“Our role is to decide whether constitutional lines were crossed, not to sit as a superlegislature rethinking policy choices of the elected branches,” four Iowa Supreme Court justices said today in two rulings that upheld the 2017 collective bargaining law.

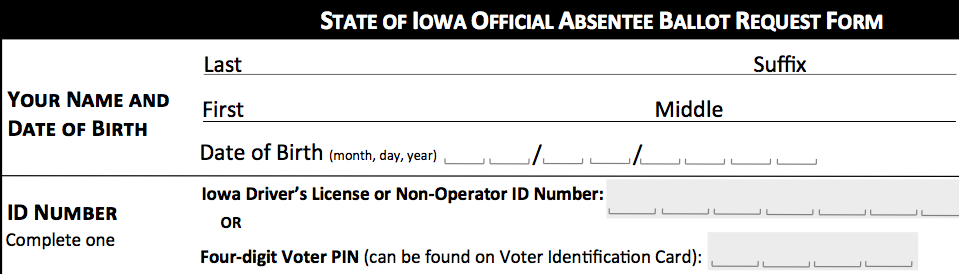

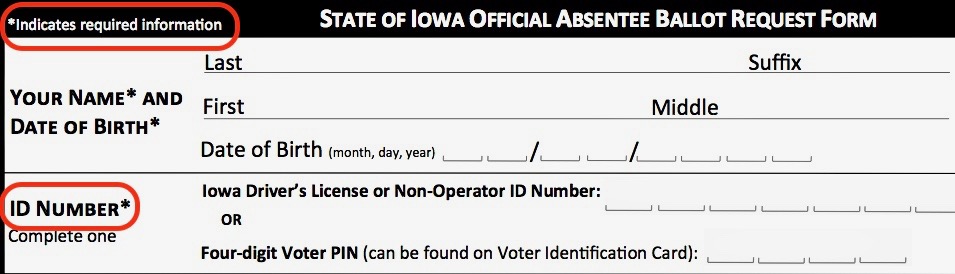

The state’s two largest public employee labor unions, AFSCME Council 61 and the Iowa State Education Association, had challenged the law, which eliminated almost all bargaining rights for most public employees but preserved more rights for units containing at least 30 percent “public safety” employees. The ISEA also challenged a provision that banned payroll deduction for union dues.

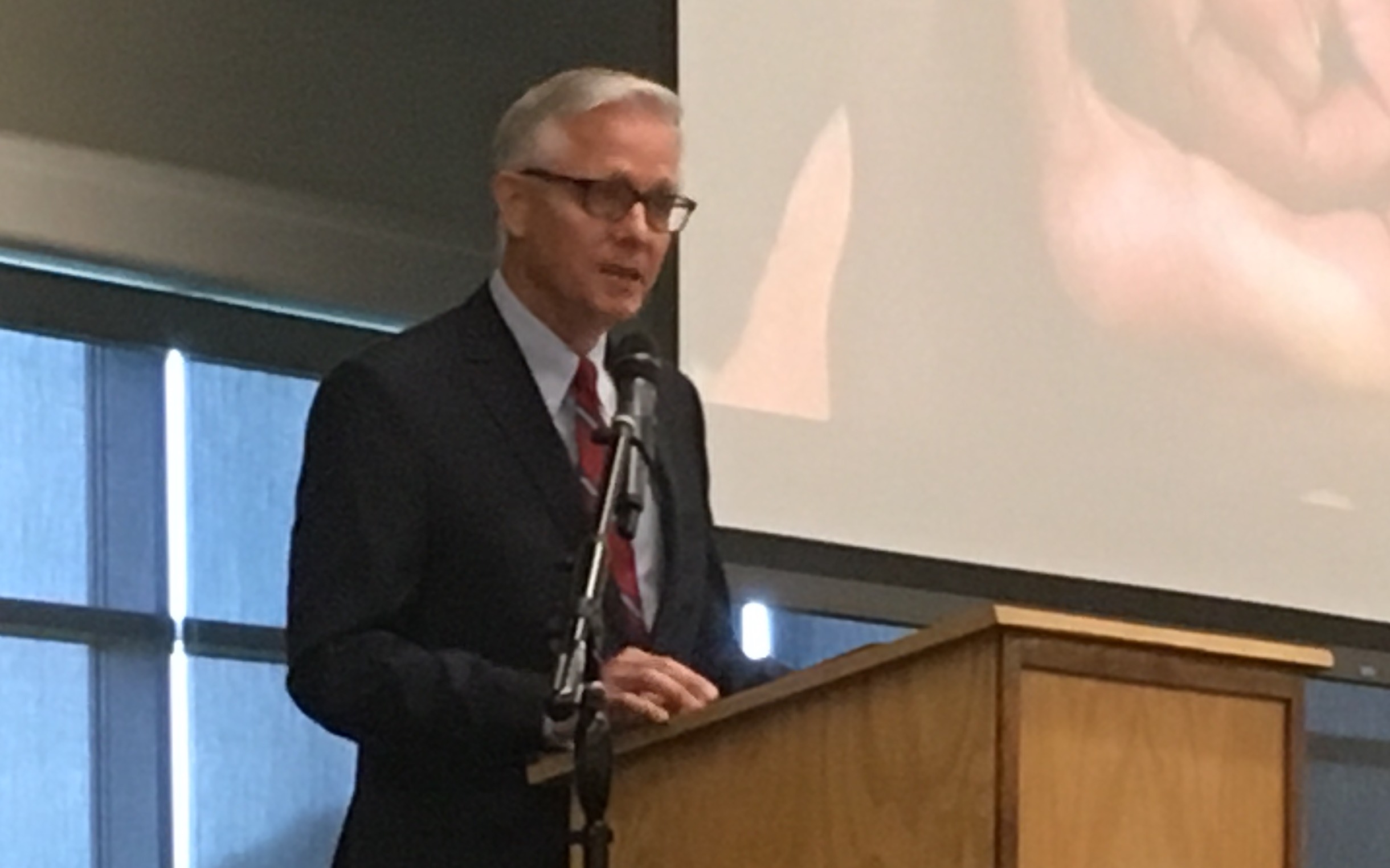

Justice Thomas Waterman wrote for the majority in both cases, joined by the court’s three other most conservative judges: Edward Mansfield, Susan Christensen, and Christopher McDonald. His ruling upheld two Polk County District Court rulings in 2017.

Chief Justice Mark Cady and Justice Brent Appel dissented from the AFSCME decision, joined by Justice David Wiggins. Appel wrote a partial concurrence and partial dissent in the ISEA case, joined by Cady and Wiggins. They would have allowed the state to end payroll deductions for union dues but struck down the part of the law that gave more bargaining rights to some workers than others. They highlighted the statute’s “illogical” classification system, under which many who receive the expanded privileges are not themselves “public safety employees,” while others “with obvious public safety responsibilities” are excluded.

Had the late Justice Daryl Hecht been able to consider this case, these decisions would likely have gone 4-3 the other way. However, Hecht stepped down while battling melanoma in December, shortly before the court heard oral arguments. Governor Kim Reynolds appointed McDonald to fill the vacancy in February. Normally new justices do not participate in rulings when they were not present for oral arguments, but the court would have been deadlocked on these cases otherwise. So file this disappointing outcome for some 180,000 public employees under E for “elections have consequences.”

Continue Reading...