Governor Kim Reynolds directed that nearly $450,000 in federal funding the state of Iowa received through the Coronavirus Aid, Relief and Economic Security (CARES) Act be used to cover salaries and benefits for staff working in her office.

According to documents Bleeding Heartland obtained from the Iowa Department of Management through public records requests, the funds will cover more than 60 percent of the compensation for 21 employees from March 14 through June 30, 2020.

Reynolds has not disclosed that she allocated funds for that purpose, and reports produced by the nonpartisan Legislative Services Agency have not mentioned any CARES Act funding received by the governor’s office. Nor do any such disbursements appear on a database showing thousands of state government expenditures under the CARES Act.

The governor’s communications director Pat Garrett did not respond to four requests for comment over a two-week period.

“THE TRANSFER OF CARES ACT FUNDS IS APPROVED BY THE GOVERNOR”

Under salary-sharing agreements the governor’s chief of staff Sara Craig Gongol signed on June 30, three of Reynolds’ staffers–health policy adviser Liz Matney, tax policy adviser Joel Anderson, and economic development adviser Daniel Wolter–had 100 percent of their salaries and benefits covered by other state agencies from the summer of 2019 through March 13, 2020.

Such agreements typically run through the end of a fiscal year. The unusual timing made me wonder whether the governor’s office had secured some other funding source, possibly related to the COVID-19 pandemic, to pay for those staffers’ compensation from March 14 through June 30.

In response to a records request, Linda Leto of the Department of Management confirmed on August 26 that CARES Act funds “supplemented the full salaries and benefits” of not only Matney, Anderson, and Wolter, but 21 employees in the governor’s office–a majority of those working there.

I had more questions, such as: does “supplemented the full salaries and benefits” mean that CARES Act funding covered the entire compensation for those employees, or only a portion of their pay? What was the total dollar amount used for that purpose from March 14 through June 30, 2020? Have CARES Act funds been used to pay salaries and benefits for the governor’s staff during the current fiscal year, which began on July 1? And if so, will that arrangement continue as long as Reynolds’ public health emergency proclamations remain in effect?

The governor’s office ignored all questions about the matter.

Leto clarified on August 31, “The transfer of CARES Act Funds is approved by the Governor,” not Reynolds’ chief of staff or anyone else in state government.

