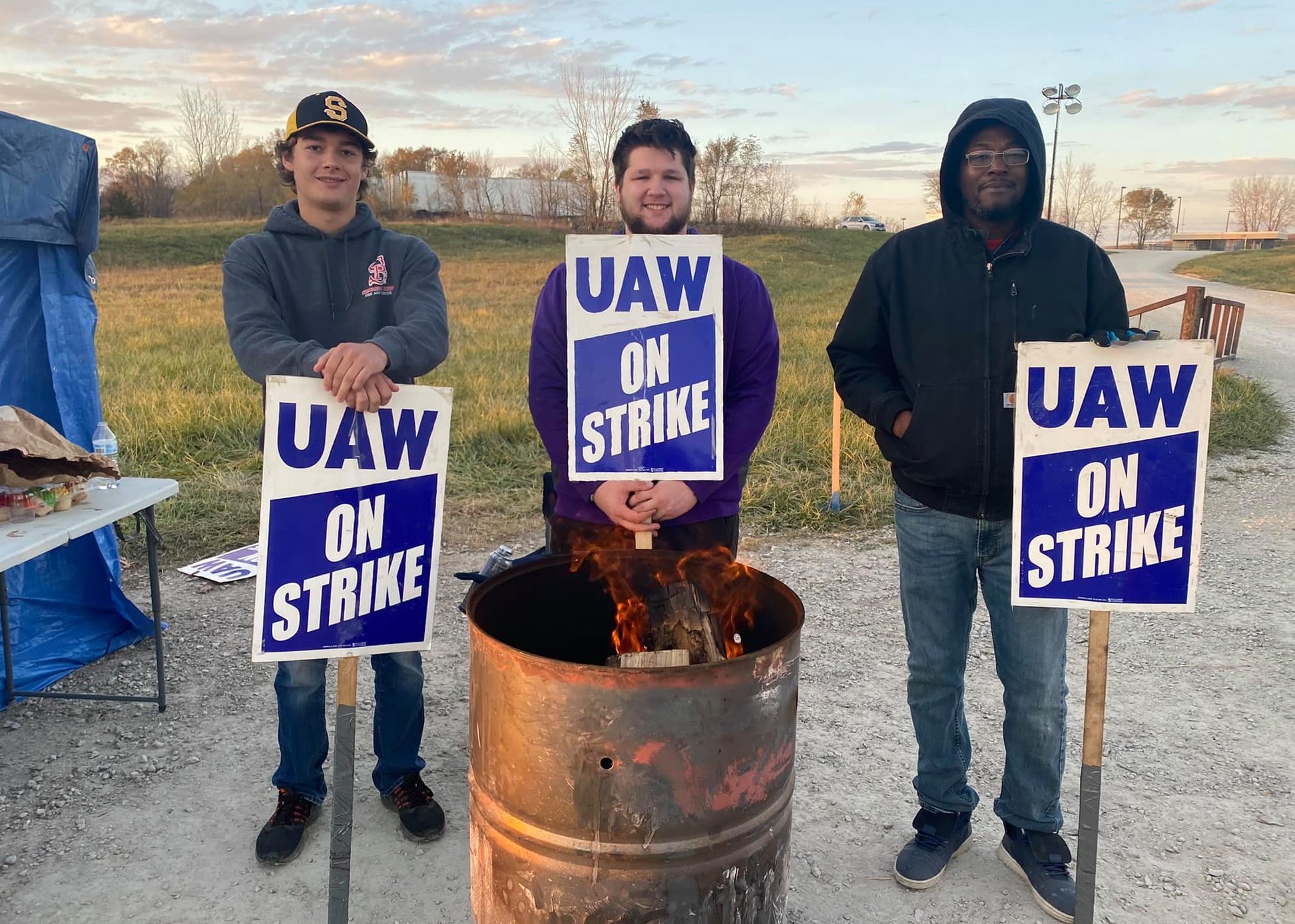

Prominent Iowa Democrats were quick to express solidarity with United Auto Workers members who went on strike at midnight on October 14. But Republican officials were mostly silent as Iowa’s largest strike in decades began.

