“Republicans led on tax reform in 2018,” Governor Kim Reynolds asserted in a news release after lawmakers adjourned for the year on May 5. “As a result, hardworking, middle class Iowa families, farmers, small business owners and workers get meaningful relief, all while Iowa’s budget priorities in future years are protected.”

None of those claims withstand scrutiny.

LITTLE “TAX REFORM” IN MASSIVE BILL

Reynolds announced during her Condition of the State speech in January,

I will be proposing a tax reform package that significantly reduces rates, modernizes our tax code, eliminates federal deductibility, and provides real tax relief for middle class families, farmers, and small businesses. […]

This is an opportunity to free us from decisions made in Washington, D.C. and simplify our tax code. And, more important, Iowans will keep more of their hard-earned money. […]

Both chambers passed Senate File 2417 by party-line votes on the last day of the session. The governor’s May 5 press release, enclosed in full at the end of this post, praised the bill for “dramatically simplifying Iowa’s overly complicated tax code,” making it “more competitive and transparent.” But the bill doesn’t live up to the hype.

In a must-read May 3 blog post, Iowa Policy Project research director Peter Fisher’s first observation about the GOP deal was, “It is not income tax reform.”

As we have pointed out previously, real income tax reform would rein in expensive business tax credits that have little effectiveness, eliminate federal deductibility, increase recognition of the costs of raising a family, and raise the Iowa standard deduction — which would both simplify taxes for thousands of Iowans, and target tax cuts at lower and middle-income taxpayers. The tax bill does none of these things for the next four years.

Earlier versions of the House bill would have increased the standard deduction and eliminated federal deductibility, but those provisions were jettisoned in favor of $40 million in corporate tax cuts and more tax preferences for high-income business owners. The bill does little to reform business tax credits; in fact, the only credits that are eliminated are those for customer energy production and conservation — solar and geothermal. [Editor’s note: only the geothermal credit got the axe in the final bill.] It adds a new and expensive loophole — a deduction for pass-through income from certain businesses.

At least three news releases from the governor’s office have claimed the tax deal eliminates federal deductibility. In reality, that provision could take effect in 2023 at the earliest. More likely, it will never happen. Certain tax code changes will phase in four years from now only if state revenues reach a level that “would require growth rates of over 5 percent per year,” according to Fisher. Big tax cuts didn’t spur economic growth or surging revenues in Kansas, Louisiana, or Oklahoma. There’s no reason to expect a different outcome here.

Triumphant rhetoric notwithstanding, Reynolds failed to persuade her own party to adopt what was supposedly a central element of her tax reform plan. That’s no surprise, since top Republicans on the House and Senate Ways and Means Committees never favored eliminating federal deductibility.

If the governor had been committed to simplifying the tax code for most Iowans, she should have insisted on increasing the standard deduction, currently set at $2,070 for a single person and $5,090 for a married couple filing jointly. “We stand very far away from providing a meaningful standard deduction in our state,” Charles Bruner said during a May 4 call with reporters.

The governor’s plan would have increased the standard deduction to $4,000 for a single person and $8,000 for a married couple. The first tax bill to get through the House Ways and Means Committee this year would have set the standard deduction at $3,000 for individuals and $7,500 for married couples. The final deal ditched what would have been the “one provision targeted at middle-income tax filers,” Bruner told journalists on May 4. Under the bill Reynolds will sign soon, filers

are not going to have any recognition of what it takes to maintain a household–buy food, have clothing, and housing. They’re not going to have any recognition unless they itemize. And then, for those who itemize who are renters, they don’t get any benefit from the cost of rent.

Fisher noted on the same conference call that the new federal tax law doubled the standard deduction to $12,000 for single individual and $24,000 for a married couple. (That was one of the few positive changes in the mostly-terrible bill Congressional Republicans approved in December.) As a result, Fisher said, most Iowa taxpayers won’t need to itemize on their federal return. However, when they fill out their state return, “they’re going to find that if they want to take advantage of the full deductions they’re eligible for, they are going to have to itemize. And that’s going to be a large portion of Iowa taxpayers.”

Reducing the number of income tax brackets won’t make the process simpler for them.

NO “MEANINGFUL RELIEF” FOR MIDDLE-CLASS WORKERS OR FAMILIES

Reynolds hailed the tax bill for “prioritizing Iowa’s hardworking, middle class families.” Her administration’s own data belie that claim.