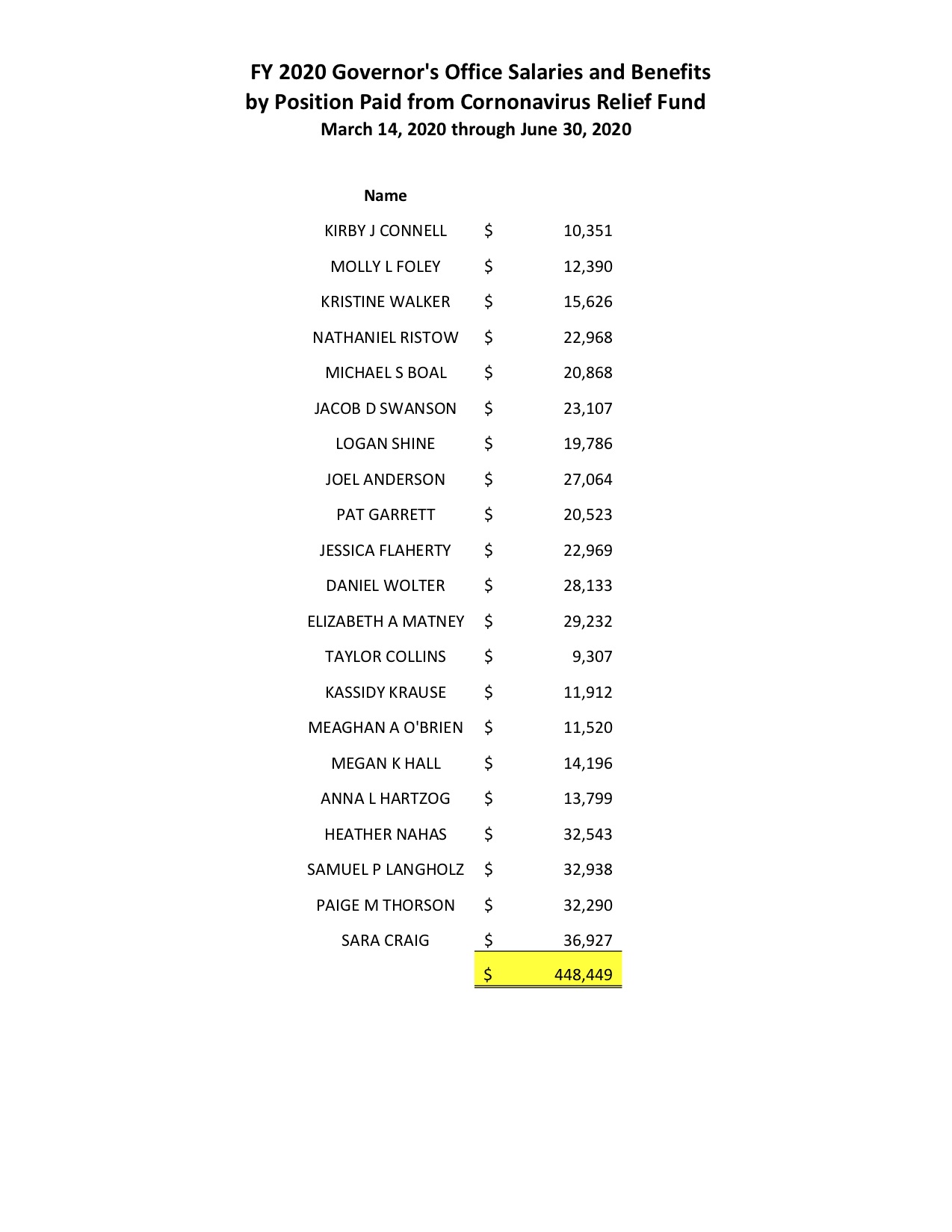

On September 11, Leto provided more details: a total of $448,448.86 in CARES Act funding was approved for wages and benefits for staff in the governor’s office from March 14 to June 30. The federal COVID-19 relief funds covered 62.59 percent of those employees’ compensation during that period.

The document from the Department of Management is enclosed below as Appendix 1.

I’m listing the staffers here in descending order by how much CARES Act money supported their compensation during the last three and a half months of fiscal year 2020. In parentheses, I’ve added a brief description of each person’s job, based on publicly available information such as news releases or LinkedIn profiles.

Sara Craig Gongol (chief of staff): $36,927

Sam Langholz (senior legal counsel): $32,938

Heather Nahas (public relations manager): $32,543

Paige Thorson (deputy chief of staff): $32,290

Liz Matney (health policy adviser): $29,232

Daniel Wolter (economic development adviser): $28,133

Joel Anderson (tax policy adviser): $27,064

Jake Swanson (adviser on agriculture, energy, trade): $23,107

Jessica Flaherty (operations manager): $22,969

Nathaniel Ristow (adviser on public safety issues): $22,968

Michael Boal (deputy legal counsel): $20,868

Pat Garrett (communications director): $20,523

Logan Shine (legislative liaison): $19,786

Kristine Walker (administrative assistant): $15,626

Megan Hall (legal assistant and office manager): $14,196

Anna Hartzog (constituent director): $13,799

Molly Foley (director of boards and commissions): $12,390

Kassidy Krause (assistant to chief of staff): $11,912

Meaghan O’Brien (deputy health policy adviser): $11,520

Kirby Connell (scheduler for governor and Lieutenant Governor Adam Gregg): $10,351

Taylor Collins (policy adviser and speechwriter for Gregg): $9,307

Total: $448,449

According to the state’s employee directory, all of the above still work in the governor’s office, except for Kirby Connell.

One senior staffer’s name is conspicuously absent here: chief operations officer Paul Trombino III. By many accounts, Trombino has been involved in COVID-19 policy discussions. However, the governor’s office did not need to find any outside support for his compensation. Leto explained on August 26 that the Department of Administrative Services has paid 100 percent of Trombino’s salary and benefits since Reynolds named him interim director of that agency on March 7, 2020.

PAYMENTS NOT PREVIOUSLY REVEALED

The Legislative Services Agency has periodically published fiscal updates on the use of COVID-19 relief funds, but none of those documents have shown any expenditures to the governor’s office. Here’s the latest version, dated August 31.

Note: the Governor’s Office of Drug Control Policy is listed as receiving $79,875. That’s not related to salary payments for Reynolds’ staff. Iowa Senate Democratic staff informed Bleeding Heartland that those funds are “part of a competitive grant” through the Byrne Justice Assistance Grants program.

