John Morrissey is a longtime Des Moines resident who has investigated state spending increases, financial anomalies, and payment disruptions associated with Medicaid privatization in Iowa. -promoted by Laura Belin

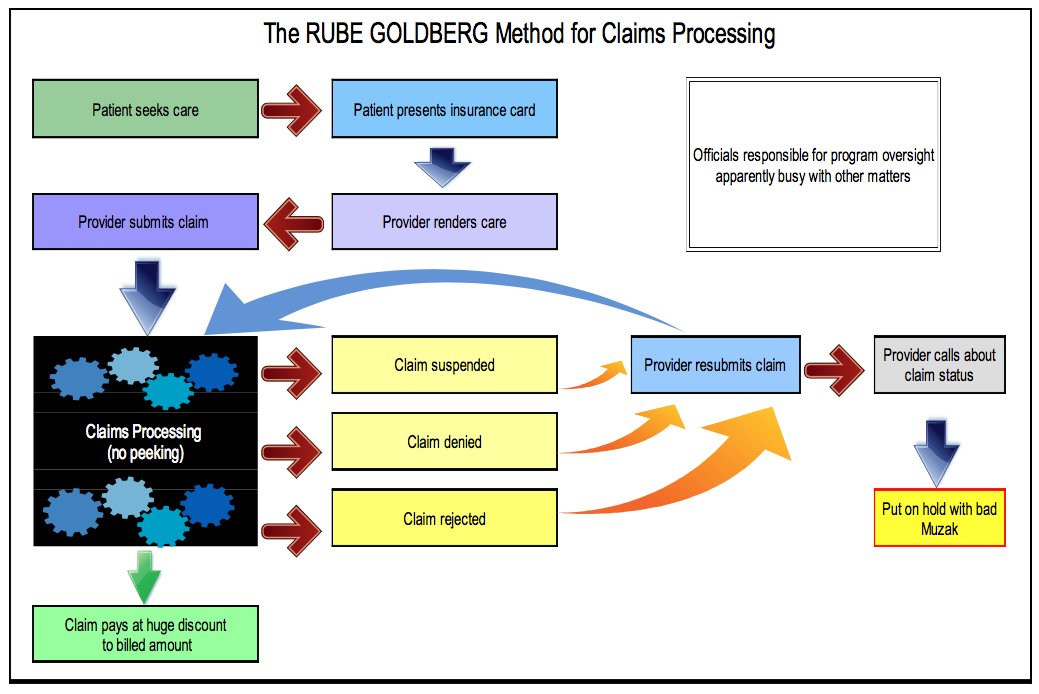

The “he said/she said” controversy between an insurance company CEO and Iowa’s governor about why UnitedHealthcare decided to leave the state’s Medicaid program might make entertaining copy, but it doesn’t address who is going to manage the care of 420,000 Iowans left in the lurch.

Nor does it address whether the remaining company (Amerigroup) is adequately prepared to handle more members, and whether a new player poised to enter our state’s Medicaid market (Iowa Total Care) has the expertise to handle special populations in Iowa such as the elderly, disabled, and very ill.

It also doesn’t consider whether the state’s traditional fee-for-service Medicaid offering has the financial wherewithal to shoulder an even larger share of the enrollment and cost. Fee-for-service was held over from the old state-run program when most of the Medicaid program was privatized in 2016. The fee-for-service program pays the claims of Iowa’s sickest and most frail Medicaid members, which the for-profit managed care organizations (MCOs) don’t want or can’t handle.

The Iowa Deparment of Human Services (DHS) did not respond to a request for comment on these issues.

Continue Reading...