The Iowa Department of Revenue and Finance (IDORF) has proposed new administrative rules, effectively providing a tax cut worth tens of millions of dollars for Iowa manufacturers. Absent a legislative response, the rule goes into effect January 1, 2016.

https://rules.iowa.gov/Notice/…

This is a serious overreach of executive power. The complexity of the issue, coupled with the unquenchable desire by the party in power to reduce taxes on business, provide the perfect climate to give a tax cut to manufacturers of some amount between $35 million to $80 million, perhaps more. This is an ongoing tax cut of increasing value. This action should be weighed against the Governor’s veto of $55.6 million of education funding….one-time education funding….because the State of Iowa ostensibly could not afford it.

And what is the stated purpose of this rule change? According to the notice, the rules are the “subject of a substantial confusion and controversy.” Furthermore, the change will eliminate “administratively burdensome distinctions…”

Periodically, a taxpayer will contest a ruling and win in court. When that happens, the Department provides a rule change that brings its practices in harmony with current law. That is not what is happening here. The Department is not losing cases in defense of the law. It simply finds the effort administratively burdensome.

How burdensome? The Department has identified 1,500 hours costing $85,000 that is required to enforce the Code of Iowa. That represents 0.24% of the revenue the Department claims to collect from this tax, and probably a lower percentage than that, for reasons discussed below. Interestingly, the Department’s budget is $17.8 million. They collect $8.4 billion in taxes. Their entire budget is 0.21% of each dollar collected. The Department should be commended for the efficiency with which it collects these complicated sales taxes owed by businesses to the State of Iowa.

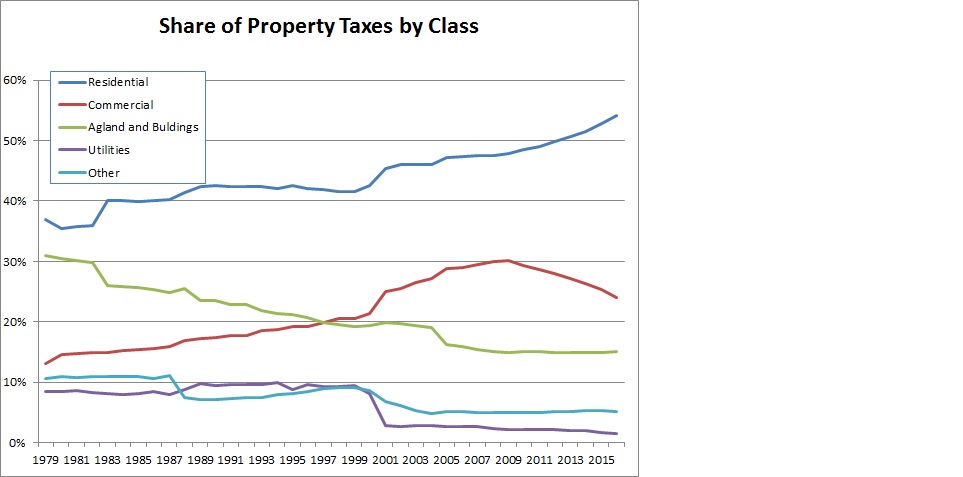

A little historical context is in order. Generally speaking, manufacturers do not pay sales tax on machinery and equipment, supplies, and replacement parts that are part of the “value-added” process. Machinery and equipment was removed from the property tax roles in the late 1990s, a tax benefit of over $200 million, primarily to manufacturers. Most of this equipment is already exempt from sales tax. This latest administrative action continues the drip drip drip of the erosion of the tax base.

