Iowa Senate Republicans are barreling ahead to debate a regressive tax plan that would reduce state revenues by 10 to 15 percent within five years. Senate Ways and Means Committee Chair Randy Feenstra, lead author of Senate File 2383, continued to describe his proposal as “bold, pro-growth tax relief” after a non-partisan analysis projected massive revenue losses.

Meanwhile, newly-released records show that in communications with other GOP senators, Feenstra greatly understated the cost of an earlier draft of his tax proposal. The documents don’t indicate whether the head of Senate’s tax-writing committee misunderstood numbers provided by the Iowa Department of Revenue or misrepresented them to downplay the price tag. (Feenstra has not responded to my inquiry.)

What is clear: the Department of Revenue never predicted that deeply cutting taxes would produce “excess” economic growth. Which isn’t surprising, since no economic boom materialized in states like Kansas and Louisiana after Republicans destroyed those states’ ability to pay for essential services.

“MORE FISCALLY IRRESPONSIBLE THAN MANY IOWANS IMAGINED”

Nine Republicans on the Ways and Means Committee used a highly irregular process last week to move the tax bill forward without any analysis of its provisions. Feenstra repeatedly promised that senators would be able to review details about the impact on taxpayers and the state budget before the full chamber voted on the legislation.

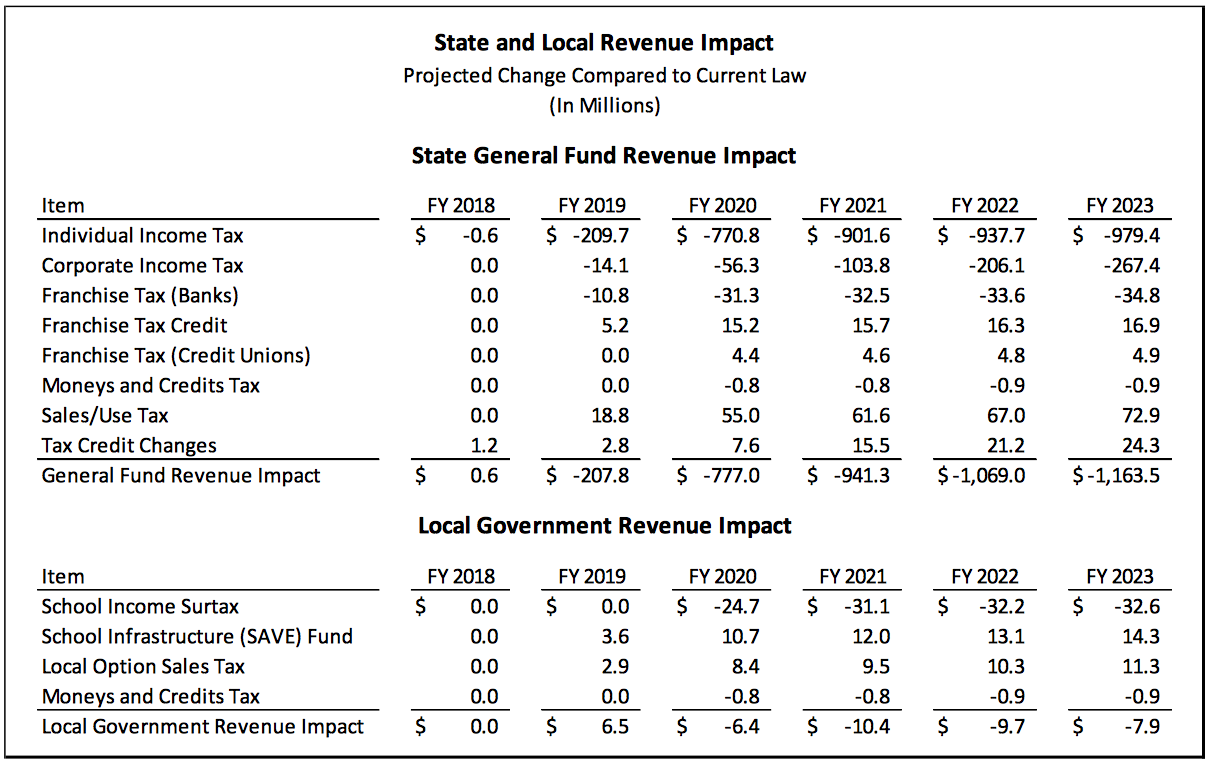

The Legislative Services Agency published its fiscal note on Senate File 2383 late in the day on February 27. The bill’s cumulative effect would reduce general fund revenue by $207.8 million in fiscal year 2019, $777 million in fiscal year 2020, $941.3 million in fiscal year 2021, $1.069 billion in fiscal year 2022, and $1.164 billion in fiscal year 2023–around 15 percent of the $7.2 billion general fund budget.

As you can see from this table, applying sales or use taxes to more goods and services and scaling back some tax credits would slightly increase revenues. But those provisions would cover less than 10 percent of the projected losses from individual and corporate income tax cuts.

To give you a sense of what $1 billion in lost revenue looks like: Democratic Senator Herman Quirmbach pointed out last week that shutting down all Iowa universities and community colleges would save only about $800 million annually. After interviewing Feenstra and other GOP senators, the Des Moines Register’s Kathie Obradovich concluded they were “clueless” on how to pay for their tax cut.

Randy Bauer, a former state budget director at the Department of Management and former senior analyst for Senate Democratic research staff, commented after the fiscal note appeared, “Those are absurd numbers – the Governor and Legislature had to resort to using the rainy day fund to balance the budget this year with far less reduced revenue.”