The state’s data portal maintains a database called Iowa Pandemic Recovery Reporting: State Expenditures, which provides “information on all expenditures made by the State of Iowa” under the CARES Act.

At this writing, the database was last updated on September 8. Most of the 3,649 disbursements reflect payments to the Iowa Department of Human Services, Iowa Department of Public Health, or Iowa Workforce Development. Some involve other state agencies or entities, like the Department of Transportation or Secretary of State’s office. No entry indicates that any funds have been allocated to the governor’s office.

Garrett did not respond to emails asking why payments for Reynolds’ staff salaries don’t appear on public databases or reports on CARES Act funding.

The Department of Management’s Leto explained on September 11,

The State’s fiscal year runs from July 1 to the following June 30. The State of Iowa operates on a modified accrual basis. The transfers of funds for Fiscal Year 2020 can be made through September 30, 2020 when the fiscal year is officially closed. Funds will be transferred prior to the September 30, 2020 deadline.

Since the Legislative Services Agency only reports on expenditures that have occurred, the $448,449 approved for the governor’s office should appear on the first fiscal update published after the fund transfer.

Whether Reynolds plans to use additional CARES Act funds to cover part of her staff’s salaries during the current fiscal year is unclear. Garrett ignored the question, while Leto replied, “The Department of Management does not have any documents responsive to your request.”

“CARES ACT DOLLARS ARE INTENDED FOR IOWA COVID-19 RELIEF”

I wondered whether leaders of the Iowa legislature’s Administration and Regulation Appropriations Subcommittee, which handles the governor’s office budget, knew Reynolds had used CARES Act money to support her operation. Insiders sometimes get a heads up before information becomes publicly available. The subcommittee’s co-chairs, Republican State Representative John Landon and State Senator Dennis Guth, did not respond to Bleeding Heartland’s inquiries.

State Representative Karin Derry, the ranking Iowa House Democrat on that panel, said in an August 31 email that she was not aware any CARES Act funds had been used to pay the governor’s staff, adding, “If true, then I would like to see the House Government Oversight Committee look into the matter.”

I circled back with Derry after learning more details about the expenditures on September 11. She replied the following day,

If the Governor spent nearly a half million dollars of CARES Act money to cover the costs of salaries and benefits for her office for 3 1/2 months, that would be deeply troubling. The State Legislature allocated $2.3 million to cover such expenses for her office for FY 2020. If she spent CARES Act dollars to cover staff salaries, then where did the allocated money go? Iowa taxpayers deserve to know how their money is being spent and why her administration has not been transparent about this use of CARES Act dollars.

CARES Act dollars are intended for Iowa COVID-19 relief. There are thousands of small businesses, families, schools, and health care providers that have been negatively impacted by this public health and economic crisis, who could have used the financial help. If the Governor took money intended to help Iowans weather this crisis to pay for her office staff, the Legislature should take action.

I also sought comment from the leaders of the Iowa House and Senate Government Oversight Committees. Republican State Representative Mary Ann Hanusa and State Senator Amy Sinclair, who chair those panels, did not respond. State Senator Tony Bisignano, the ranking Democrat on the upper chamber’s oversight committee, said in a written statement on August 31,

Thank you for raising this concern. I have asked my staff to work with the Legislative Service Agency to track the use of CARES Act funding and if any these critical funds have been used to pay for salaried employees in Governor Reynolds’ office. If we find evidence that a misuse of funds has occurred, the Legislative Government Oversight Committee should be convened to look into the use of CARES Act monies.

My next question was whether the federal government would consider these expenditures permissible.

“NECESSARY EXPENDITURES INCURRED DUE TO THE PUBLIC HEALTH EMERGENCY”

When Congress approved the CARES Act in late March, the idea was to get money quickly to state governments facing enormous financial obligations due to the pandemic. For that reason, states were not required to justify any specific use in advance.

Michael Leachman, vice president for State Fiscal Policy at the Center on Budget and Policy Priorities, verified that states need not ask for permission up front when allocating CARES Act funds. Rather, the U.S. Treasury’s inspector general “has authority to review expenditures” on audit, Leachman said. If the IG determines that any use of funds didn’t meet the conditions envisioned by the law, a state might need to repay some of the money.