The damning assessment is buried in this Iowa Department of Revenue analysis. It contains a 13-page letter explaining the policy changes and 36 pages of tables illustrating the impacts.

Table 6A projects how the income tax changes would affect Iowans at various income levels in 2019. I added the red box around the column showing the average decrease in state tax liability. Just under 970,000 Iowa filers will report incomes below $60,000 next year. On average, they will save between $1 and $152 on their income taxes.

About 32,000 Iowa tax returns will report income exceeding $250,000 next year. Those making between $250,000 and $500,000 can expect to save $2,593. Those making between $500,000 and $1,000,000 will save on average $6,465. Iowans making more than a million a year will pay on average $18,733 less in state income taxes next year.

The final deal “is more skewed to the richest Iowans than previous bills,” Fisher wrote last week. The disparity gets worse over time. The Iowa Fiscal Partnership prepared these graphics based on the Department of Revenue’s Table 9A, showing projected average income tax savings by income level in 2021.

Put another way in a Des Moines Register article by Kevin Hardy and Brianne Pfannenstiel (emphasis in original),

In tax year 2021, Iowans who earn $60,000 or less — more than two thirds of all tax filers — will save about $58 million collectively. That represents about 13 percent of the total tax savings of $443 million.

Taxpayers earning $250,000 and above — who represent about 2.5 percent of all taxpayers — will see a collective savings of $206 million. That represents 46 percent of the total $443 million taxpayers will save in tax year 2021, the Department of Revenue reports.

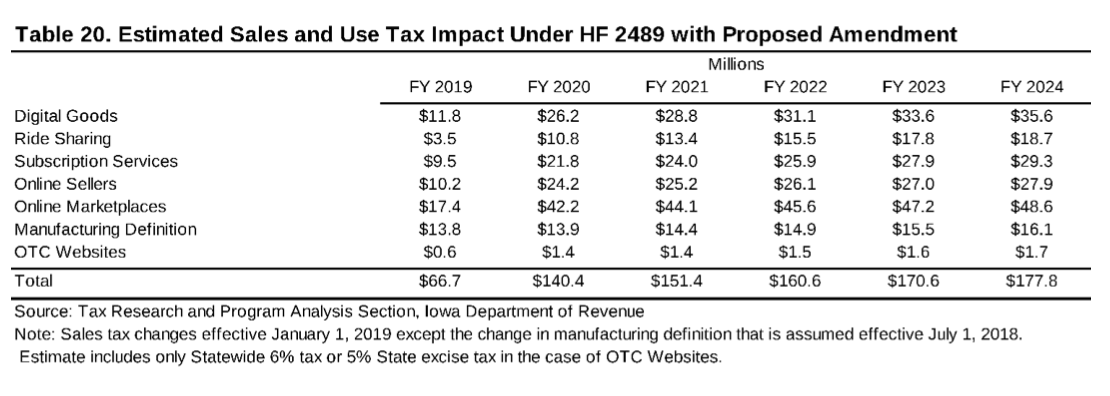

In order to offset part of the revenue lost through individual and corporate income tax cuts, the bill would apply sales tax to digital goods, ride sharing, subscription services, and products purchased online. The state’s ability to tax internet purchases isn’t a sure thing; as Randy Bauer explained here, it will depend on a forthcoming U.S. Supreme Court ruling. But assuming the policy pans out and the Department of Revenue analysis is correct, the sales tax changes will increase state revenues by $66.7 million next year and by more than $140 million in subsequent years.

In a curious omission, the department did not publish any tables projecting how much taxpayers at various income levels are likely to pay in additional sales tax under the proposal. Did staff neglect to crunch those numbers? Or did they purposefully leave them out of the findings, so as not to reveal that higher sales tax payments will cancel out much of the expected income tax savings for Iowans near the bottom of the income scale? I have inquired and will update this post as needed. (The Department of Revenue has not always been responsive.)

The Institute on Taxation and Economic Policy calculated earlier this year that new sales taxes may cost lower-income Iowans an extra $16 per year, rising to more than $200 for the wealthiest individuals.