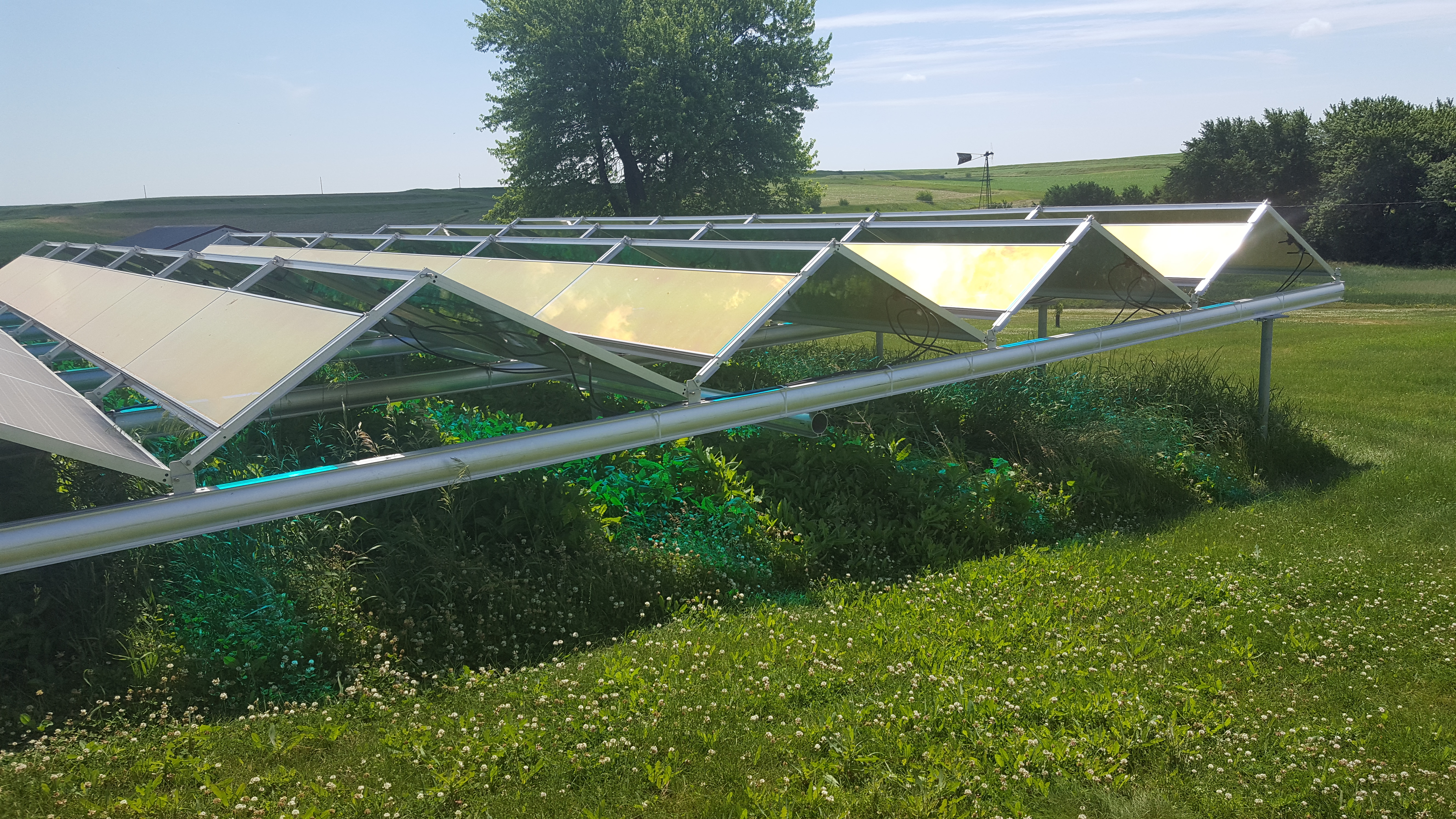

Normally, when the Governor wants to provide a tax cut to businesses or individuals, he makes a recommendation to the Legislature. The Senate and the House work out the details, and send a bill to the Governor to sign. That’s how it worked when they cut property taxes for commercial property owners by $200 million two years ago. That’s how it worked when they cut $200 million in property taxes for business in the late 1990s. That’s how it worked when they cut the sales tax on bailing twine, computers purchased by insurance companies with more than 50 employees, supplies purchased by greenhouses, or my personal favorite, the tax on sales of “tangible personal property sold to a nonprofit organization which was organized for the purpose of lending the tangible personal property to the general public for use by them for nonprofit purpose.”

The issues related to the tax itself are complicated. And the roles of the three branches of government in the execution of the sales tax are complicated as well. This combination makes it difficult to engage in a widespread public policy debate with anything beyond the soundbites. Soundbites, which in this case, are true. Namely, the Governor’s actions demonstrate that the State has enough money to give business a $365 million tax cut over the next ten years, but doesn’t have $55.6 million for schools, one time.

For those requiring a little more Inside Baseball, three factors need to be explored. First, do we really know how much this exemption will cost? Second, an explanation of why this rule is beyond the scope of the Department’s administrative authority. Third, a discussion of the process by which this rule will be implemented or overturned.

Continue Reading...