Iowa Republican senators are considering a proposal to reduce individual and corporate tax rates and eventually phase out the state’s already-limited inheritance tax. The plan would increase revenue by making more goods and services subject to the sales tax, but those provisions would be difficult to move through the legislature, and even if enacted, would replace a small fraction of the money our cash-strapped state stands to lose from the tax cuts.

Governor Kim Reynolds told journalists this week she won’t reveal specifics about her tax plan–a top priority for 2018–until she delivers her Condition of the State address on January 9. She indicated she is waiting to see how Congress amends the federal tax code.

However, Senate GOP lawmakers and staff have received a detailed set of proposals for review. Bleeding Heartland obtained a lengthy memo describing “the tax reform plan prepared for the Governor’s Office” and estimating the fiscal impact of those changes. As with pending GOP legislation at the federal level, the largest benefits would flow to the wealthiest Iowans.

The unsigned “Preliminary Analysis” provides “revised revenue estimates for a proposal based on the tax reform plan prepared for the Governor’s Office dated on October 20, 2017 with some revisions.” Lines shaded in gray reflect proposals that changed between October 20 and November 29.

John Fuller of the Iowa Department of Revenue confirmed that department personnel prepared this document at the request of Pam Dugdale, a senior analyst on the Iowa Senate Republican caucus staff who works with the Ways and Means Committee. (The memo erroneously addresses Dugdale as if she worked for the non-partisan Legislative Services Agency.)

Fuller could not say whether the proposal originated in the legislative or executive branch. Staff for Reynolds did not respond to my inquiry. My source had the impression that Senate Ways and Means Chair Randy Feenstra spearheaded the work. Feenstra did not directly answer my question but said he has told his caucus members, “before anyone gets too excited about some tax plan, we need to see what the Feds [are] doing as there could be significant changes in revenue that comes into the State.”

In any event, a lot of work has gone into drafting this plan. UPDATE: About an hour after publication, Feenstra emphasized via e-mail that “every single run” from the Department of Revenue has this much data, whether requested by a Democrat or Republican. He added, “Not sure who the author is on this one; small reductions, not sure who put this one together. However, thanks for sharing! Very grateful as I need to find out if this member is running rogue over the Senate plan.”

I’m seeking further information on whether tax policy ideas not vetted by the Ways and Means chair are typically “prepared for the Governor’s Office,” as this plan was, according to the first sentence of the memo. LATER UPDATE: Feenstra himself circulated the document to Senate colleagues on December 8, calling it “my idea of a tax plan” and “one of my final runs that I have had the DOR work on.”

Highlights from the current version:

INDIVIDUAL TAX CUTS DELIVERING LARGEST BENEFITS TO THE WEALTHY

Among the changes affecting individual taxpayers, these are the most significant (from page 5):

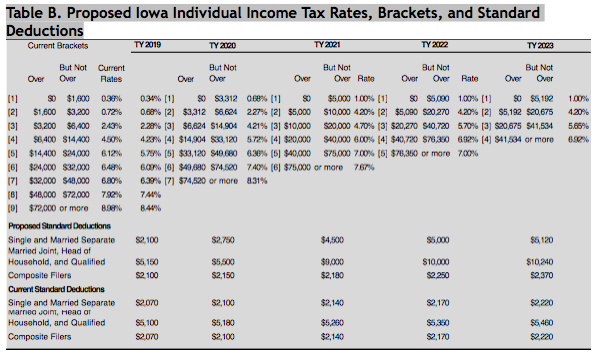

Under current law, there are nine marginal tax rates ranging from 0.36 percent to 8.98 percent. In tax year 2019, all tax rates are reduced 6 percent. Over tax years 2020 through 2023, the number of tax rates is decreased to four with a top rate of 6.92 percent.

The plan would slightly increase the standard deduction for most taxpayers and the pension exclusion for seniors as well (pages 5-7).