UPDATE: Department of Revenue public information officer John Fuller responded,

The Department has recently developed a sales tax incidence model based on the best practices of other states. Unfortunately, the data does not breakdown the mode of purchase. Therefore, we did not feel comfortable using that model to estimate the specific changes proposed in the tax reform legislation this year where the means of purchase was the key policy change as opposed to the type of good.

We are unaware of the data or methodology used by the Institute on Taxation and Economic Policy to get around the data limitations we encountered in our modeling.

Jon Muller, a former Legislative Services Agency staffer and Iowa revenue estimator, told Bleeding Heartland on May 6,

This bill represents a break with the Republicans of old. They passed a massive income tax cut in the late 1990s. But they stayed within the lines of a 5 year budget projection, and they didn’t give larger percentage cuts to rich people than everyone else. That is the most shocking aspect. Not that rich people get the lion’s share of the cuts. That’s always the case. But that across people in virtually all income cohorts, rich people actually get a larger percentage reduction in their tax bills. It’s unconscionable, even if it was affordable, which it’s not.

How unaffordable is it?

HUGE REVENUE LOSSES BEFORE ANY “TRIGGER” COMES INTO PLAY

Echoing GOP lawmakers during the House and Senate floor debate on May 5, Reynolds bragged in her press release that “Iowa’s budget priorities in future years are protected.”

Hardly.

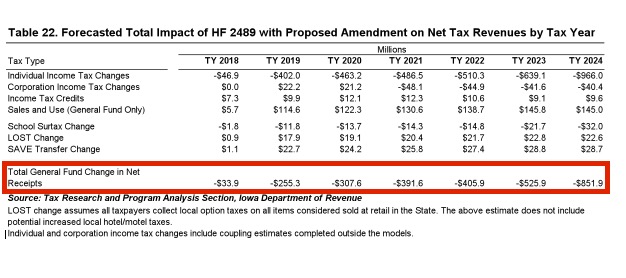

I put red lines around the key numbers from the Department of Revenue’s Table 22, showing expected net change in the state’s general fund revenues. The so-called “trigger” will determine whether Iowa eliminates federal deductibility and enacts additional rate cuts in fiscal year 2023. Before that happens, the state will collect $255.3 million less in fiscal year 2019, $307.6 million less in FY2020, $391.6 million less in FY2021, and $405.9 million less in FY2022.

An Iowa version of the new federal Qualified Business Income Deduction is one of the most costly elements. The Iowa Fiscal Partnership’s Bruner explained,

This deduction applies to the treatment of “pass-through” income that is reported on the individual income tax, as a subchapter S corporation, a limited partnership, or a sole proprietorship. These entities can fall into the definition of “small business” in terms of the number of workers employed and number of shareholders, but they can be highly profitable and by no means “small business” in terms of the money they make.

Iowa is the only state in the country actively considering legislation that would intentionally adopt this new federal provision into its state income tax code […]. Revenue estimates are that 79 percent of the benefits will go to the top 5 percent of tax filers in terms of incomes.

Speaking to reporters on May 4, Bruner pointed out that early draft bills from the governor and House Ways and Means Committee set this new business tax exemption at 25 percent of the federal level. The final deal increased the exemption to 75 percent of the federal level, tripling the annual cost to the state budget from around $23 million to $69 million. The price tag could rise further if well-off people game the system by restructuring their businesses to provide more “pass-through” income.

The final tax bill would erode general fund revenues by an additional $550 million, compared to the earlier House version, Bruner added. Revenue losses will be some $650 million more than would have happened under the governor’s first proposal. The deal fails to provide “revenue adequacy,” a key principle of tax reform.

In February, Republicans approved an extra $32 million for K-12 schools in the coming year, saying the state couldn’t afford to spend more. Yet they just voted to give up more than twice as much money for the Qualified Business Income Deduction alone. That new tax break primarily will benefit people earning six-figure incomes.

Democratic Senator Herman Quirmbach declared on the Senate floor that based on his four decades of experience as a professional economist, he would describe this proposal as “the single most fiscally irresponsible bill in Iowa history.” The Iowa Policy Project’s Fisher noted,

With over half the budget going to education, this means the underfunding of our public schools and the rising tuition and debt for our community college and university students will continue. […]

The $400 million [annual] hit to the general fund will happen no matter how slow the Iowa economy, and state revenues, grow. We could hit a recession in the next two years, and those tax cuts will remain in place.

