Dave Swenson

It is an article of faith that Iowa’s businesses are tax-burdened. Ask anyone. Farmers believe property taxes are unfair, shopkeepers bemoan the burdens of eking out a profit while still obliged to contribute to the public purse, and manufacturers uniformly lament the erosions in interstate and international competitiveness they say are caused by Iowa’s archaic system of taxes. It all makes for good rhetoric, but in the main it is not true: Iowa taxes on businesses are, like Iowans, just about average, if not a little better. And Iowa’s manufacturers enjoy a particularly privileged position compared to other commerce in the state and to other manufacturers nationally.

All of that notwithstanding, the Iowa Department of Revenue recently held hearings to eliminate, using administrative rule-making powers, a set of sales taxes typically owed by manufacturing firms. Mike Ralston, President of the Iowa Association of Business and Industry, wrote in the Des Moines Register that Iowa’s manufacturers “expect and desire to pay all the taxes they owe.” But he noted manufacturers ought to not owe these particular taxes because they amounted to double taxation, a dubious claim at best.

Writing in Bleeding Heartland, Jon Muller informed us this would be incrementally more costly to the state’s fiscal accounts over time and that the need and justification for tax relief in this very narrow area of business activity was somewhat sketchy. And the sage Peter Fisher of the Iowa Policy Project, responding in the Des Moines Register to this legislative end-run, weighed in arguing that this “tax break is not an incentive; it is a gift to business.”

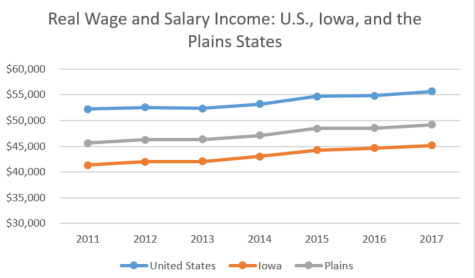

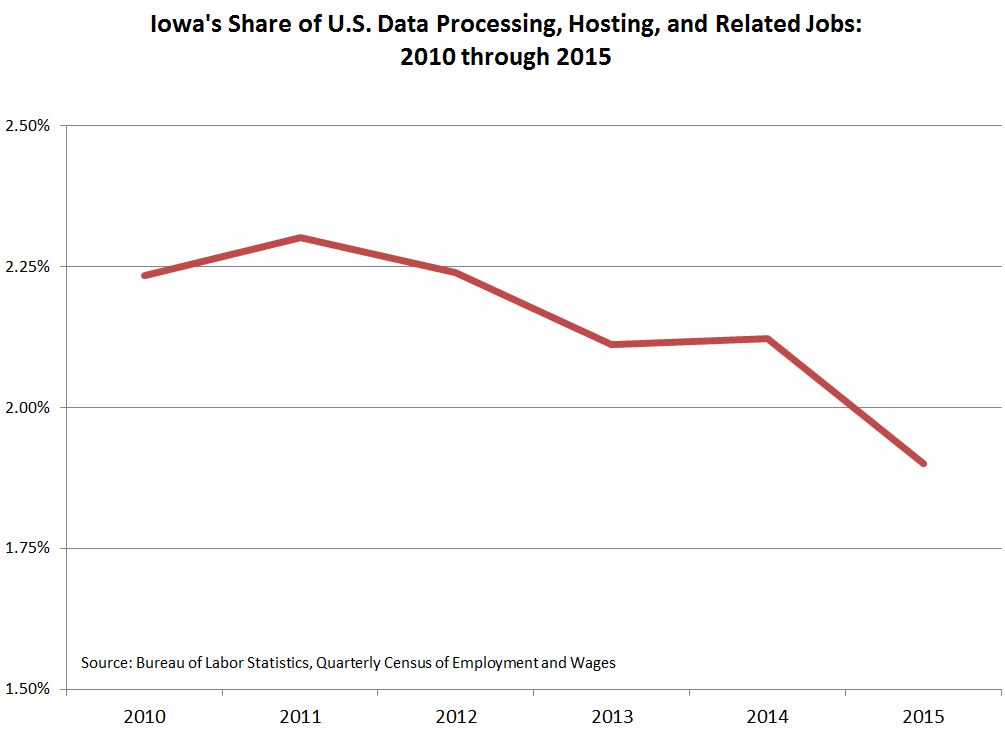

It is an easy task to evaluate Iowa’s overall situation regarding the full complement of production-related taxes that oblige Iowa businesses. The U.S. Bureau of Economic Analysis provides annual estimates of Gross Domestic Product (GDP) for state industrial categories. GDP at the state level is composed of all compensation to employees, gross operational surplus (i.e., returns to owners and investors), and business taxes on production and imports (mostly use, sales, excise, and property taxes). By dividing the taxes portion of GDP by the total, we get a fix on the relative total tax bite burdening Iowa’s manufacturing industry in the aggregate.

The first graphic below demonstrates Iowa manufacturers’ tax burden as a fraction of GDP as compared to all private businesses in Iowa.

Continue Reading...