With only four months remaining in the current fiscal year, House and Senate Republicans have not finalized a plan to cut this year’s spending by some $30 million to $40 million. Yet GOP senators are rushing to vote for ongoing revenue reductions that would be 30 times as large a few years down the road. Iowa Policy Project executive director Mike Owen slammed the “poisoned process” in this excellent commentary.

Senator Pam Jochum, the ranking Democrat on Ways and Means, said in a February 27 statement that Feenstra’s tax bill “is more fiscally irresponsible than many Iowans imagined.”

“Contrary to the claims of Senate Republicans, their tax plan is NOT fair to many Iowans, it does NOT make Iowa more competitive with other states, and it certainly does NOT take into account the ongoing budget crisis.

“Iowans understand that the tax plan offered by Senate Republicans must be viewed in light of disastrous tax-cut plans approved in Kansas and Oklahoma, which have resulted in massive cuts to education, public safety and other vital services.

State Representative Dave Jacoby, the ranking Democrat on the House Ways and Means, amplified those points in his comments on the fiscal note.

The GOP’s tax plan is worse than advertised. It’s got $790 million in new corporate tax giveaways and another oversized tax break for millionaires while low income Iowans get little. The $1.16 billion price tag will break the state budget and leave Iowans with mountains of debt.

We’ve seen the devastating reality of similar tax cut plans passed in other states like Kansas. The GOP plan will leave the state budget with deficits for the next decade, Iowa families will pay higher property taxes, public schools will continue to be shortchanged, and students will pay even higher tuition at community colleges and universities.

JUST STARTING A CONVERSATION?

Feenstra assured Ways and Means members last week that he was working with the Appropriations Committee to make the “necessary adjustments” so the tax cuts don’t “negatively affect” the state’s ability to fund priorities.

But Republicans have no plan to cover the costs. That was obvious from Appropriations Committee chair Charles Schneider’s remarks during the Clive Chamber of Commerce legislative forum on February 24 (audio here).

Schneider said the GOP tax bill, rammed through committee only a day after its publication, is “really meant to be the start of a conversation about tax reform on our side. Or the continuation of one,” since Governor Kim Reynolds has submitted her own plan to state lawmakers. He claimed Feenstra “has worked closely with the Department of Revenue” to determine the likely impact on the budget.

Republicans have not released charts or tables showing how various elements of the plan would affect Iowans of different income levels. Such information would be a standard part of Department of Revenue analysis; you can view one example of a tax “run” here. I assume Feenstra has kept those details under wraps because they would show his bill mostly benefits wealthy individuals and corporations, not low- and middle-income Iowans.

