Jon Muller is a semi-retired policy analyst and entrepreneur.

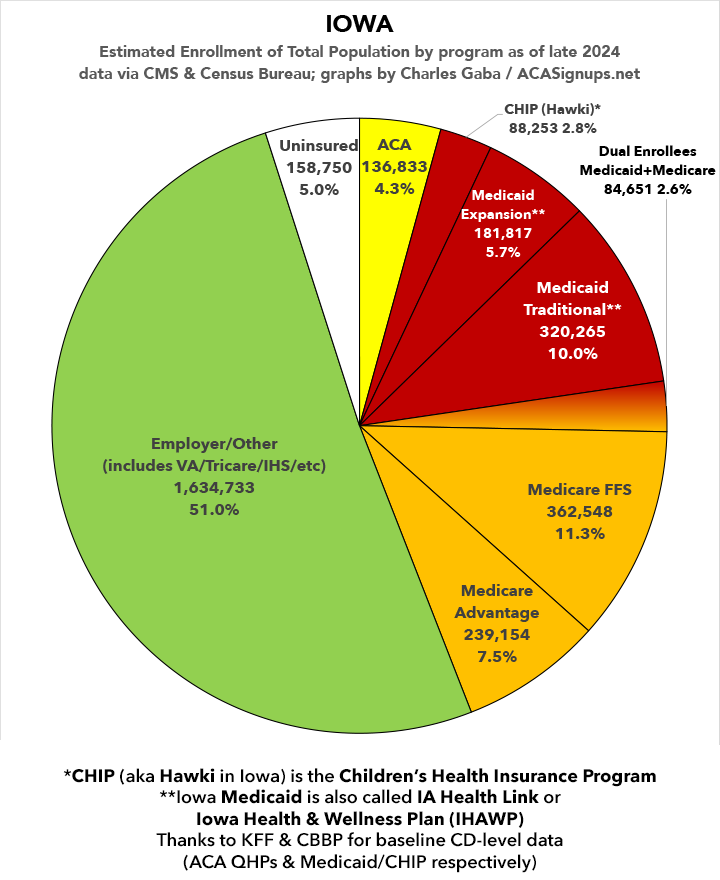

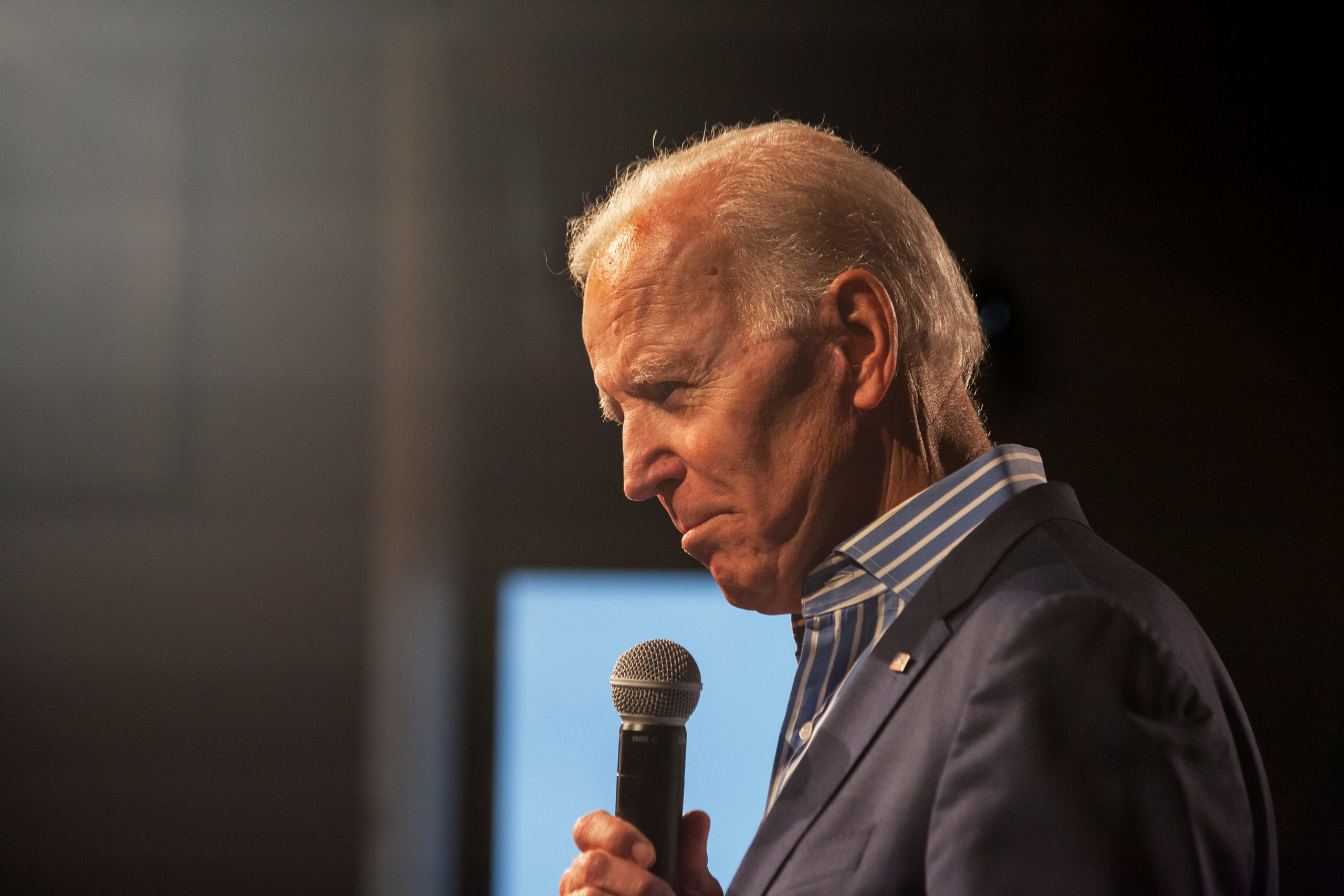

The Inflation Reduction Act (IRA), which Democrats in Congress approved and President Joe Biden signed in 2022, eliminated the subsidy cliff for health insurance purchased through the Affordable Care Act exchanges through 2025. It used to be the case that your ACA health insurance subsidy disappeared with the first dollar earned over 400 percent of the Federal Poverty Level (FPL).

Unless Congress acts to continue this provision of the IRA, the subsidy cliff will return in January. Thus far, Republicans in Congress show no interest in extending the enhanced subsidies for ACA health insurance plans.

The FPL in 2025 is $15,650 for a single person and $21,150 for a married couple. Thus, 400 percent of FPL is $62,600 and $84,600, respectively. A single person earning $62,600 currently pays $434/month on the Exchange for a Silver Plan. The married couple at 400 percent of FPL pays $599. The FPL increases with each dependent.

Under current law, a 60-year-old single person making just one extra dollar, or $62,601, experiences a rate increase of less than 1 penny/month. When the subsidy cliff returns in January, those premiums will go to $870/month, or an additional $5,119/year. For a 60-year-old married couple earning $1 more, the monthly premium will increase to $1,512, an annual hit of $10,953. These estimates are based on average rates for non-smoker 60-year-olds in Iowa. The increases could be more or less depending on other factors, including geography, age, and smoking status.

Continue Reading...