Notably, the current proposal would not end federal deductibility, which “allows taxpayers to deduct federal income tax paid from their Iowa income prior to calculating their State income tax liability for the year.” Only two states besides Iowa still have this provision on the books. Democratic lawmakers and progressive policy experts have long supported reducing individual income tax rates in exchange for ending federal deductibility (which would limit the revenue loss from the tax cut). Republican gubernatorial candidate Ron Corbett has endorsed the same trade-off. Reynolds didn’t rule out that approach in a May interview with the Des Moines Register’s Kathie Obradovich.

Worth noting: the top aide to Senate Majority Leader Bill Dix is Ed Failor, Jr. For many years, Failor led the conservative advocacy group Iowans for Tax Relief, which lobbied intensely against eliminating federal deductibility when the Democratic-controlled legislature was considering a broad tax reform bill in 2009.

Lowering individual tax rates becomes much more costly if Iowans can continue to use federal taxes paid to reduce their state taxable income. Commenting on the plan, Iowa Policy Project Executive Director Mike Owen told me on December 14, “If lawmakers seriously believe our income-tax rate structure needs to be revised, they can buy down rates with a reduction or elimination of Iowa’s unusual federal deductibility provision, in a revenue-neutral change.” He added,

In a time of budget shortfalls and service cuts it is irresponsible to be considering massive tax cuts that can be counted on to reduce revenues, by growing amounts. By the estimates provided, we would lose $900 million in both FY2023 and FY2024 from the income tax alone.

Owen derived that number from Figure 2 in the Department of Revenue memo.

I shared the memo with Democratic State Senator Joe Bolkcom, former chair of the Senate Ways and Means Committee and current ranking member on Appropriations. He found it “concerning” that the plan doesn’t get rid of federal deductibility on personal income taxes. That’s one of the “top issues” Iowa lawmakers hear people complain about when they see our top tax rate is 8.98 percent, the fourth-highest in the country. Bolkcom noted that “75 percent of the benefit of that provision goes to people of upper incomes.”

After reviewing the memo, Iowa State University economist Dave Swenson similarly pointed out,

If they are retaining federal deductability for individual income tax payers, this will result in lower state tax collections overall, with the bulk of the savings accumulating to the higher income brackets who are best able to utilize that deduction. And the overall reduction of rates by 6% will surely create problems down the road if we walk back into a recession or a regional slow-down. […]

We went through this when rates were reduced by 10 percent in the later 1990s. Then we got the 2001 recession, and we went through a series of very painful reductions in state spending (especially in higher ed). This will happen again. […] They should gut federal deductability and adjust the rates (even if it is fewer of them) so that the system, overall is revenue neutral for the majority of taxpayers. Iowa is not a high income tax state.

Table 5 of the memo shows how the proposed individual tax changes would produce the largest savings for Iowans with the highest incomes. In 2019, the average tax reduction would be $44 for someone with annual income between $20,000 and $30,000, $76 for a person making between $30,000 and $40,000, and $105 for someone with income in the $40,000 to $50,000 range. In contrast, the average savings would be $906 for an Iowan making between $250,000 and $500,000, $1,506 for someone in the $500,000 to $1 million range, and $3,215 for a person making more than $1 million a year.

It gets worse.

Iowa has long had an “unfair, regressive tax system,” in which the richest “pay a much smaller share” of their total income in state and local taxes than do middle-income or low-income Iowans. Table B shows that currently, people with net taxable income exceeding $72,000 are in the top bracket, subject to a nominal rate of 8.98 percent. Under the GOP plan, rates for people in the top tax bracket would drop gradually, but by 2023 that 6.92 percent rate would apply to everyone with net taxable income of $41,534 or more.

Swenson commented,

Basically, they’ve set it up so the top rate is applied to a school teacher with a few years under her belt all the way up to, oh I don’t know, [University of Iowa football coach] Kirk Ferentz. They are saying in effect that range is the extent of progressivity they will build into the tax system. […]

There is a clear shift of tax burden to true middle income households in this structure, and coupling that with the [sales tax] base broadening, the state’s overall tax structure will truly be more regressive than it already is.