The Iowa Fiscal Partnership obtained the Department of Revenue’s analysis of the Senate GOP bill, sent on February 26 to Jeff Robinson, senior fiscal analyst for the Legislative Services Agency. From the partnership’s report on those findings:

While [Iowa] filers with incomes over $250,000 represent only 4 percent of filers, they receive over 17 percent of the tax reductions in tax year 2019, about $120 million. By tax year 2023, 22 percent of the tax reductions, $227 million is taken by these wealthy tax filers.3 The big benefits at the top in part are the result of providing additional preferential state tax treatment of so-called “pass through” income and come on top of major tax cuts these filers receive through the recently passed federal tax cut. […]

For FY2019 13 percent of revenues disappear from the corporate income tax. This accelerates to 53 percent in FY2022.[5] (See bar graph.) Still, in FY2022 nearly half of all corporations with income under $250,000 will pay more, while only a third will pay less.[6] The gains are highly skewed to the largest and most profitable corporations.

Schneider told constituents in Clive he was “under no illusion” that House members would accept everything in the Senate’s tax bill, which he again characterized as a “continuation of a conversation.” He predicted a compromise involving phased-in tax cuts and ending federal deductibility, which are part of the governor’s proposal and will form the basis for the House Republican bill. The lead appropriator added,

I also want to stress that what’s important to us, too, and to me in particular, is to make sure that we continue to fund education, Medicaid, public safety, and other state services. We’re not going to jeopardize those for our tax bill. We’ve already committed to spend an additional 50 million dollars for K-12 education [editor’s note: see here]. So, the sticker shock of our plan may look big, but we’re realistic in knowing that we’re going to have to negotiate the final arrangement with the House and with the governor, and that we’re going to have to meet our obligations as well.

In other words: trust us, even though we can’t show how to make these numbers work.

DON’T COUNT ON “EXCESS” GROWTH TO MAKE UP FOR REVENUE LOSSES

Feenstra and others may claim during today’s Senate debate that their tax bill will generate more revenues than expected, thanks to a surging economy. The experience of Louisiana and Kansas belies stale rhetoric about “pro-growth tax relief.” Speaking to Obradovich, Feenstra even admitted, “We’re not looking at any economic growth in this bill. We hope that economic growth plays out, but we are not forecasting any economic growth.”

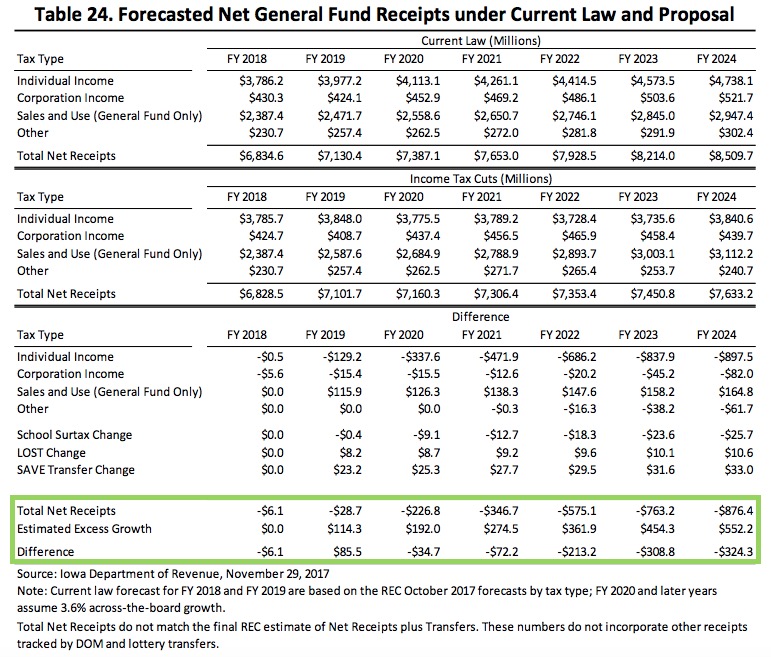

Bleeding Heartland reported in December that Senate Republicans appeared to be relying on a form of “dynamic scoring” to underplay the impact of their tax plan on the state budget. I drew that conclusion after reading Feenstra’s message to GOP colleagues and caucus staff about what was then his working draft of a tax plan. Listing the expected “cost reduction in revenue” through 2023, Feenstra pulled numbers from the last line of this table (“Difference,” or “Total Net Receipts” minus “Estimated Excess Growth”).