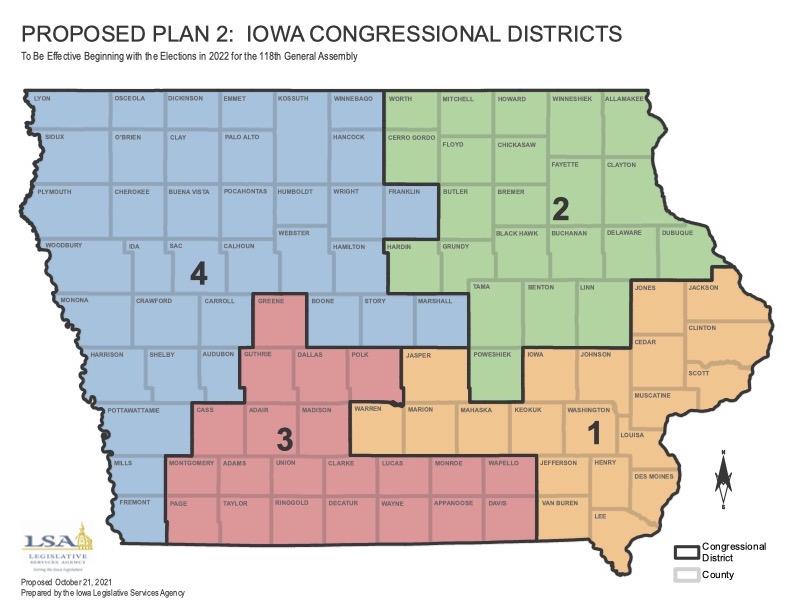

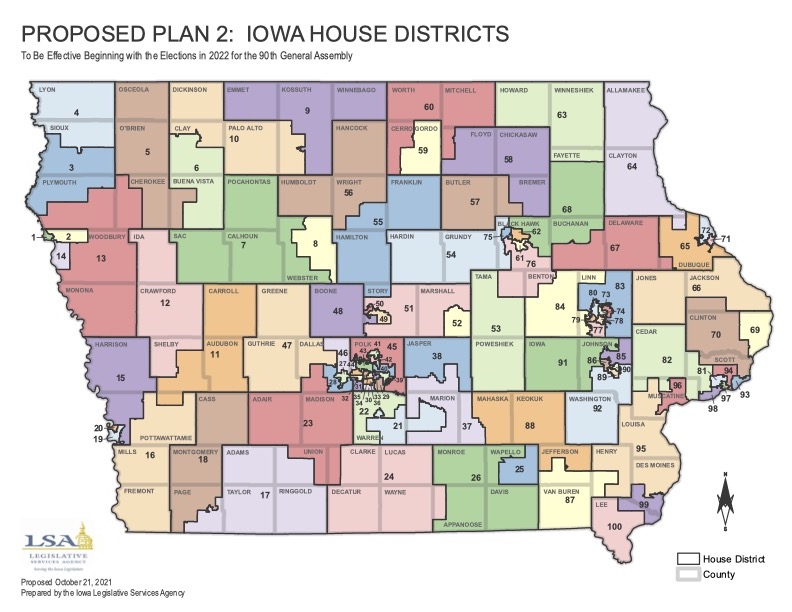

The work stoppage affects some 10,000 UAW members, of whom about 6,500 are employed at John Deere facilities in Waterloo, Ankeny, Davenport, Dubuque, and Ottumwa. Earlier this week, about 90 percent of UAW members voted to reject the company’s contract offer—a remarkable consensus, given that more than 90 percent of workers participated in the vote. Although Deere’s profits have increased by 61 percent in recent years, and CEO John May’s salary increased by about 160 percent from 2019 to 2020, the company offered workers only a 5 percent to 6 percent raise, with additional 3 percent raises in 2023 and 2025. Proposed changes to pensions also weren’t acceptable to most workers.

The last strike at John Deere plants began in 1986 and lasted for about five months. According to the Des Moines Register, the largest strikes anywhere in Iowa during the past three decades were a 1995 stoppage at Amana Refrigeration in Cedar Rapids, which involved about 2,000 workers, and a 2004 strike at Newton-based Maytag, involving about 1,600 workers.