The icing on the cake: this plan would eliminate the alternative minimum tax, a policy designed to impose at least some income tax on wealthy individuals who take advantage of many deductions, or who earn most of their money through investments rather than wages.

INCREASINGLY COSTLY CORPORATE TAX CUTS

Most of the proposed corporate tax cuts are pushed out to tax year 2022 and beyond, a tacit acknowledgment that Iowa cannot afford to enact them sooner, due to our budget crunch. In 2022, this plan would eliminate both federal deductibility and the alternative minimum tax for corporations.

Also in 2022, the top corporate income tax rate would drop from 12 percent to 10 percent, continuing to decline over four years until it reached 7 percent. During the same period, Iowa would shift from four marginal corporate tax rates to two; the lower one would eventually reach 5.5 percent. (The current lowest corporate tax rate is 6 percent.)

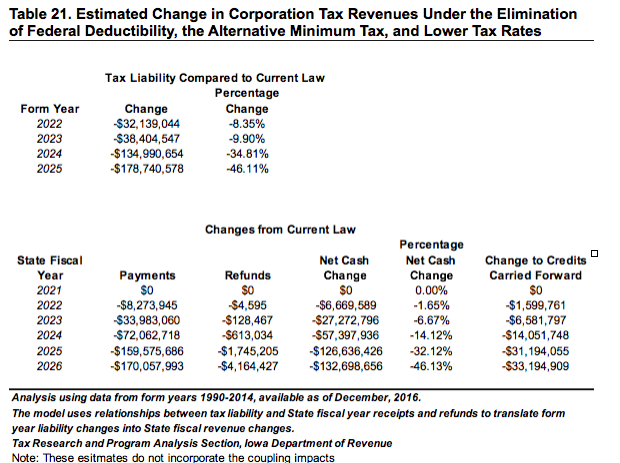

Perhaps Republican lawmakers will ignore the costs of those cuts, because they won’t take effect for a few years. But the impact on the budget would be considerable in the coming decade. The Department of Revenue projects that the change in tax liability for corporations would total $32.1 million in fiscal year 2023, $38.4 million in FY2024, just under $135 million in FY2025, and $178.7 million in fiscal year 2026. Some of that lost revenue for the state would be offset (for instance, by refunds, carry forwards, credits going forward), which explains the somewhat lower numbers in the “net cash change” column below. But that’s still a huge hit for state revenues. We struggle to fund education and other critical services adequately even under the current tax structure.

Jon Muller, a former revenue estimator and staffer for the Legislative Services Agency, commented on this part of the plan,

Iowa’s Corporate Income Tax is a Single Factor Formula. Corporations who do business in Iowa will not save a nickel in taxes if they leave the State. Nor will a company who locates to Iowa pay a nickel more in Corporate Income Tax. This is because the State Corporation Income Tax is purely a function of the Company’s sales within the State of Iowa. If the purpose of this massive tax cut is to increase competitiveness, it won’t. In fact, the lion’s share of the benefits will likely go to shareholders who don’t even live in the State of Iowa.

One more business tax cut is covered in the memo’s section on individual tax code changes. As part of “coupling” Iowa law with federal tax code, the plan proposes phasing in Section 179 expensing over five years. Here’s what Section 179 does:

This provision allows business taxpayers (including corporate taxpayers and business entities taxed through the individual income tax) to write off additional depreciation in the year a qualified depreciable asset is placed in service. Since the provision accelerates the claiming of depreciation, the provision reduces taxes owed in the first year, but increases taxes owed in later years.

Section 179 expensing is now a permanent part of the federal tax code, “set at $500,000 and indexed.” Iowa lawmakers approved Section 179 for state tax purposes several years in a row, most recently in 2016. The price tag was too high to manage this year, with revenues falling hundreds of millions of dollars below expectations.

The Department of Revenue memo discusses the cost of harmonizing state and federal codes on pages 3 and 4.