The Treasury Department published guidance for state, territorial, local, or tribal governments on use of the Coronavirus Relief Fund. I’ve enclosed the full document below as Appendix 2. The CARES Act allows funds to be used for costs that:

1. are necessary expenditures incurred due to the public health emergency with respect to the Coronavirus Disease 2019 (COVID–19);

2. were not accounted for in the budget most recently approved as of March 27, 2020 (the date of enactment of the CARES Act) for the State or government; and

3. were incurred during the period that begins on March 1, 2020, and ends on December 30, 2020.

The third point is a non-issue, since the Reynolds staffers are being compensated for work done during the acceptable time frame.

Are salary and benefit payments for Reynolds’ staff “necessary expenditures incurred due to” the pandemic? Treasury refers to using funds for “actions taken to respond to the public health emergency.”

These may include expenditures incurred to allow the State, territorial, local, or Tribal government to respond directly to the emergency, such as by addressing medical or public health needs, as well as expenditures incurred to respond to second-order effects of the emergency, such as by providing economic support to those suffering from employment or business interruptions due to COVID-19-related business closures.

Funds may not be used to fill shortfalls in government revenue to cover expenditures that would not otherwise qualify under the statute. Although a broad range of uses is allowed, revenue replacement is not a permissible use of Fund payments.

No doubt the 21 employees in question spent time dealing with matters related to COVID-19. But all were already on staff and would have been paid for their full-time work with or without a pandemic. That is to say, Reynolds would have employed a chief of staff, operations manager, legislative liaison, public relations manager, scheduler, administrative assistants, policy advisers, and so on, even if a novel coronavirus had never arrived in Iowa.

The governor’s spokesperson did not respond to emails asking how salaries or benefits paid to permanent staffers were “incurred due to the public health emergency.”

“WERE NOT ACCOUNTED FOR IN THE BUDGET”

The federal guidance states,

The CARES Act also requires that payments be used only to cover costs that were not accounted for in the budget most recently approved as of March 27, 2020. A cost meets this requirement if either (a) the cost cannot lawfully be funded using a line item, allotment, or allocation within that budget or (b) the cost is for a substantially different use from any expected use of funds in such a line item, allotment, or allocation.

Salaries and benefits for the governor’s staff were lawfully funded during the 2019 legislative session. House File 759 included a line item of $2,303,954 for “salaries, support, maintenance, and miscellaneous purposes” for the office of the governor and lieutenant governor in fiscal year 2020.

Paying the same employees who were already on staff before March 14, 2020 does not appear to be “substantially different” from the expected use of funds in that line item.

When asked how the governor’s office sees this use of CARES Act funds as consistent with federal guidance, Garrett did not reply.

The federal guidance was updated on September 2 to include several pages discussing “Use of Funds to Cover Payroll and Benefits of Public Employees.” Excerpts (emphasis added):

As discussed in the Guidance above, the CARES Act provides that payments from the Fund must be used only to cover costs that were not accounted for in the budget most recently approved as of March 27, 2020. As reflected in the Guidance and FAQs, Treasury has not interpreted this provision to limit eligible costs to those that are incremental increases above amounts previously budgeted. Rather, Treasury has interpreted this provision to exclude items that were already covered for their original use (or a substantially similar use). This guidance reflects the intent behind the Fund, which was not to provide general fiscal assistance to state governments but rather to assist them with COVID-19-related necessary expenditures. With respect to personnel expenses, though the Fund was not intended to be used to cover government payroll expenses generally, the Fund was intended to provide assistance to address increased expenses, such as the expense of hiring new personnel as needed to assist with the government’s response to the public health emergency and to allow recipients facing budget pressures not to have to lay off or furlough employees who would be needed to assist with that purpose.

Reynolds didn’t hire any new personnel to deal with COVID-19.

The supplemental guidance goes on to say that costs not accounted for in the budget will be met “if either (a) the cost cannot lawfully be funded using a line item, allotment, or allocation within that budget or (b) the cost is for a substantially different use from any expected use of funds in such a line item, allotment, or allocation.”

It then gives an example of a substantially different use: “redeploying educational support staff or faculty to develop online learning capabilities, such as through providing information technology support that is not part of the staff or faculty’s ordinary responsibilities.”

Perhaps the governor’s office could claim that Reynolds’ staff assisted the COVID-19 response in ways that were not part of their regular obligations. Without knowing exactly what individual staffers were working on, it’s hard to guess whether such a claim is credible. A chief of staff has wide-ranging duties under normal circumstances. Did Iowa really need to use $36,927 in CARES Act funding to cover part of Craig Gongol’s compensation?