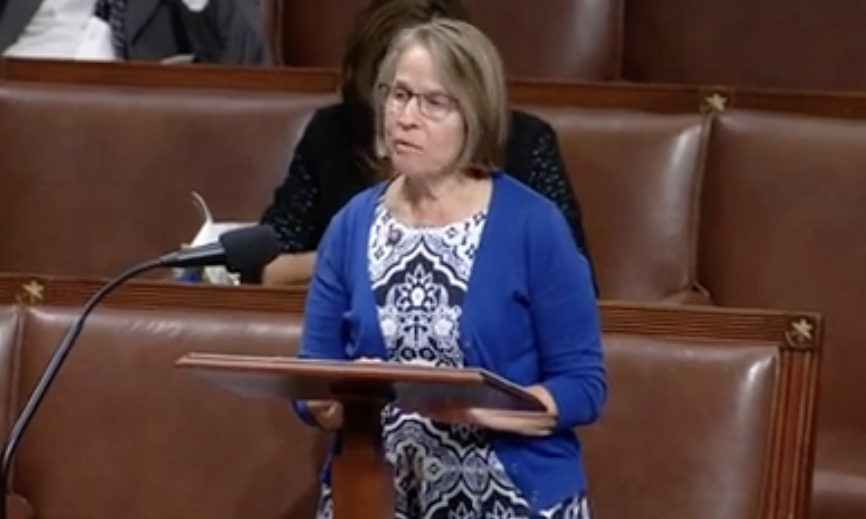

The Iowa Democratic Party issued a statement supporting the Deere workers a few minutes after midnight, and many well-known Democrats added their voices throughout the day. I’ve enclosed many of those comments below.