The provision with the largest estimated conformity cost is the higher Section 179 expensing limit. Although this is a business tax provision, most taxpayers taking advantage of this provision are small business owners or farmers who report business income on their individual income tax return. Under the proposal, the cap would be phased from the current $25,000 in TY 2017 beginning in tax year 2018 to the $560,000 effective cap for TY 2022.

Former Governor Terry Branstad’s budget did not include Section 179 expensing for 2018 or 2019. Reynolds has not signaled whether she will put it in her draft budget. The policy is a high priority for agricultural industry groups. GOP gubernatorial candidate Corbett has sharply criticized the legislature’s failure to pass a coupling bill this year.

The memo does not specify how much revenue will be lost due to the phase-in of Section 179 expensing. That policy was previously estimated to cost about $80 million per year.

ISU economist Swenson told me,

Phasing in or emulating Section 179 of the IRS code is a big wet kiss to farmers and other industries that buy equipment and machinery, in the main. Full expensing or nearly-full expensing of these investments has been around for a while. It’s popular. It only makes sense as a stimulus during a recession to help maintain demand for durable goods. And most corporations are awash with cash and industrial utilization has not recovered to the levels it was at before the recession. There is absolutely no economic argument for this.

BOOSTING SALES TAX REVENUE WITHOUT RAISING THE SALES TAX RATE

Corbett is on record supporting a 1-cent increase in the sales tax, of which 3/8th of a cent would fill the Natural Resources and Outdoor Recreation Trust Fund (approved by Iowa voters in 2010), and the remainder would help offset revenue losses from income tax cuts.

The plan now circulating among Republican senators would not raise the sales tax rate. Rather, it calls for “a modernization of the Iowa sales tax base to include digitally-delivered goods and services, consumer services, and nexus for online sellers.”

· Eliminates exemptions for several consumer purchases including digitally-delivered goods, personal instruction services, and the sales tax holiday.

· Expands the definition of nexus to include two categories of online retailers, marketplaces and non-nexus retailers that use apps on devices in Iowa to execute transactions.

· Extends the taxation of services to include subscriptions that give the purchaser the right to use items or receive services.

Table 23 lists the various goods and services that would be newly subject to sales tax under the proposal. Among the biggest revenue generators would be ending sales tax exemptions for: digitally-delivered books, games, or apps; massage therapy; delivery charges for consumer purchases; the clothing tax holiday during the first weekend of August; and architectural or engineering services.

A separate section of the table foresees charging sales tax on many online purchases. The third section estimates potential revenues from taxing “New Economy” sales such as Uber or Lyft rides, Xbox/Playstation games, or media delivery services like Netflix, Hulu, Sirius XM, Apple Music, and Spotify.

Sales taxes are among the most regressive taxes. When you consider how many goods and services could be subject to a 6 percent sales tax under this “modernization,” it’s apparent that the ensuing tax hike would cost many low- or middle-income Iowans far more than they stand to save from the income tax cuts ($100 or less for most people earning less than $50,000 per year).

Swenson told me,

Expanding the sales tax base will yield an increased reliance on regressive taxes. It will, however, help equalize the tax burden relative to purchases given existing brick and mortar stores versus internet suppliers. From a tax equity standpoint (like transactions being taxed similarly) it makes sense.

Bolkcom said he is “fully in favor of collecting internet sales tax” but questioned whether the state has the authority to do so without action from Congress. Every state is facing the problem of lost sales tax revenues due to increasing shopping online. “We’ve been waiting for some enabling legislation” from the federal government to allow states to address the issue, Bolkcom explained.

Muller described the plan to eliminate various sales tax exemptions as “a really aggressive proposal.” He anticipated it would be a heavy lift to bring state lawmakers on board, as interest groups typically fight to protect breaks they enjoy.

The Iowa Policy Project’s Owen was on the same wavelength.

the assumptions for increases in sales tax have two problems: (1) the increases if passed would not come close to filling the gap caused by the loss of income-tax revenue, and (2) they assume the increases will happen, when we know the lobby will be buzzing with activity to stop the elimination of many sales-tax breaks now on the books.

