher level to ensure they could use the program. An agreement was in the works.

Yet, when they returned the next day for discussions, the Chamber and Real Estate Roundtable, along with a small group of developers represented by a law firm in town, came with a new list of demands. They had half a dozen major issues, not to count their so-called technical changes.

After nearly 12 hours in a room with EB-5 protectionists, Judiciary Committee staff conceded and tried to find common ground. They left with an agreement in concept.But the next day when staff were called in to finalize the language, the industry said they wanted more. This is a common theme. The industry wanted more. And more. And more.

It made one really wonder if they actually wanted a bill with reforms.

Then, after all the concessions made to the industry, some members in the Senate asked us to make even more concessions.

Despite all these challenges, the four corners of the Judiciary Committee compromised even more. We gave in on many areas. We tried to strike an agreement—as much as we knew it weakened our bill – because the security reforms are so desperately needed.

But after all that, our House and Senate leadership failed us. They extended the program without changes for 10 months. No reforms. No plugs to national security. No safeguards against fraud and abuse.

The bill we presented to the Republican and Democrat leadership took into consideration edits from the industry, immigration attorneys, and several congressional offices.

Am I disappointed that the leadership simply extended a very flawed program? Yes. But, I also know that the product we had provided them on Monday night was a very flawed bill. It was watered down. It was a giveaway to New York City, Texas and rich developers who simply wanted to protect their projects. It was a giveaway to affluent urban areas and a failure for rural America.

According to ABC News, more than $30 million was spent this year alone on lobbying efforts against reforms. I would like unanimous consent to insert into the record this article, titled, “Lobbyists Declare Victory After Visa Reform Measure Dies Quietly.”

Well, it’s time for things to change. I was for reform. I wanted to make it better.

But, now I’m not so sure reforms are possible. It may be time to do away with it completely.

Maybe we should spend our time, resources and efforts in other programs that benefit the American people. Maybe it’s time this program goes away.

The next 10 months will be spent exposing the realities of this program. As Chairman, I will exercise oversight of this program even more than I have. I will ask tough questions and make more recommendations.

My quest to either have EB-5 reforms or end the program has just begun.

This is not the end. This is just the beginning.

Iowa Democratic Party press release, December 18:

Rod Blum, David Young and Steve King Vote to Shut Down the Government

DES MOINES – Today, Iowa’s GOP Congressmen – Rod Blum, David Young and Steve King – all voted against the bipartisan omnibus bill that will keep the government open until October.

IDP Press Secretary Josh Levitt issued the following statement in response:

“Iowans expect their elected leaders to work together to get things done and solve problems in Washington. But instead of working across the aisle to keep the government open, Rod Blum and David Young voted in line with Steve King and the Tea Party today in support of yet another costly government shutdown. While voting against this bipartisan agreement is completely unacceptable, it is not a surprise given that Rod Blum and David Young, like Steve King, have a history of opposing commonsense compromise agreements that are in the best interests of their districts.

“It is crystal clear that the extreme views of Iowa’s GOP Congressmen are completely out-of-touch with their constituents.”

BACKGROUND

Blum Voted To Shut Down The Government. “Rep. Rod Blum, R-1st District, joined with a majority of his Republican colleagues in opposing a continuing resolution to keep government open through Dec. 11. The measure passed 277 to 151. Democrats unanimously joined with 91 Republicans to support the measure to keep government open and avoid a shutdown that would have gone into effect at the end of the day Wednesday without passage.” [HR 179, Vote #528, 9/30/15; Waterloo-Cedar Falls Courier,10/01/15]

Blum Voted Against Bipartisan Budget Agreement. In October 2015, Blum voted against a bipartisan budget deal that would raise federal spending levels and expand the government’s borrowing authority, avoiding a default. “House lawmakers in both parties joined forces Wednesday to pass a sweeping budget deal … The final vote was 266 to 167, with 79 Republicans joining every Democrat in sealing passage.” [HR 1314, Vote #579, 10/28/15; The Hill, 10/28/15]

Young Voted Against Bipartisan Budget Agreement. In October 2015, Young voted against a bipartisan budget deal that would raise federal spending levels and expand the government’s borrowing authority, avoiding a default. “House lawmakers in both parties joined forces Wednesday to pass a sweeping budget deal … The final vote was 266 to 167, with 79 Republicans joining every Democrat in sealing passage.” [HR 1314, Vote #579, 10/28/15; The Hill, 10/28/15]

Young Voted Against Bipartisan Highway And Transportation Funding Bill. In November 2015, Young was one of only 64 members of Congress to vote against a bipartisan highway funding bill lauded by transportation advocates. “The House approved a bill to spend up to $325 billion on transportation projects on Thursday after a weeklong vote-a-rama and an intense debate about federal gas taxes … The House voted to approve the bill in a 363-64 vote. It calls for spending $261 billion on highways and $55 billion on transit over six years. The legislation authorizes highway funding for six years, but only if Congress can come up with a way to pay for the final three years.” [HR 22, Vote #623, 11/05/15; The Hill, 11/05/15]

Photo credit: Greg Hauenstein