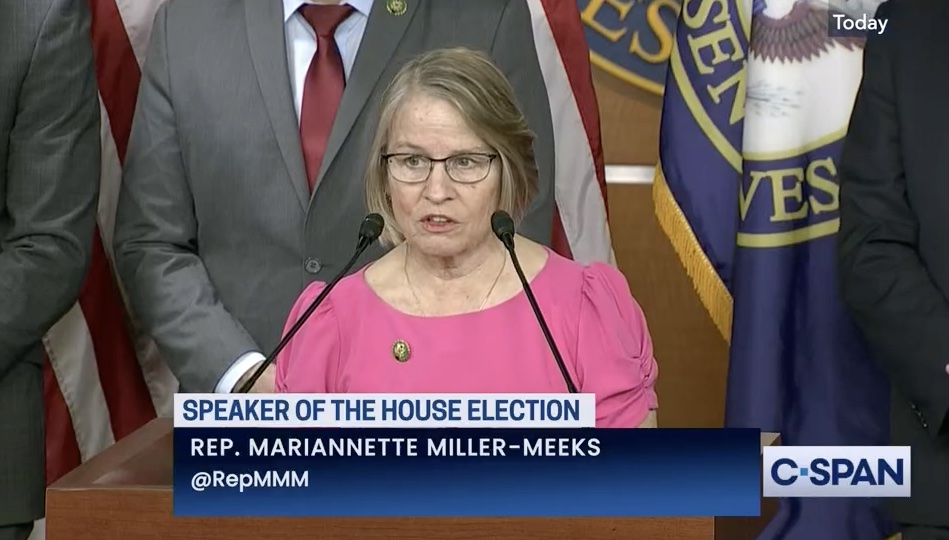

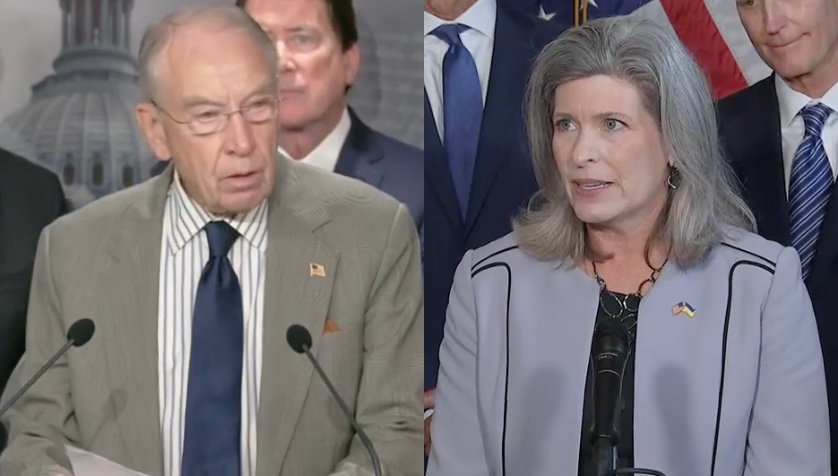

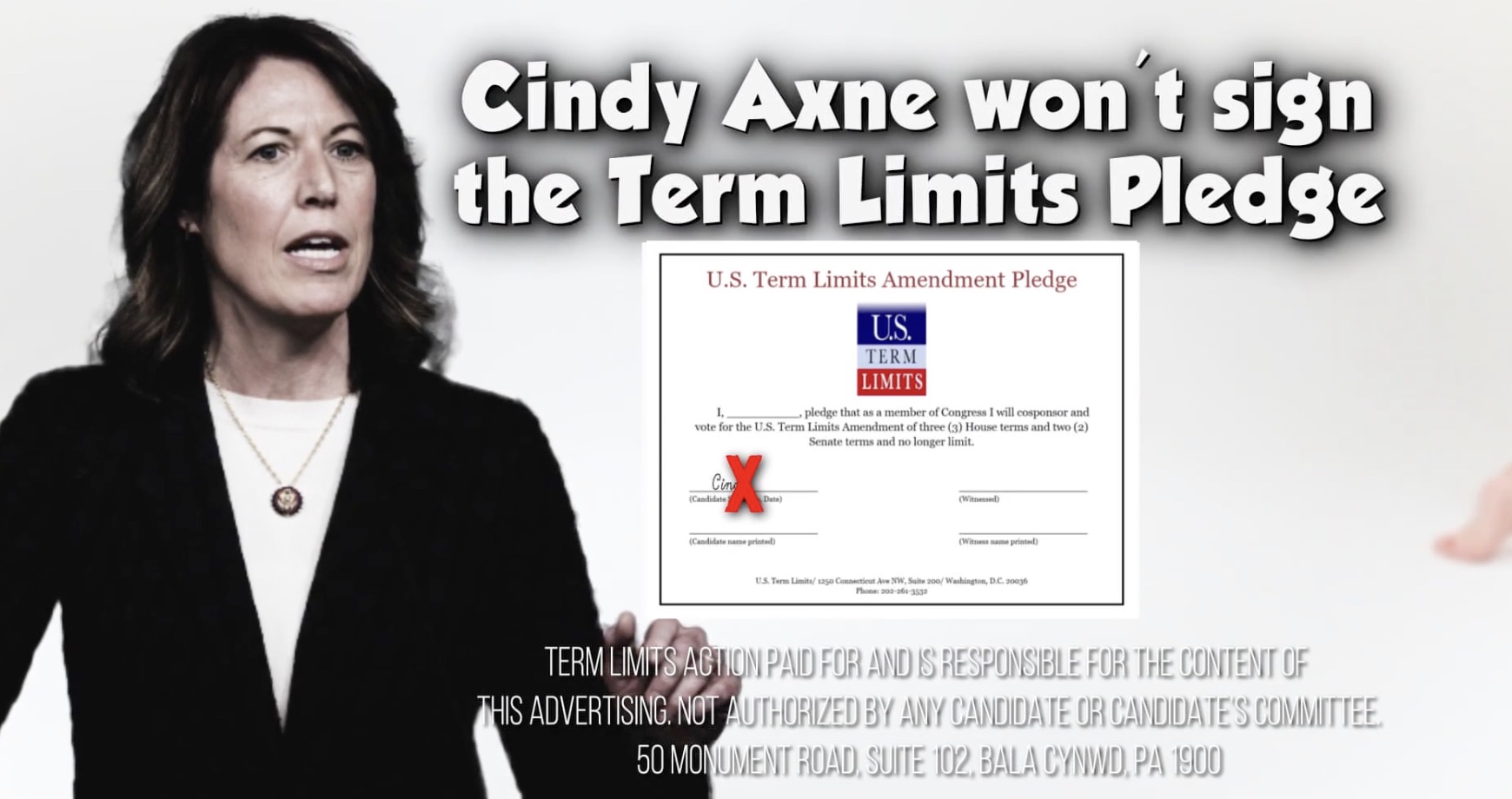

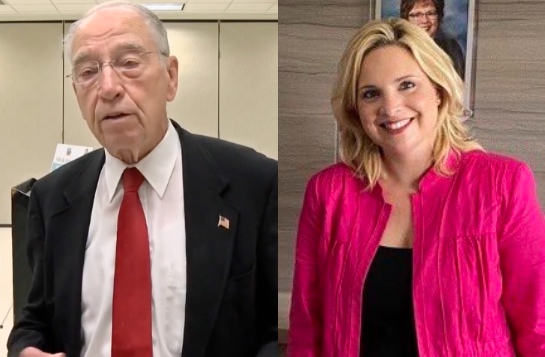

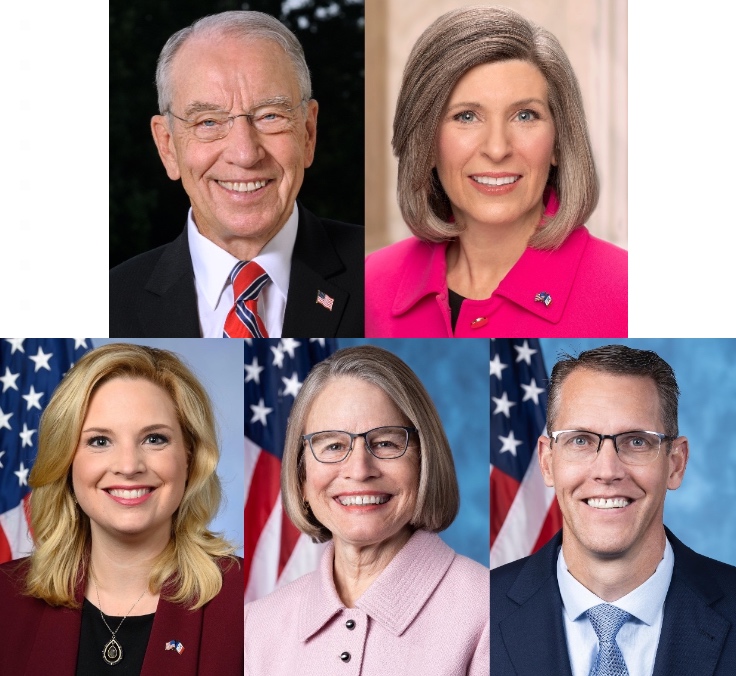