Working on disaster emergency proclamations does not strike me as “substantially different” from Langholz’s ordinary responsibilities drafting executive orders or other proclamations Reynolds signs.

By the same token, Heather Nahas joined the governor’s staff last year to serve in a newly-created position: public relations manager. Helping the governor prepare public remarks related to the coronavirus pandemic does not seem “substantially different” from working on messaging related to any other issue Reynolds may address in a speech or news conference. Garrett has served as the governor’s communications director since late 2018. Organizing media availabilities, drafting news releases, and answering (or not answering) reporters’ questions about COVID-19 is not substantially different from his work when some other topic is in the foreground.

Could the state claim that staff salary expenses were not “accounted for in the budget,” on the grounds that Reynolds hired more employees than a $2.3 million appropriation could support? House File 759 envisioned “not more than” 21 full-time equivalent positions. The governor’s staff is larger than that.

Iowa governors have long used salary-sharing agreements to cover part of the office’s payroll costs. But Reynolds took it to another level by bringing on several well-paid new staffers last year.

As Bleeding Heartland discussed here, the governor’s office asked for and received an extra $200,000 (roughly a 10 percent budget increase) for fiscal year 2020. Republican lawmakers said during House and Senate floor debate in 2019 that the money would cover new analysts on health and tax policy.

Indeed, Reynolds hired new staff in the summer of 2019 to work on health policy (Liz Matney) and tax policy (Joel Anderson). At an Administration and Regulation Appropriations Subcommittee meeting on January 29, 2020, Derry told Bleeding Heartland, she asked Craig Gongol about the two additional positions. The chief of staff asserted that the governor’s new full-time equivalent employees were the tax and health policy advisers.

But under memorandums enclosed below as Appendix 3, the Department of Human Services and Department of Revenue were covering 100 percent of Matney’s and Anderson’s compensation for most of the fiscal year. Communications staff for both departments confirmed via email that the agencies plan to cover Matney’s and Anderson’s entire salary and benefits during the 2021 fiscal year as well. According to the Department of Revenue’s public information officer John Fuller, that agency’s Director Kraig Paulsen agreed to cover the full amount of Anderson’s salary and benefits for the entirety of fiscal year 2020 when the governor’s office hired Anderson during the summer of 2019.

Similarly, the Iowa Economic Development Authority covered Daniel Wolter’s entire compensation from his first day on the job in August 2019. Director Debi Durham has approved that arrangement to continue in fiscal year 2021.

In that respect, it seems like a stretch to say payroll costs for Matney, Anderson, and Wolter “were not accounted for” when the CARES Act went into effect, or that Iowa needed to use $29,232, $27,064, and $28,133 in COVID-19 relief funding to cover 62 percent of those advisers’ salaries from March 14 through June 30.

It looks like Reynolds was on track to overspend her office budget on personnel by roughly half a million dollars and was searching for ways to cover the shortfall in the spring of 2020.

Taking $448,449 from the CARES Act would make it possible to spend nearly 20 percent more the $2.3 million the legislature approved to fund the governor’s office for fiscal year 2020.

In addition, as mentioned above, the Department of Administrative Services covered Trombino’s pay from March 7 through June 30. Records that department provided to Bleeding Heartland indicate that his monthly salary and benefits exceeded $15,600 during that period. So once he started running another agency, the governor’s office was off the hook for more than $50,000 in payroll costs for their chief operating officer.

Iowa lawmakers should not wait for federal auditors to review CARES Act spending, which could happen years from now. The state House and Senate Oversight Committees should examine how and why COVID-19 relief funds came to be spent on permanent staff in the governor’s office, and why that decision wasn’t promptly disclosed to the public.

For the sake of transparency, the governor should ask the legislature to appropriate the funding she needs to run her office effectively, instead of arranging for other state agencies or pots of federal money to cover part of her own staff’s payroll.

UPDATE: There is some confusion about one point.

Leto wrote in her September 11 email, “CARES Act funds covered 62.59% of the salaries and benefits of those employees listed in the attached spreadsheet from March 14 through June 30, 2020.”

A reader wonders whether it would be more accurate to say that state funds fully covered the salaries and benefits for staff in the governor’s office, and that the CARES Act money “supplemented” those payments in the form of bonuses.

That’s not how I understood the situation. I am seeking clarification from the Department of Management on whether the amounts listed represent portions of the staffers’ regular salaries covered by CARES Act funding, or bonuses paid out of CARES Act funds, on top of the staffers’ regular fiscal year 2020 salaries and benefits, which were fully covered through state funding sources.