Assuming every one of these sales tax proposals becomes law, the Department of Revenue projects the state would collect an additional $139.1 million during fiscal year 2019, $151.6 million the following year, increasing to $206.4 million in fiscal year 2025. That’s not close to covering the revenue lost from the corporate and personal income tax cuts.

PHASING OUT THE ESTATE TAX

This entire section of the memo is shaded in gray, indicating someone pushed to add this idea after completion of the first draft on October 20.

The Iowa inheritance tax is repealed over five years. The proposal would be effective beginning with decedents dying on or after January 1, 2021 and passing property to non-lineal descendants. It is assumed that for deaths occurring in calendar year 2021 through 2025 the applicable inheritance tax rate would be reduced cumulatively by 20% each year according to the year in which the decedents died […].

Table D (page 9) indicates that this provision will cost the state more than $20 million in revenue in 2022, rising to more than $120 million a year once the tax has been eliminated. The people who stand to benefit are generally well-off already. Many of them don’t live in Iowa, so would be unlikely to spend any of their inheritance tax savings here.

Owen’s reaction:

it is hard to know whose nephew or niece may be clamoring for the phaseout of what’s left of Iowa’s already extremely limited inheritance tax. Already, lineal descendants do not face state inheritance tax in Iowa (sons and daughters do not pay state inheritance tax on their parents’ bequests). This is a solution in search of a problem, and the cost by FY2027 is estimated to be $122.8 million. For context, that is currently the cost of about 3 percent Supplemental State Aid for [K-12] schools.

Swenson was more blunt. “Eliminating estate taxes is just stupid. The state is saying that capital gains from very large estates should escape all taxation. There is no rationale for this beyond enriching the already enriched.”

WHAT’S MISSING FROM THE GOP PLAN

For lawmakers who serve on the tax committees, Bolkcom told me, part of the job “is to make sure the state has enough revenue to meet the priorities of the people of Iowa for education, public safety, and health care.” The biggest piece missing from this plan, in his view, “is any effort to rein in tax credits” and giveaways to business, which have been the fastest-growing part of state spending in recent years. For instance, the proposal says nothing about reforming the High Quality Jobs Program or the Research Activities tax credit.

Owen noticed the same omission. “Already, the 2013 commercial property tax cut is wreaking havoc with state and local budgets and there is nothing here, apparently, to fix that.” The Iowa Policy Project wants legislators to focus on making our overall tax structure less regressive. “Any state-level tax package needs to take into account the full effect of state and local taxes, and should, on balance, be lessening the impact on lower- and middle-income earners while keeping or enhancing revenues for critical services that benefit all Iowans, particularly the most vulnerable.”

If a bill resembling this plan becomes law, Iowa will move in the opposite direction. Muller concluded after reading the memo, “We’re already having very challenging fiscal issues in this state, and these changes in the aggregate will make it much worse.” Swenson saw signs Republicans are

adopting the same strategy used at the federal level – reducing revenues and then pleading poverty forcing the contraction of state supplied goods and services. This also is an ill-advised strategy in light of the harm that has already been done to state accounts and to state service delivery given the mismanagement that has already occurred and that will most assuredly continue on through the rest of this fiscal year.

Bolkcom warned the GOP plan could “set Iowa back decades” and “place the state budget in a constant state of crisis.”

Hundreds of millions of lost revenue over the next seven years will gut our local schools and workforce development efforts, wreck our fragile mental health system and shred our health care safety net.

I’ll update this post as needed with reaction to these proposals or further details about who drafted them.

UPDATE: Ways and Means Committee Chair Feenstra told me via e-mail he is “not sure” who developed this proposal. I’ve added his further comments near the beginning of the post, just before the memo.

Governor Reynolds’ spokesperson has not responded to my inquiries but told Barbara Rodriguez of the Associated Press, “It is impossible to come up with a tax reform plan until we see what is signed into law at the federal level,” adding, “We continue working on our approach to tax reform while monitoring closely what is passed at the federal level.”