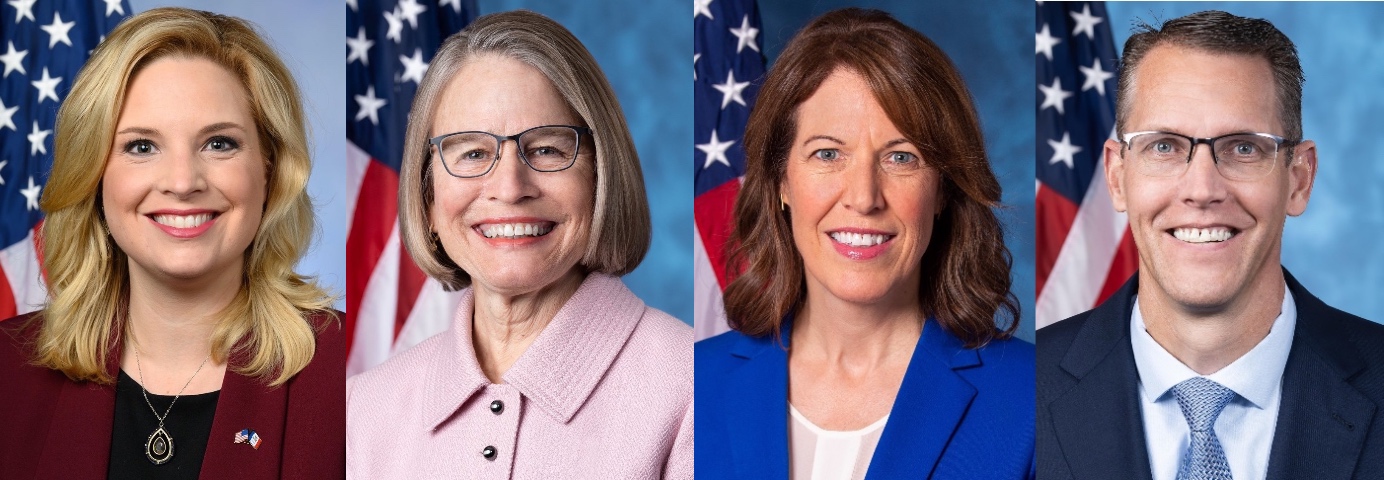

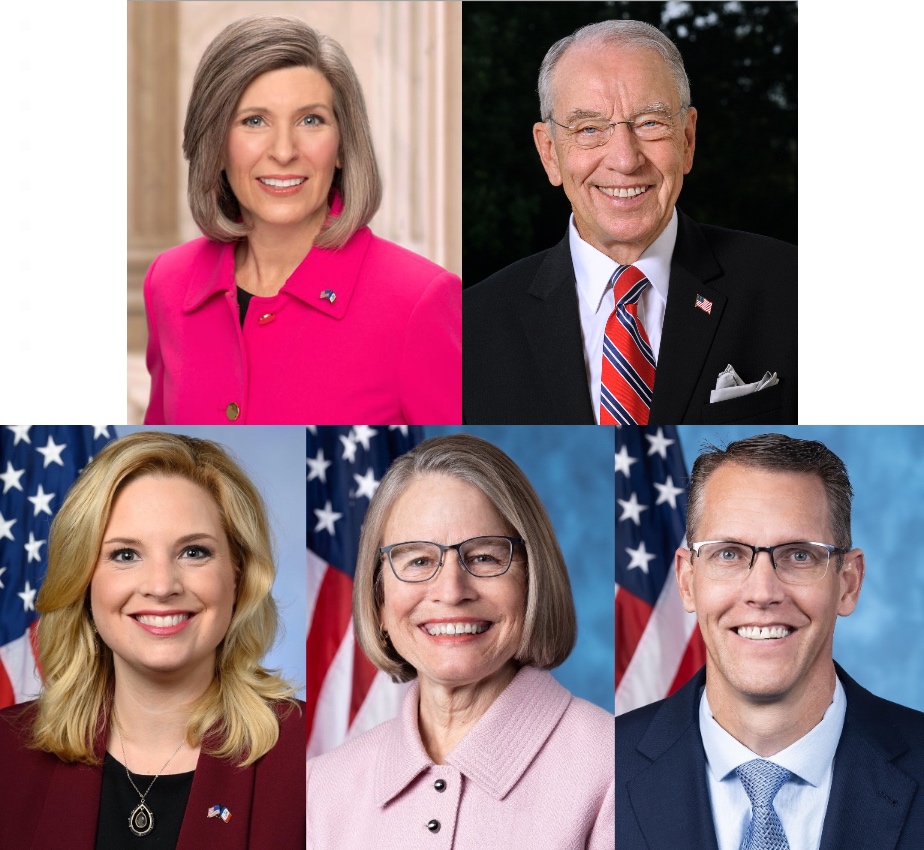

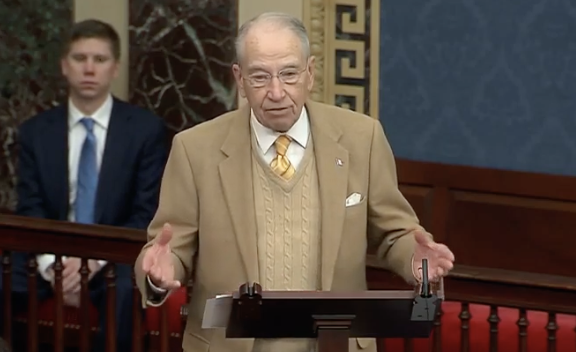

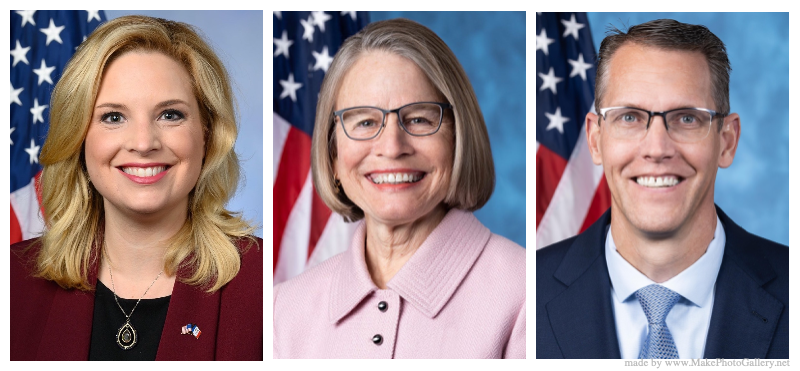