Feenstra was asserting that the numbers on the “difference” line represented how much his proposal would reduce state revenues. He should have used the higher numbers on “total net receipts” line. Note that the current bill is even more costly than the December version of the plan.

After noticing the oddities on Table 24, I asked Department of Revenue staff for the assumptions and justifications underpinning the “estimated excess growth” numbers. Ten weeks later, I’ve received no reply.

Others managed to get their questions answered more promptly. Last week, the Department of Revenue released some records I requested in late December. They included correspondence from Amy Rehder Harris, chief economist and administrator of the department’s Research and Analysis Division. Jeff Robinson had spotted the strange numbers almost immediately after I published what was then Feenstra’s working draft on December 15. In a message to Harris that day, Robinson wrote, “At the bottom of Table 24 there is a line called ‘estimated excess growth’. Is that explained somewhere in the memo (if it is I missed it). If it is not explained, could you explain it to me?”

Jace Mikels, a research analyst on the Iowa Senate Democratic caucus staff, wrote to Harris a few days later, “I was looking through the memo in this story that was shared online last week. On the final page (Table 24) there is a line described as ‘estimated excess growth’. I’ve never seen a line like this on any other report Revenue has put together. Can you tell me what this line reflects and what this estimate is based on?”

Harris e-mailed Robinson and Jakels the same explanation on December 20.

That is a new concept that my team put forward this summer based on the idea that tax revenues must grow at the rate of population growth and inflation each year in order to maintain the current level of State services (very simplified economists’ budgeting concept). Based on REMI forecasts of Iowa population and Moody’s Analytics consensus forecast of inflation, then revenues would need to grow by an average of 2.65% each fiscal year over the forecast window to keep up with population and inflation. The “estimated excess growth” amount simply reflects the estimated difference in the forecast of net receipts (assuming cumulative 3.6% growth in FY 2020 and later after REC forecasted growth in FY 2018 and FY 2019) over the baseline cumulative 2.65% growth.

Robinson thanked Harris, adding, “The numbers at the bottom of Table 24 are obviously being misinterpreted by Bleeding Heartland and the Senate Ways and Means Chair.”

For the record, I would have happily corrected my December 19 post if the Department of Revenue had answered my questions about the so-called “estimated excess growth” instead of stonewalling me for more than two months.

Feenstra is supposed to be the expert on this subject. The tax bill is his baby. I was just trying to figure out how he arrived at the numbers he cited when sharing his draft with Republican senators.

Mikels had more questions for Harris:

That explanation makes sense to me, but is there any historical data to back up including something that “would need to happen” to the balance sheet as something that will happen? The way the table comes across to me is that the estimated excess growth looks like it balances out a portion of the lost revenues from the tax policy changes. That seems counterintuitive to me because it would seem that estimated excess growth is being added on top of the forecast net receipts. Based on your explanation the estimated excess growth is more of a forecast of the need for a growth in expenditures, not what the state will be receiving in revenues.

She didn’t reply, so Mikels asked a different Department of Revenue staffer in early January,

I wanted to follow up on this email since I have not heard back from Amy yet. I would like to know why “estimated excess growth” was included on the balance sheet when it doesn’t seem to be anything that would add to revenues? Is this item going to be included as a standard practice when Revenue prepares estimates in the future?

Harris finally wrote back to Mikels on January 17.

The concept you mentioned is not something that the Department plans to include in our regular fiscal estimates and is not considered something that adds to revenues. In this case, we were trying to put long-term revenue growth forecasts into context by comparing the change in estimated general fund net receipts after the proposed reform (using REC and 3.6% growth) to any revenues estimated under current law compared to a minimal revenue baseline matching population and inflation growth.