Neither Reynolds nor GOP lawmakers have any clue how they will fund essential services with hundreds of millions of dollars less coming in. They haggled for months over $35.5 million in cuts to balance the current-year budget. They now indulge in magical thinking and repetitive talking points about tax cuts unleashing an economic boom, which will fill the state coffers. Legislatures in Kansas, Louisiana, and Oklahoma tried the same experiment and failed.

Republican appropriators looked under every sofa cushion to find money for the fiscal year 2019 budget. A few examples of gimmicks in legislation rushed through in recent days on party-line votes (far from an exhaustive list):

• Scooping $2 million from the popular Resource Enhancement and Protection program to help cover “the regular maintenance and operation of state parks” as part of the agriculture and natural resources budget.

• Transferring $2.5 million from the Skilled Worker and Job Creation Fund to the general fund as part of the economic development budget. That move was even more irregular, since the skilled worker fund is financed through gambling revenues (the Rebuild Iowa Infrastructure Fund).

• Redirecting “any unencumbered and unobligated moneys in the taxpayers trust fund” to the general fund as of July 1, as part of the “standings” bill (Section 5). Standings is typically the last bill approved before lawmakers adjourn and tends to be a grab bag of whatever the majority wants that didn’t make it into other legislation. According to Iowa House Democratic legislative staff, the Taxpayers Trust Fund maneuver will bring in about $8.3 million.

• Also in the standings bill (Division XXII), lawmakers diverted a portion of customer fees on utility bills from the Iowa Energy Center. Specifically, $1.28 million in fiscal year 2019, $2.91 million in FY2020, and $3.53 million in FY 2021 will go to the general fund instead of to the energy center. Republicans added that provision at the last minute to cover the cost of preserving the solar tax credit. The deal they struck with Reynolds would have discontinued that credit this summer.

To sum up, the bill Reynolds will tout for the rest of the year doesn’t substantially reform the income tax system. The vast majority of filers won’t receive significant savings. On the contrary, many Iowans will end up paying more due to higher sales taxes, property taxes, or college tuition. Despite the governor’s talk about “budget sustainability,” how the state will pay for public education, health care, or other services going forward is anyone’s guess.

P.S.– Republicans used a corrupt process to ram this bill through with minimal public input or deliberation. The governor’s office announced a “historic tax relief agreement” with Iowa House and Senate leaders shortly after 5:00 pm on Friday, April 27. Five days later, lawmakers still didn’t have a bill to review. The Senate Ways and Means Committee approved a version of Senate File 2417 on a party-line vote on May 2, without public hearings or a normal markup process. But Ways and Means Chair Randy Feenstra didn’t file the amendment that became the final bill until May 4, the day before lawmakers in both chambers voted on the nearly 150-page document.

Senate Republicans then used an unusual procedure to short-circuit debate on their far-reaching tax bill (two strike-and-replace amendments in a row, so all amendments proposed by Democrats or independent Senator David Johnson could be declared “out of order”).

A number of Democratic lawmakers did speak out during the truncated debate on the tax bill. You can watch Senators Rob Hogg, Pam Jochum, Matt McCoy, Nate Boulton, and Herman Quirmbach, beginning around 12:53:00 on the Iowa Senate video. You can watch Representatives Mary Wolfe, John Forbes, Chris Hall, and Minority Leader Mark Smith, beginning around 4:20:00 on the House video.

Full text of May 5 press release from the governor’s office:

Gov. Reynolds praises Iowa House, Senate on passage of historic tax reform

(DES MOINES) – Gov. Kim Reynolds praised the Iowa House of Representatives and Iowa Senate Saturday following their passage of historic tax reform, Senate File 2417.

“Republicans led on tax reform in 2018,” Gov. Reynolds said. “As a result, hardworking, middle class Iowa families, farmers, small business owners and workers get meaningful relief, all while Iowa’s budget priorities in future years are protected.”

Senate File 2417 modernizes Iowa’s outdated tax code by prioritizing Iowa’s hardworking, middle class families; reducing rates and eliminating federal deductibility, making Iowa’s tax code more competitive and transparent; dramatically simplifying Iowa’s overly complicated tax code; ensuring fairness for Main Street businesses in the modern economy; and protecting budget sustainability in future years.

UPDATE: Reynolds signed the bill on May 30.