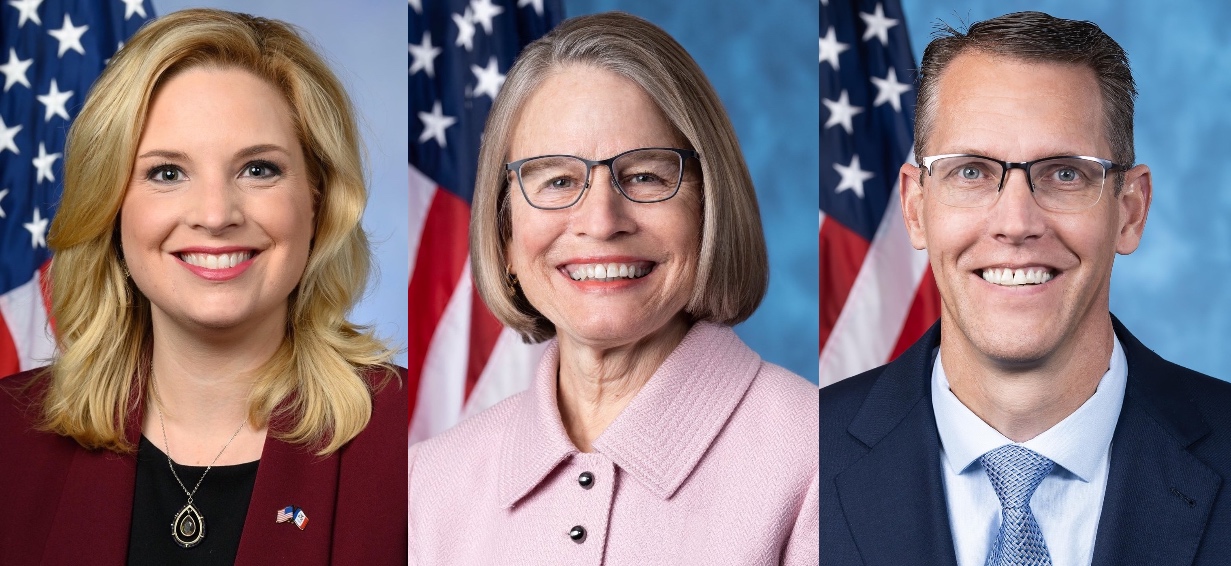

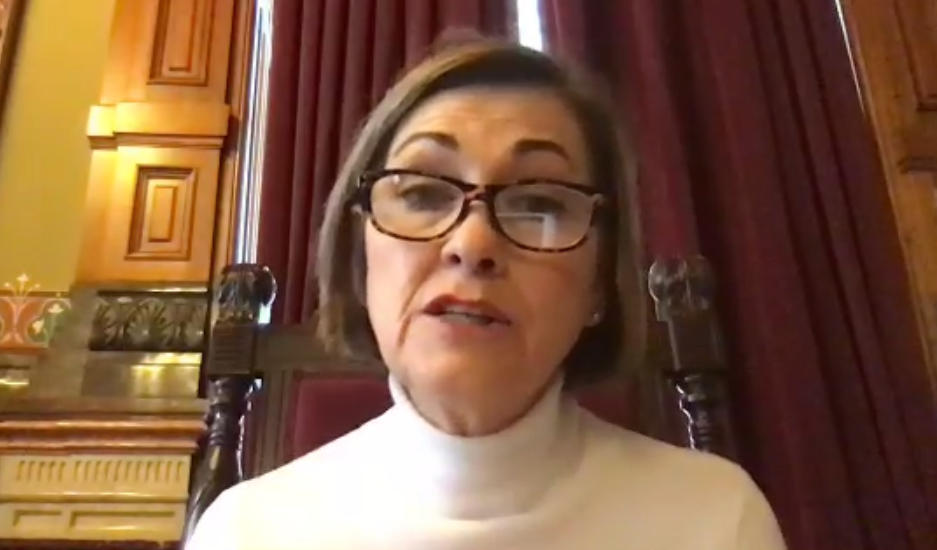

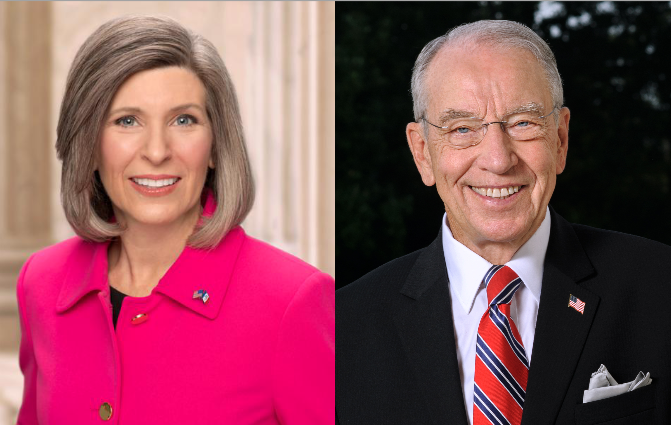

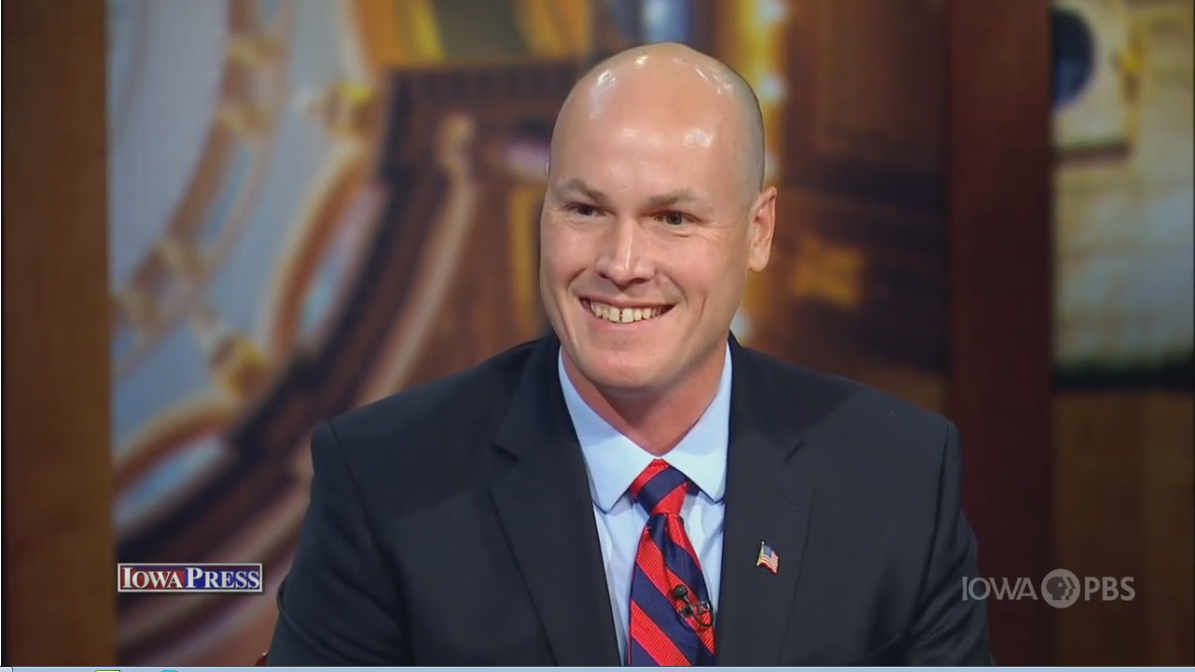

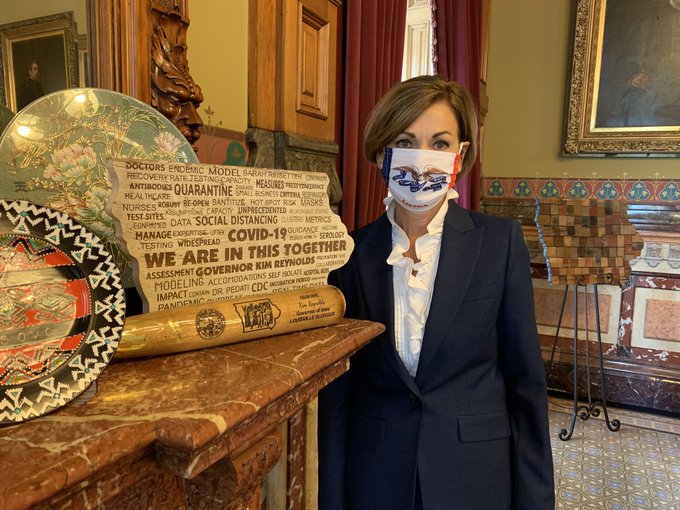

Meanwhile, Governor Kim Reynolds, Senator Joni Ernst, and U.S. Representatives Ashley Hinson (IA-01), Mariannette Miller-Meeks (IA-02), and Randy Feenstra (IA-04) said nothing about the event directly affecting thousands of their constituents. Staff for Reynolds, Hinson, and Miller-Meeks did not respond to Bleeding Heartland’s inquiries.

Continue Reading...