Key phrase: not considered something that adds to revenues.

Regardless of what you may hear from Feenstra, Senate Majority Leader Bill Dix, or others for whom tax cuts have become a religion, the government’s top analysts do not expect cutting taxes to increase tax receipts. Any new law remotely resembling this plan would send our state on what Iowa State University economist Dave Swenson called a “turbo-charged race to the bottom.”

UPDATE: During the February 28 floor debate on Senate File 2383, Jochum moved to refer the bill to the Appropriations Committee, where members could figure out how to account for $208 million less revenue in the coming fiscal year. Senators rejected her motion along party lines.

The chamber adopted a manager’s amendment from Feenstra. Among its provisions:

• phasing in higher standard deductions for some tax filers

• striking language that would apply sales tax to digital products

• reducing historic preservation tax credits from $45 million to $40 million annually (the original bill would have cut them to $35 million)

Several senators withdrew amendments that lacked the support to pass. Democrat Chaz Allen’s amendment would have restored a tax credit for volunteer firefighters. Republican Brad Zaun’s amendment would have removed the section to levy a new income tax on credit unions. The banking industry has been lobbying hard to tax credit unions like banks. Zaun apologized for disappointing his friends but said he didn’t have the votes. I would rather see a roll call on amendments like that, to get everyone on the record.

Many Democrats spoke persuasively against the bill, including Tony Bisignano, Nate Boulton, and the six members of the Ways and Means Committee: Jochum, Matt McCoy, Rob Hogg, Herman Quirmbach, Joe Bolkcom, and Bill Dotzler. Several referred to the disastrous consequences of deep tax cuts in Kansas, with Jochum and Quirmbach providing many examples. Zaun countered (erroneously) during his floor speech that the budget problems in Kansas stemmed from falling oil and grain commodity prices, not tax policies.

Quirmbach had a sharp exchange with Schneider, pressing him on where he would find even $100 million in spending cuts, let alone enough to balance the budget if this bill became law. Schneider insisted that tax cuts would make Iowa’s business climate more competitive and boost the economy in many ways.

Side note/Iowa political trivia: Quirmbach, Bolkcom, and Hogg were among the six senators who voted against the unaffordable 2013 commercial property tax cut.

Whereas Feenstra and others described their bill as “bold,” Dotzler argued that “stupid” would be a better adjective. A longtime member of the Economic Development Committee, Dotzler explained that many businesses would be hurt by the plan’s provisions.

Bolkcom quoted from the just-released Department of Revenue analysis to illustrate that wealthy people and big businesses will receive the most money back, with some 36 percent of all Iowa households expected to see either no change in their tax liability or a tax increase next year. Some of those statistics are also mentioned in this Iowa Fiscal Partnership report. Bolkcom concluded, “Working families are going to be losers in this plan.”

In his closing remarks, Feenstra thanked the top Ways and Means staffer Pam Dugdale for her work on this bill, reminding me that the Department of Revenue (in my view illegally) withheld some records I requested, including staff communications with Dugdale.

The floor manager accused Democrats of scaremongering about public services and asserted, “We know what we’re doing.” (Not likely.)

Responding to Democrats who had noted that low-income Iowans would receive the equivalent of a Happy Meal, Feenstra claimed, “Inside every Happy Meal, the toy will be $1,000.” Fast-tracking the bill made it easier for Feenstra to get away with blatantly false statements like that one.

Although his closing speech repeatedly asserted his bill would let “hard-working Iowans keep their money,” Feenstra never addressed Bolkcom’s observation that many lower-income and middle-income taxpayers would pay more under the GOP plan.

After about two hours of debate, the Senate approved the bill along party lines, 29 votes to 21 (independent Senator David Johnson joined Democrats to oppose the legislation).

1 Comment

Jaw-dropping

When I started reading this post, I wasn’t sure I would really understand it. Now I almost wish that I didn’t understand it.

PrairieFan Wed 28 Feb 9:39 PM