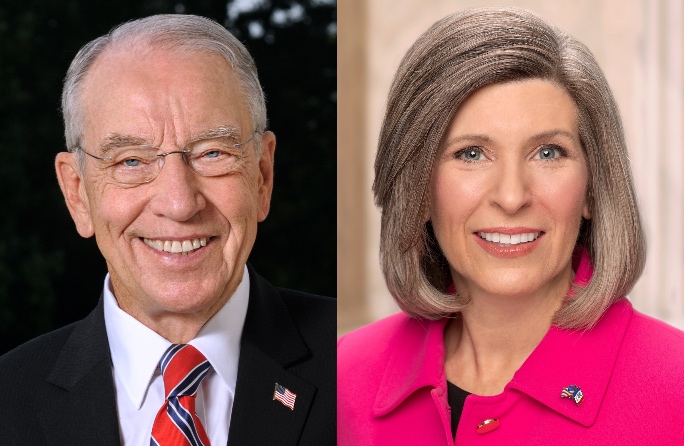

I learned at Iowa Independent that Senator Chuck Grassley told reporters on Wednesday that he would vote for the economic stimulus “regardless of what else is in the bill” if the Senate approved an amendment providing for 30-year fixed-rate mortgages at 4 percent interest.

He remained critical of the spending in the bill:

“People at the grassroots see it as a lot of spending and not very much stimulus,” Grassley said. “Somebody thinks they’re fooling the people of this country with this package, but they aren’t.”

Senator Tom Harkin’s office put out a statement on Tuesday listing some of the proposed spending that would benefit Iowans:

February 3, 2009

HARKIN: $1.5 BILLION INCLUDED FOR IOWA IN SENATE STIMULUS PACKAGE

Washington, D.C. – U.S. Senator Tom Harkin (D-IA) today announced that there are more than $1.5 billion in critical investments for Iowa included in the Senate version of The American Recovery and Reinvestment Act. These investments will create and save jobs; help with budget shortfalls to prevent deep cuts in basic services such as health, education, and law enforcement; cut taxes for working families and invest in the long-term health of our economy.

“The economy is now shedding an average of 17,000 jobs a day, and new foreclosures average 9,000 a day. We are facing what could be the deepest, longest recession since the Great Depression. We must act quickly and boldly,” said Harkin. “This bill will create jobs now while also laying the foundation for a stronger economy that works for all Americans in the future.”

The American Recovery and Reinvestment Act provides $888 billion in investments and tax cuts. Of this total, $694 billion will enter the economy by the end of Fiscal year 2010, meaning that 78 percent of the monies allocated will reach the American people by September 30, 2010, providing an immediate boost to the overall economy and creating an estimated four million jobs nationwide.

Below are the approximate investments Iowa could see if the Senate bill is passed and signed into law by the president. These amounts only include major accounts that are allocated by formula, and do not include the considerable funds that will be allocated competitively by the executive branch.

Nutrition Programs

· $2.3 million for School Lunch Programs

· $109 million for the Supplemental Nutrition Assistance Program

· $776,000 for the Emergency Food Assistance Program

Homeland Security Programs

· $639,000 for the Emergency Food and Shelter Program

Clean Water Programs

· $24 million for the Drinking Water Fund

· $54 million for the Clean Water Fund

Transportation Funding

· $389 million for Iowa ‘s Highway fund

· $46 million for Transit Funding

Housing Programs

· $7.6 million for public housing capital

· $14.8 million for HOME funding

· $16.8 million for homelessness prevention

Law Enforcement / Crime funding

· $14 million for Byrne/JAG funding

· $978,000 for crime victim programs

· $1 million to protect children against internet crimes

· $3.2 million to assist women who are victims of violence

Energy Programs

· $6.6 million for Iowa ‘s energy program

· $48.6 million for weatherization programs

Labor, Health and Human Service and Education Programs

· $18.1 million for Child Care and Development Block Grants

· $5.2 million for Head Start

· $625.6 million for the state stabilization fund

· $65.4 million for Title 1 programs

· $140.1 million for Special Education Part B Grants

· $46.1 million for Higher Education Facilities

· $1.6 million for Adult Employment and Training

· $78.7 million for School modernization

· $5 million for education technology

· $2.2 million for Community Service Block Grants

· $441,000 for Senior Meals

· $3.9 million for Employment Service Grants

· $5 million for Dislocated Worker Grants

· $5.4 million for vocational rehabilitation programs

· $7.2 million for immunization programs

Some of these programs yield more “bang for the buck” than others, and there’s an argument to be made that the stimulus bill has too much of a grab-bag quality. Yesterday Daily Kos user TocqueDeville lamented the fact that Democrats put together a spending bill instead of “a big, unifying vision for the future – a Rebuilding America Act.” I agree with much of the critique and would have liked to see some different spending priorities.

That said, even an imperfect spending bill will do more to stimulate the economy than the tax cuts favored by Republicans.

I don’t know the specifics of the amendment Grassley supports, but in general making low-rate mortgages more accessible would be good. It was stupid as well as unethical for Federal Reserve Chairman Alan Greenspan and other wise men of Wall Street to encourage so many Americans to buy adjustable-rate mortgages.

I was surprised to see Grassley say that the low-rate mortgage provision would be enough to win his vote for the stimulus. Senator Judd Gregg got a post in Barack Obama’s cabinet and still won’t vote for the bill.

If Grassley ends up voting yes on the stimulus, the wingnuts will go ballistic, but what can they do other than add a line to Grassley’s entry on the Iowa Defense Alliance “Wall of Shame”?

In other stimulus-related news, Obama published an op-ed in the Washington Post making the case for this package. Excerpt:

This plan is more than a prescription for short-term spending — it’s a strategy for America’s long-term growth and opportunity in areas such as renewable energy, health care and education. And it’s a strategy that will be implemented with unprecedented transparency and accountability, so Americans know where their tax dollars are going and how they are being spent.

In recent days, there have been misguided criticisms of this plan that echo the failed theories that helped lead us into this crisis — the notion that tax cuts alone will solve all our problems; that we can meet our enormous tests with half-steps and piecemeal measures; that we can ignore fundamental challenges such as energy independence and the high cost of health care and still expect our economy and our country to thrive.

I reject these theories, and so did the American people when they went to the polls in November and voted resoundingly for change. They know that we have tried it those ways for too long. And because we have, our health-care costs still rise faster than inflation. Our dependence on foreign oil still threatens our economy and our security. Our children still study in schools that put them at a disadvantage. We’ve seen the tragic consequences when our bridges crumble and our levees fail.

It’s a start, but I agree with early Obama supporter Theda Skocpol. Obama mishandled this effort by making bipartisanship (instead of saving the economy) his measure of success. He can undo some of the damage by going directly to the people to make the case for the stimulus. But unfortunately, the Republicans still have the upper hand if they vote against the bill and blame the president for not giving them enough input.

Continue Reading...