The guidance from the Treasury Department lists “Workforce bonuses other than hazard pay or overtime” as an example of an ineligible expense under the CARES Act. I have separately confirmed through an earlier public records request to the Department of Administrative Services that no one on the governor’s staff received overtime payments from March through June 2020.

SECOND UPDATE: Leto emailed on September 14, “To clarify, the amounts on the attached spreadsheet are for portions of the staff’s regular salary and benefits.”

I asked the State Auditor’s office whether Auditor Rob Sand will look into this use of federal funds. Communications director Andrew Turner replied on September 14, “Our office is auditing CARES Act money but we cannot comment on specifics until our audit is complete.”

THIRD UPDATE: The Iowa Senate Democrats called for an investigation of this matter on September 16. Excerpts from their news release:

“At a time when the number of jobless Iowans is through the roof and many Iowa businesses are hurting because of the pandemic, Iowa taxpayers should have confidence that federal COVID relief funds are being used only to help them,” said Sen. Joe Bolkcom, Ranking Member of the Senate Appropriations Committee.

“Instead of using funds that are desperately needed to provide relief to hard-working Iowans and closed or struggling businesses hurt by the pandemic, the Governor is diverting the relief funding for other purposes. That’s not right.” […]

The diversion is even more puzzling because the Legislature approved and the Governor signed legislation to appropriate more than $4.6 million to cover the cost of running the Governor’s office – including salaries and benefits – over the past two years.

“We need to find out what the Governor did with the extra money. The intent of the federal aid was not to allow the Governor to set up a slush fund,” Bolkcom said. “We also need to find out if this diversion is continuing.”

For the past six months, none of the documents released to the public and legislators contained any information about this diversion of funds.

“Instead of transparency by the Governor and her staff, they are hiding the ball from Iowa taxpayers,” Bolkcom said.

Democratic Senators called for a three-pronged effort to investigate this misuse of public funds:

First, Senator Claire Celsi of West Des Moines, Ranking Member of the Administration and Regulation Budget Subcommittee, will request that the State Auditor immediately investigate the diversion of funds. The Subcommittee appropriated $2,303,954 for the Governor’s office during Fiscal Year 2020 (July 1, 2019, through June 30, 2020) and $2,315,344 for Fiscal Year 2021 (July 1, 2020, through June 30, 2021). Second, Senator Tony Bisignano, Ranking Member of the Government Oversight Committee, will request that the Oversight Committee convene to allow Republican and Democratic lawmakers to question the Governor, the Director of the Department of Management and other key officials with knowledge of this diversion. Third, federal officials in U.S. General Accountability Office (GAO) will be contacted to investigate whether paying existing staff is an appropriate use of COVID relief funds.

_______________

Appendix 1: Document provided by the Iowa Department of Management on September 11, regarding CARES Act funds approved for salaries and benefits in the governor’s office

Appendix 2: The U.S. Treasury’s Coronavirus Relief Fund

Guidance for State, Territorial, Local, and Tribal Governments, as updated on September 2

Appendix 3: Memorandums of understanding between the governor’s office and three state agencies regarding salary payments for Liz Matney, Joel Anderson, and Daniel Wolter during fiscal year 2020

Appendix 4: Unanswered questions emailed to the governor’s communications director Pat Garrett regarding the use of CARES Act funds to pay staff salaries

Appendix 5: Unanswered questions emailed to Garrett regarding the use of an additional $200,000 appropriated to the governor’s office for fiscal year 2020

Top photo: Governor Kim Reynolds speaks at a news conference on April 29, 2020. Photo by Kelsey Kremer/Des Moines Register (pool).

2 Comments

Excellent - eagerly awaiting any response from Reynolds’ office

Obviously, CARES Act funds to the government should be supplemental for needs created by this emergency, not to replace budgeted funds. Good job going thru all this data and piecing it together.

VictoriaJZ Mon 14 Sep 6:54 AM

Amazing work Laura

You are doing exceptional investigative journalism . Thank you for your diligence and hard work. I especially liked Bolkom’s response:

“We need to find out what the Governor did with the extra money. The intent of the federal aid was not to allow the Governor to set up a slush fund,” Bolkcom said. “We also need to find out if this diversion is continuing.”

libre Thu 17 Sep 4:07 PM